EnchantedFairy

Above: Disney is still living off its genius founder’s mind, his Pixar descendants and lots of superhero content created by comic artists in the ’30s to ’50s.

“Balance every thought with its opposition, because the marriage of them is the destruction of illusion…”

Aleister Crowley 1875- British magician

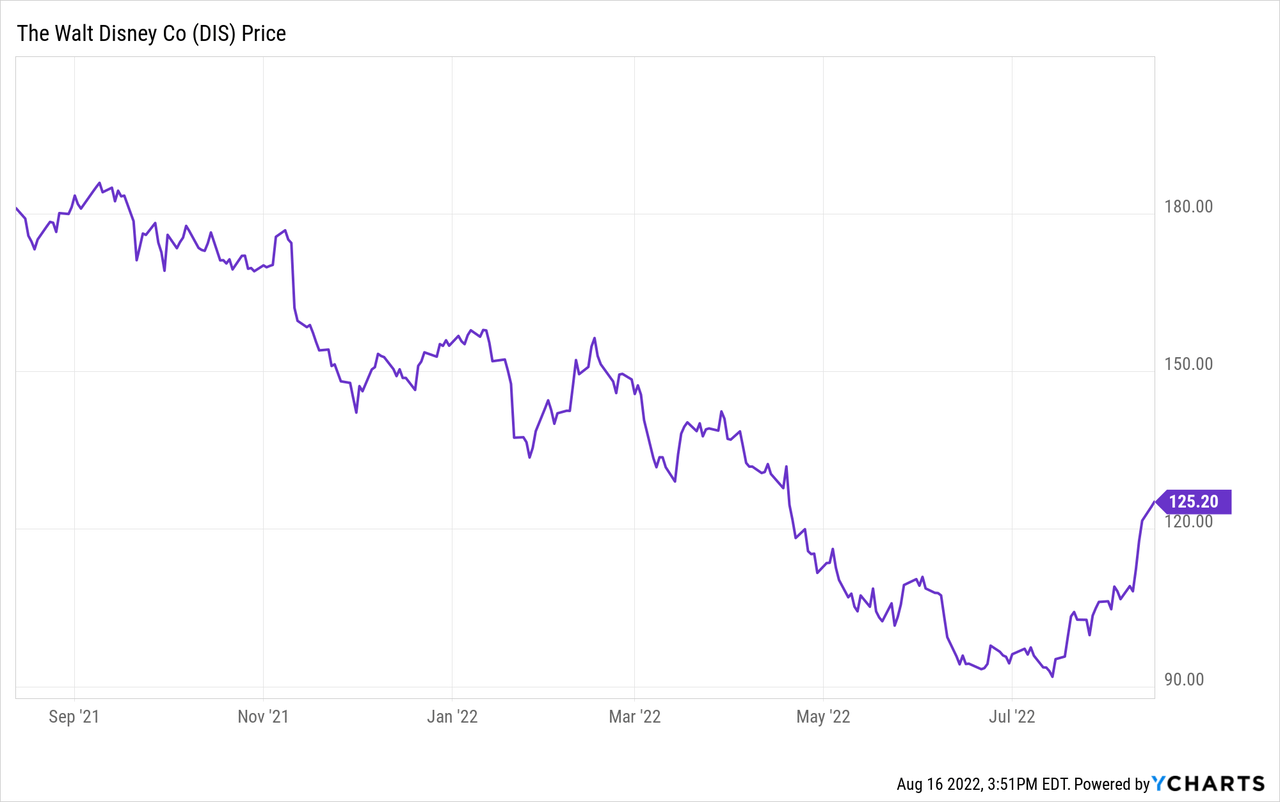

The conventional pom pom waving of some The Walt Disney Company’s (NYSE:DIS) fortress investors, who rarely see any long-term palpable rationale to support a bearish outlook on the stock, blossomed full force on the 3Q22 earnings release. And to an extent, it was vindication well worth the twirling.

To shorthand the results, we see this: Theme parks did great — undoubtedly benefitting from pent-up demand. Streaming services, passed the 221m mark for all platforms (up 7.5%), clocking a 144m increase for Disney+ for the quarter. Hulu and ESPN were decidedly less robust. And overall operating margins on the services fell 6.8% to –18.1% – management attributed this to increased cost of content and programming.

