MikeMareen

On December 1, 2022, Tesla, Inc. (NASDAQ:TSLA) finally delivered its first Semi truck to PepsiCo. Back in October, Tesla unexpectedly announced that PepsiCo will receive their first Semi truck delivery in December. At the time, there were some doubts as to whether the timeline was realistic, as Tesla has been notoriously poor at delivering on its promised timelines. Recall, Tesla initially announced the Tesla Semi in 2017 with a target production date of 2019. However, production was repeatedly delayed and was generally not expected until 2023.

While the initial delivery of the Semi is certainly an achievement worth celebrating, there are still a lot of questions left unanswered. For example, there were no details on the price or hauling capacity of the truck.

Here are three reasons why I think sales of the Semi will be slower than the 50,000 units Elon Musk is expecting.

1) Battery Weight To Determine Hauling Capacity

First, analysts need to understand that an electric vehicle’s range is a function of its battery size. According to specs, the Tesla Semi has a 500 mile range. Assuming it consumes ~2kWh / mile, this means the Semi will need to have a ~1,000 kWh battery. A 1,000 kWh battery should weigh at least 8,000 lbs, according to some industry analysts, which would eat into a trailer’s payload.

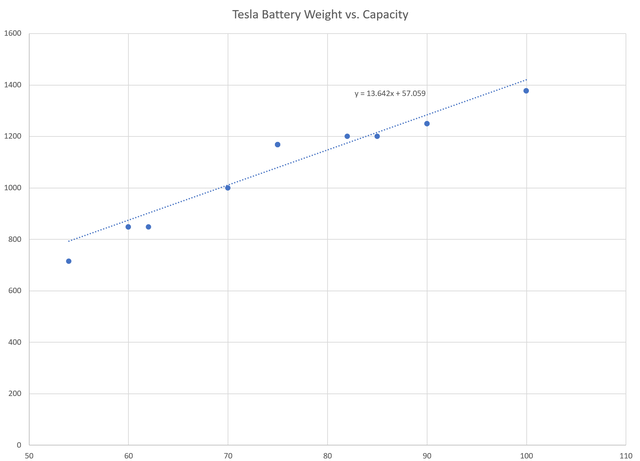

In fact, a regression of Tesla’s existing batteries and their weights suggest a 1,000 kWh Tesla battery could weigh upwards of 13,000 lbs, as the larger the battery capacity, the more wiring and cooling equipment is required (Figure 1)

Figure 1 – Regression of Tesla battery weights and capacity (Author created with data from weightofstuff.com)

Per government regulations, a semi-trailer combination is regulated to operate with a gross combined weight rating (“GCWR”) of less than 82,000 lbs. With no details on the weight of the Semi or its battery, analysts simply don’t know how much load can be hauled. For reference, an empty diesel semi-trailer can weigh up to 35,000 lbs, meaning it has a payload of ~47,000 lbs. What is the Semi’s hauling capacity relative to this reference 47,000 lbs target?

The hauling capacity is a critical input for fleet owners to determine whether an investment surpasses their required rates of return.

2) Lack Of Refueling Stations Will Limit Roll-out

Another consideration for fleet sales is the infrastructure required to refuel the Semi trucks. Although Tesla has built the largest network of superchargers in the world, with over 40,000 supercharger stations, the question is whether these supercharger stations can charge the Tesla Semi?

As shown in figure 2 from Tesla’s website, many (if not all) current superchargers are designed to accommodate passenger vehicles, not a 60-70 ft length semi-trailer.

Figure 2 – Tesla supercharger station design (Tesla)

Furthermore, even at maximum throughput of 250 kW, it may take 3-4 hours to recharge a 1,000 kWh battery versus only 15-20 minutes to refuel a diesel truck.

Until a network of supercharger stations that can accommodate the Semi are available, the sales of the Semi may be restricted to local routes (trucks making local deliveries within the 500 mile range and refueling at a local hub).

3) Without Data, Initial Sales Will Be Slow

Third, trucking fleet owners need reliability, servicing, and resale data before they commit capital to buying new equipment. They need to be able to model out whether a new truck meets their return requirements.

As the Semi is built on a completely new platform (electric vs. diesel), by a manufacturer not known for reliability, with unknown resale values, it’s reasonable to expect initial sales will be a few units at best, as test orders or for publicity.

More likely, fleet owners will stay on the sidelines and let others be the guinea pigs to test out the new EV trucks before they commit their own capital.

