Aleksei Iatsenko/iStock via Getty Images

Thesis

The Liberty All-Star Equity Fund (NYSE:USA) is a multi-managed closed end equity fund. USA does not employ leverage. The CEF is a golden standard in the equity CEF space, having outperformed the index in the past and providing investors with a high dividend yield obtained from equity market returns. Just like the index however, USA sources its performance from positive returns from the equity markets. This year the fund is down substantially (-21.5% total return) and has moved in lock-step with the S&P 500:

2022 Total Return (seeking alpha)

The CEF is overweight Financials versus the S&P 500, and although the Financials sector has performed much better that other pockets of the markets (Financial Select Sector SPDR Fund (XLF) is down only -17% year to date), USA has not outperformed the Index. We believe this is due to individual stock selection and some weak top holdings such as Adobe (ADBE), which has suffered a significant drawdown last week due to their earnings guidance and Figma purchase.

The CEF’s portfolio is, theoretically at least, well set up to weather the storm. As per BlackRock:

We advocate using a barbell strategy to position for these competing outcomes. This includes owning energy and financials as inflation fighters, and healthcare for a dose of resilience. We find other traditionally defensive sectors, including utilities and staples, to be expensive relative to the broader market.

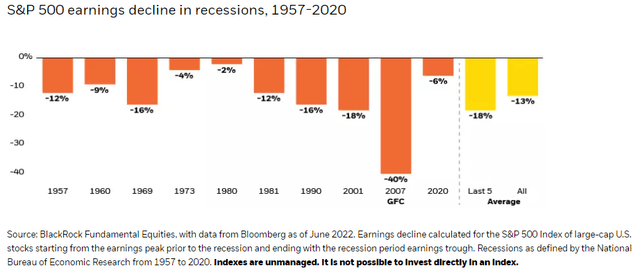

However, USA will ultimately follow the path of the general stock market. If there is more weakness to be had in the S&P 500, USA will continue to decline. We believe the next shoe to drop is the Earnings component of the P/E Ratio:

Earnings Decline (BlackRock)

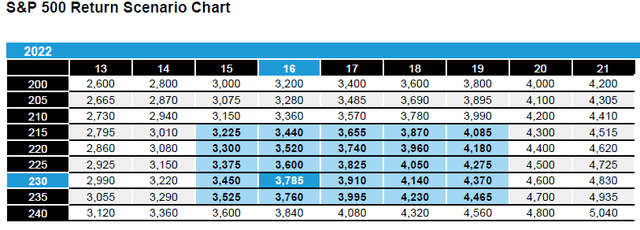

We believe the horrendous FedEx guidance from last week is just a flavor of things to come with a market-wide earnings revision storm to follow. Where the bottom lies in the Index is as much dependent on the Earnings component as it is on the P/E de-rating:

S&P 500 P/E Ratio & Earnings Matrix (Alliance Bernstein)

We are of the opinion that we are moving towards the long-term average of 15x P/E ratio, with a -5% to -10% revision down in earnings. That should move the Index to the low 3000s levels.

If you are considering buying USA then you need to frame it in your mind as buying the S&P 500 in the CEF format (i.e. you get quarterly dividends rather than long-term capital gains). The structure is also back at trading flat to net asset value, and has seen its premium fluctuate this year based on risk-on / risk-off moves.

We believe we are not there yet with the equity class decline this year hence we do not believe buying USA here represents an attractive entry point. We need to see a broad capitulation in stocks before considering buying USA, a very robust equity CEF that has produced stellar results in the past on the back of positive overall equity market returns.

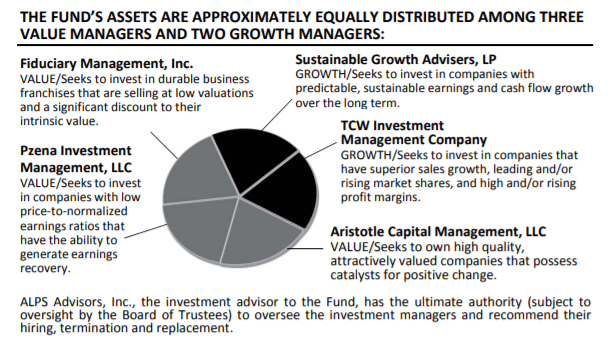

Managers

The investment advisor to the fund (ALPS Advisors) allocates portfolio management decisions to five distinct asset managers:

Fund Managers (Fund Fact Sheet)

In addition to utilizing Fiduciary Management, Pzena Investment, Sustainable Growth Advisers, TCW and Aristotle Capital for portfolio decisions, ALPS also parses out the fund style allocation by combining three value-style and two growth-style investment managers.

Holdings

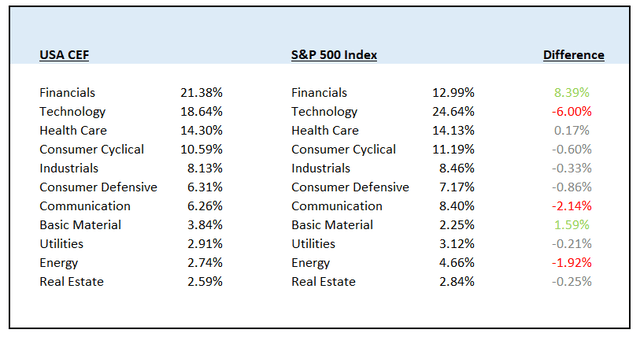

The fund is overweight Financials and Basic Materials when compared to the S&P 500:

Sectors (Author / Seeking Alpha)

We can see how USA has a very high allocation to Financials in detriment of Technology when compared to the Index.

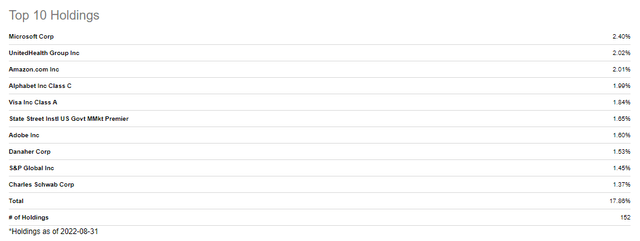

The top holdings contain only Large Cap names, with the notable presence of Adobe, which has suffered a significant drawdown last week due to their outlook and Figma purchase:

Top 10 Holdings (Seeking Alpha)

Performance

The fund has moved in lock-step with the index in 2022:

2022 Total Return (Seeking Alpha)

We can see from the above total return graph that we have not seen an outperformance year to date versus the index, despite the fund’s overweight Financials positioning.

On a 3-year basis the CEF now trails the index:

3-year Total Return (Seeking Alpha)

We can see that the fund had a very nice performance right after the Covid crisis, allowing the vehicle to outperform the Index. The CEF has now given back all those gains, undertaking a mean reversion.

Premium / Discount to NAV

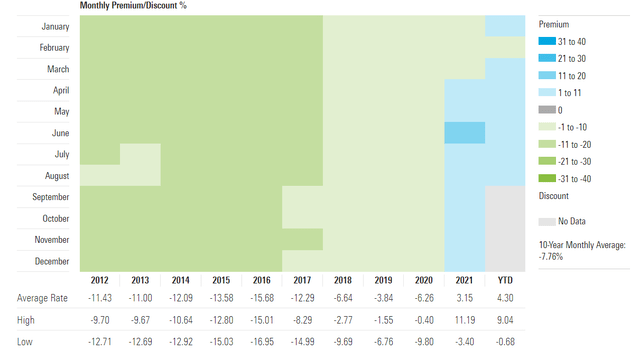

Historically the fund has traded at discounts to net asset value:

Premium / Discount to NAV (Morningstar)

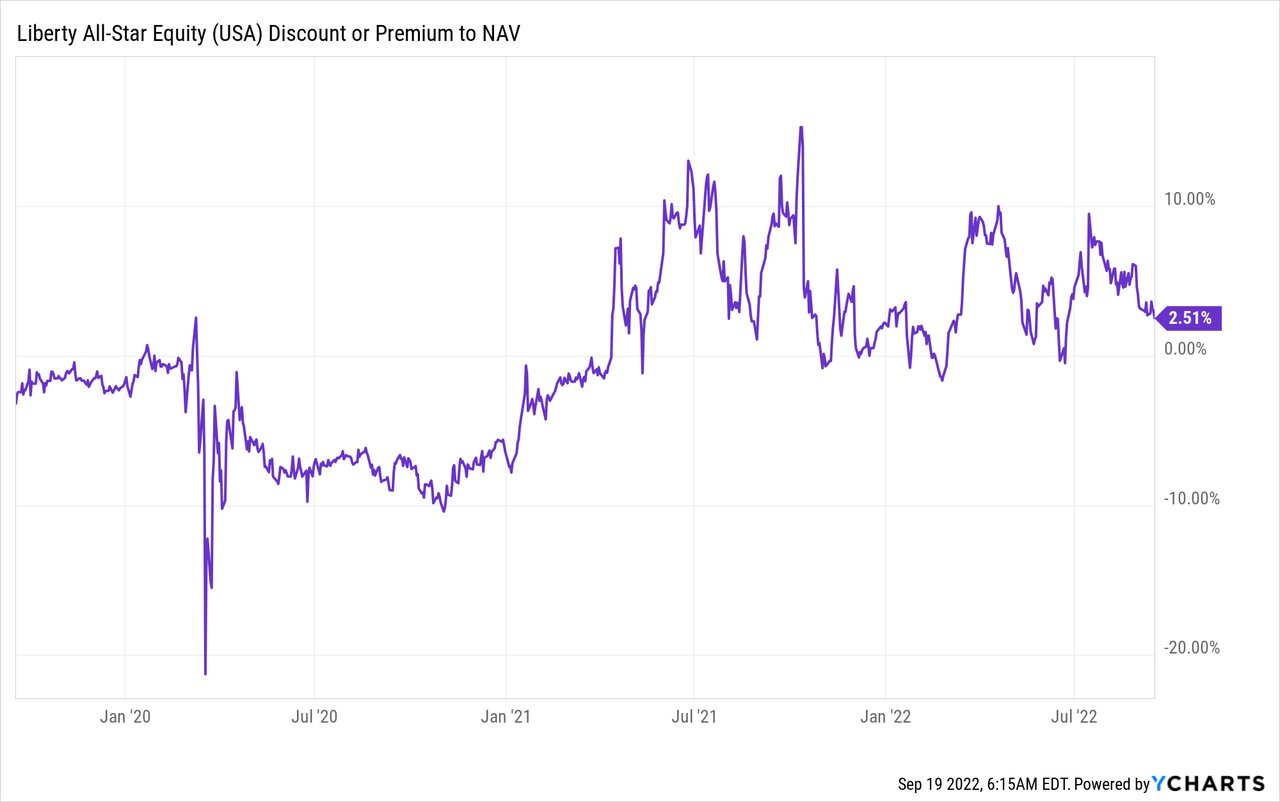

However, since the zero rates environment induced by the Covid crisis the fund moved to a premium to NAV:

The CEF has spent most of 2022 at a premium. The level of the premium has a nice correlation to general market risk-on / risk-off moves. During the June market sell-off we saw the premium collapse from 10% to nearly 0%. Expect this vector to change with market risk appetite.

Conclusion

USA is a premier equity CEF. The fund has achieved robust long-term results driven by positive annual returns in the North American equity market. The vehicle is currently overweight Financials versus the Index (>8% allocation differential) and is theoretically correctly set up for today’s environment. The fund has moved down in lock-step with the S&P 500 year to date, being down more than -20% so far. USA will ultimately follow the path of the general stock market. If there is more weakness to be had in the S&P 500, USA will continue to decline. We believe we are not there yet with the current bear market and the next shoe to drop is the Earnings component from the P/E ratio. We are targeting a revisit of the June 2022 market lows.

Be the first to comment