Vladimirovic/E+ via Getty Images

Introduction

In this article, we’re going to discuss the long-term bull case of natural gas and related energies. Especially natural gas is now in a “new era” due to subdued supply growth and accelerating demand fueled by LNG exports, a shift towards cleaner fossil fuels, and the war in Ukraine. The First Trust Natural Gas ETF (NYSEARCA:FCG), is a fantastic tool to buy well-diversified natural gas exposure thanks to a portfolio of drillers, midstream companies, and everything related to natural gas. This allows investors to outperform natural gas as a commodity and benefit from increasing shareholder distributions on top.

So, without further ado, let’s get to it!

A New Era For Natural Gas

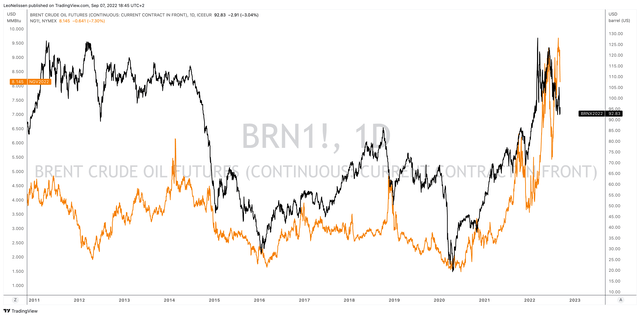

Natural gas was one of the toughest spaces to be in prior to the pandemic because prices were more or less “always” subdued.

While crude oil tended to have prolonged uptrends, natural gas was stuck below $3.50 per MBBTu (Henry Hub) in the years prior to the pandemic.

TradingView (Black = Brent Oil, Orange = Henry Hub)

