This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on June 24th.

Noah Densmore/iStock via Getty Images

Real Estate Weekly Outlook

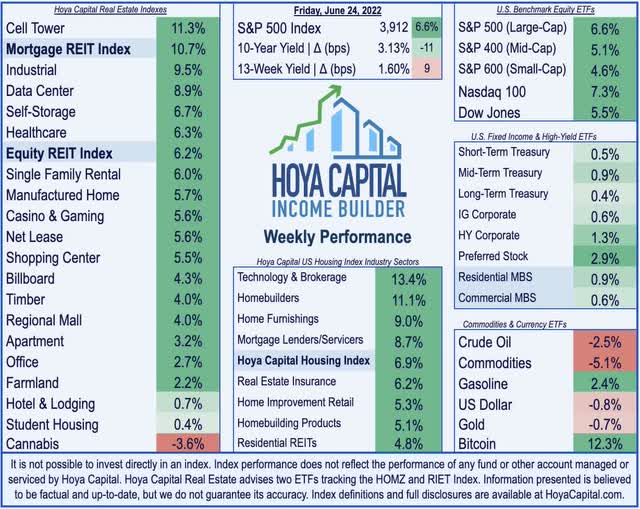

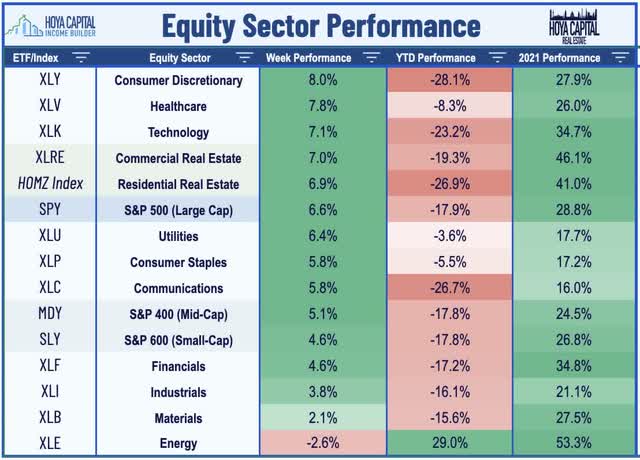

U.S. equity markets rebounded this week – posting just their second positive week in the past twelve – as interest rates moderated on further signs of softening global growth while resilient housing data helped to calm market jitters. Across two days of Congressional testimony, Federal Reserve Chair Powell reiterated the central bank’s commitment to control persistent inflation while indicating that an economic cooldown – or outright recession – may be necessary to achieve its goal. The recession may well be already upon us as PMI data in the U.S. and Europe showed the weakest readings since 2020, but resilient home sales data fueled hopes for a “soft landing.”

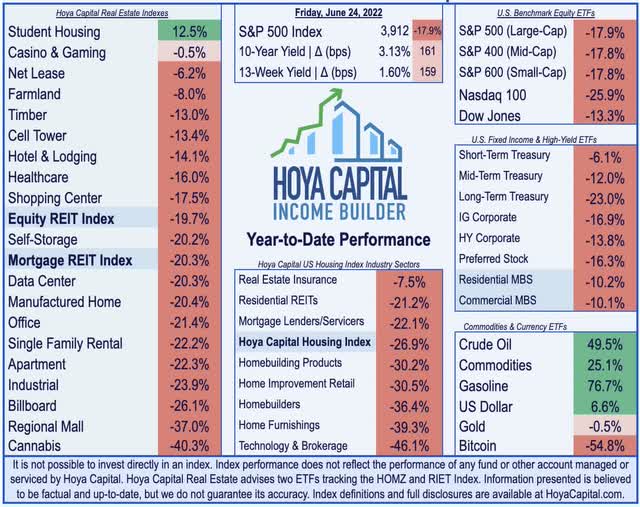

Rebounding from its worst week since the depths of the pandemic in March 2020, the S&P 500 rallied nearly 7% on the week – cutting its drawdown to below the 20% threshold of “bear market” territory. The tech-heavy Nasdaq 100, meanwhile, surged 7.3% but remains nearly 30% below its recent highs. Real estate equities were broadly-higher as well with notable strength from the “essential” property sectors – housing, technology, and industrial – amid a bid for defensive, domestic-focused market segments. The Equity REIT Index rallied 6.2% on the week with 18 of 19 property sectors in positive territory. Following steep declines in the prior week, the Mortgage REIT Index posted gains of more than 10%, as did the Homebuilder Index amid welcome signs of resilience across the critical U.S. housing industry.

