Ian Waldie/Getty Images News

Thesis

Sony (OTCPK:SNEJF) delivered a better than expected September quarter, and raised its fiscal year profit outlook – as a weak yen outpaced the negative impacts of a slowdown in Sony’s gaming business. The Japanese entertainment giant now expects operating profit for the FY 2022 to be 1.16 trillion yen ($7.8 billion), versus 1.11 trillion yen estimated previously.

If Sony would indeed achieve the said target, then the SNEJF stock would effectively be trading at about x12 EV/Operating Income and provide an operating yield of approximately 8.3%. Such a valuation is too cheap, in my opinion, as I view Sony as a strong beneficiary of the $13 trillion metaverse opportunity. I upgrade Sony stock from Hold to Buy.

Sony’s September Quarter

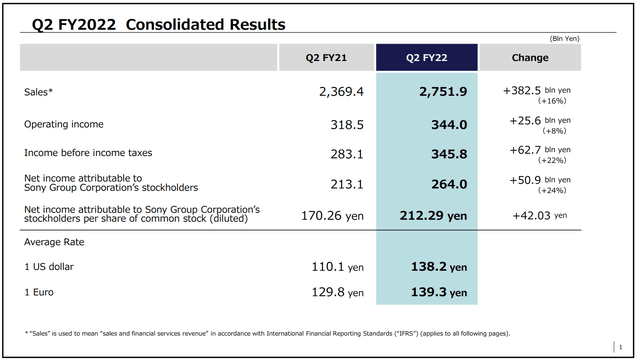

From July to end of September, Sony generated total sales of 2,752 billion yen, which compares to 2,369 billion yen for the same period one year earlier (about +16.5% year over year). Consolidated operating income jumped to 344 billion yen, versus 319 billion yen in 2021 respectively. Notably, Sony’s Q2 FY 2022 results easily beat analyst consensus which was anchored around 280.7 billion yen.

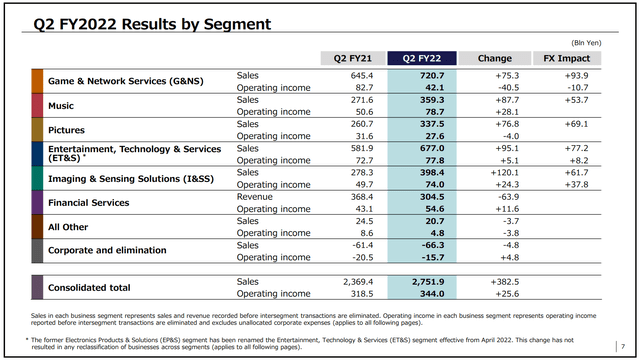

Sony strong Q2 FY 2022 was supported by a weakening yen and a solid demand environment for almost all of Sony’s segments, including ‘Game & Networking Services’ (up 11.5% year over year), ‘Music’ (up 32.4% year over year) and ‘Pictures’ (up 29.6% year over year).

On the backdrop of stronger than expected FY 2022 Q2 results, Sony raised FY guidance to be 1.16 trillion yen ($7.8 billion) of operating profit, versus 1.11 trillion yen estimated previously.

G&NS Slowdown Less Severe Than Feared

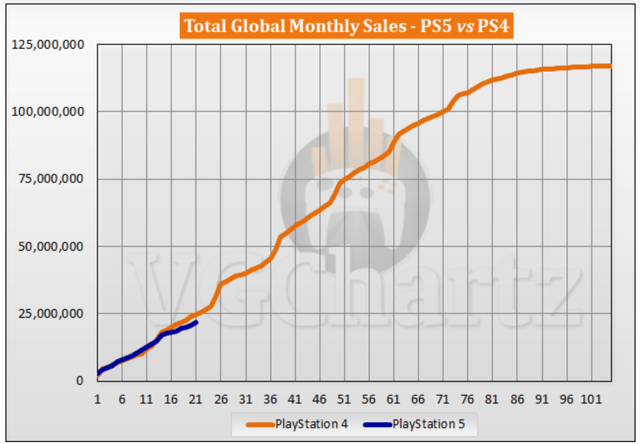

Sony’s Game & Networking Services (G&NS) is arguably the core segment of the Japanese entertainment conglomerate. And investors are pleased to learn that the slowdown in this segment is less severe than feared. In the analyst call following the earnings release, Sony management reiterated the aim to sell close to 18 million units of the PlayStation 5 console in the year ending March. And Sony hopes to sell another 23 million units of the PS5 in Fiscal 2023 – as chip shortages to assemble more PlayStation 5 consoles are easing. So far, Sony sold approximately 25 million PS5 units.

But Sony also admitted weakness – although less severe than expected and anchored on global ‘recession fears’, not structural demand headwinds:

Hiroki Totoki commented:

Players are cutting the number of titles they buy on the back of global macroeconomic conditions….

adding that:

My biggest apology is that we had to cut our outlook on games for two straight quarters.

That said, Sony shipped about 3.3 million PS5 units in the September quarter, which is approximately the same as what Sony shipped in the same period of 2021.

Slightly concerning is the PS Plus subscriber drop: which decreased to 45.4 million unique players, versus 47.3 million in the prior quarter respectively. However, with the upcoming release of ‘God of War Ragnarök‘, which is expected to be available for sale starting 9 November, Sony hopes to recapture the loss of subscribers and regain momentum for further subscriber base expansion.

Valuation: Update Target Price

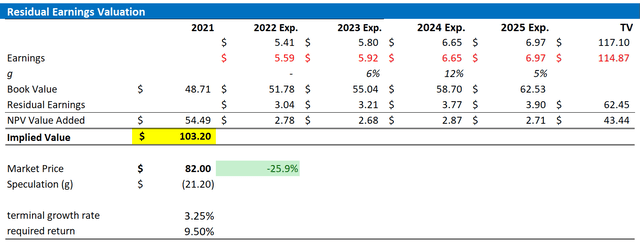

Following a strong FY 2022 Q2, I update my residual earnings model for SNEJF to account for preliminary consensus EPS adjustments, and I raise my cost of equity assumption by 50 basis points to reflect higher risk premia for the gaming industry, to 9.5%. However, I continue to anchor on a 3.25%, terminal growth rate (one percentage point higher than estimated nominal global GDP growth).

Given the EPS updates as highlighted below, I now calculate a fair implied share price of $103.20 versus 166.57 prior (SNEJF reference).

Analyst Consensus EPS; Author’s Calculations

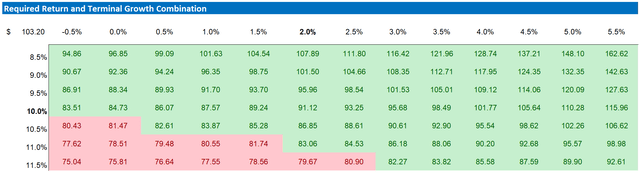

Below is also the updated sensitivity table.

Analyst Consensus EPS; Author’s Calculations

Risks

As I see it, there has been no major risk-updated since I have last covered Sony stock. Thus, I would like to highlight what I have written before:

I think Sony is relatively low-risk at current valuation levels. However, investors should monitor the following headwinds that could cause Sony stock to materially differ from my target price: 1) slowing consumer confidence due to inflation outpacing wage growth and rising interest rates could cause a temporary slowdown in Sony’s sales number of discretionary consumer products; 2) loss of competitive advantage in various business segments such as PC and smartphones given accelerating industry competition; 3) higher than expected R&D investments in order to realize new product initiatives and/or to defend competitive positioning; 4) macroeconomic uncertainty relating to the monetary policy actions; 5) That said, much of Sony’s share price volatility is currently driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though Sony’s business outlook remains unchanged.

Conclusion

I am bullish on Sony. And I believe the company is well positioned to capture a strong tailwind from the estimated $5 trillion – $13 trillion metaverse opportunity (McKinsey research + Citigroup research), as there are few companies that have comparable strength in hardware, software and content—which encloses music, motion picture and gaming. On the backdrop of EPS updates, I now calculate a fair implied share price for Sony of $103.20 (SNEJF reference). Buy.

Be the first to comment