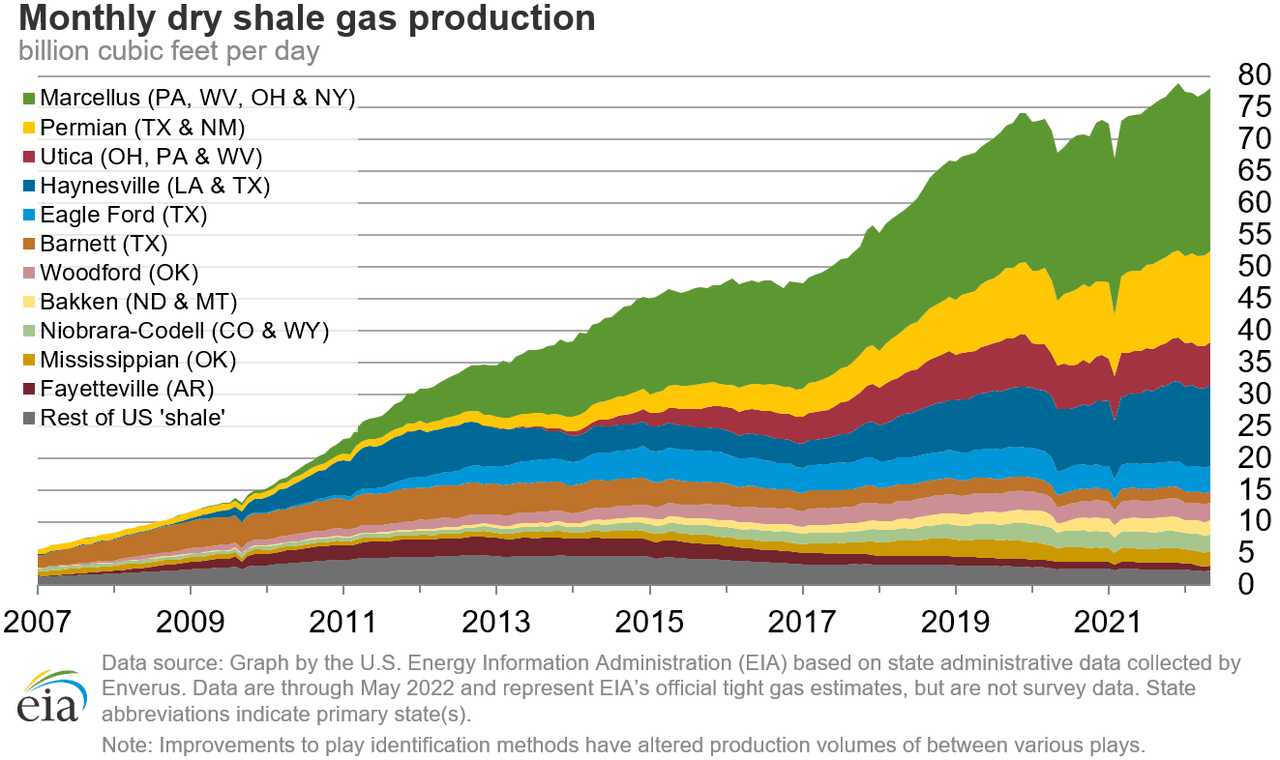

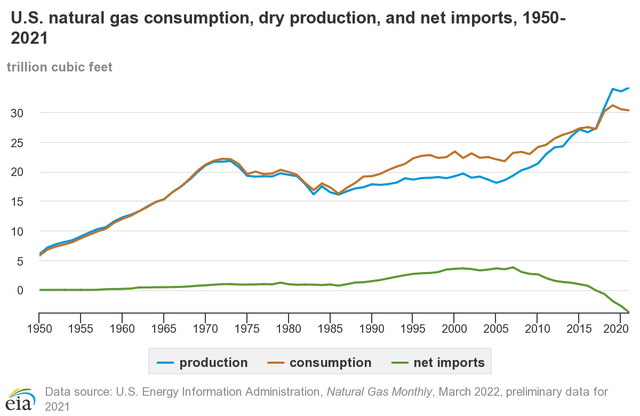

Supply was high as the shale revolution caused production to soar to more than 30 trillion cubic feet per year. This exceeded demand, turning the US into a net exporter of fossil fuels under President Trump.

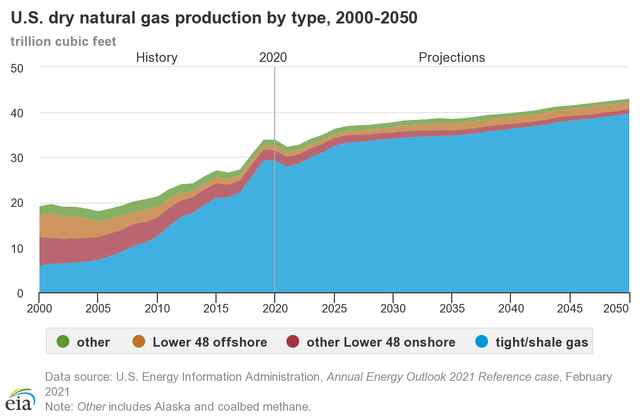

This shale revolution allowed for production growth in areas that were neglectable more than 12 years ago. For example, Marcellus is now the biggest Basin, producing roughly 20 billion of cubic feet of natural gas per day. The same goes for the famous Permian Basin in Texas and New Mexico.

EIA

The problem is that this era of supply growth is over. It was fun while it lasted – for consumers and everyone enjoying low inflation. Now supply growth is expected to come down significantly.

What we are dealing with here is a mix of the inability to maintain high supply growth and the willingness to boost output – for both natural gas and oil.

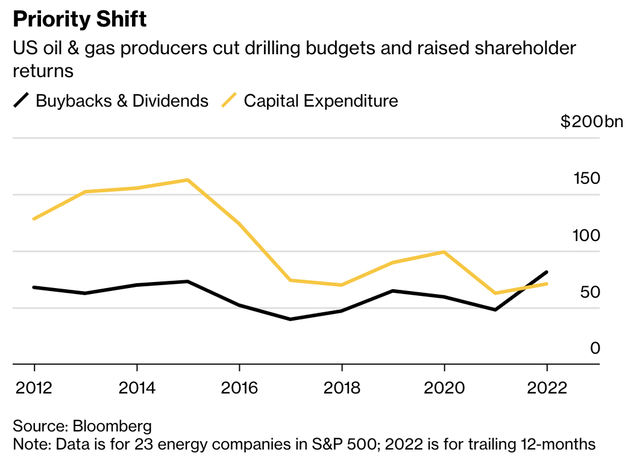

As I wrote in a recent Chevron (CVX) article (and many other articles), companies are protecting themselves against the net-zero movement by refraining from causing self-inflicted harm by boosting supply. After all, when demand comes down again, it could cause another crash as we saw in 2014/2015.

The 23 S&P 500 energy companies are spending more on shareholder distributions than on CapEx, which is a clear statement that times have changed.

Or as Bloomberg puts it (why oil supply isn’t accelerating):

They got castrated in 2016, they got slaughtered in 2020, and then they got demonized for ruining the environment after that,” said Smead, who is Continental Resources Inc.’s largest independent investor and a top-20 shareholder in Occidental Petroleum Corp. “Why would you do anything to help the people that hate you?”

Shale explorers also are unwilling to invest beyond current drilling plans because of “deteriorating efficiencies” amid cost inflation, said Noah Barrett, lead energy analyst at Janus Henderson, which manages about $350 billion.

Moreover, Goehring & Rozencwajg hit the nail on the head when they highlighted the same issue in a recent paper.

The cutbacks in upstream capital spending by the supermajors has already impacted traditional upstream production-the supermajors are shrinking very much in line with the projection we made in our first essay on the “Incredibly Shrinking Supermajors” back in the Q2 2021. Now, it looks like these supermajors, because of intense ESG pressure, are diverting huge amounts of capital away from their traditional high EROEI oil and gas businesses into ventures with energy efficiencies that are 80% lower. The energy crisis we are in now will only be made worse by what the supermajors are doing.

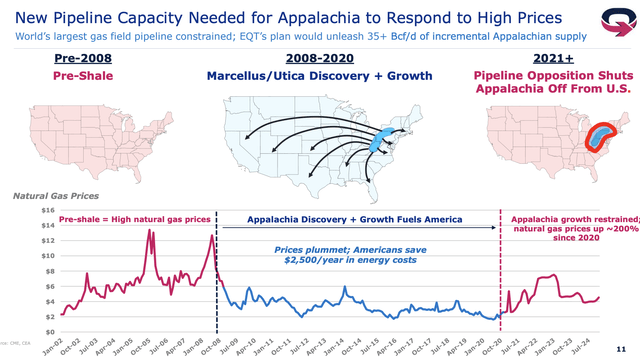

In my last FCG article, I also used a slide from gas producer EQT Corp. (EQT), which shows that natural gas has entered a new era, in this case also fueled by pipeline-related bottlenecks.

As a result of these factors, it is highly unlikely that natural gas prices come down to pre-crisis levels – in every major economic region of the world.

This week, Citigroup came out making the case that:

It will be somewhere between 2025 and 2027 that we’ll see the prices in Europe coming back to where they were at the beginning of 2021,” said Ed Morse, global head of commodities research at Citigroup Inc., in a Bloomberg Television interview. That’s because it’ll take time to replace lost natural gas from Russia.

This doesn’t mean that prices will remain at current levels, but it will mean that we’re far away from a “normal” situation of cheap energy. This also impacts the US as it will have to supply Europe and Asia will LNG to fill supply gaps.

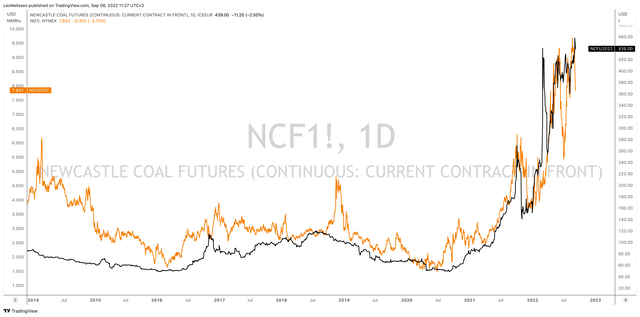

Right now, China’s demand for LNG is easing a bit due to its switch back to coal. Yet, this is boosting coal like the benchmark Newport coal futures, which are usually tied to the price of natural gas.

TradingView (Black = Newcastle Coal, Orange = Natural Gas)

With that in mind, let’s take a look at the FCG ETF.

First Trust Natural Gas ETF

The number one benefit of buying an ETF is to avoid stock picking. Especially in energy, it’s easy to buy the “wrong” company as it’s hard to assess a company’s future earnings power based on its assets, operating efficiencies, hedges, and whatnot.

According to the First Trust website:

- “The Index is comprised of exchange-listed companies that derive a substantial portion of their revenues from the exploration and production of natural gas.

- The Index is constructed by establishing the universe of U.S. listed stocks of companies involved in the exploration and production of natural gas. Companies whose natural gas proved reserves do not meet certain requirements are eliminated.

- To meet Index eligibility, a stock must also satisfy market capitalization, liquidity, and weighting concentration requirements.

- All eligible operating companies and Master Limited Partnership (“MLP”) stocks are ranked on both liquidity and market capitalization within their segments.”

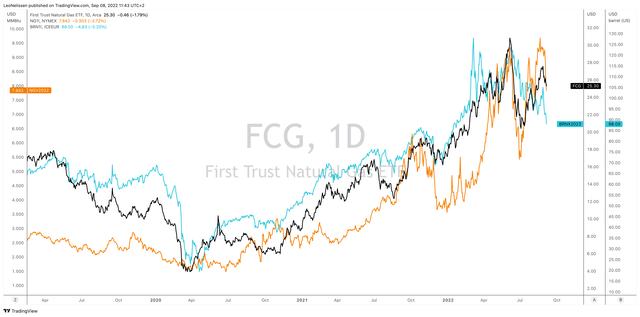

The chart below shows the comparison between the FCG ETF, the price of natural gas (orange), and crude oil (blue).

TradingView (Black = FCG, Orange = Natural Gas, Blue = Crude Oil)

The 30-Day SEC (dividend) yield is 2.2%. That’s up from 1.6% just two months ago as energy companies are hiking dividends. The expense ratio is 0.60%, which is rather high. However, the expense ratio of the biggest ETF tracking natural gas futures (UNG) is 1.35%.

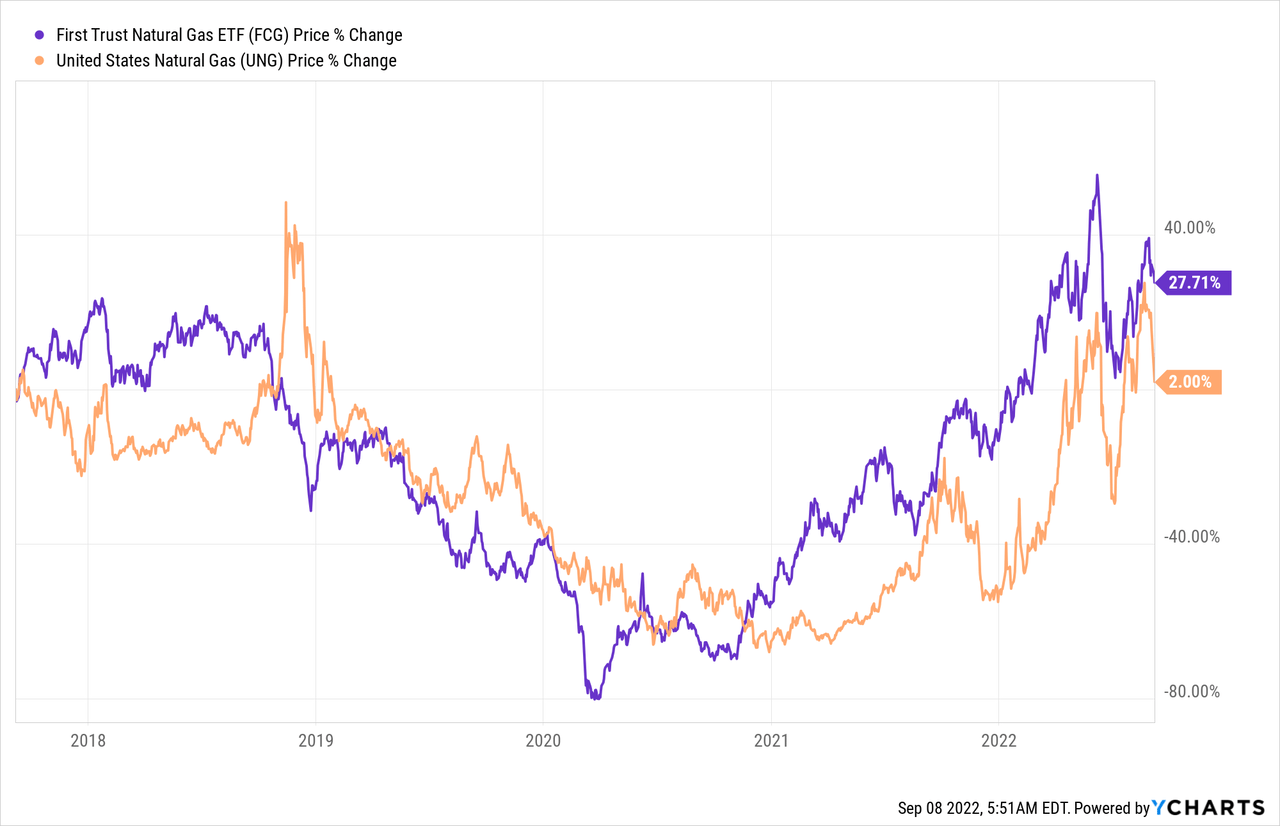

It’s also important to mention that FCG is consistently outperforming UNG. I expect outperformance to become even stronger as energy companies are in a fantastic position to generate high value through debt reduction and shareholder distribution hikes. That makes owning companies way more interesting than related commodities.

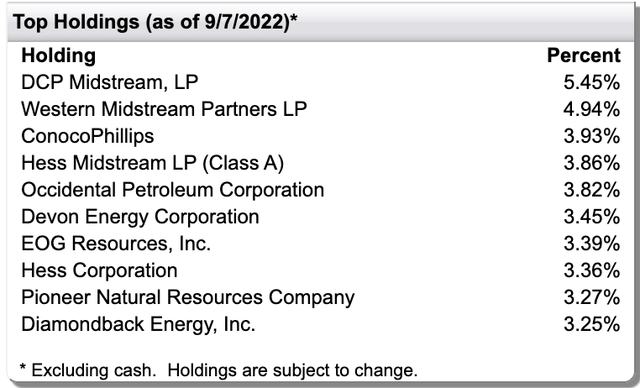

It is also important to mention that FCG is well-diversified. No holding has more than 5.5% exposure, which shows how well-diversified this fund is. After all, the ETF has 49 holdings, which would give every company 2.0% exposure in a perfect equal-weight scenario.

On top of that, the ETF has net assets worth $900 million and a daily volume of 1.7 million shares, which provides liquidity for larger orders and more active trading (which I do not recommend as I believe in the long-term potential of natural gas).

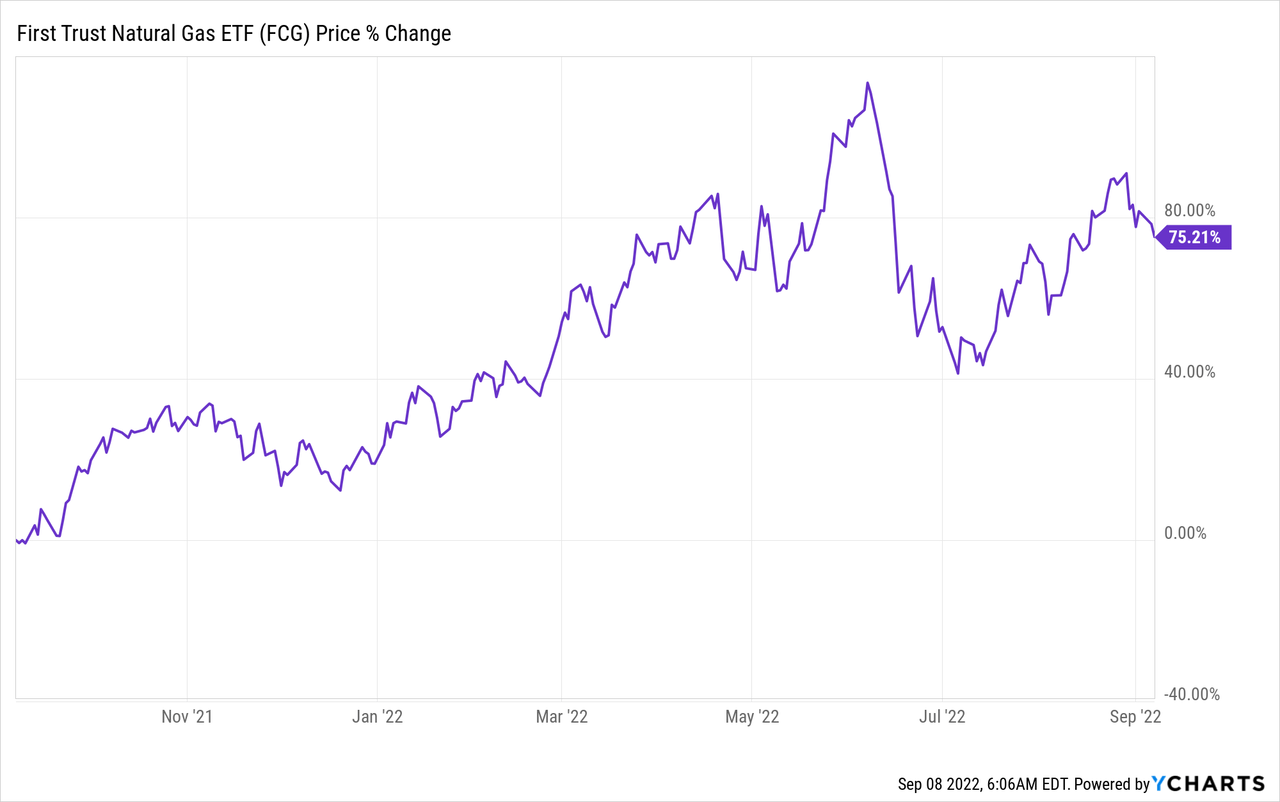

With regard to the valuation, we’re dealing with a somewhat unusual situation. FCG is up 75% over the past 12 months as energy, in general, has done quite well.

However, valuations are still extremely low as investors aren’t willing to price in the full potential of energy. I think that’s a good thing as it means there’s a lot of room for the longer-term bull case to unfold.

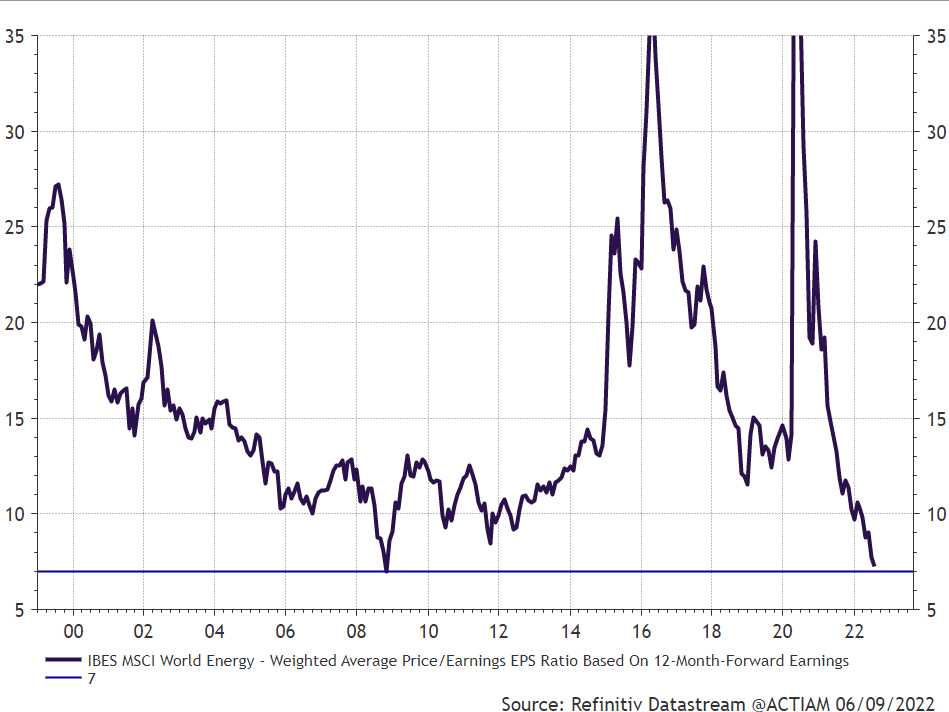

As the graph below shows, the weighted average price/earnings ratio for MSCI world energy stocks is now at Great Financial Crisis lows, which is quite ridiculous.

Refinitiv Datastream

FCG is trading at 7.6x LTM earnings, which is roughly equal to the chart above, which is based on NTM (next twelve months) earnings.

To quote Goehring & Rozencwajg once more:

Investors find themselves confronted with a market unlike any they have experienced: inflation is high, growth is difficult to come by, and raw materials are in short supply after a decade of capital starvation. Even under the most strained deflationary and inflationary periods experienced in United States history, commodities and their related equities produced large positive nominal and real returns. Unfortunately, most investors remain woefully under-allocated to this important sector — ironic given commodity related equities may be the only thing safeguarding capital in the years to come.

Takeaway

The long-term energy bull case is in good shape. While energy prices are volatile, we’re in a situation where supply growth is slowing significantly. Meanwhile, demand remains high due to a switch to more environmentally-friendly natural gas, the war in Ukraine, which is leaving Europe way short of sufficient natural gas supply, and the fact that natural gas/LNG exports are expected to accelerate for decades to come.

The FCG ETF is a great way to buy long-term natural gas exposure. The ETF is well-diversified, it has a fair expense ratio, and exposure to a wide variety of companies tied to the production, transportation, and value-adding processes of natural gas.

Moreover, the valuation of energy stocks, in general, is very fair as investors aren’t willing to give them the valuation they deserve. So far, it seems that the consensus is that this energy price surge will fade to result in “business as usual”. That is extremely unlikely to happen, which makes energy stocks even more attractive.

Long story short, investors looking for well-diversified natural gas exposure will enjoy the FCG ETF as we’re likely in the early innings of a long-term bull case.

(Dis)agree? Let me know in the comments.

Be the first to comment