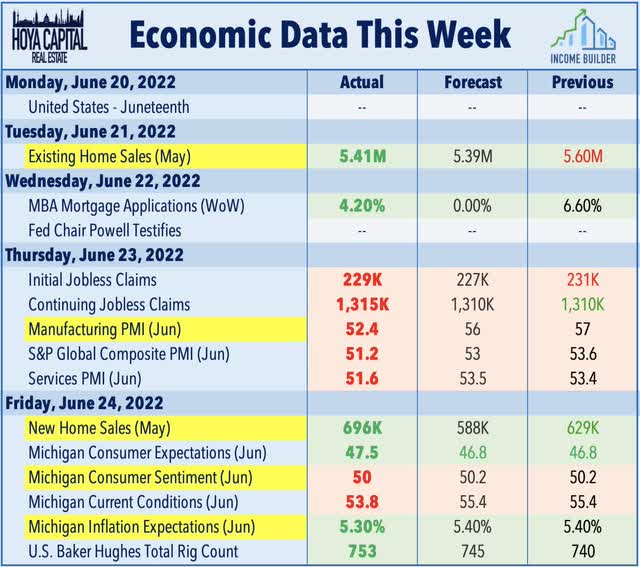

Benchmark interest rates declined for the second-straight week following the weaker-than-expected PMI data across a handful of major economies and on continued softness in Jobless Claims data which – while still historically low – have been on a mild uptrend since bottoming in April. The benchmark 10-Year Treasury Yield pulled back 11 basis points on the week to 3.07% – well below its high last week of 3.50% before the FOMC meeting while Commodities (DJP) dipped more than 5% on signs of softening demand – particularly in Europe and Asia. Ten of the eleven GICS equity sectors were higher on the week while homebuilders and the broader Hoya Capital Housing Index were notable outperformers following surprisingly strong homebuilder earnings results, fueling hope that the U.S. housing market can again serve as a source of stability amid global economic uncertainty.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

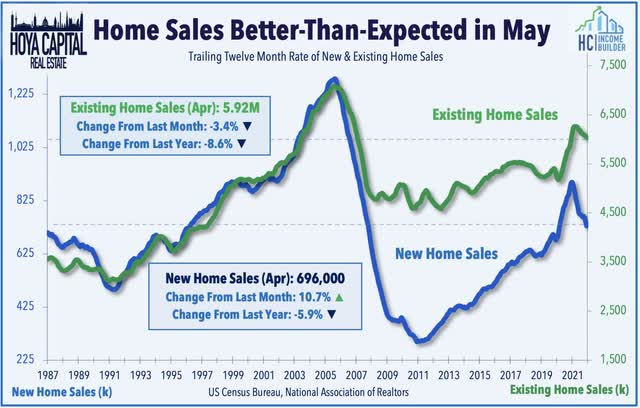

As the Federal Reserve intended, rising mortgage rates have indeed cooled the previously red-hot housing market in recent months, but the surge in rates hasn’t resulted in the sharp contraction in housing demand – or the surge in inventory levels – that some feared. New and Existing Home Sales both topped analysts’ estimates this week while homebuilder earnings results were surprisingly strong. Despite the surge in mortgage rates, mortgage applications to purchase a home have actually been quite strong through the first half of June, likely attributable to several factors including the historic surge in rents that may be pushing some households back towards ownership markets and the wider availability of adjustable-rate mortgages, which have been hard to come by for the past decade. A modest uptick in inventory levels is also likely helping to drive sales, but housing markets are continuing to see supply levels near historic lows, resulting from a decade of underbuilding.

