Avid Photographer. Travel the world to capture moments and beautiful photos. Sony Alpha User

The Global Audio Leader

Spotify Technology S.A. (NYSE:SPOT) is the global leader in music streaming and is transforming the company into an audio company. The company recently (June 8) had its first investor day since its IPO in 2018. The investor day raised a lot of questions and made me very cautious, hence why I rate it as a hold.

Stock price performance had been pretty good until the growth stock peak in February 2021 (149% return), but since then the stock has given up all its gains and then some.

Spotify Investor Day

The investor day was a long event with 600 colorful slides with interesting insights, but also some odd projections and high expectations. I’ll go over Spotify’s plan for the future and the problems I have with some of it.

The Developing Market Opportunity

Spotify recently focused a lot on expanding into new territory. In February 2021, right at the peak of the stock at almost 300€, the company announced its launch into 80 new markets and the addition of 36 new languages onto the platform. The company followed this expansion into developing markets up with the more recent sponsorship agreement with FC Barcelona, which included the naming rights for the iconic Camp Nou stadium. In the Q1 earnings call, CFO Paul Vogel made it very clear what the strategy was here:

But based on our numbers, Barcelona attracts over 700 million unique viewers per year.[…] Again, our data was just 2/3 of their audience is in emerging or developing markets where we are growing and expect to grow the fastest. It’s such a great audience to have.

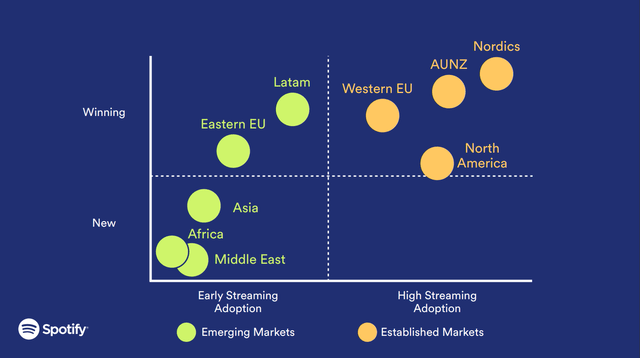

Spotify developed markets opportunity (Spotify Investor Day)

Spotify showed a graphic with the different regions they operate in. Spotify already dominates the developed countries, where streaming adoption and Spotify’s market share are high. The new regions, like Asia (ex-China), Africa and LATAM are new opportunities to increase market share early on in a developing streaming option.

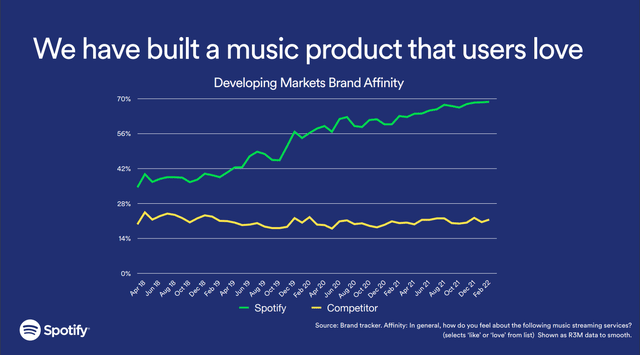

Developing markets brand affinity (Spotify Investor Day)

So far, the strategy seems to be working, based on a graphic the company showed about brand affinity in developing markets. People seem to prefer Spotify at an increasing rate, but most of this gain in brand affinity already took place before these new market entries and the FC Barcelona sponsorship took place. So the question is, are massive investments like the 280 million € sponsorship necessary? I believe that it’s justified compared to the opportunity at stake. The established markets Spotify serves are home to around 600 million people, while the developing market opportunity is in the billions of potential customers.

New Feature Rollouts

Leveraging The Artist/Fan Relationship

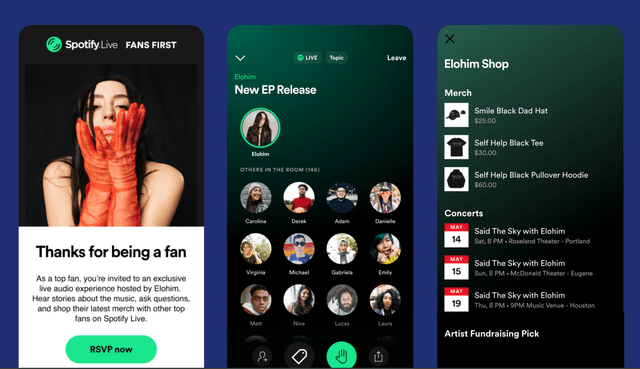

Spotify increasingly tries to leverage the existing relationship between artists and their fans by rolling out features like Live shows, similar to Twitter Spaces, or integration of merch shops or tour dates. I like this development as it simultaneously increases the value Spotify offers to its users and artists, but also offers monetization models down the road. Spotify also mentioned that its discovery mode advertisement platform showed 98% customer retention rates for fans finding an artist that way and an average increase in listenership of 40%. These stats are encouraging for the ad business, which is expected to grow to a significant portion of total revenues in the next years.

