jcrosemann

Welcome to the Vanadium miners news.

September saw generally flat vanadium prices which remain rather low. Higher vanadium prices will be needed to help support new vanadium juniors to get funded and supply the potentially strong demand for VRFBs this decade.

Vanadium uses

Vanadium is traditionally used to harden steel. Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart – Price = USD 7.20/lb (China price not given)

Vanadiumprice.com![Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart](https://static.seekingalpha.com/uploads/2022/9/27/37628986-16643345598824952.png)

China and Europe Ferrovanadium [FeV] 80% prices – China = USD 37.00/kg, Europe = USD 30.75/kg

Vanadium demand versus supply

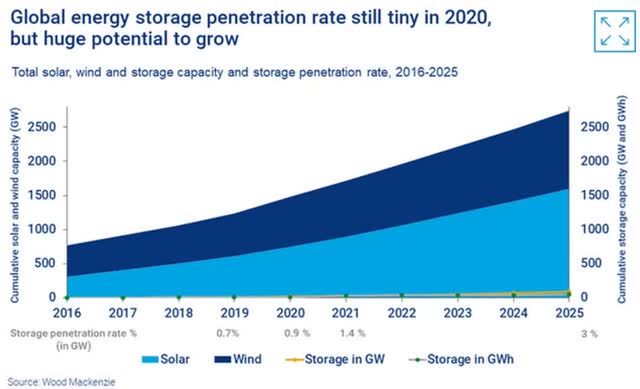

An April 2021 Wood Mackenzie report stated:

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global (energy storage) market to grow 27-fold by 2030.

Woodmac forecasts high growth ahead for solar, wind and energy storage

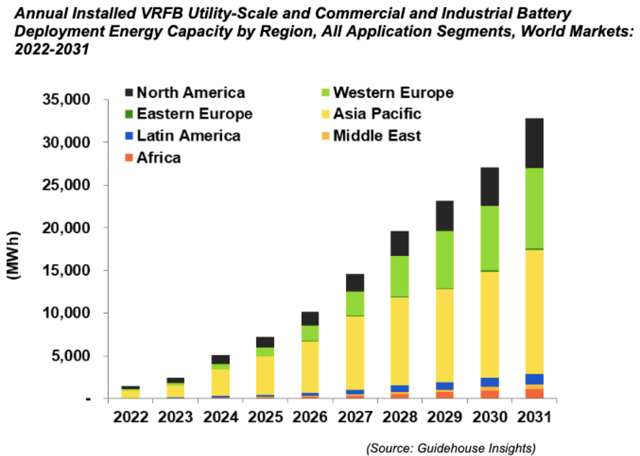

Global VRFB forecast growth by region 2022-2031

In 2017, Robert Friedland stated: “We think there’s a revolution coming in vanadium redox flow batteries…”

Vanadium market news

On September 2, Australianmining.com.au reported:

Research prompts study into uranium-vanadium plant. Toro Energy is well advanced in its evaluation of a costs estimate for a stand-alone uranium-vanadium mining and processing operation at Lake Maitland in Western Australia.

On September 5, Energy-Storage News reported:

MIT report: non-technical barriers to energy storage and how industry is getting around them… High cost and material availability are the main non-technical barriers to energy storage deployment at the scale needed… Although lithium-ion battery cells have fallen enough in cost over the last three decades to be viable for such applications, new battery technologies like vanadium redox flow batteries (VFRBs) or metal air batteries (MABs) need to be deployed in greater numbers to achieve long-term deployment goals… it is unclear if the private sector alone can drive down costs and improve performance enough for when demand does arrive, and government intervention may prove essential in getting there. The Long Duration Energy Storage Council recently set out a roadmap for what governments can do, and how long they may need to do it for… The VRFB industry is exploring other cost reduction initiatives including vertical integration into system deployment by primary vanadium suppliers like Largo Incorporated, Bushveld Minerals and new incumbents too. Another solution is to lease electrolyte to project owners instead of selling it, which removes some of the upfront capital cost. Avalon, which became Invinity Energy Systems through a merger, started this business model.

On September 26, Vanadiumprice.com reported:

Several key vanadium and titanium development industrial projects in Panzhihua were completed in the Third Quarter.

