fotostorm

The markets have been in turmoil for the better part of the last year as multiple negative macroeconomic factors jointly produced a unique storm of negativity that seems to have ended the greatest bull market in history that lasted more than thirteen years and saw the average index investor generate a 412% return during the same period.

In the almost ever-increasingly difficult stock market situation we find ourselves in today, as market liquidity is being sucked out by high-interest rates, 40-year high record inflation numbers, and ongoing geopolitical crises caused by the Ukraine conflict, there are only a few companies that seem truly resilient to the ongoing crisis, and leading the way is none other than PepsiCo (NASDAQ:PEP) itself.

The food and snack giant has solidified its position as a rock-solid inflation hedge and a top-class defensive stock in the eyes of many as it once again comes out swinging for its second quarter results showcasing its immense moat and pricing power that allowed it to push nearly all of the negative impacts down to the end customer.

Latest quarterly results

At the beginning of the year, PepsiCo already managed to top market expectations and deliver strong first-quarter results, which we have already discussed in our April article.

The food and beverage giant surprised the market and beat earnings by $0.06, posting earnings of $1.23 per share, instead of the $1.23 that was expected by the Street. It also managed to generate $16.2 billion in revenues, significantly higher than the forecasted $15.5 billion. More importantly, the company has shown strong resilience to the ongoing macroeconomic situation and once more solidified its position as an inflation hedge and a top-class defensive stock.

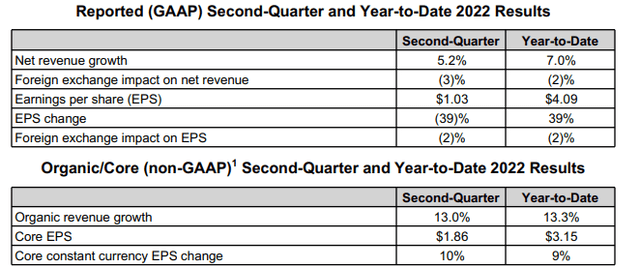

PepsiCo Second Quarter Results (Q2 Earnings Release)

With all of that in mind, one might argue that the news of PepsiCo once again overdelivering on analyst expectations does not come as that much of a surprise. The company is rather known for its somewhat conservative projections, which might have contributed to the fact that they have missed consensus earnings expectations once in the past decade.

The food and snack behemoth reported yesterday that its core earnings per share for the quarter ended June 11 came in at $1.86, above the analyst consensus call of $1.73. PepsiCo has also increased its quarterly revenue by 5.2% to $20.23 billion. The analyst estimate for the quarter was set at $19.51 billion. A key metric in the staples space, organic sales have risen 13% in the quarter as well.

Financial Performance (Q2 Press Release)

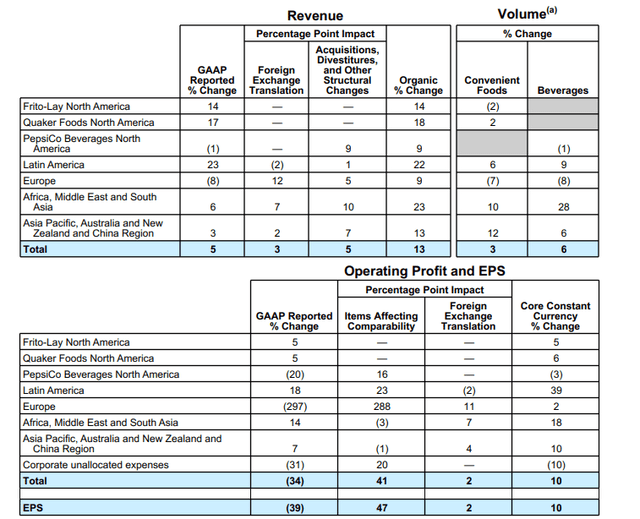

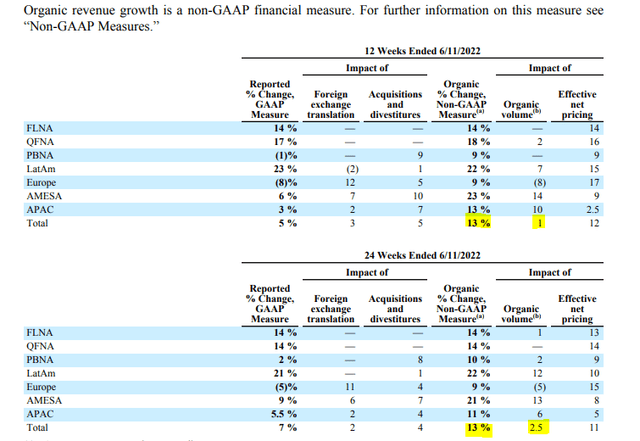

An interesting way to look at the data is that “organic revenues” growth was set at 13%, while “organic volume” grew by only 1% this quarter, effectively meaning that demand stayed the same on aggregate, while prices were raised by roughly 12%. By itself, this can be viewed as a testament to the pricing power that PepsiCo commands. Leadership pointed out it remained open to raising prices further after seeing limited pushback from consumers so far, with the vast majority still obviously proving willing to stomach the hikes.

The pricing power seems to have been most relevant in the case of Europe, which saw a significant loss of demand both as a direct result of the Russia-Ukraine conflict, with limited or no access to both countries. But also indirectly in Europe at large, which suffers significantly more from the ongoing macroeconomic situation as compared to the United States. Developing and emerging markets, on the other hand, remained resilient and managed to deliver double-digit organic revenue growth in the quarter.

Organic Volume Growth (Q2 Quarterly Report)

At the end of the day, the macroeconomic situation as bad as it is still hasn’t gotten to a point at which it would chip away at the demand for PepsiCo’s food and beverage family of products. Management felt that and was comfortable raising prices and pushing all the negative effects toward the end customer, which at least as far as the data tells us, has largely stayed loyal to the brands.

While it is interesting that PepsiCo once again beat earnings expectations and usually makes for a good headline, the main two takeaways from this quarterly results was that the company was successful in outpacing inflation and that consumers were willing to stay loyal and stick to the brands even with the prices hikes in mind. We are curious to see will this situation develop in the same manner over the course of the following months, especially in the case of further inflation surges.

We are pleased with our results for the second quarter as our business momentum continued despite ongoing macroeconomic and geopolitical volatility and higher levels of inflation across our markets. Our results are indicative of our highly dedicated employees, the strength and resilience of our categories, agile supply chain and go-to-market systems and strong marketplace execution. Our performance also gives us confidence that our investments to become an even Faster, even Stronger, and even Better organization by winning with pep+ are working. Given our year-to-date performance, we now expect our full-year organic revenue to increase 10 percent (previously 8 percent) and we continue to expect core constant currency earnings per share to increase 8 percent.

Ramon Laguarta, CEO – Second Quarter Press Release

The strong results were also reflected in the revised guidance for fiscal 2022 by the company, which now expects to deliver 2% higher organic growth than before, expecting growth of 10% instead of the previously assumed 8%. The company is also confident that it will generate significant shareholder returns in the amount of $7.7 billion, comprised of dividends of $6.2 billion and share repurchases of $1.5 billion.

Immediately accessible returns

There is a concept of “immediately accessible shareholder returns” that I often like to mention, and I believe that it really comes under the spotlight when discussing PepsiCo under the ongoing circumstances. As the market seemingly went off the cliff earlier this year, finding oneself invested in a strong cash-generating business is more important than ever.

Possibly even more important than that is having access to cash-generating businesses that enable immediate shareholder returns that can be deployed elsewhere by the investor in order to take advantage of the rapidly declining market situation. We are first and foremost discussing the combination of the company’s strong dividend program and both the announced and the expected share buy-back initiatives.

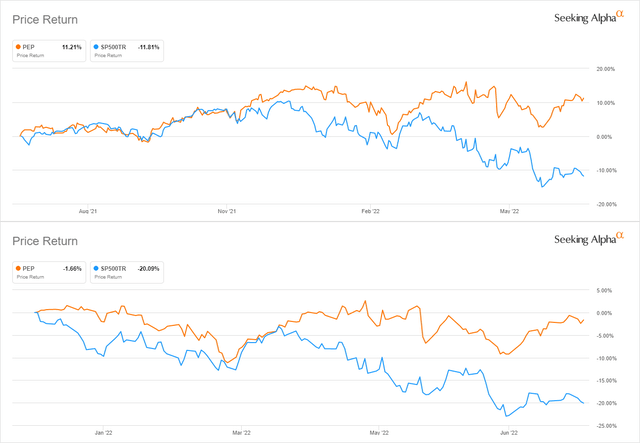

This has enabled the company to significantly outperform the market for the first time in years, with PepsiCo generating a market alpha of 18.43% year-to-date and a 23.02% one-year alpha.

PepsiCo vs S&P500 Returns (Seeking Alpha)

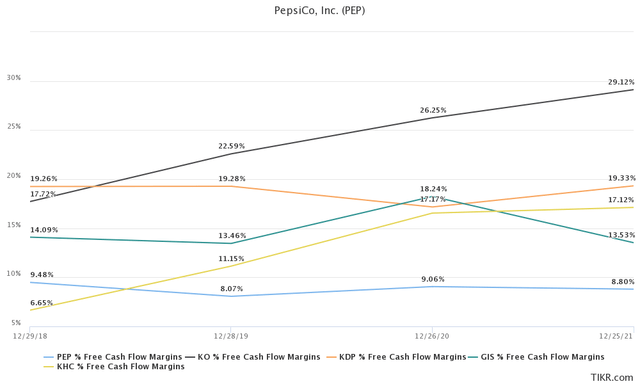

When discussing cash flows, the company can be easily defined as a free cash flow machine by managing to generate roughly $6-7 billion in free cash flow per year. However, once we take a look at the free cash flow margins, they tell a slightly different scenario, especially so when compared to companies like Coca-Cola (KO), Kraft Heinz (KHC), General Mills (GIS), or Keurig Dr Pepper (KDP) that usually manage to maintain a high double-digit FCF margin. In comparison, PepsiCo maintains its free cash flow margin at slightly under 10%.

The company maintained in its quarterly report that it generated $1.07 billion in free cash flow this quarter, significantly less than the $2.25 billion in Q2 2021 and $1.57 billion in the year before that. This is already on top of generating negative FCF in the first quarter of this year. It is worth noting that historically, the first half of the year is usually lackluster in terms of FCF generation, while the company usually manages to post better figures for the last two quarters of the year, which is a trend that seems to be relevant this year as well.

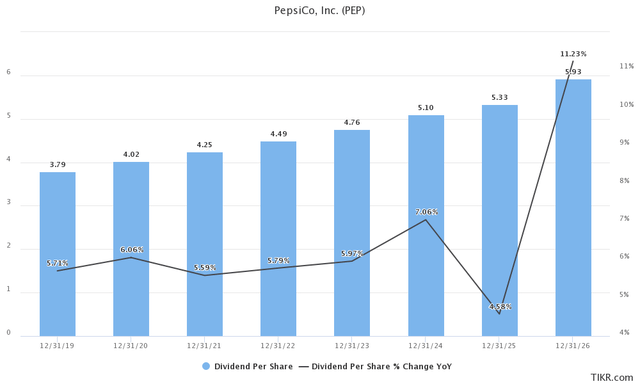

One of the strongest arguments for the food and beverage giant is its attractive dividend or more precisely, its commendable dividend growth story. PepsiCo is a company that has been successful in raising its dividend each year for the past 50 years, ultimately earning it the title of a “Dividend King” this year. This is an achievement so rare that only 31 companies held the status as of last year.

To discuss more recent events, PepsiCo went from paying out a quarterly dividend of $0.54 back in Q2 2012 to paying out $1.15 in Q2 2022 today. PepsiCo was successful in almost doubling its dividend distributions over the course of the past decade, however, this is where we arrive at another issue that I have with the company.

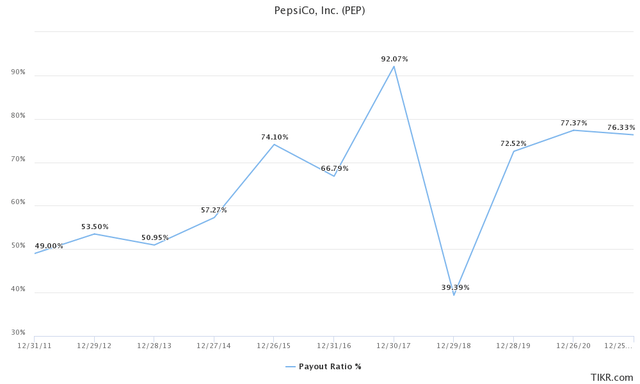

If we take a look at payout ratios for the same period, we arrive at the conclusion that they have been steadily on the rise, with less room for future increases.

Analysts still largely maintain the expectation that the dividend is going to grow in the mid-single digits, which I agree with as well, especially considering the inflationary environment that is expected over the course of the next couple of years. However, unless something drastically changes it would be smart to expect much less than what the company has historically succeeded in doing.

Dividend and Payout Estimates (TIKR Terminal)

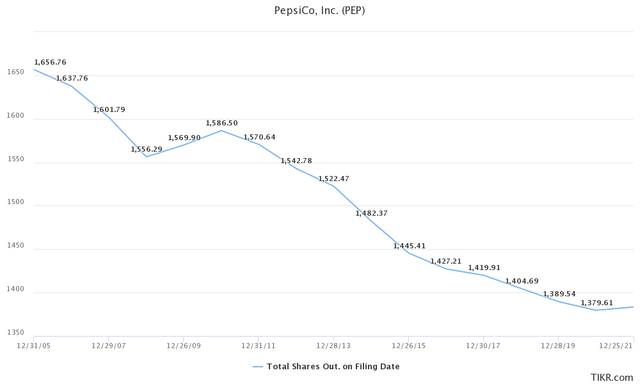

As already described in our previous articles, the intensity of the share buy-back program has been dialed down throughout the years, which is partially a testament to the rising payout ratios, but possibly also to the management acknowledging the market premium they have commanded.

Shares Outstanding (TIKR Terminal)

Given the current market predicament and the price resilience the company has displayed throughout the last twelve months, I would argue that this is largely for the better and that buybacks, even if sounding attractive at first glance, should probably be set to the side.

For example, the company’s outlook defines $1.5 billion as dedicated toward share buybacks, which roughly represents 19.44% of its expected free cash flow for the year. Dedicating almost 20% of its free cash flow in order to buy back slightly more than 0.5% of the company’s market cap does not strike me as necessarily the best use of capital.

Final thoughts and opinions

The food and snack giant has displayed an extraordinary ability to leverage its top-class brand portfolio in order to push price hikes down through the chain to the end consumer, managing to almost fully circumnavigate the negative effects of the high inflationary environment, at least for now. Data shows, except for Europe, with suffers greatly from multiple issues surrounding the Ukraine-Russia conflict, that demand for the PepsiCo family of products is still steadily on the rise.

As a result, PepsiCo was successful in solidifying its position as a great inflation hedge and a top-class defensive stock, which no doubt helped the company outperform the market for the first time in years, with the maker of Lays, Pepsi, and Mountain Dew generating a market alpha of 18.43% year-to-date and a 23.02% one-year alpha. In fact, with almost the entire rest of the market selling at significant discounts even as compared to pre-pandemic prices, the valuation situation has arguably gotten even more complicated.

While the company was successful in preserving wealth for those who were invested prior to the crash and might do so as well in the near future, in the case of further market declines, from a pure valuation perspective, it looks even pricier relative to the broader market at this point. Further to the point, the issues originating from the company’s premium valuation are still active and relevant, with the company reaching payout ratio limits that will hold back potential dividend growth as well as large buy-back programs making little sense. With fully recognizing PepsiCo as a brilliant business that we would love to own, we simply cannot escape the conclusion that the current market premium assigned to the company is significantly limiting its prospect of being a great investment opportunity.

Be the first to comment