Gross profit of $7.82b produced operating income of $2.43b a decrease of 11.6% yoy of $2.75b. Not to worry, Disney has a new price tier for Disney+ which offers consumers a $7.99 monthly fee for ad-supported viewing or $10.99 for ad-free subscriptions.

Overall, it’s fair to state that Disney’s earnings call moved the shares to $124.6 (from $112 on August 10 th) in a 52-week range, from $90.29 to $187.58. The mouse house comes through again! But not everyone, we quickly learn, has picked up the pop poms.

Enter activist Dan Loeb’s Third Point indicating it had loaded up on the stock to the estimated level of $1b, with more to come we presume.

While acknowledging the good performance, Loeb sent a Hart Scott Rodino letter to Disney CEO Chapek outlining five ideas to unlock significant shareholder value. Disney responded with the understandable, thanks but no thank kind of letter with the usual “hammada, hammada, hammada” “we’re working on that already” responses.

Loeb respectfully talked about consolidating Disney’s streaming verticals and speeding up of the company conversion of verticals to digital distribution growth trends overtaking the entire content business.

Loeb laid out the usual kudos to management for their performance in various areas — but the mailed fist in the velvet glove that is the usually most accurate characterization of such letters was there for anyone to see. Of all the gentle prods Loeb laid out, one commands our attention from the gaming peanut gallery, if you will.

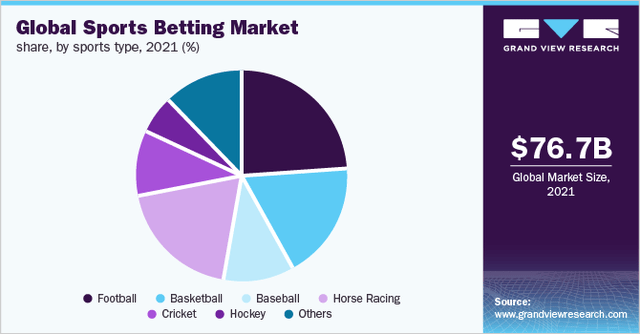

In brief, Loeb suggested a spin-off of ESPN to better and speedier facilitation of that brand to embrace sports betting ASAP. Up until then, we found most of Loeb’s suggestions viable, bearing a sound rationale to stir the contented house mice out of their holes and start the chase for the cheese.

Here’s a quick capsule of Loeb’s cures:

1.Cut costs. Disney spends far too much money relative to potential returns. A program is needed that addresses this problem as well as disposing of underperforming assets.

2. Use revived free cash flow to continue passing on dividends, to liberate money to pay down debt, repurchases shares or reinvest in fat margin businesses.

3.Integrate Hulu into Disney+ LTC platform to save costs, buy out the Comcast stake before these guys get too greedy and demand a massive premium.

4. Spin off ESPN to holders with a debt load that will ease the leverage burden on the parent. Get moving on sports betting. SORRY DAN—this is a tilt. Wrong headed, revealing a naïveté about sports betting that gives pause to the validity of the spin off for that reason.

More on this to come.

Above: Globally sports betting is widely believed to be the fastest growing sub-sector of the entire gaming industry.

5. Refresh the board. This one nails down the core of the Loeb thesis. There is little question that the Disney board as it is now largely constituted gets an F. As Loeb suggests, it lacks individuals with proven track records in tech, advertising and consumer engagement relative to the swift consumer discretionary currents changing direction post pandemic.

The Disney board are all golden resume people for certain, but upon examining their background we find precious little life or work experience that would recommend them for participating in strategic financial or focus decisions of direction in the real-world challenges Disney content faces.

It appears we have the usual box-checked array of Chapek admirers making for a tiny little world of stock grants, perks, and happy talk that often lead to the Loeb’s and Icahns of this world to lick their chops. On balance, Disney holders should lay down their pom poms and cheer Loeb on.

Neither stated or implied is the knee-jerk woke-ism that pervades the entire Disney content and presentation agenda. That is not a discussion for this forum, as it speaks to a perceived universal bacillus that has infected the entire sector—beyond our focus here.

