raul naranjo/iStock via Getty Images

Opportunity Overview

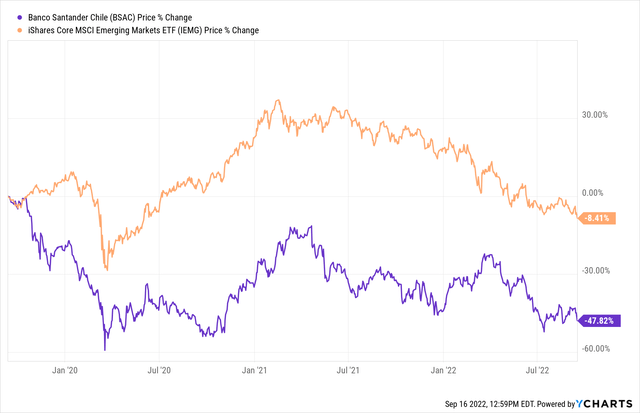

Chilean banks have been on my radar this year, and I think now is a good time to continue building positions. In my last article on Banco De Chile (BCH), I covered the macroeconomic challenges Chile is facing and how banks would fare under these conditions. Chile has had to hike rates considerably this year, and inflation still ran ahead of rates. Growth will likely slow during the next couple of years, and banks will see a drop in ROE in the coming quarters as economic conditions become worse. On the political front, things look a bit clearer now, and equities are still trading below the October 2019 levels, when political risks rose in Chile. I have not focused extensively on copper in any of my Chile articles. However, I think the price of copper also has room to run, and that last cycles catalysts are not as relevant when determining future price movements. One final benefit of investing in Chile is that several macroeconomic characteristics, such as its lower public debt, stand out relative to emerging market peers. Sovereign debt is a significant risk within emerging market equities, and Chile is in a very favorable position in this sense. Chile is a mixed bag, and I don’t expect anything magical to happen in 2023. But this looks like a good time to begin accumulating well-managed companies like Banco Santander Chile (NYSE:BSAC)

This significant underperformance is strange, as Chile has many relatively favorable macroeconomic traits and is trading at a very compelling valuation.

Updated Macro Outlook

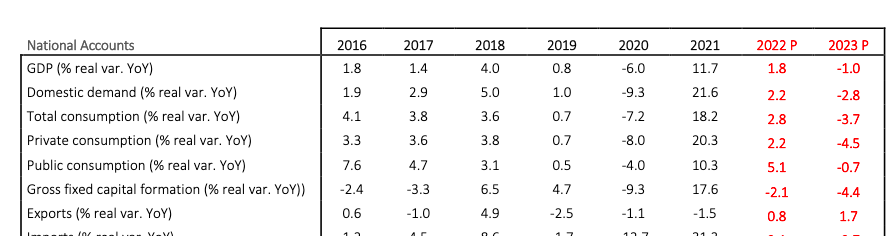

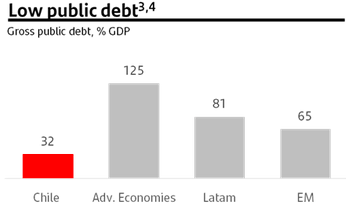

Q2 Growth fell slightly below expectations at 5.4% instead of 5.7%. Moving forward, Chile’s growth will likely be slightly below 2% during 2022, and the country faces a risk of recession in 2023. Key medium-term risks include an economic slowdown in China, the United States, and Europe, its main export markets. Private consumption will also likely decline due to the relatively higher household debt and record high inflation experienced this year. This comes at a time when rates are at a record high, which may put a strain on banks that primarily loan to consumers.

SantanderCL

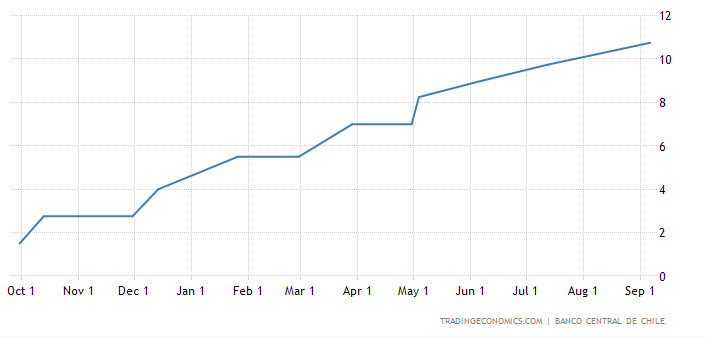

Inflation has continued to accelerate in Chile each month, which has forced the Central Bank to raise rates to 10.75% in September 2022. This represents a multi-decade high, as rates did not even break 10% following the GFC. Inflation in Chile most recently rose by 14.1% YoY, the highest level experience during these twelve months shown below. However, rates should begin to normalize in 2023 if inflation comes under control and drops below 10%.

Inflation in Chile

Trading Economics

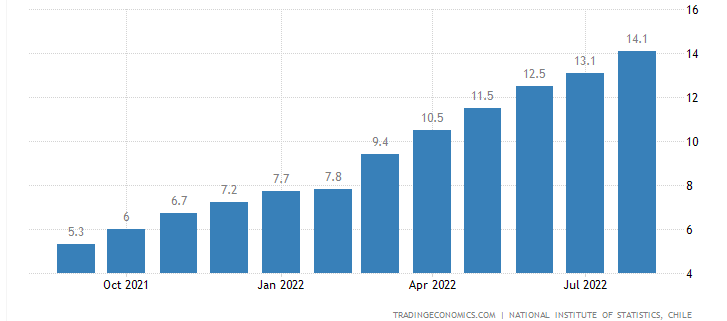

Chile recently reached an agreement with the IMF to receive an $18.5 billion flexible credit line, which should help boost the country’s credit profile. This provided much-needed relief, given that Chile’s foreign exchange reserves declined substantially in the past year. However, foreign exchange reserves still covered more than five months of imports as of the end of July 2022.

CEIC

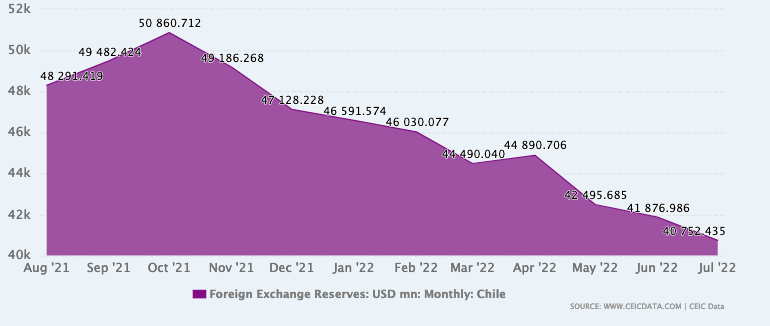

One of the main stand-out features of the Chilean economy includes the country’s extremely low level of public debt. Chile’s public debt levels are a far cry from the levels seen in other Latin American economies and emerging market economies.

SantanderCL

Interest payments as a % of total government revenue are very low compared to both Latin American and emerging market peers. This is a huge deal, as sovereign debt default risk will likely be one of the main risks within emerging markets this decade.

|

Country |

Interest payments as % of revenue |

|

Chile |

4.55% |

|

Brazil |

21.66% |

|

Peru |

8.16% |

|

Colombia |

11.74% |

|

Egypt |

33.25% |

|

Philippines |

13.32% |

|

Malaysia |

15.33% |

|

Kenya |

24.07% |

Source: WorldBank (latest data)

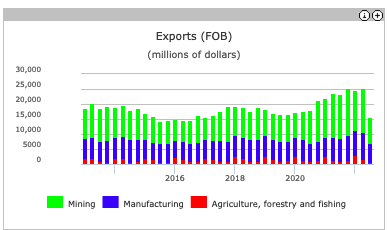

Exports still remain heavily dependent on copper (57% of total exports), and China is still its top export market (39% of exports). Chile is also very vulnerable to a slowdown in Western countries, as the United States and Europe purchase 27% of its total exports.

Banco Central

The price of copper has also been declining and is now near the lows experienced in January 2021. There could be room for the price of copper to run again during 2022-2023.

Trading Economics

Two of Chile’s main appeals include its large reserves of copper (28% of market production) and lithium (22% of production). Copper and lithium are both electrical vehicle components, and the price of both could increase if there is not enough supply online. An EV requires 2.5 times as much copper as an internal combustible engine, while solar and offshore wind both need 2-5x as much copper relative to power generated by coal or natural gas. However, many investors may reference the post-2008 commodity cycle, which was driven by booming economic growth in China, and conclude there is not much room for these commodities to run due to perceived lower demand. At the very least, I would say the price of copper declining is not a huge risk moving forward, and that there are other much greater macro and political risks in Chile. Chile could be a great investment if the copper market heats up.

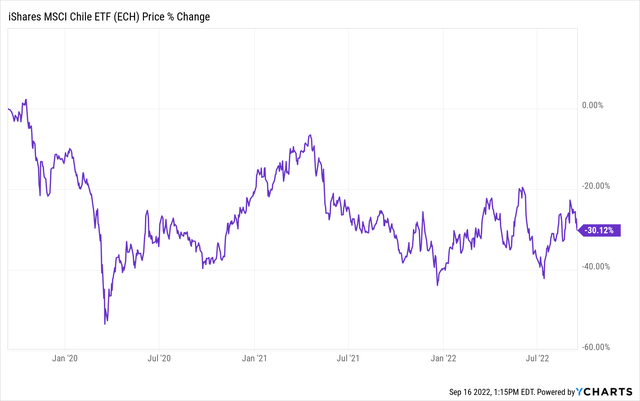

Equities Still Down Post October 2019

My motivation to invest in Chile is based on macro and the solid profile of Chilean banks, but recent political developments (rejecting the new constitution) do look better. I certainly would have bought Chile on any negative political news, but it is helpful to note things appear more stable. Chilean equities have not had much time to move on this news, especially since much of the world was focused on other events like Fed hikes/US inflation/etc. Chilean equities are still down considerably since October 2019, when protests initially began.

The iShares MSCI Chile ETF (ECH) is down nearly 30% from its peak three years ago. Although this was not purely caused by political risks, it is still well worth noting. Moreover, Chilean equities trade at a substantial discount to emerging markets. MSCI Chile trades at around 7.6x earnings, while MSCI Emerging Markets trade at 12.4x earnings.

Q2 Short-Term Boost for banks

Q2 2022 was an excellent quarter for Chilean banks, but it appears that this benefit will be short-lived. Fitch Ratings projects 1.9% GDP growth in 2022 and 0.5% growth in 2023, roughly in line with projections made by other banks in Chile. Banks also benefited from rising rates YTD, but rates will likely normalize in 2023.

Chile Benchmark Interest Rate

Trading Economics

This will put a short-term strain on banks that previously benefited from rising rates, which caused the banking sector’s net income to increase by 66% YoY during Q2 2022. The slowdown in growth will likely kick in during 2023, as there will still be additional rate hikes during Q3 2022, which allowed Chile’s benchmark interest rate to reach 10.75%. Rate cuts do not appear to be in the immediate picture, as inflation has still run ahead of rates, but there is still room for banks to continue growing as swiftly due to slower economic growth in the next five quarters. This is not to mention that NPLs may accelerate due to deteriorating economic conditions, although Chile and Banco Santander Chile are still in relatively good shape.

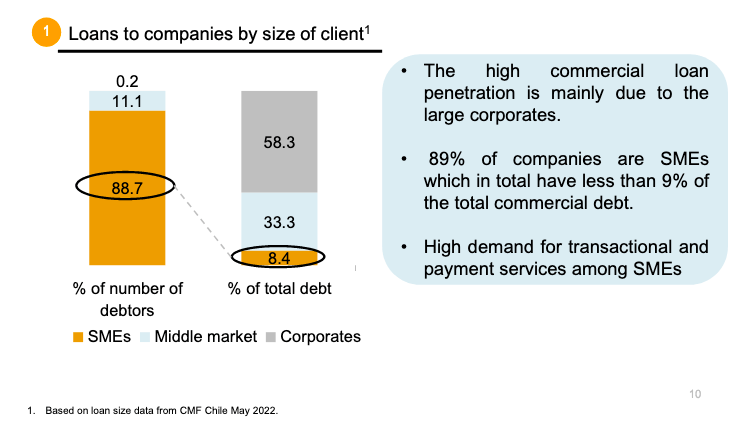

Low Representation of SMEs

There is still ample room for growth for banks that offer services to SMEs. Although SMEs represent the majority of bank clients, SME loans still only account for 8.4% of total commercial debt. Many measures taken by Banco Santander Chile, including Getnet, have been very successful among SMEs and Getnet has a 14% market share. Getnet has installed over 88,000 POSs, and 90% of its clients are SMEs. The company has ample room to increase this segment, as SME loans did drop some during Q2 2022.

CMF/BSAC

Watch Household Debt

Some reports have referenced Chile’s low household debt relative to other regional and emerging economies. However, household debt as a % of GDP is still near Chile’s historical high of 43% achieved in June 2020. Although this is not a major source of concern, it is important to monitor in the context of rising retail products during Q2 2022 and higher interest rates.

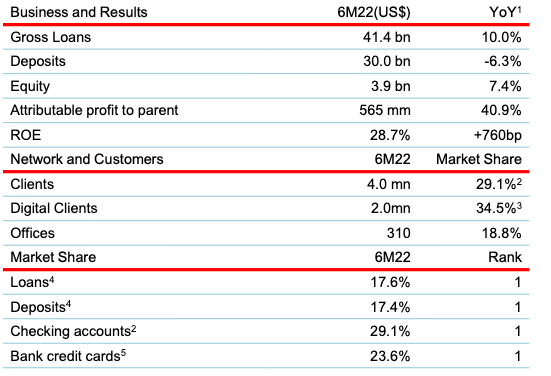

Leading Position and Diverse Offerings

Banco Santander De Chile is the leading bank in Chile in terms of deposits, loans, checking accounts, and bank credit cards. The Chilean banking sector only has 18 banks, so investing in this bank and Banco De Chile, provides decent exposure to the sector.

SantanderCL

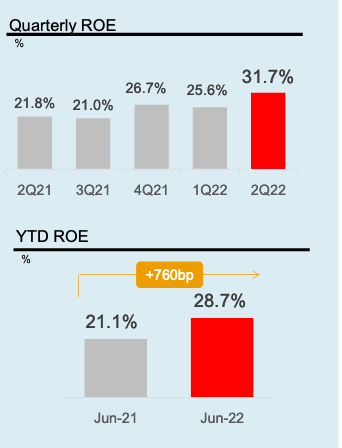

Banco Santander Chile’s gross loans grew by 10% YoY during the first 6 months of 2022, while its ROE rose by 7.6 percentage points during the same period. The company’s ROE should normalize towards the lower 20s during 2023, but these levels are still very impressive.