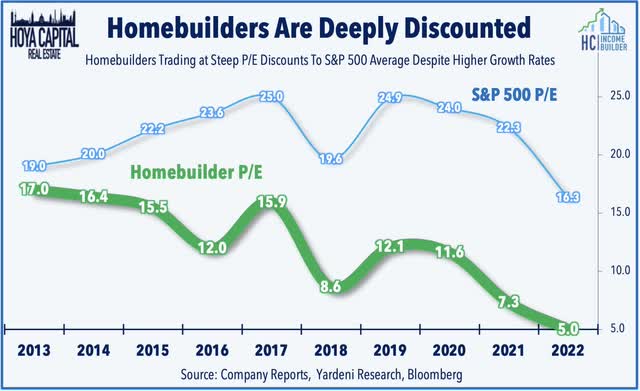

A pair of strong earnings results from homebuilders also helped to ease concerns over cracks in the critical housing market. KB Home (KBH) soared more than 14% on the week after reporting strong revenue growth and improving margins while maintaining its full-year outlook which calls for revenue growth of roughly 30%. Lennar (LEN) surged 11% after it also maintained its full-year outlook calling for 15% revenue growth while managing to grow its margins despite the challenging environment of moderating demand and rising construction costs. Remarkably, despite the double-digit revenue and earnings growth outlook – consistent across most of the public homebuilder segment – the homebuilding sector trades at its lowest average valuation ever with a forward P/E of just 5.0x.

Equity REIT Week In Review

The “essential” property sectors – housing, technology, and logistics – led the rebound this week as recession concerns and moderating rates have sparked a renewed bid for the less-economically-sensitive segments of the REIT market. Following a wave of eight REIT dividend increases in the prior week – largely overlooked amid the sharp selling pressure – the positive dividend news continued this week with the 70th equity REIT dividend hike of the year. Shopping center REIT Saul Centers (BFS) rallied nearly 12% this week after it hiked its quarterly dividend by 4% to $0.59/share. Including mortgage REITs, we’ve now seen 82 REIT dividend hikes this year compared to just 4 dividend reductions and we continue to believe that the full-year record of 130 hikes set in 2021 is still well within reach despite the recent recession worries.

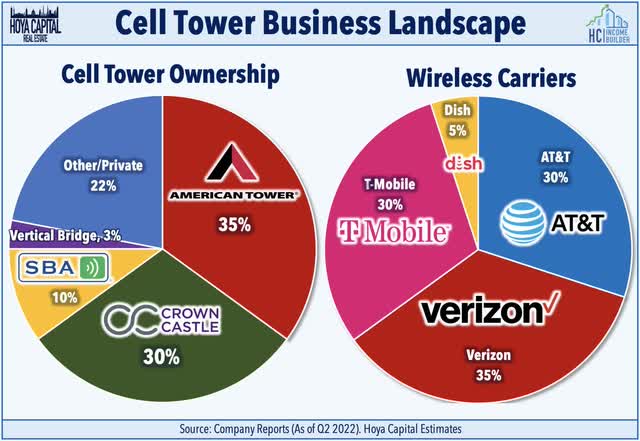

Cell Tower: Leading the rebound this week, the three cell tower REITs – American Tower (AMT), Crown Castle (CCI), and SBA Communications (SBAC) – each surged more than 10%. As discussed in Cell Tower REITs: For 5G, 4 Beats 3, tower REITs have been the best-performing property sector over the past quarter, benefiting from favorable macro shifts and positive industry-specific catalysts. DISH Network (DISH) commercially launched its 5G network last week, becoming the fourth national wireless carrier alongside AT&T, Verizon, and T-Mobile. Given the industry skepticism over DISH’s viability, any level of success is incremental for tower REITs. We noted that a path to viability for DISH could be a strategic partnership with another communications firm – possibly a Low Earth Orbit satellite provider or traditional cable company – to create a competitive connectivity offering.

