zhaojiankang/iStock via Getty Images

The Cohen & Steers Infrastructure Fund (NYSE:UTF) is a utilities and infrastructure focused fund that has strong historical performance. However, I am cautious on future performance of the fund, as P/E multiples for utilities are at all time highs with rising interest rates that could hurt valuations. If I had to choose between UTF, the Reaves Utility Income Fund (UTG), and the DNP Select Income Fund (DNP), I believe UTF is the best choice as it has the best long-term track record and highest current distribution yield. It is also trading at a slight discount to NAV.

Fund Overview

The Cohen & Steers Infrastructure Fund (“Fund”) is one of the larger closed-end-fund (“CEF”) on the market focused on investments in utilities and other infrastructure assets like pipelines and railroads. It has $2.5 billion in net assets and has been in operation for almost 2 decades. The fund’s investment objective is total returns with an emphasis on investment income.

Strategy

The strategy of UTF is to invest primarily in securities issued by infrastructure companies such as utilities, pipelines, railroads, toll roads, airports, ports, and telecom companies. Under normal circumstances, at least 80% of the fund’s managed assets (net assets plus leverage) will be invested in infrastructure companies. The fund may also invest up to 25% of managed assets in Energy-related MLPs and royalty trusts.

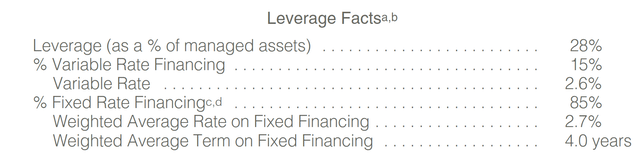

UTF also employs leverage to enhance returns. As of the June 2022 semi-annual report, the fund had 28% leverage ($909 million in leverage on $3.4 billion in managed assets), and the vast majority (85%) of the leverage is fixed rate (Figure 1).

Figure 1 – UTF leverage (UTF Semi-annual report)

Portfolio Holdings

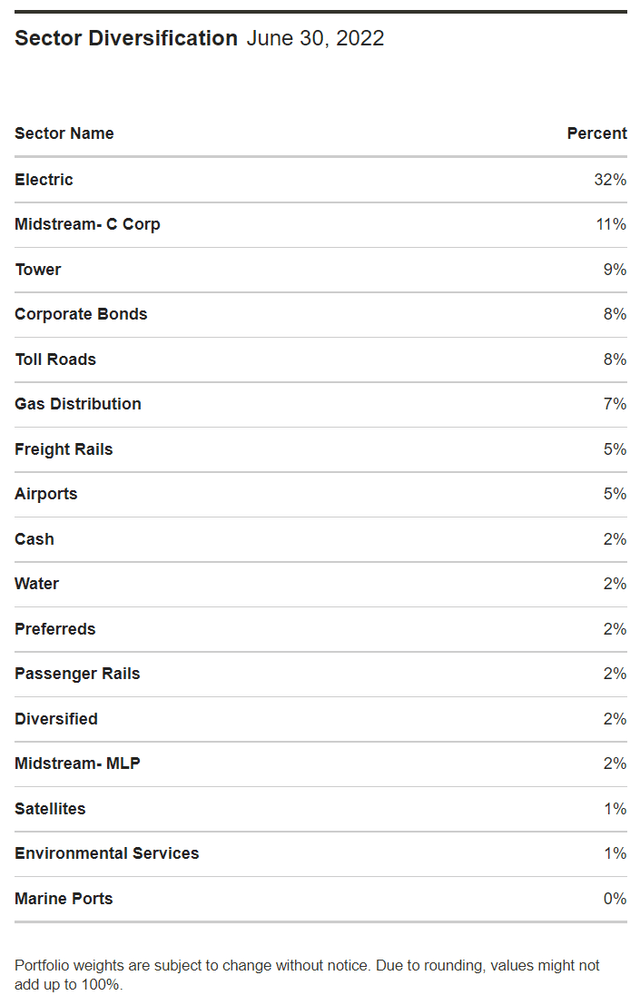

Adhering to the fund’s strategy, the UTF fund is almost 100% invested in infrastructure assets, with the sector breakdown shown in Figure 2.

Figure 2 – UTF sector breakdown (cohenandsteers.com)

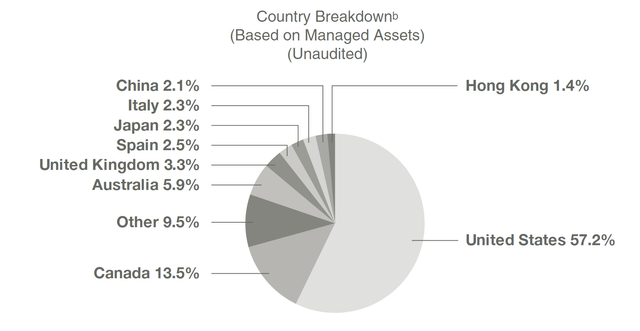

The fund also invests all over the world, with Figure 3 showing its geographical breakdown of managed assets.

Figure 3 – UTF geographical breakdown (cohenandsteers.com)

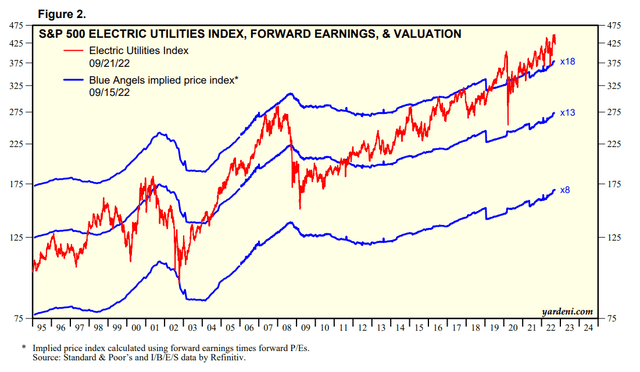

Returns

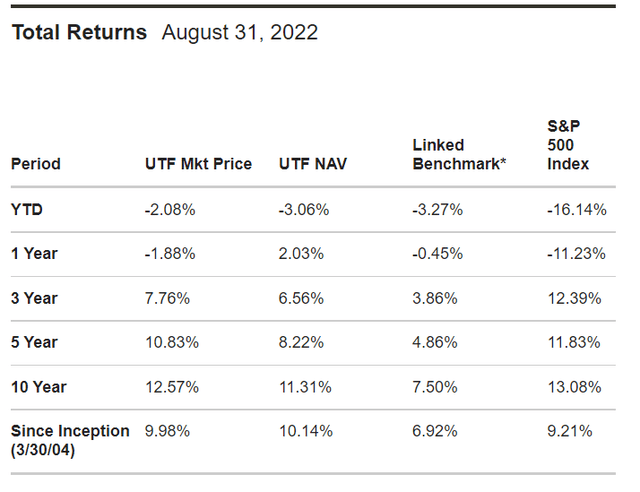

For a defensive infrastructure fund, UTF has delivered exceptional long-term performance, with a 10-year annual return of 11.3%, not far below the S&P 500 Index’s 13.1%. If calculated from inception, UTF has outperformed the S&P 500 Index, delivering 10.1% returns vs. 9.2%. On shorter time frames, UTF has lagged the S&P 500 Index, with 3 and 5 year returns of 6.6% and 8.2% vs. 12.4% and 11.8% respectively, as markets were driven higher by growth stocks.

Figure 4 – UTF historical returns (cohenandsteers.com)

Importantly, the UTF has outperformed its benchmark, which consists of a blend of 80% infrastructure (currently using the FTSE Global Core Infrastructure 50/50 Net Tax Index) and 20% Preferred Securities (BofA Fixed Rate Preferred Securities Index). This suggests management skill in selecting investments that have beaten the benchmark.

