Kwarkot

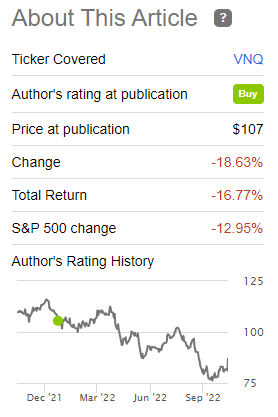

Earlier in the year, I wrote about the Vanguard Real Estate ETF (NYSEARCA:VNQ), a diversified U.S. REIT index ETF. In that article, I argued that VNQ would benefit from increased inflation, through higher housing prices and rent, and from the ongoing shift towards value stocks and old-economy industries. The fund has slightly underperformed since, as rising interest rates put downward pressure on real estate prices and rents.

Previous VNQ Article

Since my last article, housing prices and rents have cooled off, while REIT valuations have normalized. As industry conditions have materially worsened, I’m updating my rating on VNQ to hold. The fund seems fine, but I see no tailwinds, some risks, and few reasons to believe it will outperform moving forward.

VNQ – Basics

- Investment Manager: Vanguard

- Underlying Index: MSCI US Investable Market Real Estate 25/50 Index

- Expense Ratio: 0.12%

- Dividend Yield: 3.58%

- Total Returns CAGR 10Y: 6.69%

VNQ – Overview

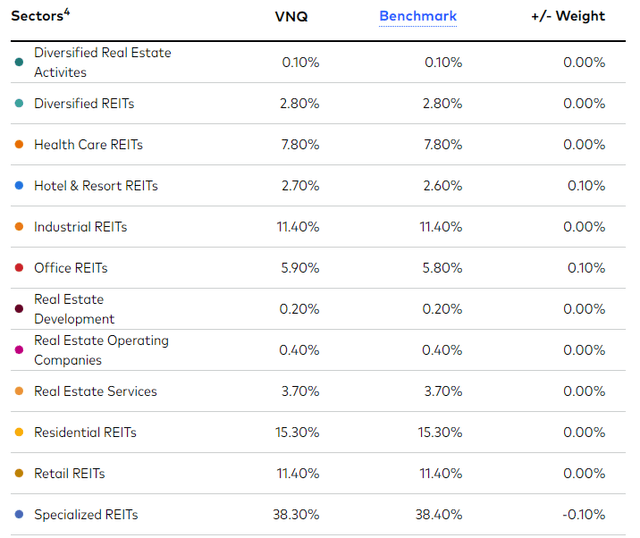

VNQ is the largest U.S. REIT index ETF. REITs, or real estate investment trusts, are companies which own and operate real estate assets, including single-family homes, apartment buildings, commercial properties, and the like. VNQ tracks the MSCI US Investable Market Real Estate 25/50 Index, a broad-based index of these same securities. It is a relatively simple index, which includes all relevant U.S. REITs meeting a basic set of liquidity, trading, size, industry focus, and corporate structure criteria. It is a market-cap-weighted index, with caps meant to meet regulatory standards concerning diversification and concentration.

VNQ is an incredibly well-diversified REIT fund, with investments in 168 different securities, and with exposure to all relevant REIT sub-segments. Residential REITs are the largest segment, with a 15.3% allocation. Residential REITs were also seeing strong growth in prior years, as institutional investors gobbled up single-family homes to rent. Growth has stalled as of late, due to a cooling housing market and higher interest rates.

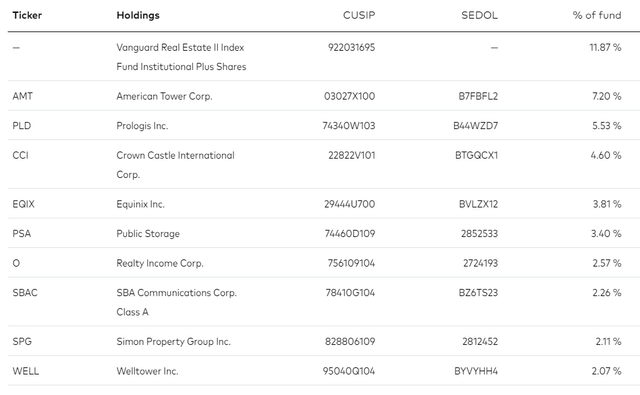

VNQ is about as concentrated as the average equity index fund, with the fund’s top ten holdings accounting for around 36% of its value. I’m excluding an investment in the Vanguard Real Estate II Index Fund Institutional Plus Shares (VRTPX), as VRPTX tracks the same index as VNQ, and so said investment does not materially impact VNQ’s exposures.

Besides the above, nothing much else stands out about the fund, its index, or holdings. It is a relatively simple U.S. REIT fund, with the characteristics and holdings one would expect from such a fund.

VNQ – Positives and Benefits

VNQ provides investors with diversified exposure to U.S. REITs. Doing so has two significant benefits.

First, is the diversification itself. Diversifying a portfolio, through investments in different asset classes, funds, and securities, reduces portfolio risk and volatility, and is almost always a benefit for shareholders. VNQ is a well-diversified fund and provides exposure to a less common asset class and so could be used to diversify an investor’s portfolio. REITs are correlated to stocks, so the benefits from diversification are somewhat blunted, but they are definitely still there.

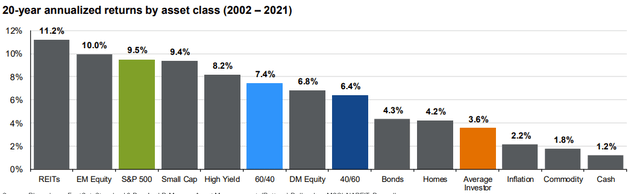

Second, is the fact that U.S. REITs are one of the best-performing asset classes in the world. U.S. REITs generally outperform relative to most asset classes, including high-yield corporate bonds and international equities. U.S. REITs have also outperformed relative to U.S. equities for the past twenty years or so, although outperformance is not consistent, nor does it occur during all relevant time periods.