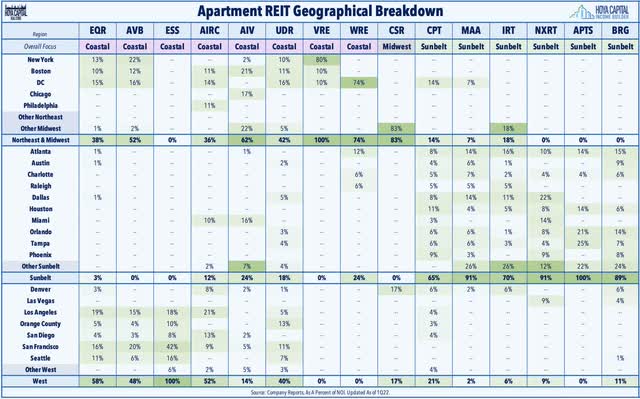

Apartment: Blackstone (BX) officially closed on its $5.8B acquisition of Preferred Apartments Communities (APTS) for its non-traded REIT platform Blackstone Real Estate Income Trust (“BREIT”). APTS’s common stock will no longer be listed on any public market. Elsewhere, Apartment Income (AIRC) announced that it will take full ownership of four newly-developed properties from Apartment Investment and Management Co. (Aimco) (AIV). The two firms split in late 2020 to effectively “spin-off” the development unit, which retained the Aimco name. The four properties include 865 apartment homes in the Miami, Boston, Denver, and San Francisco metro markets. Aimco and AIRC also modified the terms of their strategic relationship to gain clearer separation between the entities – a positive development for both considering the lingering market confusion about the relationship. Apartment Income now owns and manages 76 communities in 11 states and the District of Columbia.

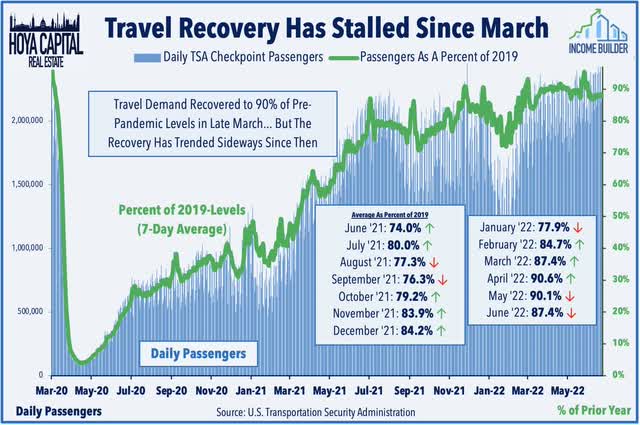

Hotel: Bad news wasn’t necessarily good news for economically-sensitive property sectors including hotel REITs, which lagged once again on concerns over slowing demand. TSA Checkpoint data continues to show a stalling-out in the travel recovery with June still on-pace to decline to the lowest level since March as a percent of pre-pandemic throughput. Ashford Hospitality (AHT) was a bright spot on the week, however, rebounding more than 10% after providing an upbeat business update in which it noted that its comparable hotel EBITDA in May came in higher than the prior month. Two of its hotels – Hilton Boston Back Bay and the Renaissance Nashville – had occupancy levels of over 90% and both assets exceeded the comparable April and May 2019 Revenue Per Available Room (“RevPAR”) levels. Despite the recovery, however, AHT’s total RevPAR remained 7% below the comparable May 2019 level.

Cannabis: This week, we published Cannabis REITs: Weeding Out The Weak. A perennial performance leader over the past half-decade, cannabis REITs have been slammed in 2022 amid concerns over tenant financial health given the sharp re-pricing of risk and tighter financial conditions. Owning the “Pharmland” – the physical real estate – had been one of the few cannabis plays that was working amid a decade-long stretch of dismal investment performance from broader cannabis ETFs. Marijuana legalization has progressed at the state level, but federal legalization efforts remain stalled, a “double-edged sword” for cannabis REITs that thrive in the murky legal environment, but also need healthy operators that will pay the rent. Cannabis REITs have faced remarkably few tenant non-payment issues thus far, and considering their remarkable dividend growth rates over the past half-decade, we remain cautiously optimistic on these perennial high-flyers.

