jetcityimage

Thesis

We follow up on our previous article (Sell) on Exxon Mobil Corporation (NYSE:XOM), as there have been several noteworthy developments on its price action and estimates over the past month.

We urged investors to reduce their exposure as we didn’t think XOM justified its premium. Furthermore, we noted a potential bull trap (significant rejection of buying momentum) in June on its long-term chart was forming and therefore warranted caution.

Our thesis has played out accordingly, as XOM has significantly underperformed the SPDR S&P 500 ETF (SPY) since our previous article, despite its “cheap” valuations. XOM delivered a return of -14.65% against the SPY’s 0.6% gain since our article on June 14.

Exxon is scheduled to report its Q2 earnings card on July 29. The consensus estimates suggest that it could be a quarter of massive profitability. Despite that, some investors could be confused why the market still sent XOM down more than 20% from its June highs. Furthermore, it traded at an NTM FCF yield of 9.53% at its June highs, well above its 5Y mean of 5.42%. Has the market gone crazy? The market is getting it all wrong, isn’t it!

We learned never to argue with the market. Instead, we learned to pay attention to significant price structures and why they formed at certain price levels. Also, we learned that price action is forward-looking, not backward-looking. Therefore, knowing how to interpret price structures appropriately could help investors make sense of their analytical models. Also, it could proffer investors keen insights into how the market could behave moving forward.

Given the steep decline in XOM over the past month, we revise our rating from Sell to Hold.

While we are not convinced that the sell-off is over, we observed oversold technicals on the short- and medium-term charts. Therefore, the market could use its near-term bottom to attract dip buyers. Moreover, investors/traders who executed directionally-bearish set-ups could also cover their positions.

However, we urge investors not to buy this dip. Instead, investors should await another potential bull trap predicated on a short-term rally before cutting exposure further.

Peak Profitability in Q2

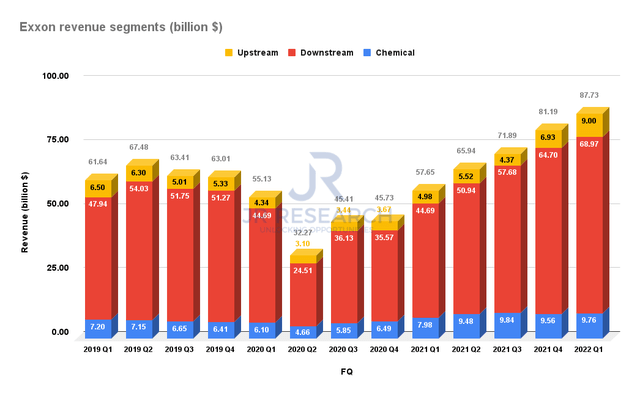

Exxon revenue segments (Company filings)

There’s no doubt that Exxon has benefited tremendously from the tailwinds that lifted the leading energy players since its March 2020 COVID bottom. The gains have also been broad-based, as seen above, benefiting all its critical revenue segments, including downstream.

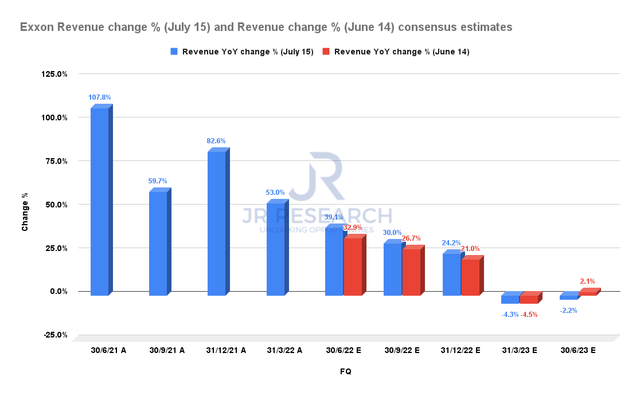

Exxon revenue change % comps (S&P Cap IQ)

However, investors must remember that the market is forward-looking. The market is a forward discounting mechanism that prices events ahead of time.

Notably, the consensus estimates (generally bullish) suggest that Exxon’s revenue growth is expected to fall markedly through Q2’23. Furthermore, the Street even upgraded Exxon’s estimates for FY22 since our update in June, as seen above. Despite that, the market still battered XOM over the past month. Therefore, we believe it demonstrates the market is already looking past its spectacular FY22 to what lies ahead.

If you see what we observed, it doesn’t look good. And remember, the Street is generally bullish, so the consensus estimates already have an embedded bullish tilt.

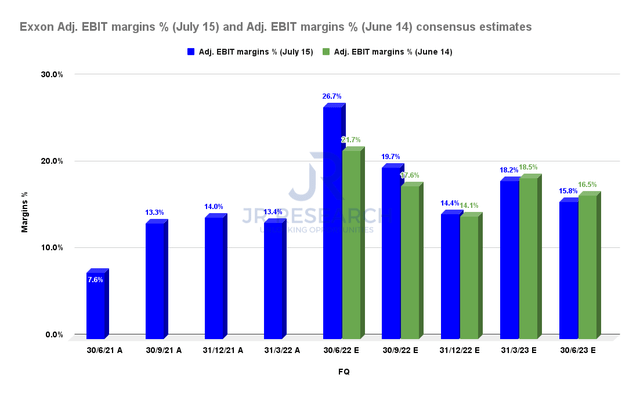

Exxon adjusted EBIT margins % comps (S&P Cap IQ)

In addition, the Street also upgraded Exxon’s FY22 adjusted EBIT margins, as seen above, since our update in June. The revised estimates expect Exxon to deliver an adjusted net income of $15.64B in Q2’22, well above its June estimates of $12.6B. Wells Fargo (WFC) even updated in early July that it expects Exxon to post a net income of $17.9B (14.5% above consensus), as it added (edited):

A near record performance from the Upstream segment (just below Q3’08) and what appears to be record performance from the other segments combined should be well-received by investors, in our view. – Barron’s

Again, even the bullish Street consensus thinks Exxon’s profitability margins could moderate through Q2’23, as seen above. Therefore, investors should consider that Exxon’s Q2’22 profitability could likely be its peak.

Don’t Ignore The Recession Impact On Exxon Mobil

Despite all the media frenzy over record-high oil prices and how the leading energy players are expected to post record profits quarter after quarter, we urge investors not to follow the news blindly.

Furthermore, the WTI crude futures continue to point to markedly lower oil prices ahead. For instance, July 2026 contract was priced at $67.79, well below July 2024’s contract pricing of $73.99. Exxon also cautioned in its 10-Q on the impact of lower oil prices. It emphasized (edited):

The oil, gas, and petrochemical businesses are fundamentally commodity businesses. This means ExxonMobil’s operations and earnings may be significantly affected by changes in oil, gas, and petrochemical prices and by changes in margins on refined products. Any material decline in oil or natural gas prices could have a material adverse effect on certain of the company’s operations. (Exxon’s FQ1’22 10-Q)

The market has also understandably turned its focus toward recessionary fears, exacerbated by the Fed’s rate hikes. Therefore, investors should not brush off such headwinds, thinking that the tight supply/demand dynamics surrounding the leading energy players could compensate for potential demand destruction.

Exxon also cautioned in its filings:

The demand for energy and petrochemicals is generally linked closely with broad-based economic activities and levels of prosperity. The occurrence of recessions or other periods of low or negative economic growth will typically have a direct adverse impact on our results. (10-Q)

Also, the IEA recently reduced the forecasts for oil demand in 2022/23, as the WSJ reported commentary by the IEA (edited):

The worst oil-supply crisis in decades is showing tentative signs of easing as flagging economic growth weighs on demand for crude while sanctions on Russia are having less impact on oil production than expected. – WSJ

XOM Is Primed To Underperform

| Stock | XOM |

| Current market cap | $350.29B |

| Hurdle rate [CAGR] | 6% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 8% |

| Assumed TTM FCF margin in CQ4’26 | 10% |

| Implied TTM revenue by CQ4’26 | $363.51B |

XOM reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a hurdle rate of 6% in our valuation model. It aligns with XOM’s 5Y total return CAGR of 5.91%. We also used an FCF yield of 8% to model the market’s valuation dynamics.

Notably, the market formed June’s bull trap on its long-term charts at an FY24 FCF yield of 7.27%. XOM last traded at an FY24 FCF yield of 9.24% at its near-term bottom. Therefore, we believe an 8% yield is appropriate. Also, we urge investors not to use its NTM FCF yield of 14.3% in their modeling, given falling FCF margin estimates from FY22.

Using a TTM FCF margin of 10%, we need Exxon to post a TTM revenue of $363.51B by CQ4’26. While it seems achievable as Exxon is expected to post revenue of $393.03B in FY22, we urge investors to look forward.

Since the market set up the massive bull trap in June, we believe it indicates that the market expects Exxon’s revenue and profitability to moderate, moving ahead, in line with the consensus estimates.

Therefore, we believe there’s a considerable risk that XOM may not even meet our revenue target at an implied hurdle rate of 6%.

Is XOM Stock A Buy, Sell, Or Hold?

We revise our rating on XOM from Sell to Hold.

We observed that XOM is likely at a near-term bottom, as its short- and medium-term technicals are oversold. However, we do not encourage investors to buy this dip. Instead, they should wait for a deeper retracement to improve their chances for outperformance.

Our valuation model suggests that XOM could underperform moving ahead as its revenue growth and profitability moderate moving ahead.

Be the first to comment