JHVEPhoto/iStock Editorial via Getty Images

Bausch Health Companies (NYSE:BHC) is a $2.7 billion market cap company with an interesting ~88.75% stake in the $6.1 billion market cap Bausch + Lomb (BLCO). Bausch Health also does $3 billion in EBITDA. Before anyone rushes to buy, they should realize the company also has an astounding $21 billion in long-term consolidated debt.

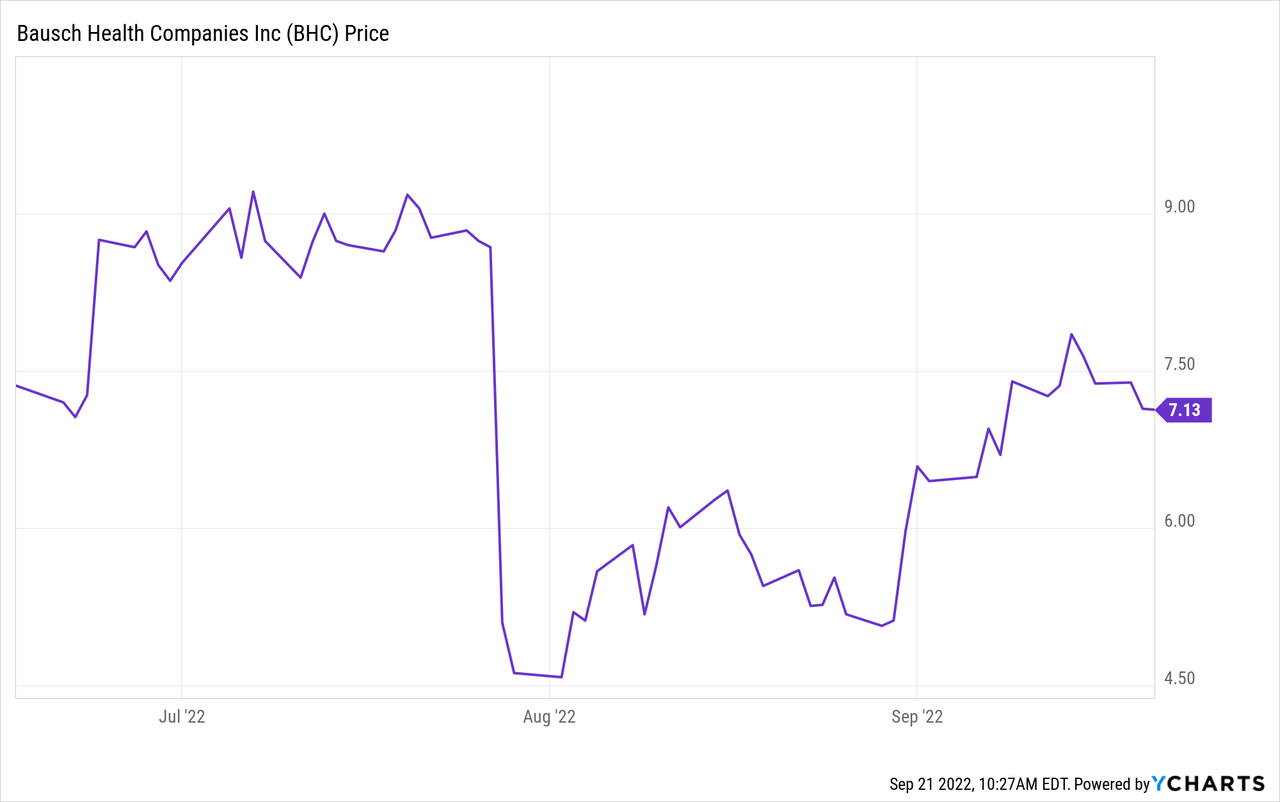

This company is a so-called equity stub. Small changes in the prospect of the enterprise will swing the stock price in a wild manner. It is also a complicated company that has evolved out of the fallen angel Valeant Pharmaceuticals.

The 88.75% stake in BLCO is super interesting because the company intends to spin (most of) this stake out to shareholders. It has already put most of this stake into a subsidiary and wants to spin it out once BHC meets a few standards regarding stand-alone viability, like a 2-1 fixed charge coverage ratio and a debt level that’s below 6.5-6.7x adjusted EBITDA. The company won’t spin out the entire stake as I believe it holds 10% directly on the balance sheet. It could monetize this stake by selling it on the open market. It could use the proceeds to reduce debt, for example.

If BHC spins out the BLCO shares, that’s incredibly interesting because if BHC were to spin out all the BLCO shares except 10%, that means all BHC shareholders receive a pro rata equivalent of $4.76 billion worth of BLCO shares. That’s more than the value of all BHC shares currently. Meanwhile, shareholders would still have their BHC shares as well.

This financial engineering isn’t great for bondholders, and for example, the Bausch Health Companies Inc. 5.25% 19/30 bond trades at a bid-ask spread of 30 and 40 cents on the dollar. The debt is also under much pressure because of the sea change in Fed policy since November 2021. Whatever the reason for the large discount to its face value, the company is taking advantage by retiring debt through the open market. In June 2022, the company retired outstanding senior unsecured notes with par value of $481 million for just ~$300 million. Almost all of BHC’s debt is fixed rate (85%), and I expect we’ll see the Fed continue to hike rates. This should negatively affect the value of BHC’s debt and make it even cheaper to retire debt. Retiring debt also makes it easier for the company to meet the standards it is going by to decide whether to spin off the remaining BHC shares.

Before you’re counting on Bausch Health to soon distribute the BCO stake, consider that the company moved a ~38% stake to a different subsidiary on August 22. August 30 it seems to have borrowed through that subsidiary. This suggests to me the spinoff is more likely to happen in a multi-step process. This move likely increased the chances we’ll see a partial spinoff in the short to medium term, but decreased the chances of a full spinoff in the intermediate term.

A spin-out of a 40% stake in BLCO still represents $2.44 billion in value. Given BHC’s market cap of $2.7 billion, that remains very attractive. I think the market has given up a bit on BHC accomplishing a (partial) spinoff soon. The stock declined significantly on a potentially serious longer-term issue with key cash flow generator Xifaxan (because of generic competition). But the company seems to think this isn’t an issue until 2029 at least. It recovered some after that, but it still seems very cheap given the potential spin-off.

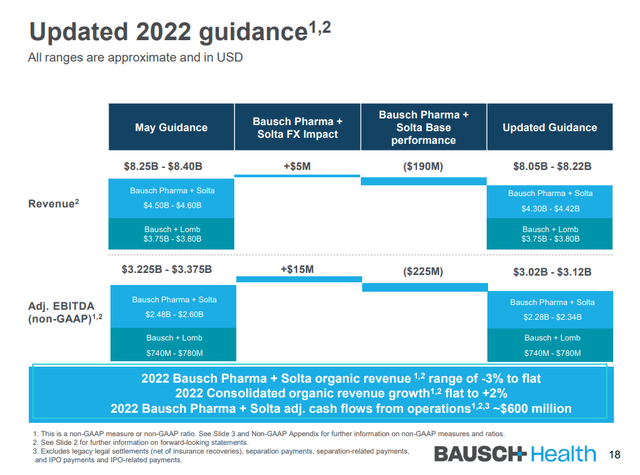

But Bausch Health now has $19.3 billion of net debt (without BLCO). The latest guidance update talks about $2.28 billion of adjusted EBITDA. If I multiply that by 6.7 I get to $15.276 billion.

Bausch Health guidance (Bausch Health)

Around that level of debt, it is more likely BHC will spin anything off. The only way to get there quickly is to sell or IPO Solta. The latter is something the company tried in order to raise a few billion. But it backtracked because of the bad market environment.

The company also holds 10% of BLCO shares. The company can sell these 125 after the BLCO IPO and get its hands on some $600 million. That’s even more interesting because BLCO can take out debt at a discount to face value. It could, for example, take out $900 million of debt. Their ability to take out debt at a discount may get magnified by further Fed moves. Cash flow has a similar advantageous multiplier. As debt gets taken out, the calculation for debt to EBITDA is significantly impacted. Here’s a hypothetical scenario. What if BHC sells the aforementioned $600 million BLCO stake and generates $600 million in free cash flow next year. It then uses this to take out debt at 35% of face value. It could decrease debt to ~$15.9 billion. Both Salix and Solta are growth assets with very high margin profiles. It’s not inconceivable EBITDA picks up some (not to mention inflation) next year. That could put the company within the debt-to-adjusted EBITDA ratios it’s seeking.

Admittedly, this is a highly favorable scenario with no big setbacks. But it is also possible the company can sell some assets (like Solta) and get within comfortable ratios sooner.

BHC is a highly volatile equity stub. The strategic plan to spin off the BLCO shares (partially) makes it highly attractive. As this scenario becomes reality, it should catapult BHC shares upwards in value. Overall, I think it’s worth having some exposure here, as the company’s deleveraging path and goals seem achievable and there’s a lot of potential upside. I see inflation and rate hikes as somewhat favorable to the company as well.

Be the first to comment