Mortgage REIT Week In Review

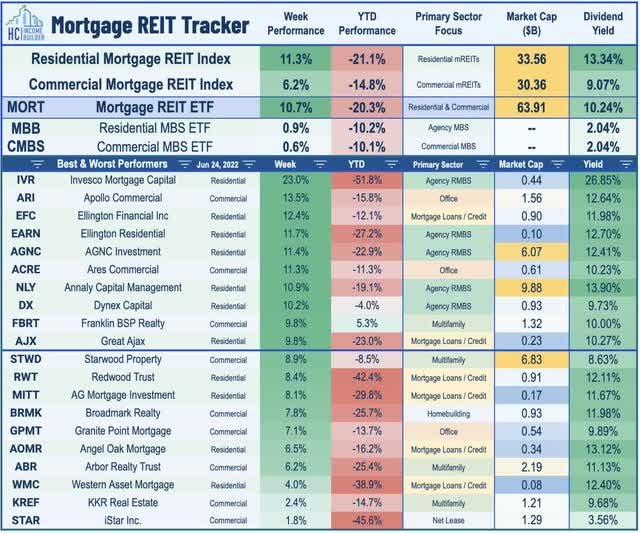

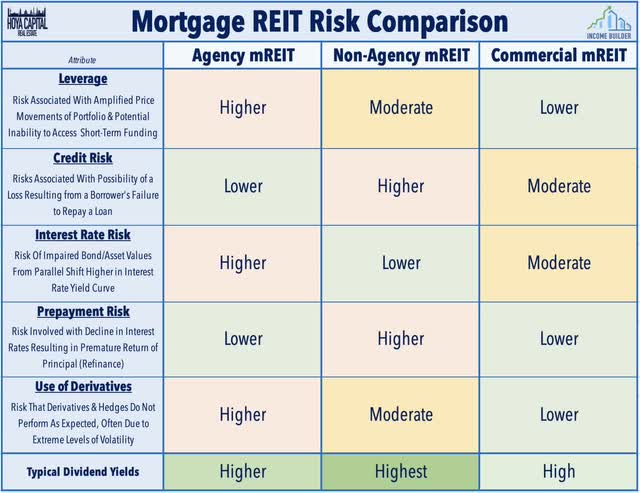

Mortgage REITs led the rebound following sharp declines in the prior week, benefiting from the bid for mortgage-backed bonds and a retreat in the MOVE Index – a measure of interest rate volatility – from the highest level since the turmoil in March 2020. New Residential Investment (NRZ) – which we recently added to our REIT Focused Income Portfolio – soared more than 13% after announcing that it will internalize its management structure while retaining its executive suite, which the company estimates will result in $0.12-$0.13 per share in cost savings per year. Beginning in August, NRZ will change its name to Rithm Capital and will trade under the ticker RITM. Ten mREITs posted double-digit gains on the week led by the 23% surge from Invesco Mortgage (IVR) following a similar-size plunge in the week prior.

As discussed Mortgage REITs: Everything In Moderation, sharp changes in interest rates in either direction can wreak havoc on mREITs that are caught over-levered or improperly hedged, but most mortgage REITs have been able to navigate the turbulence more effectively than market pricing suggests. Even with their double-digit average dividend yield, we’ve noted throughout the year that most mREIT dividends are covered by EPS and not at immediate risk of reductions. This week, ARMOUR Residential REIT (ARR) and Two Harbors (TWO) maintained their dividends at rates representing forward dividend yields of roughly 17.0% and 14.5%, respectively. Western Asset Mortgage (WMC) – one of the hardest-hit mREITs this year – also maintained its quarterly dividend at $0.04. WMC had previously reduced its payout from $0.06 in March – one of four mREITs to reduce their dividend this year compared to twelve mREITs that have raised their dividend.