Tesla Semi Financial Impact Is Likely Limited

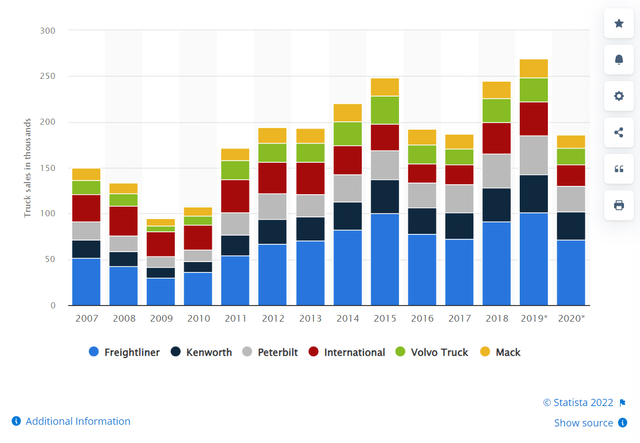

Elon Musk is known for his ambitious proclamations and stretch goals, so analysts and investors should take his target of 50,000 Semi units by 2024 with a grain of salt. They need to understand that the Class 8 truck market in the U.S. is only ~200,000 units per year (Figure 3). It is simply unrealistic for Tesla to capture 20-30% of the market within 1 year of launch.

Figure 3 – US Class 8 truck sales (Statista)

Given the generally risk-averse nature of truck fleet owners and the points I highlighted earlier in this article, a more realistic target for Tesla is to sell a few thousand units of the Semi within the first few years as it builds out infrastructure and operating data.

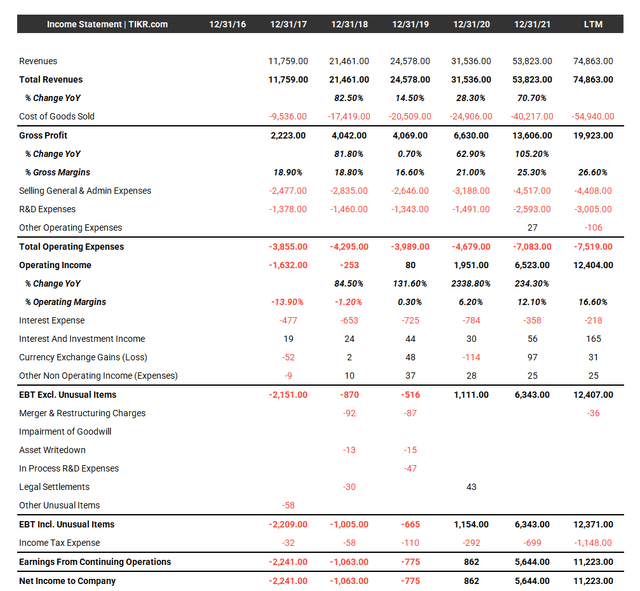

A new high-end diesel semi truck can cost upwards of $200,000. Assuming Tesla prices the Semi in line with high end diesel trucks and can sell 5,000 units in 2024, the Semi business can add $1 billion in revenues. However, against Tesla’s LTM revenues of $75 billion (and growing at a rapid clip), $1 billion in Semi revenues in 2024 will be a drop in the bucket that may not move the needle (Figure 4).

Figure 4 – Tesla consolidated income statement (tikr.com)

Risks To My Call

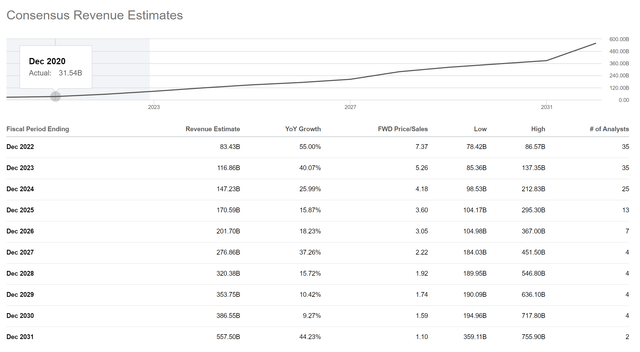

Of course, I could be wrong and fleet owners could be chomping at the bit to purchase the Tesla Semi for their fleets (ignoring the lack of refueling infrastructure, reliability data and resale value data). However, even if I am mistaken and Tesla does sell 50,000 units of the Semi in 2024, that would only translate into ~$10 billion in revenues, or less than 10% of the company’s 2024 consensus revenue estimates of $147 billion (Figure 5).

Figure 5 – TSLA consensus revenue estimates (Seeking Alpha)

Conclusion

While the first Semi delivery is an achievement worth celebrating, I think the hype by analysts and the company on sales of 50,000 units by 2024 is totally unrealistic. The whole Class 8 market is roughly ~200,000 units per year, and I don’t see fleet owners rushing to buy the Tesla Semi based on just one livestreamed event. A more realistic target of a few thousand units will translate into ~$1 billion in revenues which will not move the needle for Tesla.

Be the first to comment