Distribution & Yield

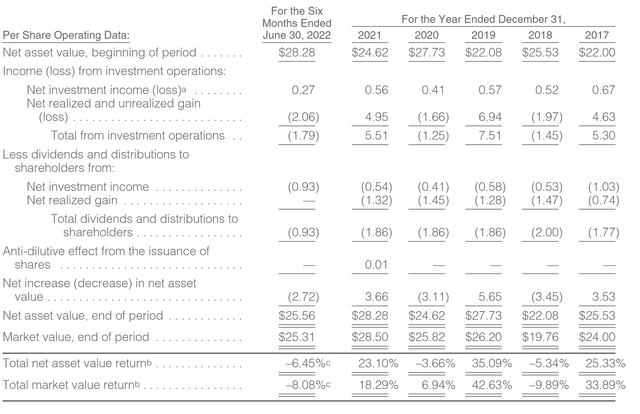

The UTF fund has a long history of paying its high distributions. Currently, the fund is paying a $0.155 / share monthly distribution that has been kept constant since 2018. The current annualized yield is 7.6%. The fund also pays a periodic special distribution. The last special distribution of $0.14 was paid in December 2018.

Looking through the fund’s historical results, we see that distributions have been funded through net investment income (“NII”) and realized gains for the past several years. In 2021, 29% of the distribution came from NII, and 71% came from realized gains (Figure 5). This is comforting to know the fund has not had to dip into return-of-capital (“ROC”) to fund its high distribution yield.

Figure 5 – UTF historical distribution breakdown (UTF Semi-Annual report)

YTD to August, the distribution has been funded through NII and realized gains in roughly similar ratios (Figure 6).

Figure 6 – UTF 2022 YTD distribution breakdown (cohenandsteers.com)

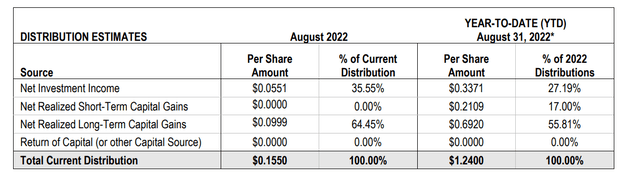

Fees

UTF fees are modestly high, compared to peer funds. As a % of net assets, expenses was 2.05% YTD 2022. Excluding interest expense, it was 1.32% (Figure 7). Actual management fee is set at 0.85% of managed assets.

Figure 7 – UTF fee as % of net assets (cohenandsteers.com)

For comparison, UTG has a 0.575% management fee rate, and a 1.23% expense ratio. DNP has a 0.60% management fee rate, and a 1.77 expense ratio.

Risk

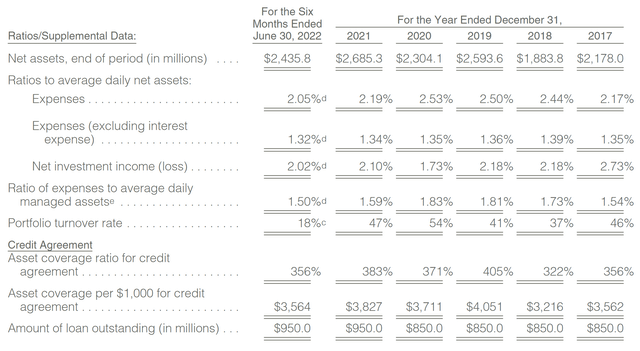

Similar to my comments in my recent articles on the UTG fund and the DNP fund, UTF has several main risks. First, if we look at Figure 8, we can see that utilities are currently trading at multi-decade high P/E multiples. So while historical results have benefited from multiple expansion, from ~13x in 2004 when UTF began to >18x currently, going forward, it may be tougher for valuation multiples to expand, so forward returns will have to rely on earnings growth.

Figure 8 – Utilities trading at multi-decade high multiples (yardeni.com)

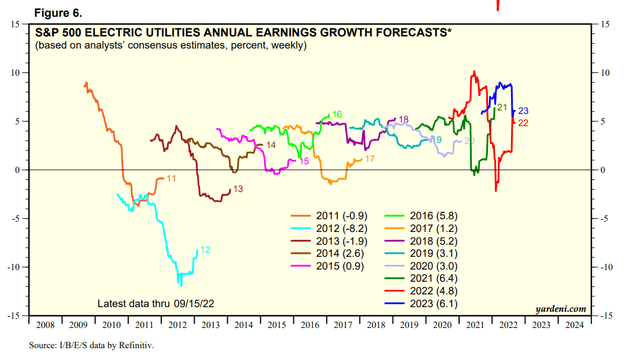

With forward earnings growth of 5-6% expected for 2022 and 2023 and historical earnings growth sub 6%, it may be hard for UTF to deliver the 8 – 10% total returns that the fund has achieved historically (Figure 9).

Figure 9 – Utilities earnings growth (yardeni.com)

Second, with the Federal Reserve continuing to increase interest rates, we could actually see valuation multiples contract, especially for long duration assets like utilities and infrastructure where the revenues and cash flows are far out in the future and are sensitive to increases in discount rates.

Finally, note that for levered funds like UTF, rising interest rates could potentially hurt net investment income as the interest it pays for leverage rises. Luckily, for UTF, 85% of its leverage is fixed rate with a weighted average rate of 2.7%. However, as the leverage is refinanced, they will most likely be at higher interest rates, as even 2-Yr treasury yields are now above 4%.

Figure 10 – 2Yr Treasury Yield (tradingeconomics.com)

Comparing UTF, UTG, and DNP

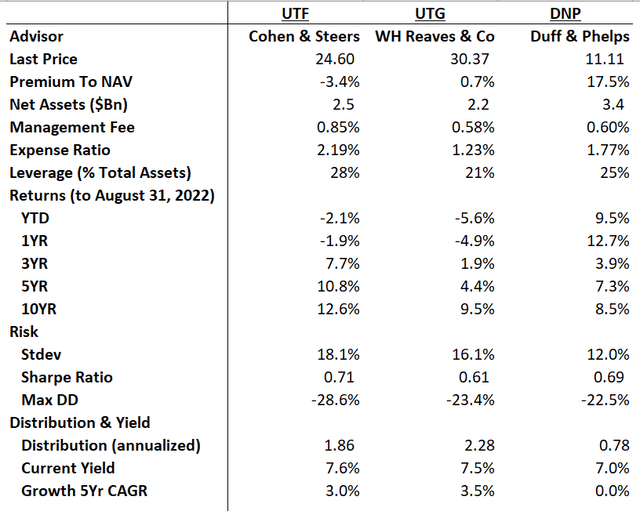

Comparing the UTF fund against peer utility and infrastructure funds like UTG and DNP, we see that total return-wise, UTF has the highest long-term returns, with 10 Yr CAGR returns of 12.6%. However, in the short-term, DNP has been navigating the current drawdown period best, with positive YTD and 1YR returns.

In terms of risk, UTF is the most volatile and has the highest drawdown, but also the highest sharpe ratio. DNP appears to be the most defensive fund, with materially lower volatility.

In terms of distribution and yield, UTF is paying the highest current distribution yield at 7.6%. It also has been growing its distribution at a 3.0% 5YR CAGR (although the distribution has been constant at $1.86 since 2018). UTG is the only fund that has materially grown its distribution since 2018.

Finally, UTG has materially lower management fees and total expenses. UTF has the highest fees. UTF is trading at a discount to NAV, while DNP is trading at a large premium.

Figure 11 – Comparison between UTF, UTG, and DNP (Author created with data from Seeking Alpha, Portfolio Visualizer, and Cefconnect)

Weighing all the factors above, I believe UTF is the best out of the three funds. First, it has the highest historical returns on a 3, 5, and 10 year basis, which suggests management ability to outperform over a cycle. Next, UTF has the highest current distribution yield. Finally it trades at a slight discount to NAV. The drawback with UTF is that it utilizes the most leverage and has the highest expense ratio.

Conclusion

In summary, the Cohen & Steers Infrastructure Fund is a utilities and infrastructure focused fund with strong historical performance. I am cautious on future performance of UTF, as P/E multiples for utilities are at all time highs with rising interest rates that could hurt valuation multiples. However, if I had to choose between UTF, UTG, and DNP, I believe UTF is the best choice as it has the best long-term track record and highest current distribution yield. It is also trading at a slight discount to NAV.

Be the first to comment