J.P. Morgan Guide to the Markets

VNQ provides diversified exposure to one of the best-performing asset classes in the world, a significant benefit, and one that makes for a very compelling investment thesis. Although VNQ does have its benefits, it also has many risks and drawbacks. Let’s have a look at these.

VNQ – Risks and Drawbacks

VNQ’s underlying holdings are all U.S. REITs. These companies all own and operate U.S. real estate assets, and so have significant exposure to the U.S. real estate market. REIT asset values are dependent on real estate prices, while REIT cash-flows and dividends are dependent on rents. Both tend to see strong growth year after year, owing to the dynamism of the U.S. economy and real estate market. Strong asset value, cash flow, and dividend growth have underpinned U.S. REIT outperformance for decades, as mentioned above.

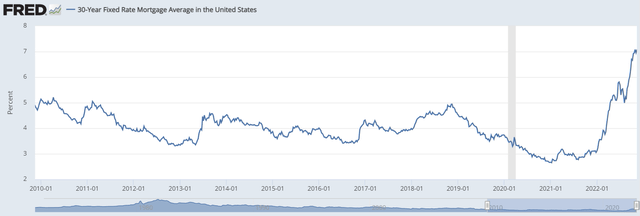

VNQ has significant exposure to the U.S. real estate market and said market is cooling off. Commercial property prices are down 6% YTD, residential housing prices are down 2% these past few months, while sales tumble 13%. Institutional investors are scaling back purchases, as are individual investors. The U.S. housing market is cooling off for a myriad of reasons, chief among them rising interest rates. Higher interest rates mean higher mortgage rates, with the 30-year fixed mortgage doubling in 2022, rising from around 3.0% to around 7.0%.

As mortgage rates skyrocket, real estate financing and opportunity costs increase, leading to significantly reduced affordability, demand, and, ultimately, prices and rent.

Higher interest rates leading to higher financing costs are, I think, pretty self-explanatory. Real estate is generally partially financed with debt/mortgages. Higher mortgage rates mean higher mortgage payments for any given level of debt, which makes it more difficult for homebuyers and investors to afford real estate. As per analyst Charlie Bilello, increased housing prices and mortgage rates have about doubled the expected monthly mortgage payment for the average new home, a significant increase. Lots of homebuyers and investors could afford new homes with 3.0% mortgage rates, but they can’t afford them with 7.0% mortgage rates.

Higher financing costs mean plummeting demand for real estate, and one can’t demand an asset one can’t afford, which should ultimately result in lower real estate prices and rent. Both have been the case these past few months, as expected.

Higher interest rates also lead to higher opportunity costs for real estate assets. As an example, VNQ’s 3.6% dividend yield looked attractive when the 10Y treasury rate hovered around 1.5% earlier in the year, but it looks quite mediocre now that said rate reaches 4.1%. As interest rates rise investors will demand higher yields from their real estate investments which, under current market conditions, means lower asset prices. VNQ’s investors, for instance, can’t really force the fund to increase its dividends until these are at least equal to treasury yields. VNQ’s investors can, however, sell the fund/its underlying holdings until share prices plummet, after which the fund’s yield should at least equal treasury yields. In practice, this process plays out at the real estate market level, not at the REIT or REIT fund level, but the end result is the same: lower share prices for VNQ.

Higher interest rates imply higher long-term expected returns for real estate assets, and these are achieved by significant reductions in asset values. As mentioned previously, this has been the case since inception, as expected.

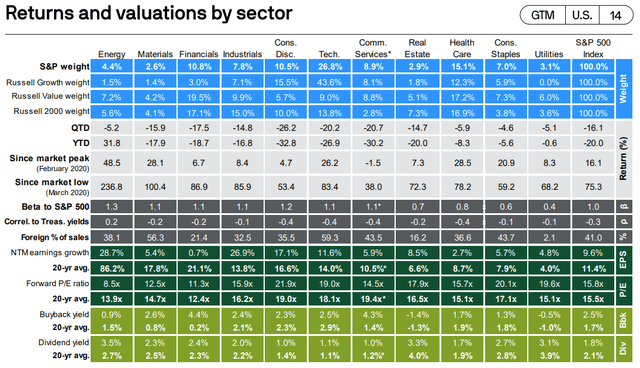

Worsening industry conditions have led to lower REIT share prices and softening valuations, but by less than expected, and by less than the equity market average. The result is less competitive REIT industry valuations. As per J.P. Morgan, U.S. REITs are slightly overvalued relative to their historical average on earnings, buyback, and dividend yield measures, and slightly overvalued relative to broader equity indexes on earnings. Source below, although you might have to squint to see the data.

J.P. Morgan Guide to the Markets

Worsening industry conditions have also led to lower expected earnings growth for most U.S. REITs, mostly due to declining/stagnating rents. J.P. Morgan is expecting earnings growth of 8.6% for these companies for the next twelve months, versus growth of 9.5% for broader equity indexes.

Worsening industry conditions have led U.S. REITs to trade with relatively expensive valuations and below-average growth prospects, a broadly negative situation.

Conclusion – No Reason to Buy

VNQ is a diversified U.S. REIT index ETF. Due to worsening industry conditions, relatively uncompetitive valuations, and below-average growth prospects, I see no reason to invest in the fund at the present time.

Be the first to comment