It is difficult to quantify the extent to which the pc board of the company imposes conventional wisdom woke agendas to management and how it may impact real-world earnings. But viewing the board from its experience and skill sets brought to the table suggest that Loeb is tracking on target here.

Why Loeb is wrong about ESPN and sports betting

ESPN, among the woke-ist of the Disney verticals, is the poster child in my view for the corporate failure too few investors are willing to see that has a history that began with the departure of the dynamic duo of Eisner and Katzenberg back in the day. These two had their successes and failures for certain. But their singular focus on monetizing the foundational genius of Walt Disney has been unsurpassed by their successors. It has taken the geniuses of Pixar and the creativity of the legendary cartoonists of the comic book superhero genre to keep Disney stocked with viable content for many decades. Buying free agents as it were, instead of home grown all-stars, is part of the Disney style that may not continue to provide winners.

The massive blunder of Disney regarding sports betting began the day after the U.S. Supreme Court decision in May of 2018 opened the flood gates to legalization.

ESPN should have been locked, loaded and ready to pounce instead of sniffing around the edges, shucking and jiving about the company’s “family legacy” that did not fit well with that betting sinful practice.

lswr

Above: Just nine of the fourteen (and counting) platforms that an ESPN sports book app would encounter from day one.

It was clear that no one, repeat, no one, even the subsequent market share leaders of today who pounced first, had a better post position at the starting gate of sports betting than did ESPN.

In 2018, ESPN clocked 86m viewers down 2m from 2017 and part of a longer term decline that periodically popped north depending on the sports calendar or news events in that world.

By any measure, just after the court go-ahead, the market was wide open for battle. Clearly, both DraftKings (DKNG) and Fan Duel (OTCPK:PDYPY) had a great head start with their huge daily fantasy sports contingents having the best crossover demos to which they could market. Right behind them were the major casino operators, already running live sports books.

And behind them, an army of wannabes from the global operators diving headlong into the burgeoning U.S. market, to total newbies who figured that even a single digit share of market would be worth carving out if they got into the swim.

What became clear was that if an entrant locked their efforts early into a partnership deal with sites that already had monster sports followings, they could buy in cheaper than the massive media spent it would take to establish a new brand.

The first mover in that direction was Penn National Gaming (PENN) now Penn Entertainment. In 2020, Penn bought into 38% OF Barstool Sports site bringing them 55m of Dave Portnoy’s “stoolies” into the potential customer base. By this year, they acquired it all.

Yet, despite this natural combination, Penn’s sports betting business has never clocked above mid to low-single-digit market shares of total sports betting win. And that’s fine with management because they were among the first entrants to recognize that the cash bleed for promotions and media to gain market share footing in new markets was punitive. So they began cutting back on promotional expense, looking to become among the first of the sites to turn profitable.

But what happened overall was that before you could find footing in any existing or new state, you were facing a massive deluge of promotional spend by the market leaders running into the multi-billions. Later entrants had little choice but to open their fiscal veins and pour out the promo and media blood money, build sponsorship deals with leagues and players.

And before you could say touchdown, there were, and still are, 14 distinct platforms currently crowding the sports betting field. Had the ESPN platform been locked and loaded as we noted above right from legalization, its 86m viewer base could have produced a first tier competitor to both Fan Duel and Draft Kings. Instead, its navel contemplation over the last four years now has spun off an ESPN SPORTS BOOK facing these guys in hand to hand combat:

Fan duel and Draft Kings: combined share of total market ~60%. Bring up the top tier rear behind them, Bet MGM, Caesars Sports Book, adding an estimated combined share of 35%, leaving ~15% for the formidable competitors in the second and third tiers:

FoxBet, Barstool, Bet65, BetRivers, PointsBet, 888 Holdings, Betaway, BallyBet, Sugarhouse, theScore, Super. Still active but with the for sale sign hanging on them already, BetAmerica (Churchill Downs), WynnBet (Wynn Resorts Ltd.).

Thus far, not one of these platforms is in profit yet primarily due to the massive cost of promos and media. A recent survey of bettors indicated that the prime reason (83%) they bet on a given platform was the deals offered on games or series. Penn has learned that the golden demo they bought in Barstool is nice but that on a practical basis, the crossover from stoolies to regular sports bettors falls below expectations.

The top tier platforms earnings releases continue to contain assurances that their promo spend is beginning to shrink, either by design or necessity. Some are forecasting moving into profit before the end of 2023. Time will tell. The platforms have become addicted to promos and media—all chasing the same potential customer base as more states legalize. ESPN’s 2022 revenue is estimated to come in ~$11.4b. The top tier sports betting signs are all moving rapidly into the $1b to $2b annual revenue zone.

The legacy hold percentage of all sports bets has remained constant over decades: the books average 7.1% win of handle. So while the estimated CAGR of the sector is above 10%, Statistica estimates 2022 win coming in at $3.6b, moving up by 2024 to $10.1b for the entire sector. We are more bullish. We believe sports betting will reach and level out at ~$25b by 2028 or before, with the top tier four operators commanding well over 55% of total win.

For further context:

Total handle legal sports betting from June 2018 th YTD July 2022 $141,887,482b. Win: $10.2b.

Hold: You guessed it, 7%.

An ESPN mind experiment

Above: The best of ESPN content could be easily adapted to a sports book site giving bettors advance peeks at special shows. But that’s a plus, not a business model by itself.

Let’s assume the following:

Instead of sleeping at the switch, which is what Disney was doing when the court approved sports betting, they already should had been working with a tech stack provider, ready to go live with an ESPN branded sports book thrown out to their 86m regular viewers.

Now we know the ESPN demo is loaded with young people under legal gaming age, individuals who do not have the disposable income necessary to bet regularly and lots of empty calorie viewers who may buy a team jersey now and then, but otherwise just sit and watch.

We also know that ESPN undoubtedly has masses of passionate fans of given teams and sports who do bet now and then on key games, series and of course Super Bowls. When the court ruled, ESPN should have had (perhaps they did), deep dive research ready to roll as to the percentage of their audience who could be tagged as regular bettors.

I have to believe that would be at very minimum a build to 1.5m monthly users, betting an average of say $80 to $100 a month.

Adjusting those numbers by season, by weighting of fandom by state, our calculation comes to ESPN out of the gate in 2018 would by now, be churning out ~$1.5 to $1.7b in annual win—or ~10%+ contribution to its annual overall subscriber income of $11.4b. Its revenue per subscriber is ~$8.50 as compared with DKNG’s average revenue per user per month of $103.

Where were the numbers crunchers in 2018?

More importantly, instead of being an afterthought entry, ESPN would probably be among the top tier platforms. Not only on sheer brand identity, but because deploying their already established content and programming to a betting site would build considerable incentive for many fans to view the content and place bets on the same site.

Instead, a spinoff and subsequent move into sports betting now as urged by Loeb confronts ESPN with 14 competitors, in a sector dominated by four powerful entrants, triggering the need, regardless of its brand awareness levels, to heavily promote. And it is a fairly certain bet that weaning play away from the top four who command some established loyalty would be an undertaking that could not be totally marketed at low cost on the ESPN site. Even cross marketing on Disney’s other streamers is no panacea.

On balance, our mind experiment tells us that Loeb’s thought of an ESPN spinoff does work in terms of reducing the parent’s leverage, allowing a new management to do a hard headed, top to bottom review of programming costs, of contract heavy personalities and implied but not spoken, rid the space of excessive woke-ism that is more likely to annoy bettors than passive viewers. Its ability to do in game, live betting is fine, but FoxBet has it and its yet to be a bonanza.

But it does not work in terms of providing a base from which to make a bigtime sports betting leadership position that could have a material impact on its earnings as a pure play in the sports betting space.

In summary, Disney’s dawdling, its responses to “when?” such as “we are studying it,” betray a considerable lapse in management and board judgment to date. This is not to totally dismiss the idea to bring sports betting into ESPN, but more to considerably lower expectations and prepare for hand to hand, expensive combat for the crumbs that would be available after the top tier platforms eat their fill.

Spinning off ESPN is on balance a sound suggestion on many fronts for investors. There are many avenues open besides sports betting that could open revenue doors. But that would take, as Loeb suggested, a new management team, unfettered by Disney mantras, which could build a pure play stock in overall sports media that could hold great promise for investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment