Thinglass/iStock via Getty Images

Investment Thesis

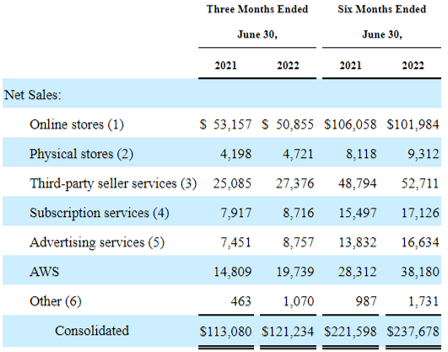

Amazon (NASDAQ:AMZN) is growing to be a jack of all trades, given its multiple fingers in many different pies. YTD, the company reports seven differing revenue segments, with the majority of revenues still attributed to e-commerce at 41.9% for now. The others include physical stores at 3.8%, third-party sellers at 22.5%, subscriptions at 7.1%, advertising at 7.2%, AWS at 16.2%, and others at 0.8%. If one were to simply take a quick look at AMZN’s FQ2’22 press release, it would be very easy to be overwhelmed by the monstrosity of its various businesses and expansion plans.

Amazon Revenue By Segment

Seeking Alpha

With its latest acquisition of One Medical (ONEM), it seems that AMZN is also very bullish about the prospects of primary care services, on top of its existing Amazon Care and Pharmacy. One that appears overcrowded at the moment, with Teladoc (TDOC) still struggling to report profitability thus far. We shall see if AMZN is able to turn this into gold.

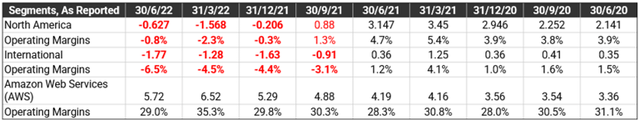

AMZN’s Operating Income

In the meantime, if we were to take a closer look at AMZN’s operating income, it is evident that the company is utilizing high volume low margin strategies for its North America and International segments. Thus, highlighting its single-digit margins thus far, which had clearly dipped negatively in the past three quarters. The company reported the North America segment with -$0.62B of operating income and -0.8% of margins in FQ2’22, while the International segment recorded -$1.77B and -6.5%, respectively.

In contrast, AMZN’s AWS segment has obviously held up the crumbling fort exceedingly well, with operating margins of 29% and operating incomes of $5.72B in FQ2’22. That had helped the company achieve a relatively decent operating income of $3.31B in FQ2’22, though it remains a far cry from $7.7B in FQ2’21. Nonetheless, the AMZN management appears determined to follow this path to the end, no matter the amount of pain in the short term.

Therefore, as a long AMZN myself, I suppose we can only sit back and observe for now, if their long-term investments will really pay off handsomely, assuming that consumer demand can catch up with their current overcapacity and further expansions. Only time will tell.

AMZN Will Continue To Post Losses For The Next Few Quarters

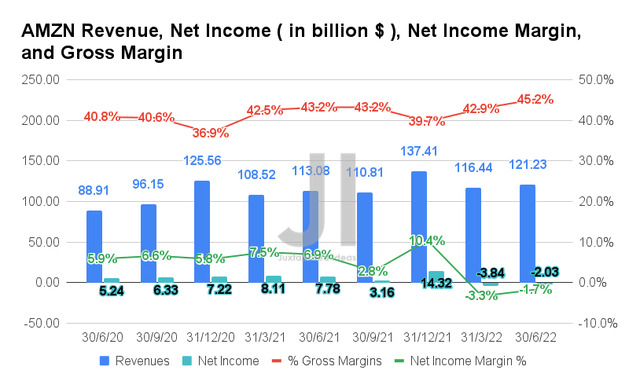

Despite the reopening cadence and global supply chain issues, AMZN has done very well for itself, since it reported revenues of $121.23B and gross margins of 45.2% in FQ2’22, representing excellent YoY growth of 7.2% and 2 percentage points, respectively.