REIT Capital Raising And REIT Preferreds

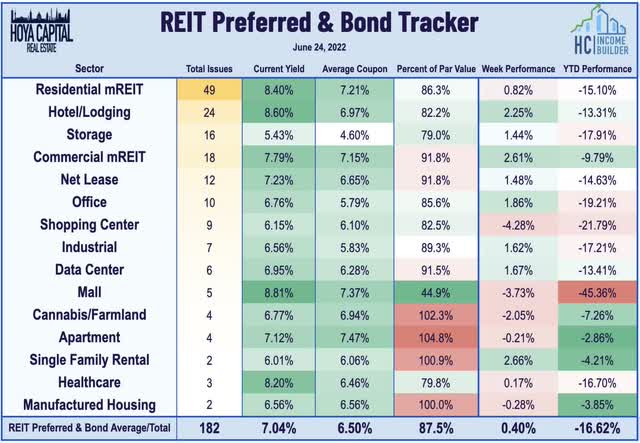

The Hoya Capital REIT Preferred Index rebounded this week following last week’s sell-off. The preferred series of Two Harbors (TWO) led the way with gains of roughly 5% after its board authorized the repurchase of up to 5M preferred shares which may include its 8.125% Series A (TWO.PA), 7.625% Series B (TWO.PB), and/or its 7.25% Series C (TWO.PC) preferreds. On the downside, this past week were the preferreds of Cedar Realty (CDR), which plunged over 20% after a judge denied an effort to temporarily block the REIT’s sale to Wheeler Real Estate (WHLR) – a controversial deal that benefited common shareholders at the expense of preferred holders, as WHLR is expected to pause CDR’s preferred dividends upon acquisition.

2022 Performance Check-Up

With one week remaining in the first half of 2022, Equity REITs are now lower by 19.7% on a price return basis while Mortgage REITs have slipped 20.3%. This compares with the 17.9% decline on the S&P 500 and the 17.8% decline on the S&P Mid-Cap 400. With the exception of the student housing sector, every REIT sector is now in negative territory this year while ten property sectors are lower by over 20%. At 3.13%, the 10-Year Treasury Yield has climbed 161 basis points since the start of the year, briefly breaking through the prior post-GFC-high rate of 3.25% reached in 2018 and touching a recent high of 3.50%. The 2-Year Treasury Yield has climbed from 0.73% to 3.06%.

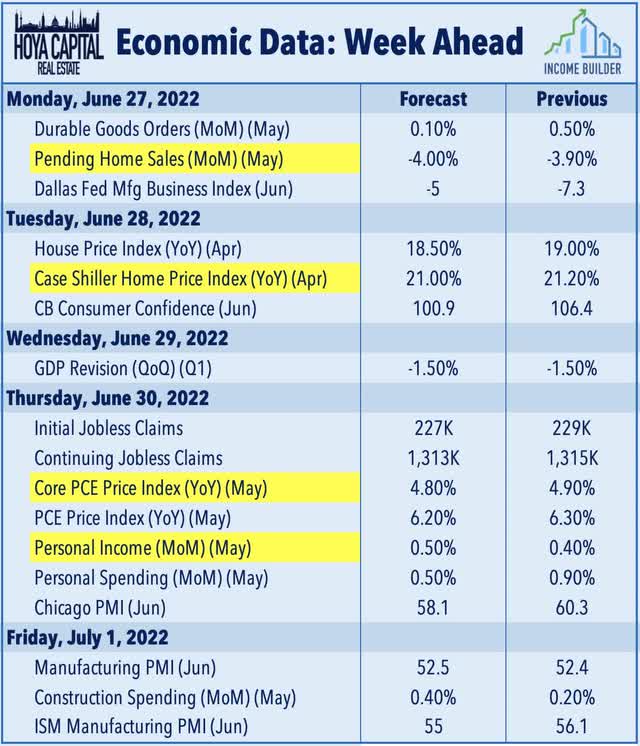

Economic Calendar In The Week Ahead

We’ll see another busy slate of economic data in the week ahead with several key inflation and housing market reports. Following a pair of better-than-expected home sales reports this past week, we’ll see Pending Home Sales on Monday. We’ll see home price data on Tuesday with reports from Case Shiller and the FHFA but due to the nearly two-month lag in these indexes, the effect of the recent cooldown is unlikely to be reflected for several months. The most closely-watched report of the week will be PCE Price Index on Thursday which investors – and the Fed – are hoping will finally show some signs of moderating price pressures. We’ll also be watching Construction Spending on Friday and a flurry of Purchasing Managers’ Index (“PMI”) data and consumer sentiment surveys throughout the week.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment