porcorex

Interest rates remain a hot topic, as concerns around inflation are not yet in the rear view mirror. This has suppressed stock prices in many traditional dividend sectors, including REITs. However, I do believe we are in the final stretches of high inflation and with an eventual end in sight, the market will likely revert to giving high quality assets a bid.

As such, it may be a good idea for savvy investors to start layering into high quality names now, as it wouldn’t make sense for asset prices to remain depressed over the medium to long term while consumer prices are up.

This brings me to Regency Centers (NASDAQ:REG), which is one of the highest quality names in the shopping center space. Unlike many of its peers, REG didn’t cut its dividend in 2020, and in this article, I highlight why it remains an attractive buy at present, so let’s get started.

Why REG?

Regency Centers is a large self-managed REIT that specializes in the acquisition, development, and management of grocery-anchored shopping centers. Founded in 1963, the company is headquartered in Jacksonville, Florida, and has a diversified portfolio of properties located in major metropolitan markets across the United States. At present, it owns 400+ properties that are well-positioned in desirable locations leased to more than 8,000 tenants.

REG offers a number of attractive features. The company’s focus on grocery-anchored shopping centers (80% of its portfolio) provides a stable and consistent source of income, as groceries are a necessity that people continue to purchase even during economic downturns. In addition, Regency Centers has a strong track record of success, with several decades of experience in the industry and a portfolio of high-quality properties that are well-maintained and well-leased.

REG’s properties are seeing robust demand, as reflected by its 94.7% occupancy during the third quarter, reflecting a 20 basis point improvement sequentially. REG’s small shop leased percentage also increased by 40 basis points sequentially, to 91.4%, sitting well above the 85% rate that is generally considered to be healthy for small shop occupancy.

Moreover, REG is seeing respectable blended lease spreads of 7% on average on new and renewal leases. These strong operating fundamentals led management to raise its full year core operating earnings guidance to 7% YoY growth from the prior year.

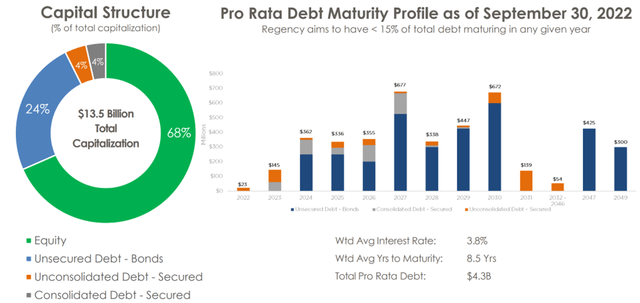

Meanwhile, the dividend was raised by 4% in November, and is very well-covered by a 65% payout ratio, based on FFO per share guidance of $4.02 at the midpoint. REG also maintains a strong Baa1 rated balance sheet with a healthy net debt to EBITDAre ratio of 5.0x, sitting well below the 6.0x level that ratings agencies generally consider to be safe for REITs. REG has a long weighted average debt maturity of 8.5 years at a low weighted average interest rate of 3.8%.

As shown below, REG has relatively low debt maturities next year, and has well-laddered maturities thereafter. This is done on purpose, as it enables management to more or less match lease maturities and hike rents in line with the interest rate environment at the time of debt maturities.

REG Debt Profile (Investor Presentation)

Moreover, higher interest rates are actually a mixed blessing for lower leveraged landlords of high quality properties, as in the case of REG. That’s because this raises the cost of development for higher leveraged players, effectively locking them out of the market, and thereby raises the value and desirability of existing properties. Management is cautiously optimistic around its portfolio positioning, driven by renewed appreciation for physical retail and has a strong pipeline, as noted during the recent conference call:

Our dense suburban trade areas also continue to benefit from structural tailwinds stemming from post-pandemic migration patterns and hybrid work, but also by a renewed appreciation for the value of brick and mortar retailing. Additionally, and just as importantly, we are well-positioned to continue to execute on our self-funded growth strategy.

While the costs of raising incremental capital have risen meaningfully over the last several months, our strong free cash flow and balance sheet dry powder enable us to continue to invest in our value creation pipeline on an earnings accretive basis without the need to raise new equity capital or sell assets into an illiquid transaction market.

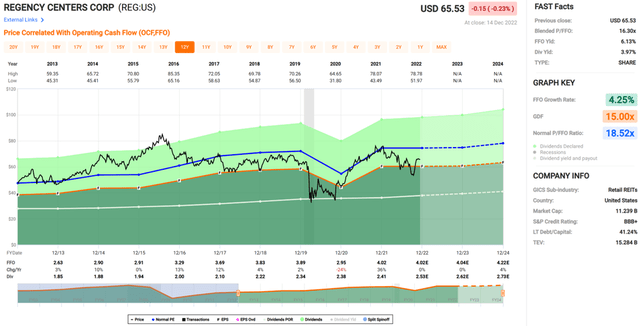

Lastly, REG remains attractive at the current price of $65.53 with a blended P/FFO of 16.3, sitting comfortably below its normal P/FFO of 18.5. I would expect for REG to trade more or less in line with its historical valuation, considering the quality of its portfolio, and strong demand characteristics for quality properties in desirable locations.

Investor Takeaway

Overall, Regency Centers is a strong retail REIT that has seen healthy demand for its properties, and is well-poised to benefit from the structural tailwinds of post-pandemic migration patterns and hybrid work. With a healthy balance sheet, attractive dividend yield, and a reasonably attractive valuation, I view REG as being a good all-weather buy at the current price.

Be the first to comment