Zontica/iStock via Getty Images

Chewy, Inc. (NYSE:CHWY) stock has recovered sharply from the lows of around $23 seen in May but the stock is well below the 52-week highs of close to $98 registered in August 2021. Although the recovery has been stellar in the last month or so, CHWY stock is still down more than 27% this year, which makes it an underperformer compared to the S&P 500 Index which is down 21% in 2022. Pandemic winners are proving to be the biggest losers in this transitory era where we are headed toward normalcy, which begs the question of whether Chewy’s best days are already behind the company. In this article, we will evaluate the long-term prospects for the company to determine whether it’s rational to expect Chewy stock to break the $50 barrier once again.

Is Chewy Profitable?

Chewy, Inc. is a pet care-focused pure-play online retail and wholesale consumer discretionary company. During the pandemic, the company saw an increase in demand for pet products, resulting in an unexpected swing in Chewy’s profits. Chewy benefited from pandemic-related restrictions that led to a global lockdown, which fueled the growth of the e-commerce industry and also led to a sharp rise in the interest in pets. The market share of e-commerce sales increased from 15% of global retail sales in 2019 to 21% in 2021 aided by these positive developments in the e-commerce sector. According to National Geographic data, the demand for adopting or fostering pets also increased dramatically in 2020 as people who were confined indoors raised pets as a way to deal with pandemic-related stress. According to Morgan Stanley (MS), the number of households with pets increased by 5.6% in 2020. This increased demand for pet services and products propelled the pet care industry to new heights and helped Chewy eventually reach profitability in two quarters in fiscal 2021.

Similar to how the pivot toward online purchasing due to extended lockdowns and social distancing rules played a significant role in Chewy’s success, the reopening of the economy has brought significant challenges for the company. Chewy’s business was disrupted by supply-chain and inflationary pressures as well. For the last three quarters of 2021, the pet supply e-commerce giant reported a continuous deceleration of growth and increasing net losses. Wall Street analysts expected the company to report net losses in the first quarter of 2022 as well, however, the company exceeded expectations by reporting a surprise profit and better-than-expected margins.

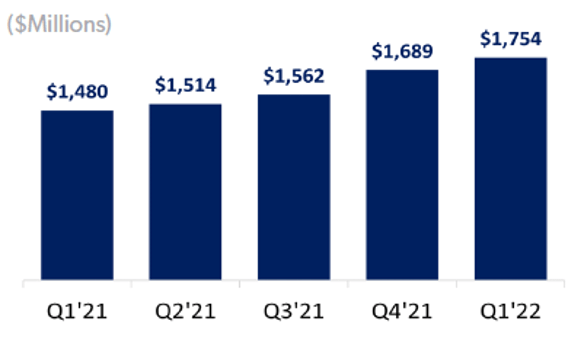

In the first quarter of fiscal 2022, Chewy’s sales increased 13.6% year-over-year to $2.43 billion, driven by the strong performance in the Consumables and Healthcare categories. Additionally, the company reported greater Autoship penetration rates, with Autoship customer sales rising to a new high of 72.2% of total net sales. The company defines Autoship customers as customers who have had an order shipped through the company’s Autoship subscription program within the previous 364 days. This program offers automatic reordering and delivery. The consistent growth of Autoship demonstrates the increasing number of high-value customers, who, according to the company, have predictable purchasing patterns and are more likely to participate in the subscription program for a long period of time.

Exhibit 1: Autoship Customer Sales

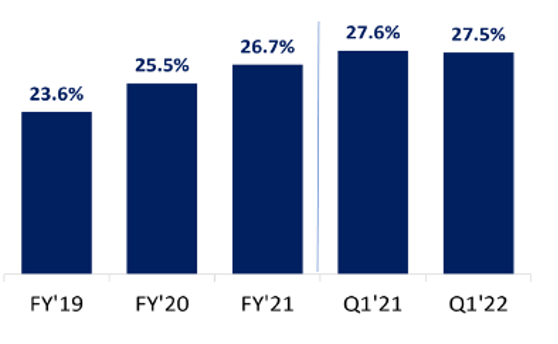

Q1 shareholder letter

With an increasing number of valuable and long-term customers, spending per customer is likely to move higher in the future as well, resulting in long-term recurring revenue streams via subscription services. The company now serves an active customer base of 20.6 million and the engagement of customers was also high in the first quarter with average annual spending reaching a record $446. Net income was $18.5 million, down from $38.7 million reported in the corresponding quarter the previous year due to slightly lower gross margins and higher SG&A spending. First-quarter gross margin came to 27.5%, down 10 basis points year-over-year. Chewy ended the quarter with $600 million in cash and no debt on its balance sheet.

Exhibit 2: Gross Margin

Q1 shareholder letter

The number of pet owners and pet-care spending can be expected to increase due to the health benefits of pet ownership, and Chewy continues to implement new strategies to maintain its position as a market leader in the pet-care industry. The company has ambitious plans for the coming years to strengthen its position in the fresh and prepared pet food market, which is estimated to represent an addressable market opportunity worth $1 billion. Chewy is also gaining market share in the pet healthcare space, and the company now plans to enter the pet insurance space with its insurance and wellness offering CarePlus. Trupanion, a pet insurance provider, is developing a suite of pet insurance plans for Chewy’s CarePlus which is set to launch in the second quarter. CarePlus, once launched successfully, will provide a unique and lucrative opportunity for Chewy in the growing veterinary healthcare market.

In March, the company also announced plans to launch two new businesses in 2023: Chewy Loyalty, a customer loyalty program, and Sponsored Ads on Chewy.com. Loyalty programs are known to increase sales as data shows that they make customers more likely to do business with brands and recommend them to others. Adding a loyalty program to an e-commerce platform, according to Incentive Solutions, can increase average order quantity by 319%. Furthermore, in this digital era, the advertising business has proven to be profitable. Allowing suppliers to run advertisements on its website is beneficial for two reasons: first, this will diversify the revenue sources of the company, and second, it will help establish Chewy as a one-stop shop for pet owners.

Chewy is trying to tap into profitability today but there has been no consistency so far when it comes to profits. That being said, investing in stocks is more about the future and less about the past. Chewy, from a financial performance perspective, seems to be headed in the right direction.

Is Chewy Stock a Good Long-Term Pick?

Chewy stock has had a challenging time after riding high at the height of pandemic fears. After reaching an all-time high of over $118 in February 2021, the stock has been trending downward primarily due to unfavorable macroeconomic developments. Even though CHWY rose around 20% after reporting a surprise profit for the first quarter, many investors and analysts remain skeptical of Chewy’s ability to repeat the same in the next quarter amid rising inflation and supply-chain challenges. Although we believe Chewy’s growth is likely to hit a speed bump in the next few quarters, the company’s guidance tells a different story. The management expects growth to pick up in the second half of the year.

Although the company’s gross margin took a hit on a YoY basis, it increased 210 basis points compared to the fourth quarter of 2021. In the short term, the challenging macroeconomic environment and Chewy’s new outbound freight contract with FedEx Corporation (FDX) may continue to worry investors. However, we believe the company possesses some ability to remain resilient in the face of adversity because of logistics initiatives such as Chewy Freight Services and import routing, which were launched in Q4 2021 to enhance customer satisfaction and offset rising freight prices. Long-zone shipments to customers increased by 15% in the first quarter, and on-time delivery increased sequentially by almost 800 basis points. These improvements led to lower costs and an improved customer experience, and we believe these positive developments could lead to customer stickiness in the long run. For an e-commerce platform to succeed, customer stickiness plays an important role, and there’s reason to believe Chewy is focused on this important aspect.

In the long run, the company is likely to benefit from two macro factors. First, e-commerce penetration of global retail sales will continue to grow, and second, pet ownership is expected to skyrocket over the next five years. According to the American Pet Products Association, currently, 70% of U.S. households own a pet, and pet expenditures have increased from $90.5 billion in 2018 to $123.6 billion in 2021, driven by the trend of “humanization of pets.” This trend combined with easy accessibility to pet care resources will continue to drive spending on pet care, and Chewy seems well-positioned to make the most of this trend.

When selecting an investment, we look at two important aspects: the story of a company and the numbers. Chewy’s story is easy to understand and the company’s recent financial performance (revenue growth in each of the last 12 quarters) suggests this story is backed by numbers as well. The next step for an investor is to determine whether it makes sense to pay 1.7 times forward sales to invest in the company today. Based on conservative assumptions, we estimate Chewy’s intrinsic value to be around $51.84 per share using a discounted cash flow model, but at the same time, we believe Chewy stock might come under pressure before gaining traction again. Contrary to the company management’s expectations for growth, we believe the next few quarters will prove to be difficult for the company and the industry as inflation finally makes its way into the wallets of Americans, and we also believe that it makes sense to wait for some hard data from Chewy’s customer retention improvement efforts before jumping on board.

Takeaway

Chewy seems to be moving in the right direction and we believe Chewy stock will trade above $50 in the long run. For this to happen, however, the company needs to maintain profitability by retaining existing customers and even more importantly by adding new customers. Both these tasks, in our opinion, are easier said than done amid macroeconomic challenges. We believe Chewy stock does not offer an acceptable margin of safety today to initiate a new investment, and for this reason, we will remain on the sidelines.

Be the first to comment