setthaphat dodchai

A reader recently suggested I take a look at the Standpoint Multi-Asset Fund (MUTF:BLNDX). I’m always interested in looking at new and alternative funds, so here are my unbiased two cents.

I think BLNDX’s strong returns since inception makes it worthwhile to monitor. However, I don’t think it is actually an ‘all-weather’ fund as advertised. Looking through the strategy and portfolio holdings, I think it is more like a 50/50 blend of an equity fund and a managed futures fund. Given the relatively short performance history and small portfolio management team, I would be hesitant to commit large amounts of capital to the fund.

Fund Overview

The Standpoint Multi-Asset Fund utilizes an ‘all-weather’ approach to managing investments. The goal of the fund is to provide investors with stable returns across a diverse set of economic conditions, especially those where traditional asset allocations have difficulty generating returns. As of April 2022, the fund has $319 million in net assets, although Seeking Alpha and Morningstar shows the fund having $470 million in AUM.

The fund has two class of shares: BLNDX is the institutional class, with minimum investment of $25,000 and REMIX is the investor class, with minimum investment of $2,500.

Strategy

Standpoint markets the fund’s ‘all-weather’ strategy as being diversified across geography, asset class, and investment styles. BLNDX’s strategy holds long positions in equity ETFs to replicate exposures that resemble a global market-cap weighted index of developed markets such as the U.S., U.K., German, and Japan. The fund also invests either long or short in futures contracts from seven sectors: equity indices, currencies, interest rates, metals, grains, soft commodities, and energy. Finally, the fund may invest up to 25% of assets in a wholly owned subsidiary that act like a CTA hedge fund.

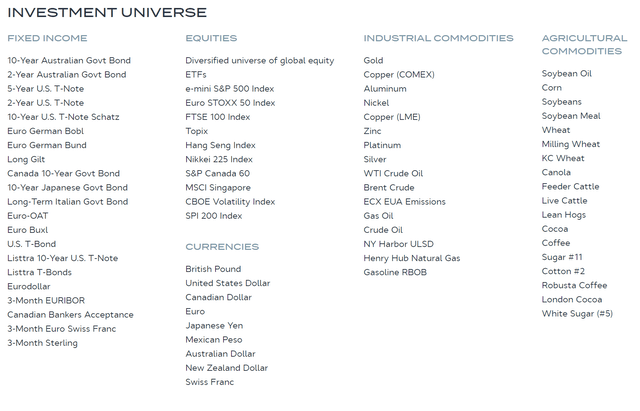

Figure 1 lists BLNDX’s investment universe. As we can see, the fund’s investment universe is quite broad, encompassing most asset classes that have liquid futures markets or ETFs.

Figure 1 – Standpoint Multi-Asset Fund investment universe (standpointfunds.com)

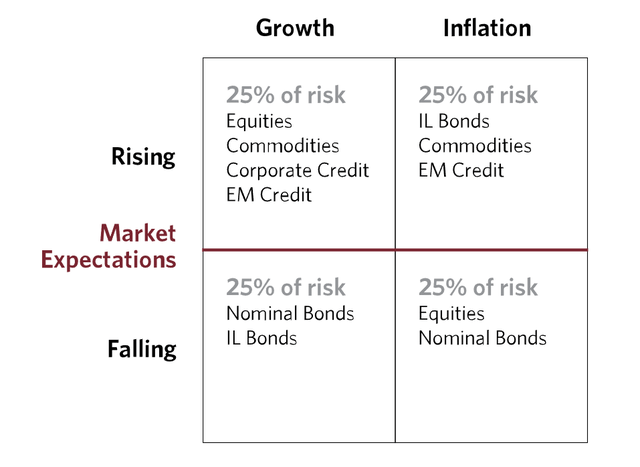

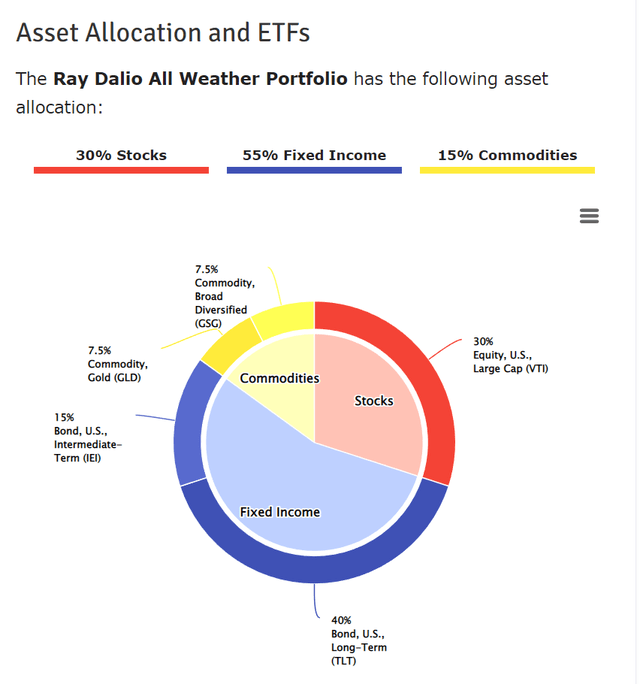

When I hear someone mention the strategy ‘all-weather’, I am always reminded of Ray Dalio and Bridgewater, the pioneers of all-weather investing. The basic concept of Ray Dalio’s ‘all-weather’ investment strategy is to design a portfolio that has components that will work in all market conditions. For example, Figure 2 shows a simple ‘all-weather’ asset allocation according to Bridgewater.

Figure 2 – Simple all-weather asset allocation (bridgewater.com)

Portfolio Holdings

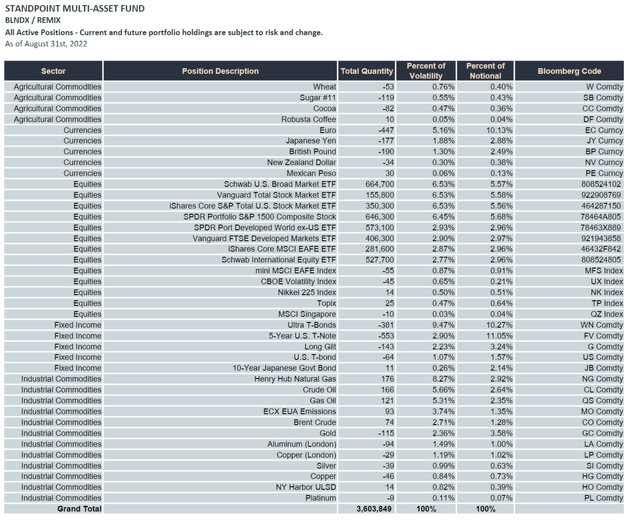

Figure 3 shows a snapshot of the Standpoint Multi-Asset Fund’s current positions, as of August 31, 2022. As we can see, the fund is currently long equities through ETFs, short agriculture commodities, short foreign currencies like the Yen and Euro, short bonds, long energy commodities, and short industrial commodities.

Figure 3 – Standpoint Multi-Asset Fund portfolio Holdings August 31, 2022 (standpointfunds.com)

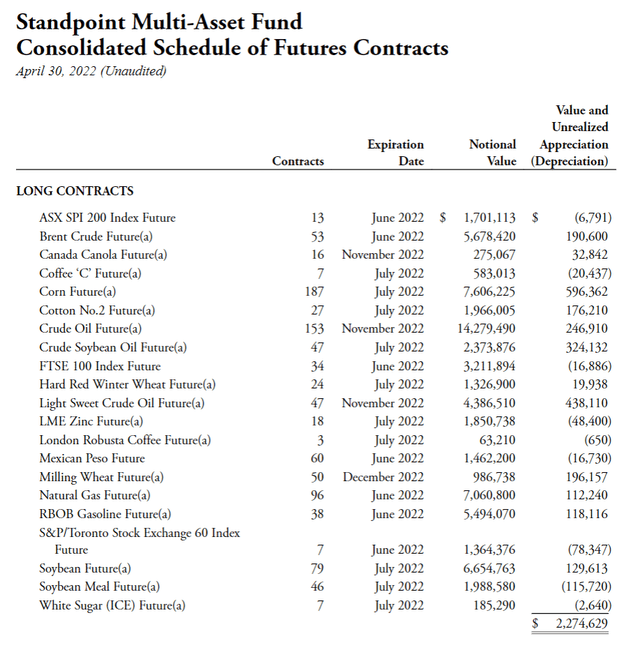

Note, in contrast to the ‘set and forget’ idea of a traditional ‘all-weather’ strategy, the Standpoint Multi-Asset Fund appears to be frequent trader of futures. If we look at the Semi-annual report from April, the fund had been long some commodities in April that it is now short in August (i.e. Wheat), and is now long or short some commodities where it had no positions in April (i.e. Gold, Aluminum, Copper, etc.).

Figure 4 – Standpoint Multi-Asset Fund long futures position, April 30, 2022 (standpointfunds.com)

Being a frequent trader is not necessarily a good or bad thing, but it is just not an ‘all-weather’ portfolio in the traditional sense.

Return

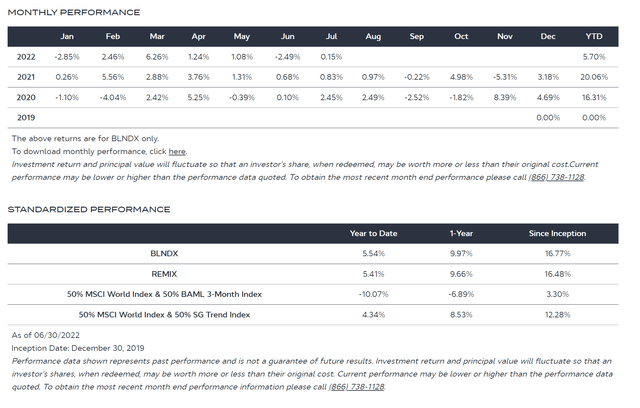

The Standpoint Multi-Asset Fund is a young fund, with an inception date of December 30, 2019. Its performance in the short time-span has been stellar, with a 16.8% annualized return since inception for the institutional class. Importantly, it has been in positive performance territory for 2022, a difficult task for many investors (Figure 5).

Figure 5 – BLNDX performance (standpointfunds.com)

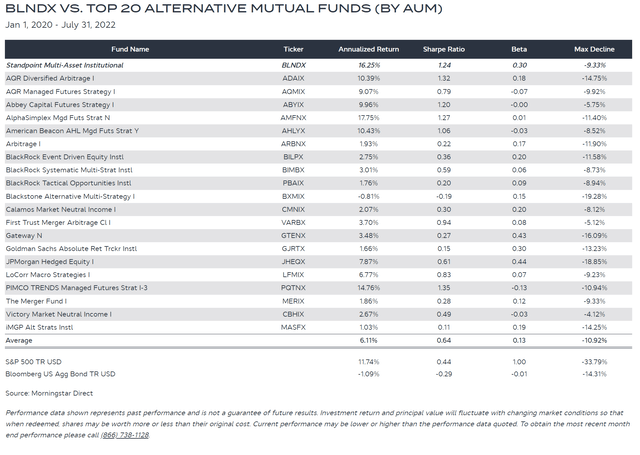

BLNDX also has impressive performance relative to many of the best alternative funds on the market. Figure 6 shows a comparison between BLNDX and the top 20 alternative mutual funds for the period January 2020 to July 2022. BLNDX has higher than average annualized returns (16.3% vs. 6.1%) and a higher than average Sharpe Ratio (1.24 vs. 0.64), with a smaller than average max drawdown (9.3% vs. 10.9%).

Figure 6 – BLNDX vs. Top 20 alt funds (standpointfunds.com)

Fees

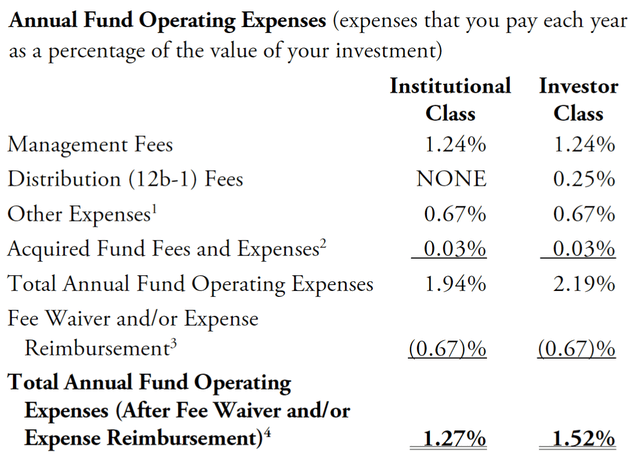

In terms of fees, the Standpoint Multi-Asset Fund charges a 1.24% management fee, and total operating expenses of 1.94% for the Institutional Class (Figure 7).

A few things to mention regarding fees. The investor class charges an additional 0.25% distribution fee. Fund expenses for the wholly-owned subsidiary are rolled up into ‘Other Expenses’, which appears high on first glance. Finally, the fund manager has waived certain portions of the fees until February 2023 to keep the overall operating expenses lower, as the fund is still ramping up.

Figure 7 – Standpoint Multi-Asset Fund Fees (standpointfunds.com)

Distribution & Yield

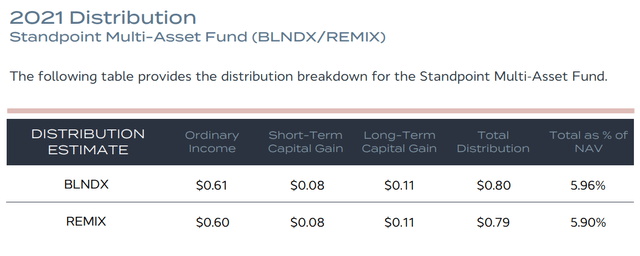

The Standpoint Multi-Asset Fund issues a year-end distribution. In 2021, the fund paid $0.80 per unit for the institutional class, BLNDX, equal to a 6.0% yield on NAV (Figure 8).

Figure 8 – Standpoint Multi-Asset Fund distributions (standpointfunds.com)

Comparison To Simple All-Weather Portfolio

One way I like to analyze asset allocation funds is to compare it to a few simple asset allocation models that I can create using ETFs. For example, in Money: Master The Game, Ray Dalio shared with Tony Robbins a simple model for the all-weather portfolio that can be replicated with 5 ETFs (Figure 9).

Figure 9 – Ray Dalio All Weather Portfolio (lazyportfolioetf.com)

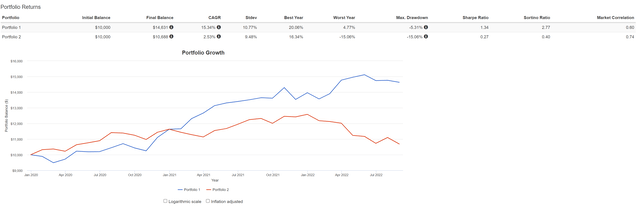

Comparing between BLNDX and the Ray Dalio portfolio (Figure 10), we can see that the Standpoint Multi-Asset Fund has certainly outperformed on most metrics for the time period under consideration (January 2020 to August 2022). It has far higher returns (15.3% vs. 2.5%) and Sharpe ratio (1.34 vs. 0.27) and lower drawdowns (5.3% vs. 15.1%). However, it does have a slightly higher volatility (10.8% Stdev vs. 9.5%).

Figure 10: BLNDX vs. All-Weather (Author created using Portfolio Visualizer)

Is It Really All-Weather?

Taking a step back, it might be a fair question to ask whether the Standpoint Multi-Asset Fund is really an ‘all-weather’ fund. While the equity position seems relatively constant (41% equity weight in April vs. 36% equity weight in August), the constant trading of futures resembles that of a CTA Hedge Fund that employs a ‘managed futures’ strategy. (For more background on managed futures and CTA hedge funds, please refer to my recent article on the DBMF ETF).

In fact, Standpoint may have tipped its hand in how it views itself. Refer to the performance table in Figure 5 above. In the last row, Standpoint compares the Multi-Asset Fund against a blend of 50% MSCI World Index / 50% SG Trend Index. The SG Trend Index follows traders of trend following methodologies.

When viewed from the lens of a 50/50 blend of equity fund / managed futures fund, BLNDX’s performance makes much more sense. Commodities have been in a ripping bull market since the COVID-19 pandemic, especially in late 2021 and 2022, so trend following strategies like managed futures have vastly outperformed.

In fact, with the understanding that BLNDX is more of a managed futures product, we can see its performance in the context of Managed Futures alt-funds in Figure 6 like the AlphaSimplex Mgd Futs Strat N (AMFNX) with 17.8% annualized returns and 1.27 Sharpe Ratio and the PIMCO TRENDS Managed Futures Strat I-3 (PQTNX) with 14.8% returns and 1.35 Sharpe Ratio. BLNDX’s returns and Sharpe Ratios (16.3%, 1.24), while still high, no longer look extraordinary.

Risks

The biggest risk I can think of for the Standpoint Multi-Asset Fund is the ‘black-box’ nature of its investment strategy. It is not a standard ‘all-weather’ asset allocation fund. Rather, it is a 50/50 blend of a market-cap weighted developed world equities fund, and a managed futures fund. While performance has been strong in the short time period since the fund launched, future performance is critically dependent on management’s acumen and ability to adapt to changing market conditions.

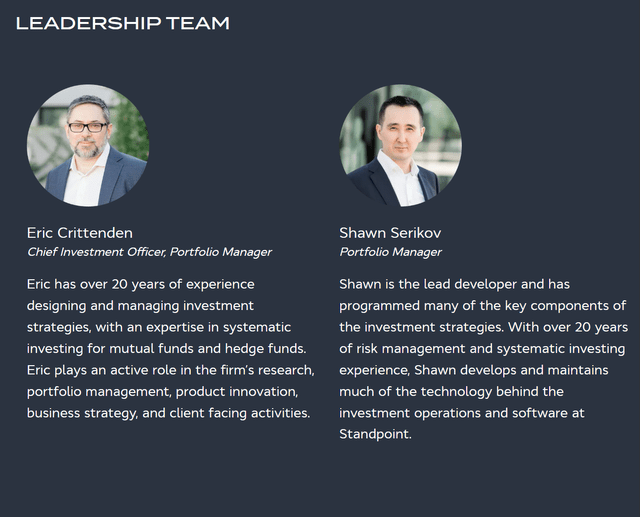

Speaking of management, it is important to highlight that Standpoint is a relatively young asset management firm, with only 6 employees on LinkedIn. The Multi-Asset Fund is managed by Eric Crittenden and Shawn Serikov (Figure 11), both formerly from Longboard Asset Management (a small Arizona-based asset manager with 16 employees on LinkedIn). While Mr. Crittenden has had prior experience as Co-Founder and Co-CIO of Longboard, Mr. Serikov’s prior experience was a Computer Systems Analyst at Longboard (incidentally, I’m not sure how Mr. Serikov has 20 years of risk management and systematic investing experience given his LinkedIn profile only has work experience since 2011).

This reliance on Mr. Crittenden may introduce ‘key-person’ risk, especially as so much of the fund’s performance is dependent on timely futures trades.

Figure 11 – BLNDX portfolio managers (standpointfunds.com)

Conclusion

In conclusion, I am intrigued by the Standpoint Multi-Asset Fund’s strong performance since inception. However, I don’t think it is actually an ‘all-weather’ fund, at least not in the traditional sense. I think of it more as a 50/50 blend of an equity fund and a managed futures fund. Given the relatively short performance history to analyze and small portfolio management team, I would be hesitant to commit large amounts of capital to the fund. I think it is definitely worth monitoring though.

Be the first to comment