buzbuzzer/iStock via Getty Images

All values are in CAD unless noted otherwise.

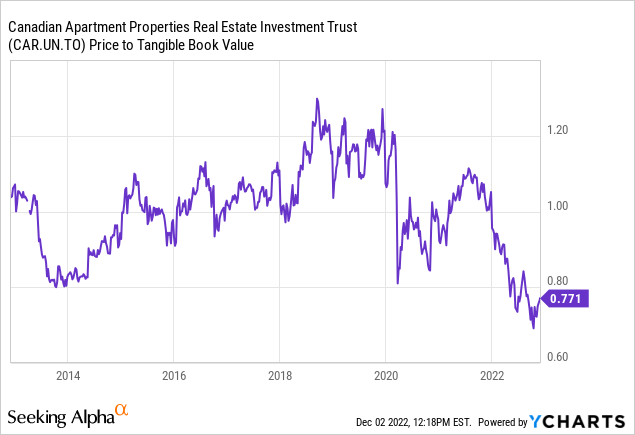

Canadian Apartment Properties Real Estate Investment Trust (OTC:CDPYF) (TSX:CAR.UN:CA) or CAPREIT was trading at a 10% discount to its net asset value or NAV the last time we wrote on it. It was back in early March of this year, and we called the discount magnitude a rare event, based on its history.

Investors have done well buying this REIT at a 10% discount historically, that is, before this year. This time really was different. We rated this apartment REIT a buy based on our growth expectations for the net operating income or NOI. We considered the key risks, that of inflation and rising interest rates to control the said inflation, but still remained bullish on its prospects. CAPREIT had an 80-basis point buffer on its refinancings before the hikes started to bite and it had a healthy balance sheet and interest coverage. We went with a one-year price target of $64.

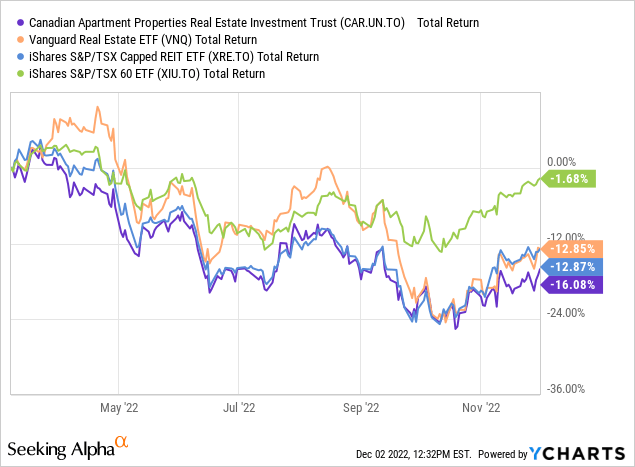

The not so preliminary action tells us that our price target will not come to fruition in the timeline we envisioned, unless Santa comes in locked and loaded to take out the bears. While the broader market has outperformed CAPREIT, it has performed more or less in line with other real estate. Let us go over the recent results of this beaten down REIT to gauge whether we should cut and run or hold on for longer term rewards.

The REIT

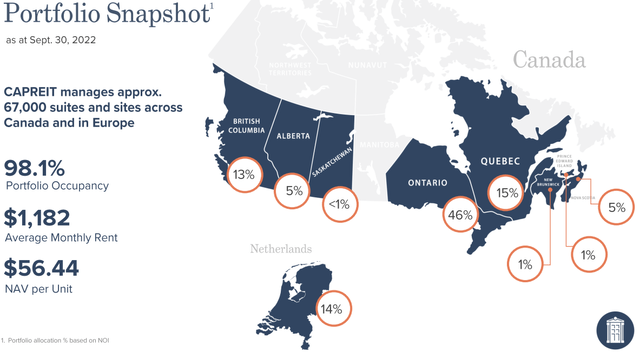

One of the largest of its kind, CAPREIT owns and manages multi-unit residential rental properties such as apartments and townhomes and manufactured home community sites [MHC]. Its 67,000-suite portfolio is predominantly in the Canadian provinces of Ontario, Quebec, B.C., Alberta, and Nova Scotia along with the Netherlands.

It also holds majority interest in European Residential Real Estate Investment Trust (ERE.UN:CA) that operates primarily in the Netherlands.

2022 Thus Far

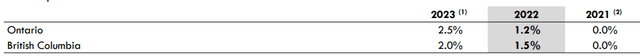

Two of the provinces it operates in have rental caps in place.

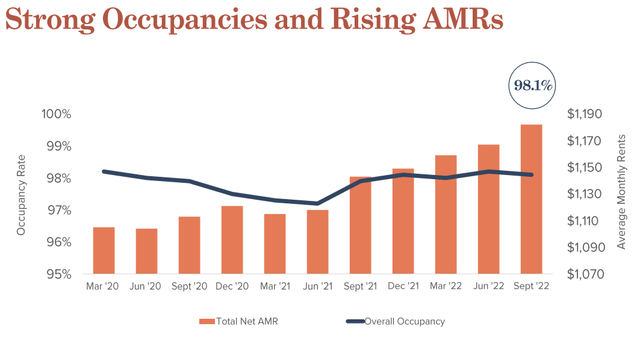

Despite this applying to more than half its portfolio, CAPREIT managed to achieve a 3.4% growth in the average monthly rents compared to Q3-2021. On a same property basis, the growth was slightly lower at 2.8%. This impressive performance was due to accretive rental rates on turnovers and renewals, along with net new properties added to the portfolio. It also witnessed stronger occupancy rates across the board and particularly in Quebec.

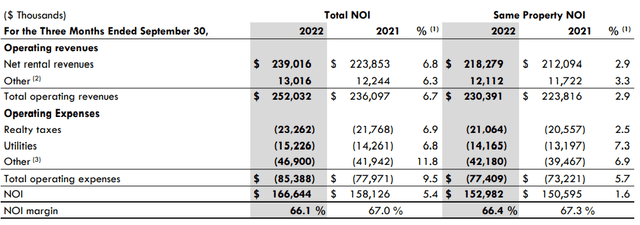

With higher rental caps for 2023 and more room to increase, we expect to continue seeing this upward trend next year. The operating revenue reflected the healthy rental rate increases, however, higher offsetting costs resulted in a lower comparative operating margin.

The increase in other expenses was primarily due to repairs and maintenance that was postponed during the COVID-19 lockdowns, which should even out in subsequent periods. In addition, the CAPREIT is paying for interim septic tank related maintenance costs for some of its MHC properties and is proactively working towards a more permanent solution.

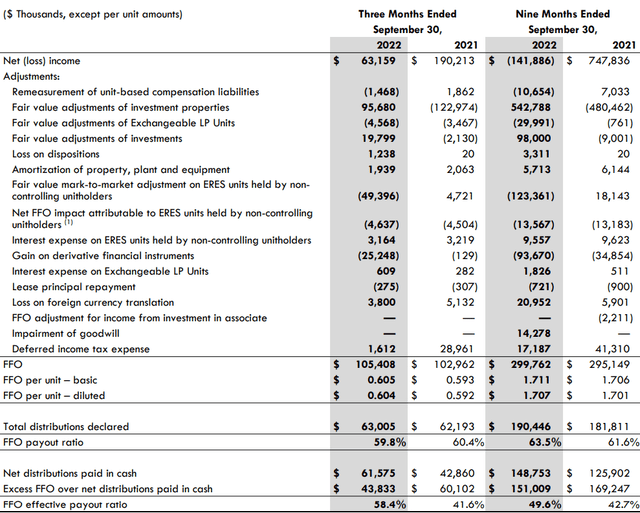

The higher NOI trickled down to a correspondingly higher funds from operation number. Even the FFO per unit increased despite a higher weighted average number of units compared to 2021.

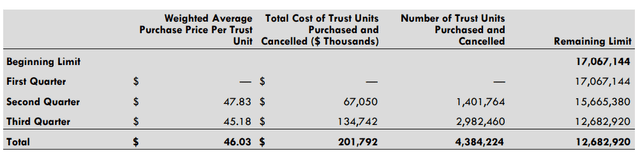

Although the weighted average number of units was comparatively higher than last year, the units at the end of September 2022 were actually lower. CAPREIT has been buying back shares under NAV for since Q2 and this will be accretive for the unitholders in subsequent periods.

CAPREIT had a little over $101 million in cash and cash equivalents and $312.6 million available from its Acquisition and Operating Facility at the end of Q3-2022. In addition, $1.3 billion worth of its investment properties are unencumbered by mortgages. Most of these properties do serve as a security against the credit facility, however. Besides the available liquidity, this REIT maintains a healthy payout ratio (around 60%) and has plenty of room to build it cash reserves.

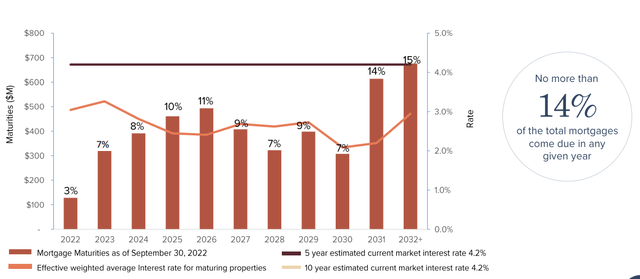

Around 10% of its mortgages are maturing by the end of 2023 and 99.2% of the total mortgages are financed at fixed rates.

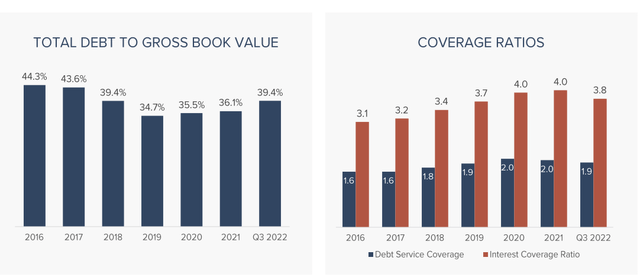

While higher than the previous year, it has a healthy debt to book value and coverage ratios.

While the fair value of the properties has been written down to account for the higher cap rates this year, the reduction for the fee simple interests or the multi-family portfolio does still seem modest.

Verdict

With a 12 cent/month dividend, it currently yields 3.33%. Management also expects to announce a special distribution in December after crunching their tax numbers.

We’ve done some calculation. There’s likely going to be something we’re going to — there will likely be a special distribution this year. But we’re likely going to announce that later in the month — or sorry, in December when we finalize the numbers because we still have two months ago in terms of where our taxable position will be, but we’ll be announcing something in the coming months.

Source: Q3-2022 Earnings Call Transcript

The payout ratio is comfortable and CAPREIT has room to raise in the future. Of course, the yield by itself is hardly enticing considering that risk-free rates are above that and most REIT do indeed yield more than that. The long thesis here comes down to whether you believe in the NAV and the ability to generate long term growth of this base. Yes, you may argue that interest rates may go higher and inflation may stay strong. That is certainly possible. But that will also make owning homes in Canada next to impossible. Apartment replacement costs should also rise as a result. CAPREIT will recycle capital accretively as well. We remain bullish on its prospects and think the longer-term cycle will play in its favor. We continue to own it and our covered calls (expiring in December) fortunately mitigated about half the decline so far. We rate it a buy and maintain our $64 price target.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment