lindsay_imagery/E+ via Getty Images

Maritime shipping stocks have always made me sea-sick

The price of Genco’s (NYSE:GNK) shares are not exempt of the bobbing that afflicts all shipping stocks. This both creates numerous opportunities for value-purchases and nausea. The inherent volatility must be taken into account and for this specific reason, I caution against overexposure to the sector. However, carefully timed, shipping stocks can provide good value, great dividends, and substantial capital gains. The volatility is mostly from market forces which rock the stock as expectations of economic activity crest and crash. These market forces are not silly or short-sighted, but they do reflect the surface rather than the deeper drivers of value.

The intelligent investor realizes that the day-to-day price reflects the clash of opposing expectations, of fear and greed of millions of people and dollars. The deeper trend, however slower to evolve, is more permanent. Go fish for value in the troughs and you will be rewarded.

National security is reordering global supply chains

The global order — how countries relate to each other — is changing. The Russian war of aggression in Ukraine is not a catalyst but rather a manifestation of the tectonic shift through which we are living. The world that emerged after the end of the Cold War with the United States as hegemon has been morphing into a multi-polar world of competing centers of power. While international relations scholars and diplomats hotly debate how exactly this new world order is to be forged, the resolve to use financial and economic power to advance political aims is clearly established. This ranges the gamut from petty Chinese bans of a cartoon that looks like its leader, to state-encouraged company boycotts for expressing concern over slave labour used to pick cotton, to multi-year projects to reduce dependence on others for critical imports. These latter, deep currents remaking our world, are the ones that concern us — and maritime shipping companies like Genco. Why? Because these are forcing a rearrangement of global supply chains. And this rearrangement of supply chains to increase resiliency will come at the cost of lesser efficiency in the short- and medium-term, which implies, among other things, a lengthening of shipping distances.

The autarkic forces on the rise are not a harbinger of the end of globalization or international trade — far from it. However, it is not like trade is on the march under a liberal, rules-based global order. What is emerging is a re-think of trade on the basis of national security. Although economic arguments were most prominent during Corn Laws debate in the UK, the protectionist side raised the issue of national security:

Because free trade meant relying on foreigners for Britain’s food supply, the nation’s security became a topic of concern. National security remains to this day one of the most compelling arguments for protectionism[…] If export markets were to dry up or agricultural exports were to withhold supplies (such as during time of war), how would Britain obtain its food?

— Schonhardt-Bailey (2017) ‘Free Trade: The Repeal of the Corn Laws’ in Frieden, Lake and Broz (ed.) International Political Economy. New York: W.W. Norton & Co., p.86

National security is precisely what is driving Brazil’s National Fertilizer Plan, China’s drive to Africa as an alternative source to Australian iron, and Europe’s scramble to replace Russian gas.

Oceans and ships

If you want to feel tiny, you can go to the Grand Canyon, contemplate the immensity of the universe while star-gazing, or just look at a major seaport. The sheer scale of goods moved by sea is mind-shattering. It is virtually impossible to move the amount of cargo any other way than by sea. The travails of exporting land-locked Ukrainian grain are a salient example of the importance of maritime shipping.

Genco is a dry-bulk shipping company. This means it carries dry, unpackaged cargo in gargantuan holds.

Dry bulk encompasses most of our modern society’s basic inputs. From agricultural commodities to bulk minerals to cement. All of these need to be transported by sea in very large ships. The world needs these commodities to feed itself, protect itself, and to otherwise maintain what makes modernity what it is.

Genco’s fleet and solid balance sheet

Genco has a moderate fleet of ships in three sizes: capesize, supramax, and ultramax. Capesize ships are the largest and hold 170,000 to 180,000 deadweight tons; Supramax and Ultramax are smaller carrying around 60,000 deadweight tons.

Genco’s fleet is fairly new: the oldest vessels date from 2005 and their average age is just over 11 years. Several ultramax and capesize vessels were acquired in recent years. You can find the fleet here.

More importantly, most of its fleet, at the time of writing, is either underway, or loading/unloading. One way of measuring utilization is the percentage of a vessel’s draft with respect to its maximum, since the more cargo a ship is carrying, the heavier it is and the lower it the water it sits. The average percentage of maximum draft of the entire fleet is currently over 75%. Just under half of the fleet underway to a destination and of those moored or anchored, the average percentage of maximum draft is nearly 74%, indicating they are full. Genco is doing good business and its ships are in demand.

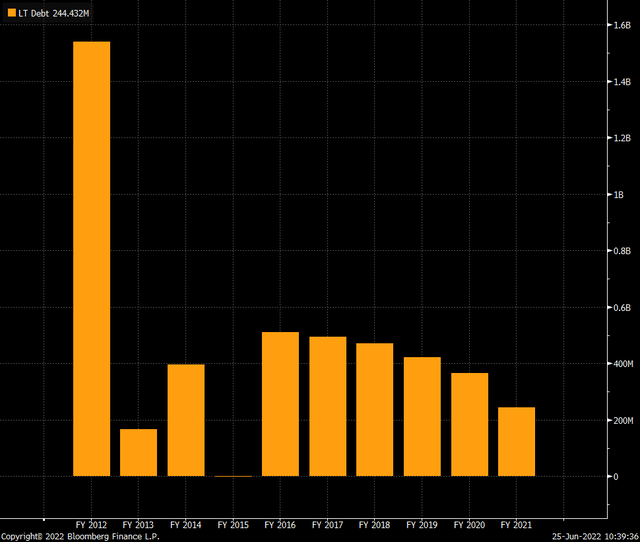

Aside from acquiring new ships, Genco has been investing heavily in deleveraging its operations — reducing its debt load. This is what makes its balance sheet stronger than some larger competitors, like Star Bulk (SBLK). It is also what will allow it to focus on growing dividends and weathering the cyclical nature of hauling cargo across the world. This is the strategy that the company has been executing well over the last several quarters.

Decreasing long-term debt (Bloomberg)

The company has been publicly expressing its desire to increase dividends while decreasing debt over several earnings calls and it is a core strategy of the company. The importance of paying down debt and the overall strategy is well-illustrated in the comments from the January 27, 2022 analyst call

One of the reasons why that is incredibly important to this dividend strategy is that it drives down our cash flow breakeven so we are able to pay higher dividends because of that very low cash flow breakeven.

The value strategy is based on three pillars. It’s based on significant dividends from cash flow generation. I talked about the breakeven rate. We have also delevered as I said. We will continue even though we will not have mandatory debt repayments in 2022, we will continue to repay debt over the year

John Wobensmith, President and CEO

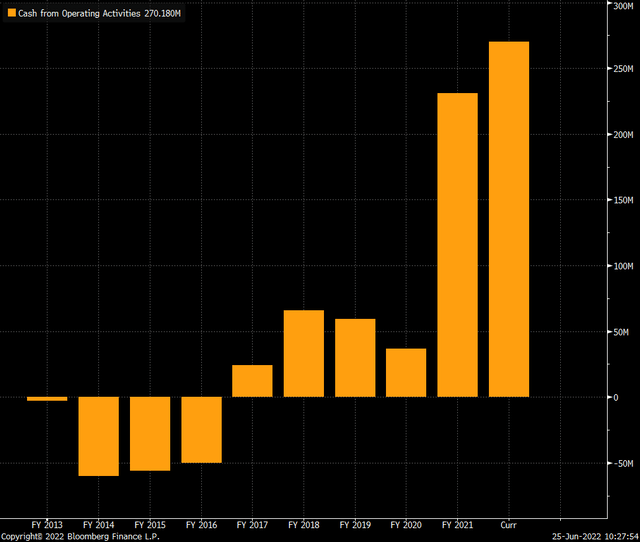

Indeed, Genco has been increasing its cash from operations, substantially.

Increasing cash from operations (Bloomberg)

This is why it is a compelling buy

Cash is flowing into the company, the debt burden is being quickly reduced while the fleet is being increased (and used). Dividends have been on the rise and the stock is now yielding over 17% on a recent sell-off driven by broader market forces. This is a fair moment to purchase, exploiting the trough created by investors reeling from headlines.

Beyond the medium-term, however, the prospects are murkier, since the realignment of the world order and trade flows is likely to find a new equilibrium that is more efficient in terms of ton-miles than what is currently the case. Until then, Genco is doing good business while derisking — and it’s passing on the profits to shareholders through dividends. Purchase now, collect your income for a few years and… invest in some Gravol too!

Be the first to comment