Spotify fans first (Spotify Investor Day)

The Podcast Opportunity

Podcasts obviously were one of the big talking points in the investor day, with Spotify investing billions into acquiring companies like Podsights and Chartable and acquiring original content like the Joe Rogan Experience (and what an experience it has been so far for Spotify with all the scandals).

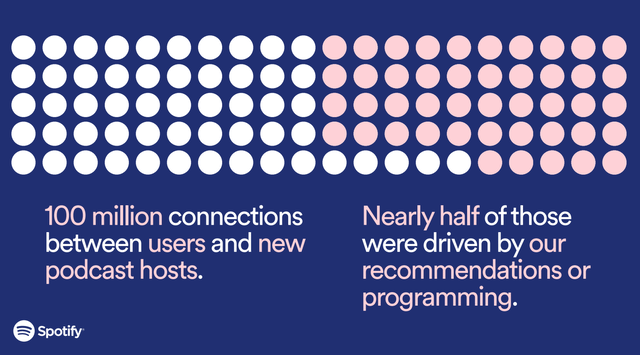

Podcast discovery (Spotify Investor Day)

Spotify is leveraging its recommendation algorithms with Podcasts the same way they do it with music. This led to a sharp increase in new connections between listeners and podcast hosts. Video podcasts should further increase the connection between users and podcast hosts, I’m very curious to know if this feature finds adoption. The percentage of users listening to podcasts increased from under 7% in 2018 to 30% last quarter.

Besides increasing ad revenue on podcasts, Spotify is also rolling out a subscription feature. Spotify won’t take a cut for podcast subscriptions until 2023, when the take rate will be just 5%, compared to 15% on Apple’s podcasting platform. Spotify is playing the long game and is looking to capture creators into its system instead of trying to rush profitability through podcast subscriptions. So far, the company saw a 90% retention rate across podcast subscribers, which isn’t too great compared to its retention rates in other parts of the business (93.5% in developing markets, consolidated 96.1% and 97.6% in developed markets). With only 14% of podcast listening hours being monetized so far, there is massive upside potential here out in the future.

Spotify’s Financials

Up until this part, I really liked what Spotify showed us, but some of the financials are way too euphoric for my liking. I like my companies to under-promise and under-deliver instead.

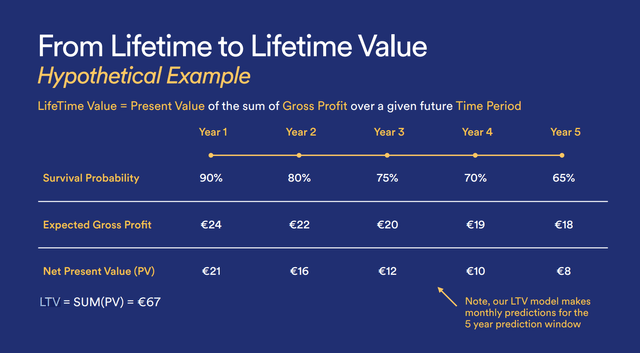

Lifetime Value Breakdown

Spotify keeps talking about optimization for the Lifetime Value (LTV) of customers, so this example they included helps understand this. LTV is the “Present Value of the sum of Gross Profit over a given future Time Period” for Spotify. So effectively, there are two levers for Spotify to increase LTV with each business decision: Increase customer retention and increase gross profit per customer. Currently, Spotify is investing a lot of money in initiatives that they expect to increase these two variables in the future.

Lifetime value breakdown (Spotify Investor Day)

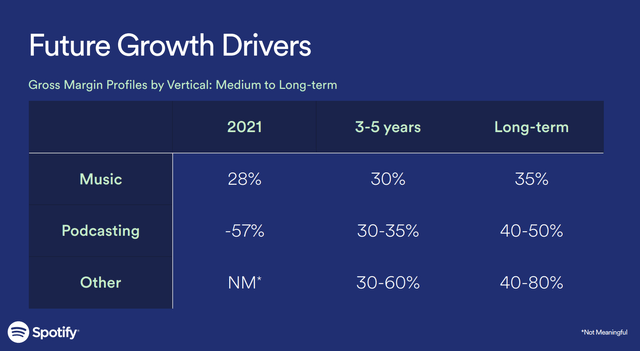

The Gross Margin Problem

Ever since going public, Spotify’s story was dependent on incremental gross margin improvement. From 2018 to now, gross margins only increased from 23 to 26%, a big reason for the depressed share price. Currently, podcast has a very negative gross margin due to the excessive investment in original content to get users onto the platform. The customer acquisition part has worked well so far, and Spotify rose to the top of podcast consumption in just a few years. The long-term goal is to grow gross margins across the board to eventually arrive at a 40% margin in 2030 (more to that in the next segments).