On September 27, Bloomberg reported:

Tesla’s big batteries aren’t the fire problem. Lithium is……There are viable alternatives…….Vanadium redox batteries, for instance, have a low levelized cost, are scalable, don’t degrade and there is no risk of combustion. These powerpacks use recycled metal from petroleum waste and can be charged and discharged without wearing out……With lithium prices hitting records, there isn’t enough of the metal to power the future, anyway. Systems will need to diversify, so it’s time to look for technologies that we can all live with – without the looming risk of fire, exorbitant costs or blackouts.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

No vanadium news for the month.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

AMG’s Q2, 2022 recent earnings report stated:

- Construction and commissioning of the new vanadium spent catalyst recycling facility in Zanesville, Ohio is proceeding as planned. The roaster is fully operational, and the entire plant is expected to be at run-rate capacity by the end of the fourth quarter of 2022……

- AMG’s first lithium vanadium battery (“LIVA”) for industrial power management applications is proceeding as planned and the objective is to be fully operational in the fourth quarter of 2022.

- Shell & AMG Recycling B.V. (“SARBV”) and its partner, the United Company for Industry (“UCI”), have signed an agreement with Saudi Arabian Oil Company (“Aramco”). Basic engineering has begun on the first of four projects to build, own and operate a conversion plant of vanadium-containing gasification ash supplied by Aramco into vanadium oxide and vanadium electrolyte.

You can view the latest investor presentation here and a recent Trend investing article here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On September 2, Bushveld Minerals announced: “Amendment to the Investment Agreement between Bushveld Energy and others and Mustang Energy Plc (“Mustang”)…..”

On September 13, Bushveld Minerals announced: “Unaudited Interim Results for the six months ended 30 June 2022.” Highlights include:

- “Revenue of US$76.2 million (H1 2021: US$47.0 million) and Adjusted EBITDA1 of US$15.6 million (H1 2021: Adjusted EBITDA loss of US$10.8 million) supported by higher vanadium prices and the weaker ZAR:USD exchange rate’s positive impact on costs.

- Operating profit of US$6.1 million (H1 2021: loss of US$19.7 million).

- Cash balance of US$7.0 million at 30 June 2022 (US$15.4 million as at 31 December 2021), with ongoing positive cash generation since period end.

- Free cash flow2 of US$7.1 million (H1 2021: negative US$19.8 million).

- Total borrowings of US$76.73 million (31 December 2021 US$ 80.9 million).

- Financial close achieved at Vametco’s mini-grid project, enabling site clearance and progress with many project activities.”

Outlook

- “Positive Adjusted EBITDA and free cash flow expected to continue into the second half of 2022, which will be used to meet the remaining capital requirements and debt repayments.

- Group 2022 production guidance adjusted downwards to between 3,900 mtV and 4,100 mtV.

- Group production run rate of 5,000 – 5,400mtVp.a. still expected to be achieved by the end of 2022.

- Construction of the Electrolyte manufacturing facility (BELCO) is now 80% complete, production expected in H1 2023.”

On September 13, Bushveld Minerals announced: “Issue of equity and novation of Lind Convertible Loan Note.”

You can view the latest investor presentation here.

Largo Inc. [TSX:LGO] [GR:LR81] (LGORF) (NASDAQ:LGO)

Largo Inc. is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil as well as a producer of VRFBs.

On September 15, Largo Inc. announced:

Largo announces completion of qualifying transaction for Largo Physical Vanadium Corp… Paulo Misk, President and Chief Executive Officer of Largo commented: “Completion of the Qualifying Transaction represents an important milestone for Largo, LPV and the vanadium sector. Leveraging the unique characteristics of vanadium, prospective investors are now provided with a new vehicle to invest in physical vanadium and gain exposure to the long-term fundamentals of the commodity – a key transition metal for greener steel, strategic and energy storage industries.” He continued: “Through the segregation of vanadium, a key cost component of vanadium redox flow batteries (“VRFB”), LPV intends to enhance the adoption of VRFBs by prospective customers in the long duration energy storage market and thus, grow vanadium demand in the future.”

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio”, as well as being a small vanadium producer.

No vanadium news for the month.

Ferro-Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR state: “The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

On September 15, Ferro-Alloy Resources announced: “Interim results for the six months ended 30 June 2022.” Highlights include:

Operating highlights

- “Feasibility study ongoing on both Phase 1 and Phase 2 of the Balasausqandiq project.

- Drilling of four ore-bodies (OB 1 – 4) nearing completion, early indication of a possible 40% resource increase from early X-ray fluorescence results of 800m strike comparison in OB1.

