Torsten Asmus

The latest inflation numbers were recently released (July 13th). These numbers show the annual inflation rate accelerated to 9.1% in June 2022. This is the highest level since 1981. Breaking down the CPI, the biggest rise was from energy, up 41.6%, with gasoline prices up 59.9%.

Oil prices went negative during the travel lockdown of 2020 and oil prices surpassed $100/barrel just last month, before having a slight correction downwards. Russia is the 3rd largest oil supplier in the world, supplying nearly 11 million barrels per day. As the Russia-Ukraine war still rages on, the supply and demand imbalance could potentially be upset. Then if we combine this with increased oil demand from the economy reopening and services coming back online, then it’s no surprise oil stocks are the place to be.

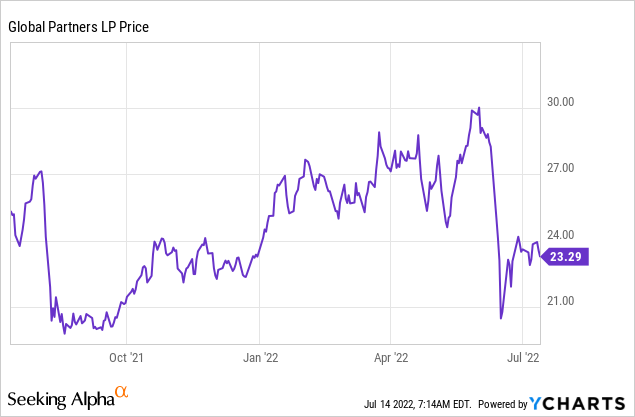

Global Partners LP (NYSE:GLP) is the perfect stock to ride the gasoline price surge and protect your portfolio against inflation. The company offers the ability for investors to “own the gas pump” as they have a network of over 1,700 gas stations and nearly 12 million barrels of storage capacity. In addition, they pay a delicious 10% dividend derived from a diversified downstream operation.

Let’s dive into the Business Model, Financials and Valuation for the juicy details.

Solid Business Model

Global Partners LP is one of the largest independent owners, suppliers and operators of gasoline stations and convenience stores across the US. In addition, it has one of the largest terminal networks “tank farms” in the northeast and is a leading wholesale supplier.

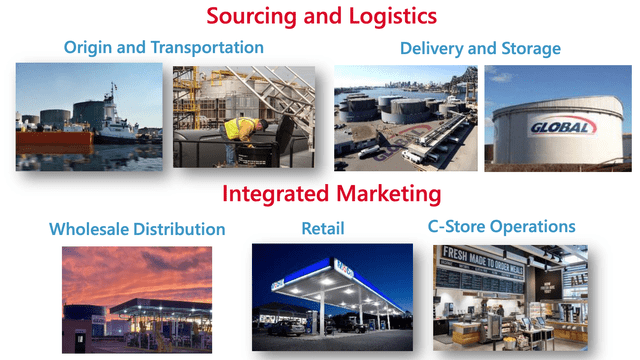

The company’s vertically integrated business model offers economies of scale and enables them to extract value at multiple parts of an oil products lifecycle, from storage to transport and sale.

GLP Model (Investor Presentation )

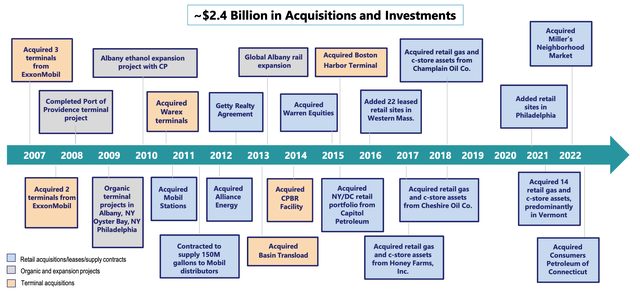

Management executes an aggressive acquisition strategy. In the first quarter of 2022, the company acquired Millers neighborhood market, which gave them access to 23 convenience stores and fuel supply agreements at 34 locations across the mid-Atlantic region. GLP also acquired 26 Wheels convenience stores and fuel operations in Connecticut.

GLP Network (Investor presentation Q12022)

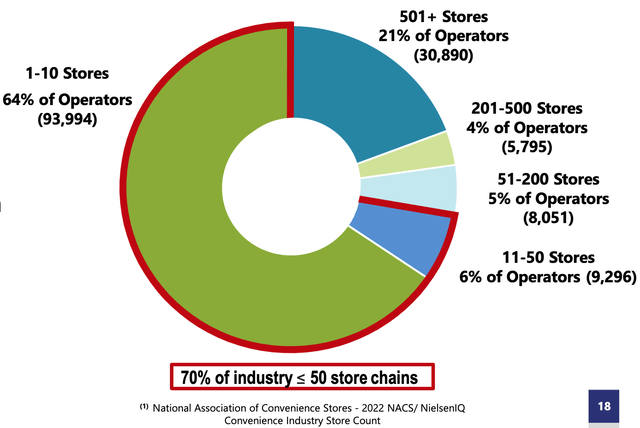

The U.S. convenience store market is extremely fragmented, with 70% of the industry having chains of less than 50 stores. This offers a significant opportunity for GLP to continue acquiring and generate instant low-risk cash flows.

US Convenience store (National association Convenience stores)

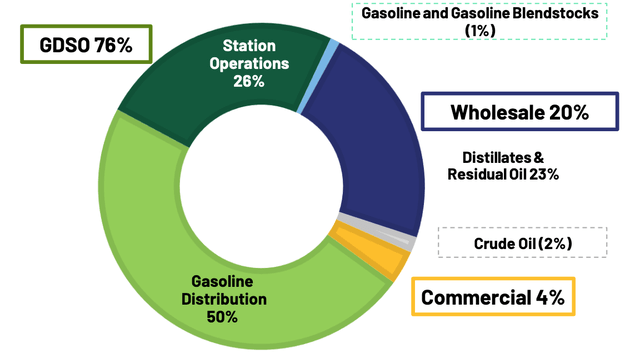

Financials are Flowing

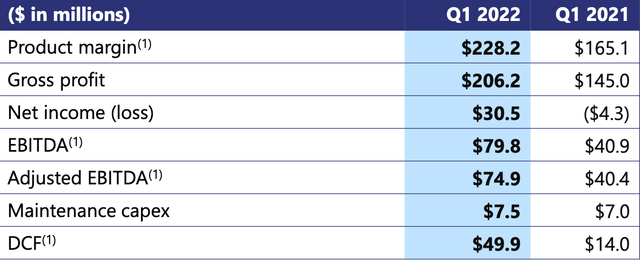

GLP produced strong financial results for the first quarter of 2022. Increasing Oil prices, drove up Product Margin by 38% to $228 million compared to $165 million in the first quarter of 2021. The Product Margin is primarily driven by the largest segment Gasoline Distribution and Station Operations (GDSO), which made up 76% of Product Margin or $173 million. The next biggest segment is Wholesale, which made up $47.1 million of the total. Wholesale includes various oil products, crude oil, propane, biofuel and renewable diesel. The company then sells these products to integrated oil companies and home heating retailers. Finally, Commercial makes up 4% of the total and consists of heating oil, kerosene, diesel and bunker fuel. Its customers include Government agencies, shipping companies and large commercial clients.

GLP Business segments (Q122 earnings report)

Net income turned to a positive $30.5 million in the first quarter of 2022, up from a negative $4.3 million in the equivalent quarter last year. Maintenance Capex only increased by 7% from $7 million in the first quarter of 2021, to $7.5 million by Q122. This is a positive sign to see, as it shows high operating leverage from existing assets with minimal extra maintenance required.

GLP Financials (Investor presentation 2022)

Distributable Cash Flow (DCF) hit a record high, with $46.4 million, up a tremendous 256% from the prior year’s quarter. The oil price boom should keep the momentum high at least for the next one to two years. Also, it should be noted that as this is a downstream company, GLP has to purchase the fuel it sells. Thus, it doesn’t benefit as strongly from rising oil price, but does experience margin expansion when oil prices fall. Thus, when the oil market does turn around, the company should still be able to cover its dividend. In addition, the large number of convenience stores should keep earnings stable for the years ahead, as they are not dependent on oil prices. Gas station convenience stores have always been expensive and had “pricing power” due to a captive audience of hungry drivers. Thus, its stores can raise food prices with inflation.

Management’s aggressive acquisition strategy is fully embracing the opportunity right now, and I believe this is the right tactic moving forward. They have a track record of executing these acquisitions through boom or bust, so it’s fair to say that will continue.

GLP Acquisition Pipeline (Investor presentation)

In the decades ahead, I also see opportunities for the company to leverage its station properties for electric vehicle (“EV”) charging locations. GLP was recently awarded a grant from Massachusetts to install EV charging station at nine of its stations. As an extra data point, Oil giant Shell (SHEL) has already started to convert some of its fuel stations into EV charging bases. Really, GLP is a real estate company which happens to specialize in oil, but applications can be changed, which gives the stock some “future proof.”

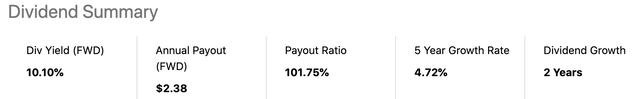

GLP pays a tremendous forward dividend of 10.1%, with a 5-year growth rate of 4.72%.

GLP Dividend Yield (Seeking Alpha)

Valuation

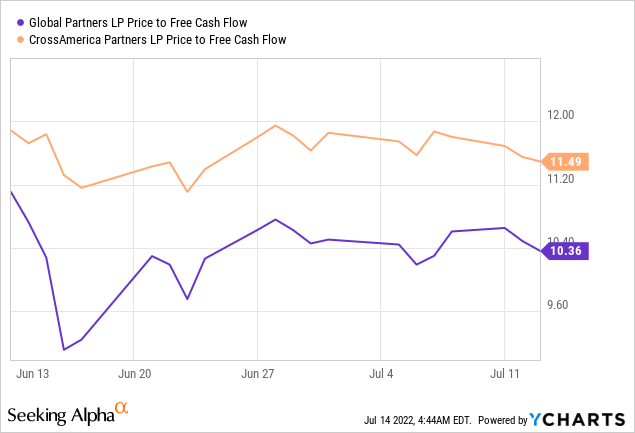

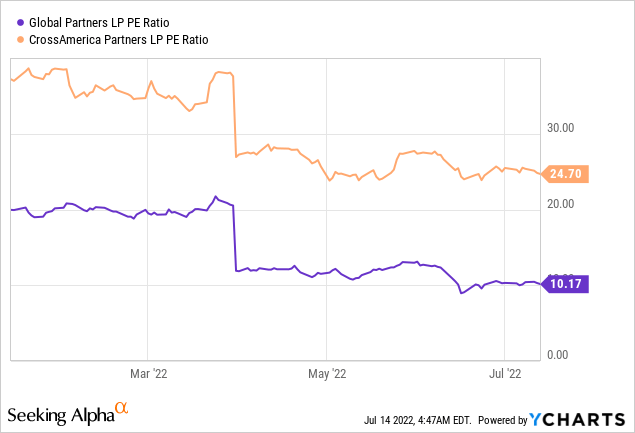

In order to value GLP, I have compared it with a similar company CrossAmerica Partners LP (CAPL), which is a large fuel station and convenience store MLP. Global Partners has a Price to Free Cash flow of 10.36. This is cheaper than that of CrossAmerica Partners LP, which has a Price to Free Cash Flow = 11.5.

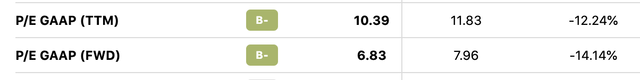

I have also compared via Price to earnings ratio, which shows GLP has a P/E = 10. This is substantially cheaper than CrossAmerica, which trades at a P/E = 25.

As a general value check, GLP trades at a Price to Earnings (FWD) ratio = 6.83, which is -14% cheaper than the energy sector median of 7.96.

To take into account debt, GLP trades at an EV to Sales (FWD) = 0.15, which is 91% cheaper than the energy sector median. In addition, it is -17.8% cheaper than its own five-year average.

Risks

Oil price correction and EVs

In the words of Billionaire Investor Howard Marks, “The Market Moves in Cycles.” I am a firm believer in cycles in commodities, stocks and almost everything else in life. Oil prices went negative during the travel lockdown of 2020, and now we are seeing a major boom with prices close to $100/barrel.

There is no doubt the long-term secular trend is towards renewable energy and EVs. The Biden administration wants 50% of New Cars to be electric by 2030 and has announced a staggering $7.5 billion towards EV charging infrastructure. As mentioned above, GLP can leverage its gas stations to employ EV charging infrastructure. However, I would like to see them aggressively acquiring a few EV charging players in the space or building out infrastructure. As, although margins will take a hit in the short term, I believe it will create more long-term shareholder value.

Final Thoughts

GLP is a tremendous company, which truly offers the ability to “own the gas pump” across many U.S. gas stations. The fragmented convenience store industry offers the potential for low-risk, cash flow generating acquisitions, and the company has a proven track record of executing on those. Its Commercial and Wholesale businesses also offer some diversification across various oil products and customers. In addition, the company pays a delicious 10% dividend, and the stock is undervalued relative to a close peer and its own history. Overall, this looks to be a great stock for income investors to hedge their portfolio.

Be the first to comment