J. Michael Jones

With the Federal Reserve seemingly prepared to the put the economy into recession to solve our significant inflation problem, investors have been fleeing from many cyclical stocks. However, not all economic cycles are the same, some sectors will perform better than in past downturns, others worse. In the case of Synchrony Financial (NYSE:SYF), markets have become too pessimistic, creating an attractive opportunity with the stock falling from $50 last year to $28 now.

Synchrony is one of the leading credit card issuers, having partnerships with many retailers, including Amazon (AMZN), Suzuki, SleepNumber, and many others. As a consequence, their borrowers are bit lower income and have higher credit risk than for a credit card company like American Express (AXP). Still, 77% of its borrowers are prime or superprime.

Now, in this economic slowdown, I prefer firms with US vs global exposure as natural gas prices are much lower here than in Europe, and China’s COVID-zero policy remains a source of great uncertainty. Synchrony is a pure play on the US. Within the US economy, the consumer remains relatively well positioned. Credit card delinquencies tend to rise when people lose their job. Today, the jobs market is very firm with jobless claims back below 200,000. There are still more job openings than unemployed Americans, so even if layoffs pick up, many workers can find a job elsewhere.

Now, high inflation has squeezed consumers’ disposable income, but gasoline prices have fallen by about 25% since their peak earlier this summer, which will provide relief. Additionally, consumers still have not spent all of their “excess savings” during COVID, and household net worth among the bottom-half of the country (the most likely cohort to default) has more than doubled since the pandemic to $4.4 trillion, according to the Federal Reserve. Accordingly, I think even as the economy slows, credit quality can prove resilient. This optimism is not reflected in SYF shares.

Currently, the company is performing well. Last quarter, it earned $1.60 per share, bringing earnings over the past 12 months to $6.85, giving shares a less than 5x P/E. Clearly, markets do not expect this level of earnings to sustain. And that is likely correct as the past eighteen months have been about the best period to be a credit card lender as government stimulus checks brought delinquencies and defaults to essentially record lows. As that tailwind fades, and losses normalize, credit losses will rise from very low levels.

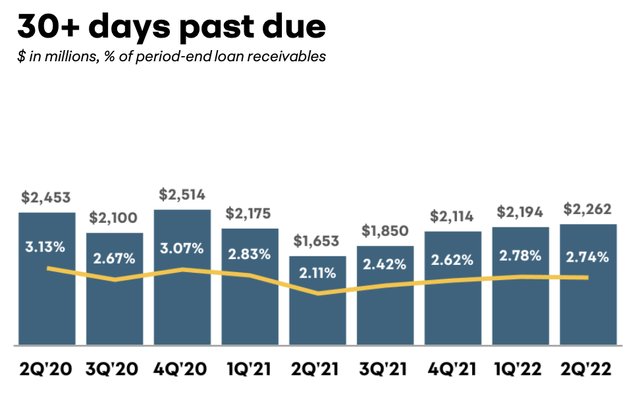

At the end of 2019 (when the economy was going well), 30+ day delinquencies were 4.44% for Synchrony. In Q2, they were just 2.74%. While this has risen from the lows last year, it remains a very strong level. We are seeing consumer credit gradually move toward normal but in no way are the trends alarming.

To reflect this normalization, SYF set aside $724 million for credit losses last quarter. Remember, it still earned $800 million even with this credit loss provision; that is how profitable its underlying business is because it charges about 20% for its credit card loans, which at $78.9 billion makes up the lion share of its $97 billion in assets. In total, the company has set aside $8.8 billion or about 10.6% of its loans to cover losses. At the end of 2019, SYF had $5.6 billion in loan losses to cover its $104.8 billion in assets.

SYF has run its business assuming delinquencies would normalize as fiscal stimulus faded, which is in fact happening. This means though that it is carrying sufficient loan loss reserves for this normalization, and relative to its history, it is actually being conservative, with over $3 billion in incremental reserves. Because it has adequately provisioned for a rise in losses, earnings can be fairly resilient, given my view that the health of the US consumer will keep delinquencies from rising too far above 2019 levels.

Beyond its adequate loan losses reserves, SYF is well capitalized with a 15.2% common equity ratio. This is above the firm’s 11% target and the 14% it ran before COVID. Because earnings have been so strong and capital ratios are solid, the company has been significantly reducing its share count via buybacks. It has repurchased about 15% of the company over the past year, taking its share count to 495.3 million for a book value of $25.95, up 10% over the past.

SYF is trading about 1.1x book value even as it earns a 24% return on equity, implying about a 20% return for investors in the stock if it sustains that operating performance. Now given the economic downturn, let’s assume it has to boost quarterly loan loss provisions by 20%, which would be an incremental $150 million from Q2, a level I believe to be conservative given its strong allowances. That would reduce earnings from the $1.60 Q2 pace to $1.30. Additionally, the company has limited exposure to interest rates because most of its loans like credit cards are variable rate, like its borrowings (primarily deposits). But if its net interest margin compressed by 100bp, that would reduce earnings by about $0.08 for run-rate EPS of about $4.75-5 per share during a moderate economic downturn.

That provides about $2.5 billion in annual earnings power, which can be returned to shareholders. On top of this, as SYF gradually approaches its target 11% capital ratio, that provides another $3 billion of capital that can be returned. That positions SYF to maintain and increase its 3.2% dividend yield over time while continuing to aggressively repurchase shares – likely over $2 billion/year or about 15% of the stock per year at its current share price. That amount of repurchase activity will enable EPS and book value to rise at a low-double digit pace off of my $5 2023 EPS target.

I am looking for shares to move to the $40 area over the next year. Given the cyclical nature of credit card borrowing vs other types of lending, SYF is likely to have a below market multiple. But up to $40, the company will be able to purchase 10% of the outstanding stock per year and trade around 1.5x book value. Long-term shareholders should root for the share price to stay low as the company’s significant capacity for buybacks allow it to retire even more shares and more quickly grow per share earnings power.

Ultimately, patience will be rewarded in Synchrony. The company has managed its business to prepare for a cyclical downturn. It has excess capital and strong loan loss reserves. This allows management to aggressively repurchase stock while continuing to generate about $5 in earnings. At less than 6x run-rate earnings and with the buyback retiring 15% of shares a year, investors’ concerns over a recession have pushed SYF stock to extremely cheap levels. I see 50% upside from here.

Be the first to comment