- Metallurgical test work confirms 93% recovery into leach.

- Expansion and adaptation of Existing Operation near completion.

- Half year production of vanadium pentoxide 95% higher than H1 2021.

- Production of ferro-molybdenum scheduled to increase with commissioning of new resin circuit in H2.

- High grade nickel concentrate production to start in H2, with associated additional recovery of vanadium.

- Conversion of AMV to vanadium pentoxide to start in final quarter of 2022.

- Vanadium pentoxide prices remaining high compared with historic average levels.

- Annualised production rate is expected to reach the targeted 1,500 tonnes of vanadium pentoxide equivalent towards end of 2022.

- Carbon by-product proven suitable for use in tyre manufacture, significantly increasing its potential value.”

Financial performance.

- “H1 revenue of US$3.9m, while materially ahead of last year, has been impacted by the supply chain issues caused by the war in Ukraine and the after effects of Covid-19

- Uncertainty remains as to the impact these issues will have on the outcome for H2 but the Company expects H2 revenues to be significantly greater than H1.”

On September 15, Ferro-Alloy Resources announced:

Result of placing and subscriptions……the Company has raised gross proceeds of £8.2 million (approximately US$9.5 million) through the issue of an aggregate of 68,424,084 new ordinary shares of no par value (“Ordinary Shares”) in the capital of the Company at a price of 12.0 pence per Ordinary Share (the “Issue Price”)……

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

No news for the month.

Investors can read the latest company presentation here.

Vanadium developers

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On September 2, Neometals announced: “S&P Dow Jones Indices announces September 2022 quarterly rebalance of the S&P/ASX Indices.” Neometals was added to the ASX300.

On September 23, Neometals announced: “ESG and sustainability report…”

You can view the latest investor presentation here.

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia. VSUN Energy was launched by AVL in 2016 to target the energy storage market for vanadium redox flow batteries [VRFBs].

On September 1, Australian Vanadium announced:

First term sheet for iron titanium coproduct signed with Tianzhu Steel… AVL plans to produce approximately 900,000 tpa of FeTi coproduct from the Australian Vanadium Project, after production of approximately 11,000 tpa of vanadium pentoxide from its proposed mine and processing facility in the Mid West region of Western Australia……The non-binding Term Sheet extends the terms of the LOI and is the next step towards finalising a binding offtake agreement.

Catalysts include:

- 2022/23 – Possible further off-take and/or JV partner announcements.

You can view the latest investor presentation here, or read a Trend Investing CEO interview here.

Technology Metals Australia [ASX:TMT]

The Company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km southeast of Meekatharra in the mid-west region of Western Australia. Technology Metals Australia is studying (“Integration Study”) to combine the high grade, high quality Yarrabubba deposit with the Gabanintha Vanadium Deposit to form the Murchison Technology Metals Project (MTMP).

On August 30, Technology Metals Australia announced: “TMT key investor in future battery industries CRC’s Electrolyte Project.” Highlights include:

- “TMT to work with the Government backed Future Battery Industries Cooperative Research Centre (FBICRC) to enhance the performance of Vanadium Redox Flow Batteries (VRFBs).

- TMT is the largest shareholder in the Project and demonstrates the company’s commitment to downstream vanadium processing.

- Product from TMT’s Murchison Technology Metals Project (MTMP) to be utilised as feedstock for vanadium electrolyte research.

- TMT’s vanadium electrolyte subsidiary vLYTE to leverage off the findings of the Project.”

You can view the latest investor presentation here.

TNG Ltd. [ASX:TNG] [GR:HJI] (OTCPK:TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product.

On September 12, TNG Ltd. announced: “TNG to assess the use of hydrogen reductant to reduce Mount Peake carbon emissions.”

You can view the latest investor presentations here.

Vanadium Resources Limited [ASX:VR8] [GR:TR3]

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

No significant news for the month.

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

On September 23, King River Resources announced:

Speewah Vanadium Project conceptual development plan…..KRR’s conceptual development plan is an open-cut mining operation scaled at 5Mtpa of feed to an on-site processing plant targeting production of a high-grade magnetite concentrate for export. The exported concentrates could then be refined overseas by salt and reduction roast methodology to target vanadium pentoxide (V2O5), titanium dioxide (TiO2) and iron co-products… Speewah is Australia’s largest vanadium-in-magnetite deposit based on tonnes and V 2O5 content (Figure 1). The deposit comprises a Measured, Indicated and Inferred Mineral Resource of 4,712 million tonnes at 0.3% V 2O5, 3.3% TiO2 and 14.7% Fe…….The large deposit size supports a conceptual development plan for a potentially long mine life…..

You can view the latest investor presentation here.

Vanadiumcorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:VRBFF)

VanadiumCorp Resources Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

No news for the month.

You can view the latest investor presentation here.

Richmond Vanadium Technologies Pty Ltd (“RVT”) ASX IPO planned for late 2022 – Spin-off from Horizon Mining [ASX:HRZ]

RVT now owns 100% of the Richmond Vanadium Project. It has a global Mineral Resource of 1.8Bt @ 0.36% Vanadium Pentoxide (V2O5).

On September 2, Richmond Vanadium Technologies Pty Ltd announced:

Region’s battery charge. LONG-HELD plans to establish a new industry based on one of the world’s largest deposits of vanadium could soon be creating hundreds of jobs in North Queensland. Richmond Vanadium Technology is preparing a prospectus to raise capital and list on the Australian Securities Exchange later this year. If successful, the company’s vanadium project, which will include a $243m open pit mine, will create work in the mining, processing and refining of the metal and position Townsville as a site for the manufacturing of batteries.

Phenom Resources Corp. [TSXV:PHNM] (OTCQX:PHNMF) (formerly First Vanadium Corp.)

The Carlin Gold-Vanadium Property hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a Historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

On September 13, Phenom Resources Corp. announced:

Phenom Resources provides new vanadium intercepts on its Flagship Nevada Project……The average true thickness estimate of these shallow intercepts is 18.8 m (61.7 ft) at a grade of 0.58% V2O5.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTCPK:SYAAF) (OTC:SRHYY)

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTC:DMNKF)

Other listed vanadium juniors

- BlackRock Metals (Private)

- Gladiator Resources [ASX:GLA]

- Golden Deeps [ASX:GED]

- Intermin Resources [ASX:IRC]

- Maxtech Ventures [CSE:MVT]

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Pursuit Minerals [ASX:PUR]

- QEM Limited [ASX:QEM]

- Sabre Resources [ASX:SBR]

- Strategic Resources [TSXV:SR] (OTCPK:SCCFF)

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Voyager Metals Inc. [TSXV:VONE][GR:9VR1] (OTC:VDMRF) (formerly Vanadium One Iron Corp.)

- Venus Metals [ASX:VMC]

- Victory Metals [TSXV:VMX]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Enerox GmbH (90% Bushveld/10% Cellcube Energy Storage Systems)

- Invinity Energy Systems (LSE:IES) (IVVGF) (OTCQX:IESVF)

Conclusion

September saw generally flat vanadium prices which are currently rather low.

Highlights for the month include:

- MIT report: Non-technical barriers to energy storage and how industry is getting around them… High cost and material availability are the main non-technical barriers to energy storage deployment at the scale needed

- Vanadium redox flow batteries (VFRBs) need greater production scale to drive down upfront costs to better compete against Li-ion batteries.

- VRFBs have a low levelized cost, are scalable, don’t degrade and there is no risk of combustion/fire. With lithium prices hitting records, there isn’t enough of the metal (lithium) to power the future, anyway.

- Bushveld Minerals reports Free cash flow2 of US$7.1 million in H1, 2022.

- Largo Inc. announces completion of qualifying transaction for Largo Physical Vanadium Corp. Prospective investors are now provided with a new vehicle to invest in physical vanadium.

- Australian Vanadium first term sheet for iron titanium co-product signed with Tianzhu Steel for the Australian Vanadium Project. The Australian Vanadium Project plans to produce 11,000 tpa of vanadium pentoxide.

- Technology Metals Australia becomes a key investor in future battery industries CRC’s Electrolyte Project. To work to enhance the performance of VRFBs.

- Phenom Resources new vanadium intercepts on its Flagship Nevada Project. The average true thickness estimate of these shallow intercepts is 18.8 m (61.7 ft) at a grade of 0.58% V2O5.

As usual, all comments are welcome.

![China and Europe Ferrovanadium [FeV] 80% prices](https://static.seekingalpha.com/uploads/2022/9/27/37628986-16643346279529939.png)

Be the first to comment