In contrast, AMZN continues to post net losses of -$2.03B and net income margins of -1.7% in FQ2’22, representing a notable decline of 79.3% and 8.6 percentage points YoY. However, it is important to note that these were mostly attributed to the losses of its investments thus far, at a total of $13.93B for the past two quarters. Otherwise, AMZN would have reported an adj. net income of $3.36B in FQ2’22 and $4.71B in FQ1’22. Not as alarming indeed.

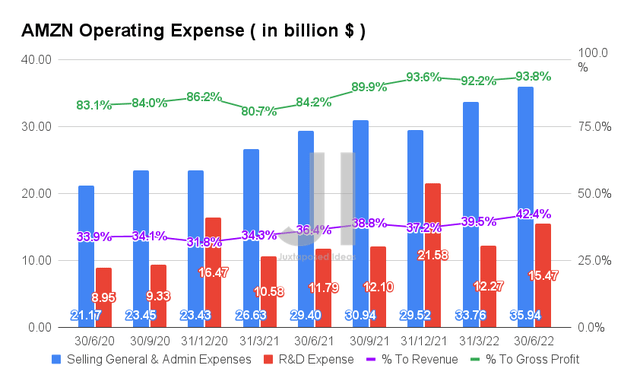

However, AMZN is also a company with massive operating expenses, with a total of $51.41B reported in FQ2’22. It represented QoQ growth of 11.6% and YoY of 24.8%, respectively. In addition, the ratio to its growing revenues accelerated faster than the former, since its operating expenses now account for 42.4% of its revenue and 93.8% of its gross profits by FQ2’22. That is an enormous increase from FQ2’21 levels of 36.4% and 84.2% or FQ2’20 levels of 33.9% and 83.1%, respectively. Therefore, pointing to AMZN’s poorer net income profitability over the past few quarters, compared to FY2021 or FY2020 levels.

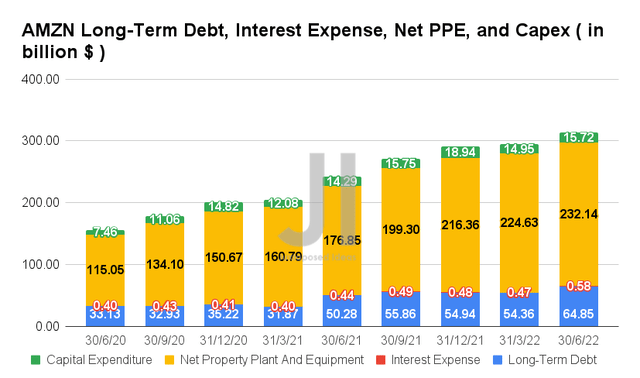

It is evident that AMZN continued to rely partly on its long-term debts for its aggressive expansion thus far. By FQ2’22, the company reported long-term debts of $64.85B and interest expenses of $0.58B, representing a massive YoY growth of 28.9% and 31.8%, respectively. In the meantime, AMZN also grew its net PPE assets to $232.14B and capital expenditure of $15.72B by FQ2’22, representing a tremendous increase of 31.2% and 10% YoY, respectively. It is no wonder that the company reported an overcapacity in FQ1’22 and FQ2’22.

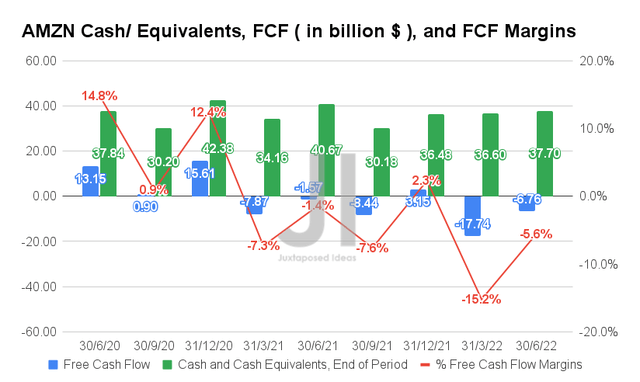

Nonetheless, it seems that Andy Jassy is very committed to this expansion strategy, since AMZN pressed on with major distribution centers in Southern California and Colorado, while also planning a $550M warehouse in Niagara. Furthermore, the company expects to open 250 additional delivery stations and fulfillment centers by the end of the year, on top of its existing warehouse space of 379M sq. feet in May 2022, representing a massive increase of 229% from pre-pandemic levels. Therefore, it is not hard to see why AMZN’s Free Cash Flow (FCF) profitability has been impacted for the past few quarters and will continue to be impacted in the short term.

In FQ2’22, AMZN reported an FCF of -$6.76B and an FCF margin of -5.6%, representing a notable decline of 430.5% and 4.2 percentage points YoY, respectively. If we were to take into account the company’s performance in FQ2’20, it indicated a further decline of 20.4 percentage points then. In the meantime, we also do not expect much improvement for the next two quarters, due to AMZN’s aggressive expansion projects.

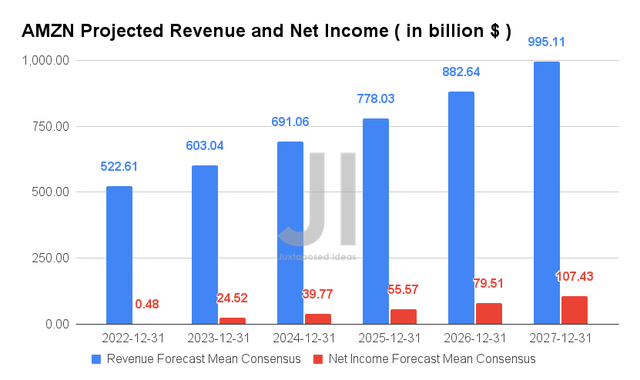

For the next six years, AMZN is expected to report revenue growth at a CAGR of 13.32%, while resuming its robust profitability from FY2023 onwards, with a net income CAGR of 44.68 through FY2027. Its net income margins are also expected to improve tremendously, from 4.1% in FY2019, 7.1% in FY2021, and eventually to 10.7% by FY2027. Thereby, highlighting AMZN’s prowess as one of the FAANG stocks.

For FY2022, consensus estimates that AMZN will report revenues of $522.61B and net incomes of $0.48B, representing YoY growth of 11.2% though a decline of 98.5%, respectively. It is evident that Mr. Market is very understanding of this particular decline, since the stock’s valuations and price actions are still trading at an apparent premium thus far. We shall see, if current levels hold for the next two quarters. Only time will tell.

In the meantime, we encourage you to read our previous article on AMZN, which would help you better understand its position and market opportunities.

- Amazon: Fed’s Rate Hike Spells Trouble For Its Growth And Profitability

- Amazon: Let The Sky Fall And Crumble – The Bottom Is Near

So, Is AMZN Stock A Buy, Sell, or Hold?

AMZN 5Y EV/Revenue and P/E Valuations

AMZN is currently trading at an EV/NTM Revenue of 2.71x and NTM P/E of 86.55x, lower than its 5Y mean of 3.23x and 94.12x, respectively. The stock has also recovered from its previous slump by 35.53% and currently trading at $139.50, down 25.8% from its 52 weeks high of $188.11, though at a premium of 37.7% from its 52 weeks low of $101.26.

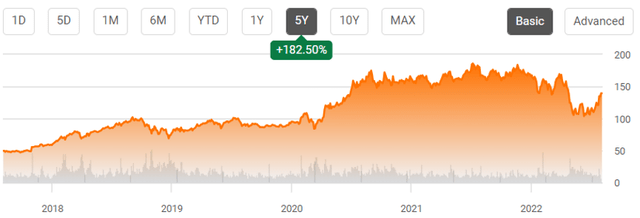

AMZN 5Y Stock Price

Nonetheless, we do not recommend adding AMZN here, despite consensus estimates’ strong buy rating with an eventual price target of $174.34 and a 24.96% upside. We prefer to monitor the situation a little longer, considering the Fed’s recent hike in interest rates, which may potentially lead to a decline in its e-commerce and Prime subscription segments moving forward. In addition, since the company seems to be committed to growth at all costs, we expect further temporary headwinds for its margins and profitability. Thereby, triggering further weakness in its stock performance in the short term, after the AWS rally is digested.

Therefore, we rate AMZN stock as a Hold.

Be the first to comment