sndr/iStock Editorial via Getty Images

Introduction

Investors were eagerly waiting for Starbucks’ Investor Day which delivered some interesting updates, proving, once again, that the now-resigning CEO and founder Howard Schultz knows how to trace the path for the future of the company.

Summary of previous coverage

About a month ago I shared my research on Starbucks (NASDAQ:SBUX) pointing out the reasons why I picked the stock for my portfolio. The company enjoys good gross profit margins that hover around 27%. The net profit margins are usually at 13-14% making the company highly profitable within its industry. Furthermore, Starbucks beats even McDonald’s when we look at the return on total capital (ROTC) of 18.5%. This is become more and more a key metric I look at because, even though I like dividends and buybacks, I need to know if the company is able to deploy its capital at a high rate of return, without which there would be no growth and, as a consequence, no dividend increase. Though I think Starbucks has somewhat of a high payout ratio at 60%, I believe that such a good ROTC makes somewhat up for it because it tells us that the company is able to use its remaining 40% at a high rate of return. Needless to say, Starbucks checks the boxes when thinking about moat and brand value. Finally, it is company that is not done growing, as we will see.

Takeaways from the Investor Day

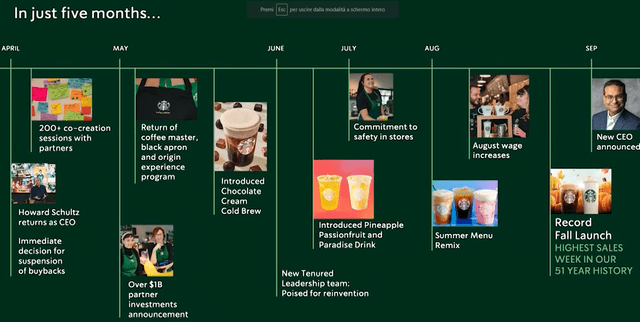

During the event, Schultz shared his understanding of Starbucks’ history which I think investors should read. He ended up talking about the past five months, and the goals achieved to reinvent once again the company. To prove Starbuck’s strength, Schultz pointed out that the recently introduced fall campaign allowed the company to reach its highest sales week in its whole history.

Starbucks Investor Day Presentation

Starbuck presented its reinvention plan that aims at accelerating earnings growth to 15%-20% annually over the next three years, compared to the previous 10-12% guidance. Starbucks will try to achieve this through four key drivers:

- comparable store sales growth

- store growth

- margin expansion

- disciplined capital allocation

Thanks to the reinvention plane, comp growth is now expected to increase to the range of 7% to 9% annually over the next three years, up from the previous guidance of 4% to 5%.

New stare growth is driven especially by international demand. This will lead Starbucks to grow its net store count by 7% annually. US store growth will be around 4%. The company will have around 45,000 stores by the end of 2025, with a target of 55,000 by 2030. In the U.S. we will see 2,000 new openings. New store economics are expected to continue delivering 50% return on investment and 25% cash margin.

These two actions combined – comp growth and store growth – should lead to a revenue growth around 10% to 12% annually, up 2% compared to the previous guidance. It is indeed quite bold for a company the size of Starbucks to commits itself to double digit growth for a three year time-span.

Regarding the third point, it is worth reporting what Rachel Ruggeri, Starbuck’s CFO, said during the event:

We expect an outsized impact on the plus side of the equation driven by sales leverage from the accelerated revenue growth inclusive of strategic pricing, improved turnover, efficiency in our stores and labor leverage, as John had outlined today and some of which we shared with you in the Tryer Center earlier. We also expect waste reduction as well as supply chain savings across the P&L and G&A leverage over the near – over the long term as the reinvention plan investments begin to lessen and we get leverage from the accelerated revenue growth.

What about the investments? Starbucks is going to spend around $1 billion of incremental investments, half of which reflect the annualization of the investments made during 2022 for wage and benefit increases.

Capex is expected to grow to $3 billion annually, up $500 million from the previous guidance. However, the ROIC is expected to exceed 25% in the next three years, proving once again that Starbucks is very effective at deploying capital with high returns. At the same time, I was pleased to see that the company intends to keep its payout ratio at 50%, without putting in danger its balance sheet. The pleasant news for many investors was that Starbucks is also resuming its share buyback program which should yield a benefit of 1% on earnings net of interest. The balance sheet will still see a net-debt/EBITDA ratio under 3 times, keeping the company’s investment-grade rating of BBB+. In total, Starbucks should return around $20 billion to its shareholders.

These are ambitious goals. But what exactly is the innovation that will ignite Starbucks’ operations to reach them?

Taking care of its employees

First of all, the company had recently some issues with its partners and employees. The company admitted it had a trust deficit. This is why the company committed over $1 billion to improving and elevating partner experience. I do think this is money worth spending because it would be a huge cost to see many partners and employees leave the company. A part of the reinvention plan will be linked to giving baristas a scheduling empowerment and enabling different employees to enjoy different wages based on their experience and the cost-of-living in a certain place. Secondly, working conditions will be improve through implementation of workflow and automation tools that allow lower value-added tasks to be done in order to free up time and energy for other tasks. As stated in the press release, Starbucks has identified a number of near-term solutions that will be implemented to ensure a thriving partner experience:

- Wage and recognition innovation, including helping give partners the hours they need, expanding digital tipping, and incorporating other opportunities to increase overall pay.

- New well-being benefits, including offering enhanced sick pay, new savings and student loan management benefits, and additional mental health support.

- Personalized career mobility through a newly introduced partner app and the development of personalized career paths.

- Investments in store managers, including new leadership trainings, reinvention of scheduling and decisioning tools, and career journey mapping to improve store manager retention and empower them to focus on core functions of the job that increase satisfaction and overall performance of their store partners. Stores managed by partners with over three years of tenure have 13% greater weekly sales and higher customer satisfaction.

This important work is beginning with Starbucks over 9,000 U.S. company-operated stores. Starbucks then plans to rapidly implement the most effective and scalable best practices to its other U.S. and global stores.

New technological innovation

Starbucks announced two key innovations: the Clover Vertica and the Siren System.

With the Clover Vertica, Starbucks wants to elevate the quality and craft of hot brewed coffee. Not only, but the implementation of this technology will speed up coffee delivery with customers who will be served freshly brewed cup of hot coffee in just 30 seconds.

Secondly, Starbucks will be keen on launching new food as a complement of its beverages, since it has already reached a 40% of customers who add food to their order.

Thirdly, Starbucks will launch its Cold Pressed Cold Brew technology. John Culver, North America COO, explained this innovation helping us grasp how meaningful its impact will be:

Currently in our stores, cold brew is steeped for 20 hours, and it takes more than 20 steps to make. Across 16,000 stores, 365 days a year, it takes a lot of time and it’s a pain point for our partners. This new technology that I’m talking about enables us to deliver the same great-tasting cold brew product in a matter of seconds, a matter of seconds, and in fewer than four steps. It’s a step change in innovation and it’s significant. And when you consider that we spend over $50 million a year on labor to brew our cold coffee, this is a significant game changer for us. From 20 steps to 4, from 20 hours to a matter of seconds; we are completely reinventing the experience for our partners and for our customers through how we’re producing the beverages and warming our food in our stores.

Finally the last innovation I liked was the new Siren System, which is designed to simplify tasks across beverage and food platforms in order to meet the growing demand for customization of hot and cold beverages and warm foods. As part of the Siren System, Starbucks has redesigned its cold beverage station, which significantly reduces the time and number of steps to make cold beverages, unlocking productivity gains and ultimately freeing up time for partners to connect with customers.

Takeaways and valuation

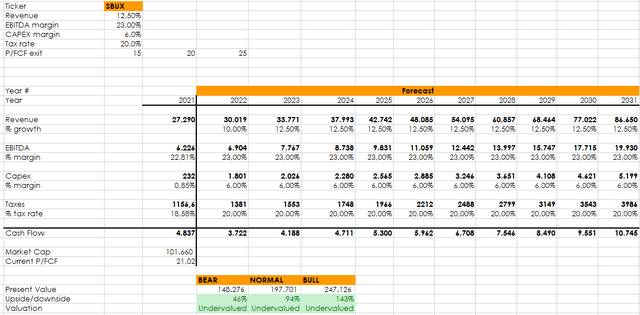

If we sum up these news to the fact that recent reports have shown that the demand for Starbucks’ beverages remains strong with one of the primary drivers of the recent spike in demand was the change in the menu and the fall release, there are reasons to believe in Starbucks’ resilience. Plugging in some numbers from the new guidance, I modified my previous cash flow model and I got the following result: if Starbucks performs with the guidance provided, we are before a very interesting opportunity, as shown below.

I started my position around $90 and I have averaged down as the stock reached the $70s and I do plan on adding some shares over the next few months. There may be some turmoil over the short-term, but with the expansion of Starbucks’ business we are going to see, I think there is enough to believe that shareholders will enjoy interesting returns over time.

Be the first to comment