Maksim Labkouski

Introduction

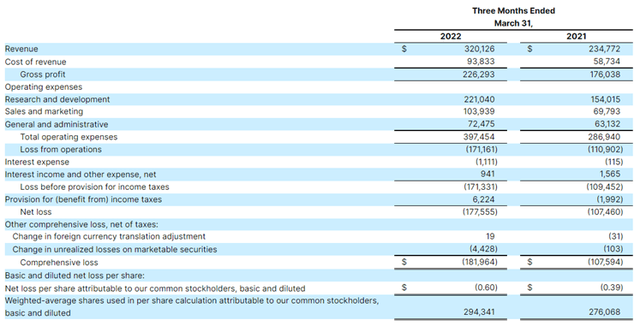

Unity Software Inc. (NYSE:U) belongs to the high-growth and no-income tech segment of the stock market. It traded at an all-time high of $210 per share a little more than half a year ago back in November of last year, while today it is trading at $32.8 per share, down almost 84% from its all-time high. Today, the price to sales ratio still stands at 7.8 compared to roughly 50 during the peak days. So, the company isn’t exactly cheap, especially not in an environment where they have had to reduce revenue outlook more than once – more on that later.

Unity has had its fair share of problems this year, posting its Q1 results on May 11th with shares crashing 36% due to a miss on revenue and a reduced revenue outlook for the year.

On June 29th, it was reported that Unity had decided to lay off people in the hundreds, not normally something we expect to see out of a high-growth company. That amount represented a substantial chunk of the employee pool for a company having fewer than 6.000 employees.

July 13th was supposed to bring some good news, as Unity announced that Unity and ironSource Ltd. (IS) merge. Instead, Unity’s stock tumbled another 17.5% intraday, not least because the news came with a statement concerning the Q2 performance, with a new revenue cut announced.

I’ve been looking at Unity since it was trading at roughly $90 per share, but kept my distance. Today’s news didn’t bring me closer, as I’m not an immediate fan of the math behind this deal. Let’s have a look.

The Deal – Strategic Observations & Outlook

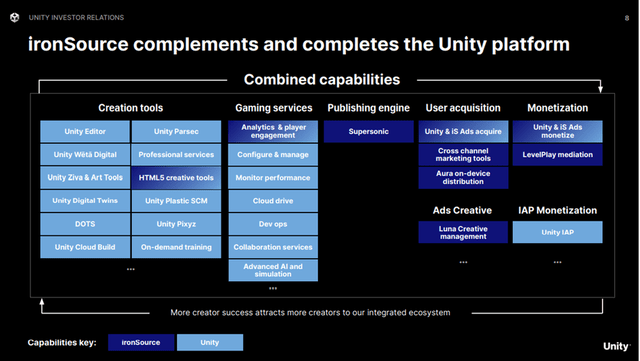

First of all, Unity’s business model focuses on a platform, known as “creation tools,” aimed at primarily game developers, while having branched outside gaming to the metaverse in general. Here, developers can obtain access to tools for development, based on a subscription model. What Unity does, is so value adding, that a very significant amount of the most popular mobile games are developed on the basis of Unity software. Additionally, Unity also supports developers to run and monetize games, referred to as “gaming services.”

Unity’s existing business model is highlighted in light blue, with the addition of ironSource being highlighted in dark blue. As can be seen, Unity is very heavy on the creator side of things as well as running the games, but lacking the downstream capabilities concerning publishing, user acquisition, and monetization.

In terms of financial synergies, management highlighted the following positive expectations concerning the deal

- Highly accretive merger is expected to deliver a run rate of $1 billion in Adjusted EBITDA by the end of 2024, and $300 million in annual EBITDA synergies by year three.

Strategically, management highlighted the following

- Combining the two, creates a company capable of both creation and growth, striking a more balanced posture, securing a more value-adding process for developers.

As such, I also believe this deal makes sense from a strategic perspective, not least because it may also alleviate the problems associated to the Q1-2022 performance.

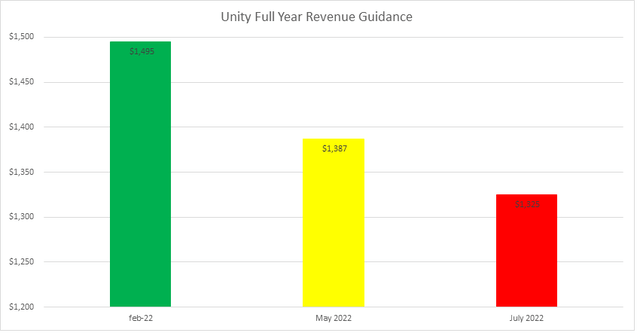

- Back in February of 2022, management reported its Q4-2021 and released the FY-2022 guidance, with a midpoint revenue expectation of $1.49 billion, which represented a 35% YoY growth rate.

- Then Q1-2022 results were released in May 2022 and management had to revise the guidance as a result of data issues causing adds not to provide the clicks expected, causing less revenue for developers and Unity. Unity staff had to intervene on behalf of the software malfunction to clean the data. New midpoint guidance was $1.38 billion representing a 25% YoY growth rate.

- July 13th, as part of the announcement was a new guidance. Unity expects to perform slightly better for Q2 than its guidance issued during Q1, which was a range between $290-$295 million. I’ll make use of $296 million as you’ll see in a minute. In addition, full year guidance was revised to $1.3-$1.35 billion. New midpoint guidance representing just above 19% growth YoY.

There wasn’t any conference call, so we won’t know for sure what caused this revised guidance until the upcoming quarterly results. However, visualizing the development looks the following.

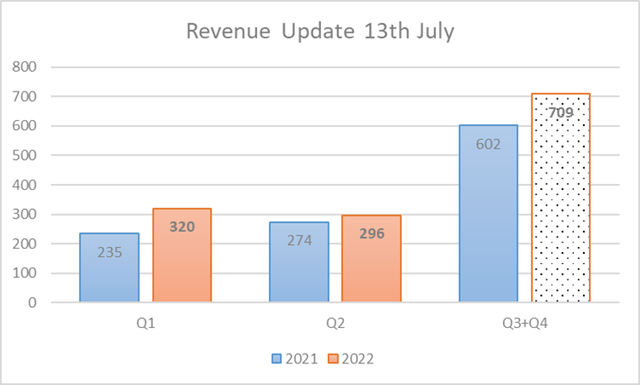

Given what we know today, the already published Q1 results, and just published communication for expected Q2 results, it’s possible to have a look at what’s expected for the rest of this year.

Q1 secured a 36% YoY growth rate, with Q2 expected to provide growth of roughly 8%, slightly better than the adjusted guidance during the announcement of Q1. Before having received the new guidance, Q3 and Q4 would have to secure $774 million in revenue to live up to the previous FY-2022 guidance, requiring a growth rate of 29%. This was under the assumption that Unity had resolved the issues reported during Q1 and managed to supercharge the growth to get back on track – remember, Q1 showed 36% growth, so this wasn’t unreasonable.

However, with the new guidance, Q3 and Q4 will now have to secure roughly $709 million in revenue, corresponding to a growth rate of 19% growth. Going from 29% to 19% growth, that’s quite a hair cut and with each new downwards revised guidance, we begin to trust management less and less. This causes uncertainty as to what’s the real growth for Unity going forward, and also part of the answer as to why the stock responded to strongly to the news.

The Deal – Financial Observations

Here I’ll focus on three areas of interest.

- Institutional investor support

- Share buyback program as part of the deal

- Dilution of shareholders.

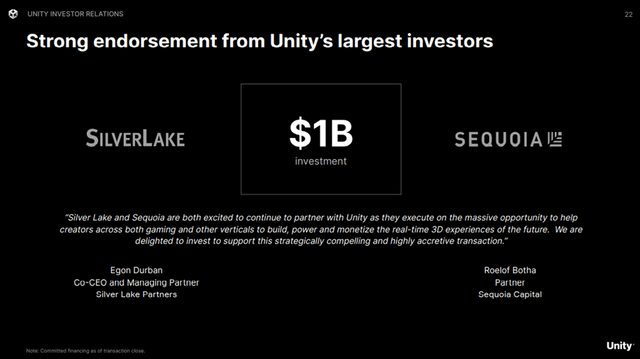

First of all, the two largest institutional investors endorsed the deal, by pledging a $1 billion investment in the company in the form of senior convertible notes. Here I’d like to highlight the favorable 2% interest rate provided by SilverLake and Sequoia, perhaps not surprising given they are some of the largest shareholders. Instead of paying back the loan, Unity will have the option to convert to shares, causing dilution.

Additionally, as part of the deal, to combat share dilution, a buyback program of $2.5 billion, supposed to take place over the coming 24 months, has been authorized. This corresponds to roughly 21.2% of the existing float based on the current market cap between $11-$12 billion.

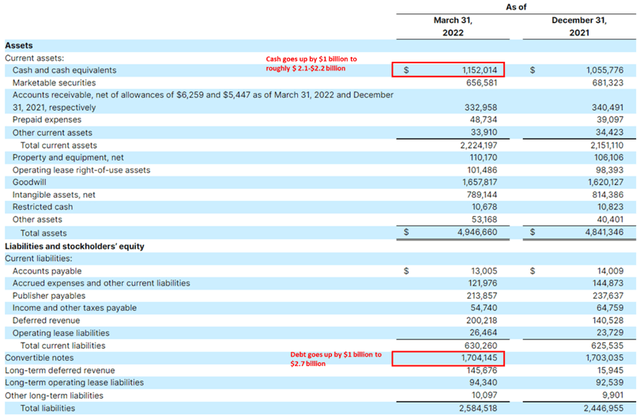

If we look at the math, however, it starts to get a bit worrisome. Whenever I published articles for companies in the high-growth, no-income space, I always emphasized the need to invest in companies with solid balance sheets. A healthy cash to debt position is what carries a company through periods of economic uncertainty. In favor of Unity is the fact that they have been cash flow positive recently, but it’s of course uncertain if that will persist given the continued revised guidance. Supposedly, laying off people would strengthen the cash flow, time will tell.

Remember, in the balance sheet illustration below, that those funds will go towards a share buyback program, leaving the debt alone on the balance sheet. My guess would be that those notes are indeed converted to shares at one point.

When it comes to dilution, here is what we know.

Entered into a definitive agreement under which ironSource will merge into a wholly-owned subsidiary of Unity via an all-stock deal, where each ordinary share of ironSource will be exchanged for 0.1089 shares of Unity common stock. Once closed, current Unity stockholders will own approximately 73.5% and current ironSource shareholders will own approximately 26.5% of the combined company

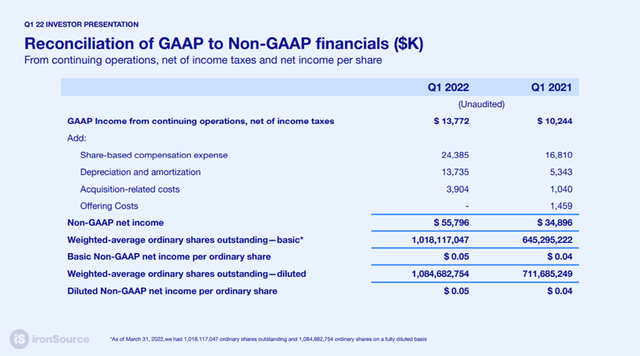

By the end of their Q1, ironSource had 1.084 billion shares outstanding. Assuming that level is roughly the same today, that corresponds to an additional 118 million new Unity shares. If we assume Unity made full use of their newly approved buyback program, they would be able to buy back roughly 76 million shares with the $2.5 billion, meaning an additional 42 million shares that stand to dilute shareholders.

The question is, then, how much does this dilute existing shareholders?

Unity Q1-2022 Profit and Loss Statement

If we look at Unity’s Q1, we can see they had roughly 294 million shares at that point in time. During their Q1 announcement, it was stated they expected to have roughly 350 million shares on a fully diluted basis by end of 2022. Adding the additional 118 million shares to that figure, dilution comes in at 33%. Again, assuming they bought back all the shares today, dilution would still come in at 13% on a forward basis. If we take departure in the 294 million shares, the dilution is of course larger.

I’m not a shareholder today, but I never like, as a shareholder, to be diluted by such a margin. I also don’t like seeing my high-growth tech stocks take on a lot of debt if the balance sheet isn’t super strong. In this instance, debt is taken on to perform buybacks. That doesn’t sit well with me. As investors in high growth and immature tech stocks, we have to accept dilution, it’s part of the game. The question is, of course, to what extent – that’s an individual assessment.

What Are We Left With?

Unity is going the direction of what appears to make a lot of sense from a strategic perspective. This is me saying so, without being familiar with ironSource as a company. However, based on the material disclosed by the companies, there appear to be synergies to the benefit of their customers, which I like. Potentially, management is creating a metaverse powerhouse, but that is another uncertain parameter that we can’t know for sure today given the immaturity of the marketplace.

On the other side, management disclosed another reduction in FY-2022 outlook, the second of this year. This hollowed trust in management also in terms of what the real long-term growth rate is for this company, causing the stock to drop 17% intraday.

Unity’s balance sheet isn’t pristine, and management is taking on a substantial amount of debt to pay for the ironSource merger in the form of combating dilution. That move is not substantial enough to combat the actual expected dilution, at least not when based on today’s outstanding number of shares and price per share, which of course can change a lot by the time the deal is closed. Effectively, management is raiding debt to pay for share buybacks, potentially converting that debt to new shares should that be preferred as opposed to repaying the debt.

I’m not an immediate fan of this approach given the state of the global economy and a potential drawdown in activity. This would require strong balance sheets for individual companies in order to avoid being forced into making unwanted moves to keep the boat afloat.

Be the first to comment