Gross margin situation (Spotify Investor Day)

Raising Unrealistic Expectations

Finally, I want to talk about my biggest problem with the investor day: The unrealistic expectations from management.

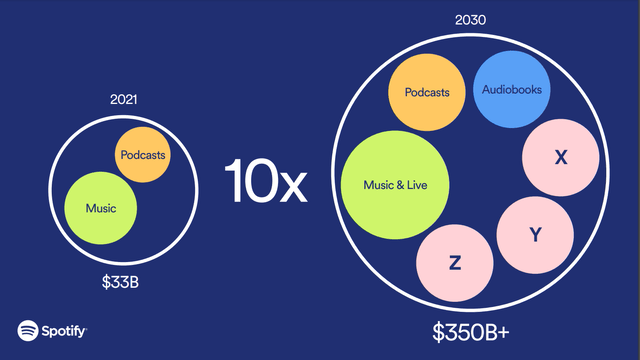

Spotify TAM evolution (Spotify Investor Day)

Total addressable market (“TAM”) metrics are always to be viewed with a grain of salt. Spotify is looking to expand into three new segments, which weren’t revealed, besides the expansion into Podcasts and audiobooks. Currently, these segments are tiny, with 2020 podcast revenues at $1.1 billion and audiobook revenues at $3.5 billion. These new segments are expected to grow into $20-30 billion industries within 9 years. I find it questionable if these segments can grow to almost the same size as the music industry, and it raises pretty high expectations at a tenfold increase for the opportunity ahead.

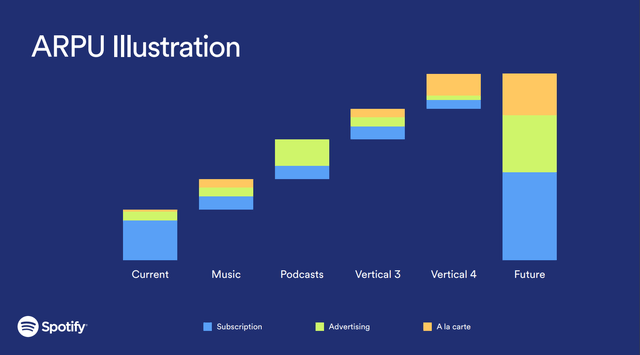

Spotify ARPU development (Spotify Investor Day)

Spotify also showed how they project ARPU to increase over the rest of the decade. Advertising is expected to grow into the majority of the business (a la carte represents the two-sided marketplace, which is a way of advertising in my opinion), driven especially by podcasts and the new verticals that aren’t revealed yet. Spotify’s advertising business has shown some good progress but hasn’t proven itself yet, so these projections need to be proven in the coming years.

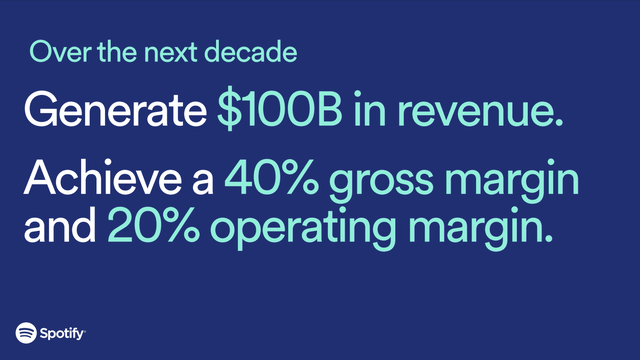

Spotify 2030 goals (Spotify Investor Day)

What really caught me off-guard was the goal to grow to a $100 billion revenue company with 40% gross margins and 20% operating margin. This goal would result in the following compound annual growth rates (CAGR):

| 2022 trailing(m) | 2030(m) | CAGR(22-30) | CAGR(17-22) | |

|---|---|---|---|---|

| Revenue | $11260 | $1000000 | 31% |

29% |

| Gross Profit | $3000 | $40000 | 38% | 48% |

| Operating profit | $368 | $20000 | 64% | 28% |

Spotify expects a slight acceleration in revenue growth and a massive acceleration in profitability. These expectations are very bold, especially because the company also has a big scale. It is one thing to scale from $3 billion to $11 billion. It’s a totally different story to go from $11 to $100 billion. I prefer management teams that lowball expectations and beat those. Management lost some of my trust with this aggressive guidance, and I see Spotify as a hold right now. I hold around 2% of my portfolio in this stock, making it one of my smallest positions.

Be the first to comment