Santander CL

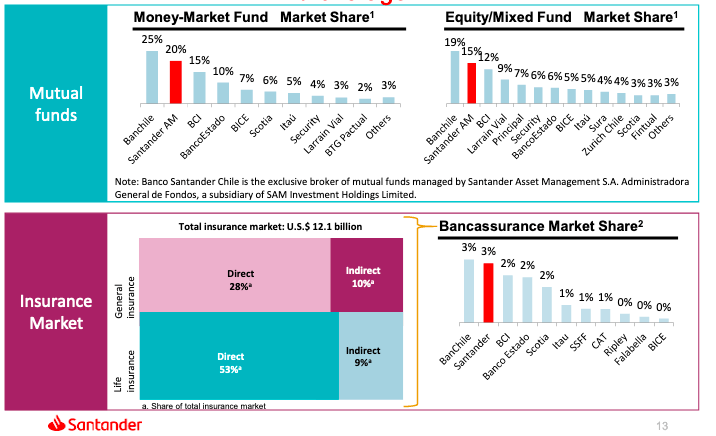

BSAC has the potential to do well in other areas such as mutual funds and the insurance market. The insurance market is largely dominated by foreign companies and larger domestic insurance companies, although Banco De Chile is currently ranked 10th.

Santander CL

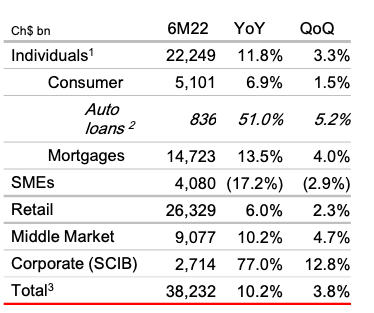

Loan Growth breakdown

Key areas for Banco Santander Chile to focus on include SME loans and retail loans, as these segments experienced below-average growth. An increased SME focus could help diversify away from the strong dependence on retail loans, especially mortgages. BSAC is only targeting 8-10% loan growth and loan growth may fall even further during 2023 if BSAC’s guidance moves in line with projected economic growth.

Santander CL

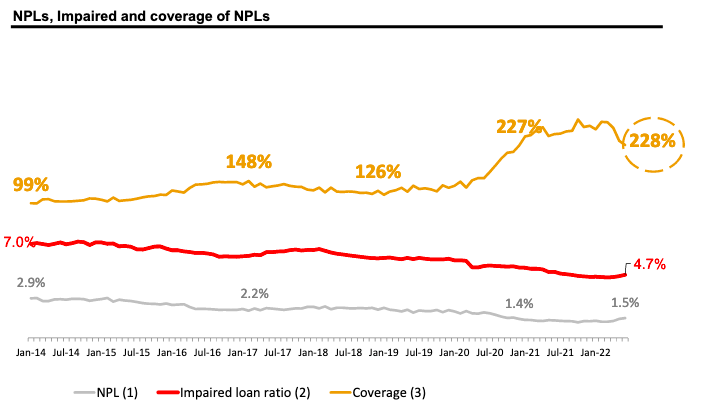

NPLs are not a major risk at the moment, but there should be an uptick in NPLs during the next few quarters and for the remainder of 2023, as economic growth in Chile declines. Banco Santander Chile’s coverage ratio is near an all-time high, and NPLs are slightly below the industry average.

Santander CL

Takeaway

This looks like a good time to begin accumulating, and I will likely save some cash to buy any dips in 2023. Chile has its fair share of economic and political risks ahead of it, but equities look very attractive from a relative value standpoint. Chile even trades at a discount to the MSCI frontier market index, which trades at 10.9x earnings. However, it is also crucial to note that equities in the region are also cheap. It is quite possible that markets like Brazil, Chile, and Colombia could substantially outperform other frontier and emerging markets in the coming years.

|

Country/Index |

P/E |

P/B |

|

MSCI Emerging Markets |

12.41 |

1.64 |

|

MSCI Chile |

7.64 |

1.50 |

|

MSCI Peru |

9.28 |

1.52 |

|

MSCI Brazil |

5.51 |

1.55 |

|

MSCI Colombia |

5.54 |

1.15 |

Source: MSCI

Be the first to comment