Vanit Janthra/iStock via Getty Images

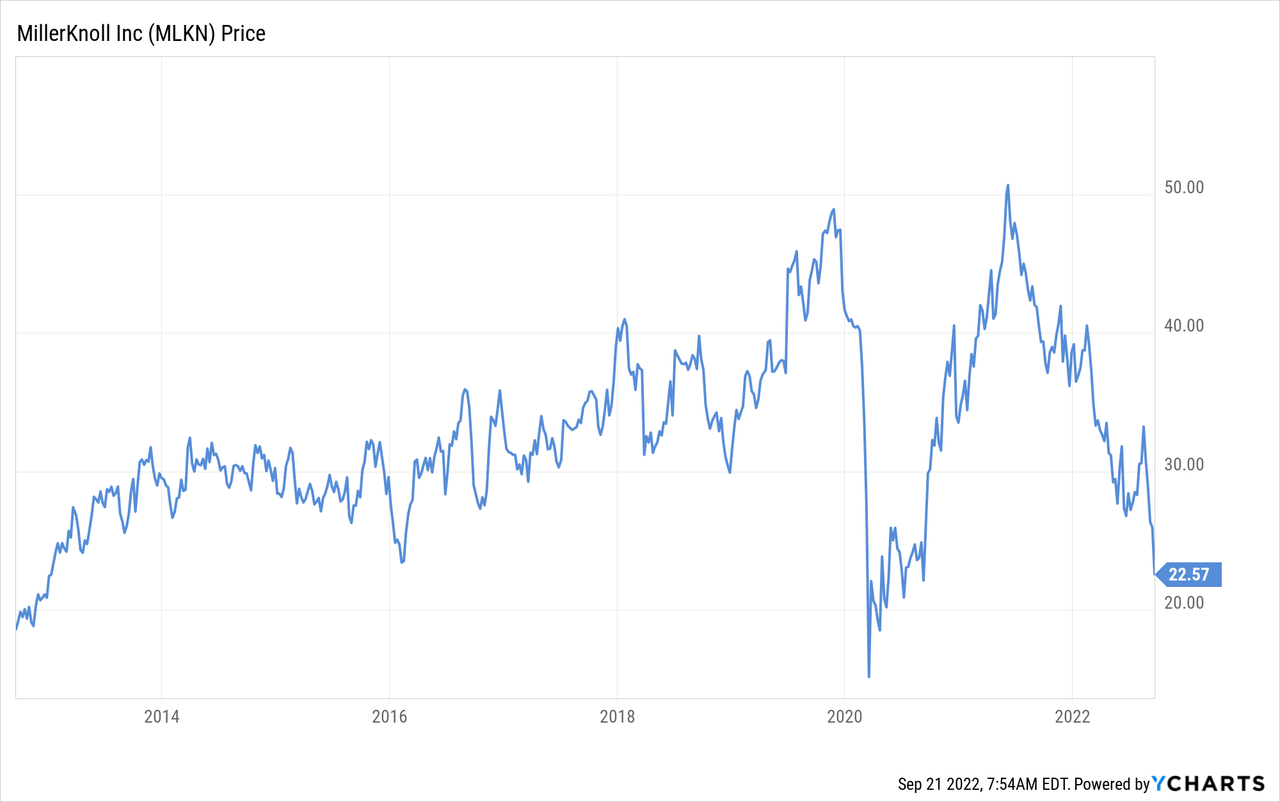

Shares of MillerKnoll (NASDAQ:MLKN) have been severely punished during this bear market, currently approaching values last since during the Covid crash. Contrary to what the price graph would seem to indicate, their business has not evaporated, instead the company is reporting impressive revenue numbers. The main issue is with margins, due to higher commodity costs and other inflationary pressures, and that is why results for Q1 of fiscal year 2023 are so important. If margins bounce back as expected, the main rationale for keeping the share price this low will go away, and we would expect a quick share price recovery. However, if a profit margin improvement fails to materialize, the market could punish shares even more.

As we covered in our last article, management believes there is a strong possibility that profit margins have hit a bottom. The company has also been implementing pricing actions which should start to have a positive effect on the profit margins to be reported for Q1. As we’ll see, the valuation has become quite compressed. Much like a coiled spring, positive news or margins should make shares bounce back with force.

Financials

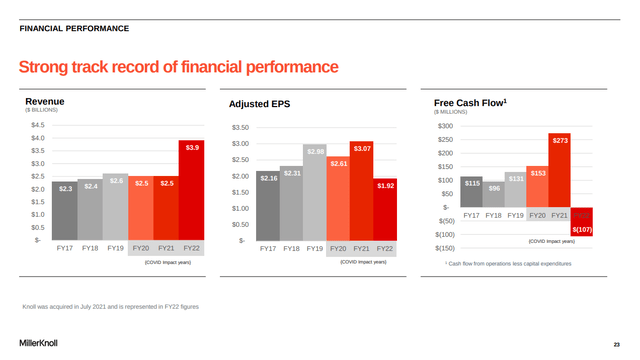

It is important to remember how this company looked like before Covid. It was called Herman Miller then, was generating ~$2.6 billion in revenue, and more importantly, it was delivering strong free cash flow and adjusted earnings of ~$2.98. Just before Covid hit, the share price was approaching ~$50. Despite the huge challenge that Covid posed for the company, it proved resilient, pivoting to more direct to consumer sales, and later purchasing its rival Knoll. The purchase brought significant inorganic revenue growth, but so far it has failed to materialize in the form of higher earnings per share, despite the advertised synergies. It is difficult to tell if the reason is that the acquisition turned to be less attractive than expected, or if it was simply that it coincided with increased inflationary pressure. Q1 results should give us more clarity in this respect.

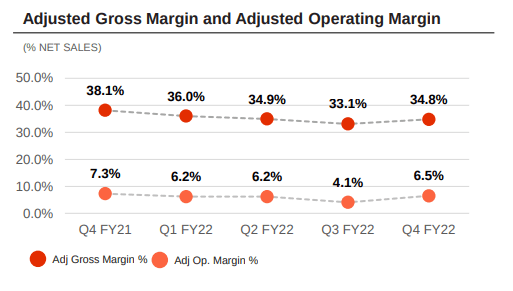

MillerKnoll Investor Presentation

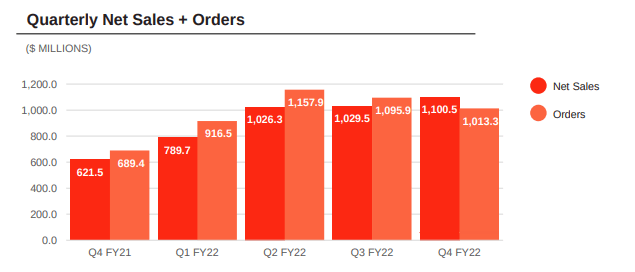

We are a bit concerned about the net sales to be reported in Q1 FY 23 given that order intake in Q4 FY22 was a little bit weak compared to other recent quarters. However, we believe the market will not care that much if net sales are weak, as long as orders rebound and more importantly, that margins show significant improvement.

MillerKnoll Investor Presentation

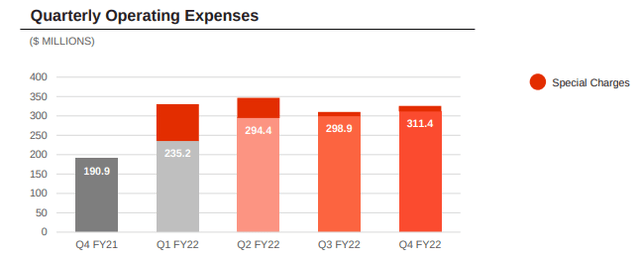

There should also be less difference between GAAP and non-GAAP numbers, given that the special integration charges have been moderating.

MillerKnoll Investor Presentation

The company guided Q1 FY23 adjusted gross margin to a range of 34.7% to 35.7%. We’ll be disappointed if it does not hit the upper part of the range at least, given how much time management spent during the last earnings call talking about the price increases and supply chain mitigation efforts they have been working on.

MillerKnoll Investor Presentation

Growth

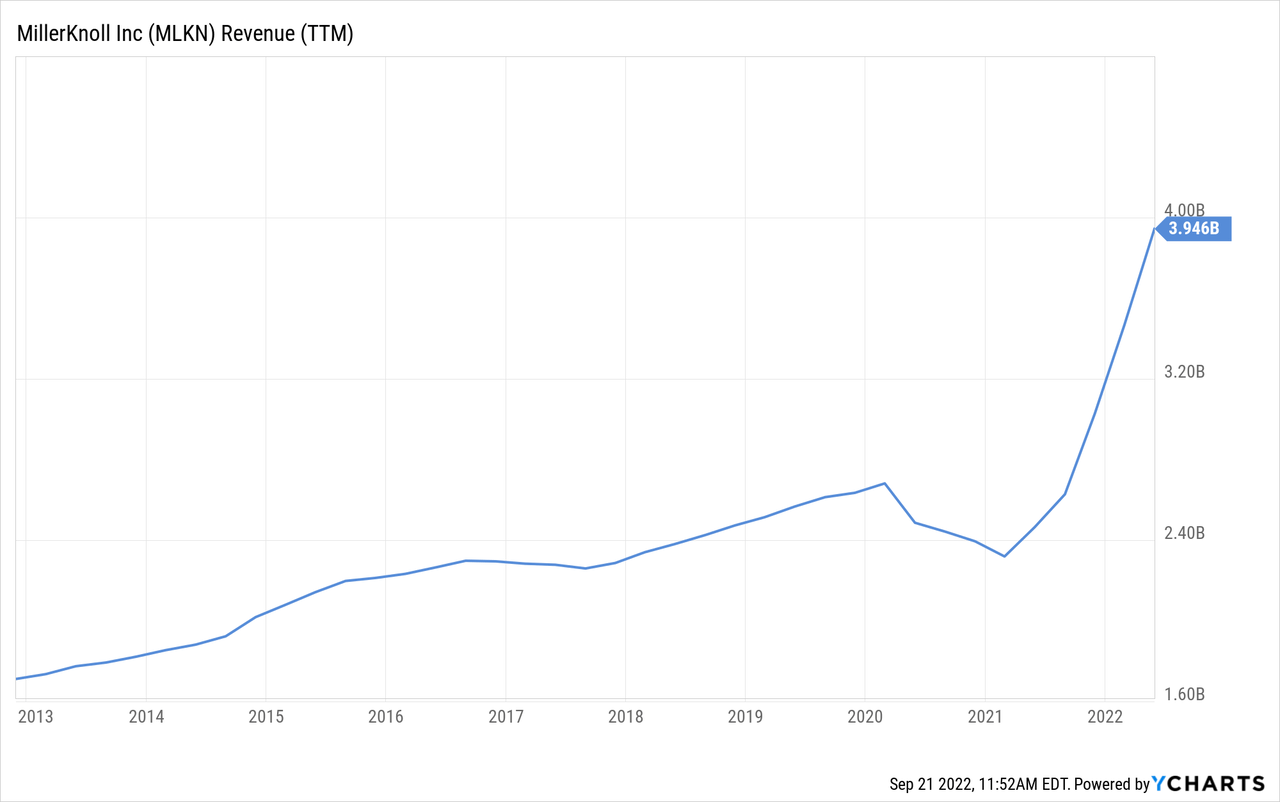

In contrast to the price graph, the trailing twelve months revenue graph shows how much bigger a company MillerKnoll has become thanks to the acquisition and also proving its resilience in terms of sales. The reason for showing this is to remind readers that this is a growing business, one that needs to fix its commodity prices and supply chain issues for sure, but at the end of the day, it is a growing business with a lot of potential.

Balance Sheet

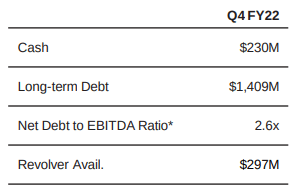

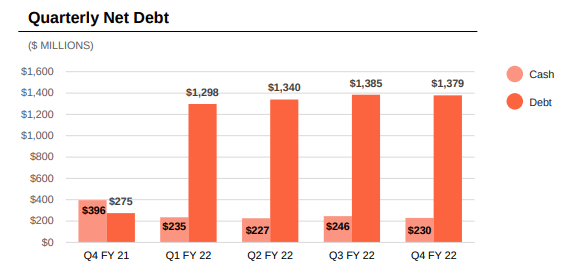

One thing that is important to point out about the acquisition is that it did weaken the balance sheet significantly. While the company still has significant liquidity available thanks to a decent cash balance and revolver availability, the amount of long-term debt is much bigger, and the company now has to operate with a 2.6x net debt to EBITDA leverage ratio.

MillerKnoll Investor Presentation

This is in sharp contrast to the balance sheet before the acquisition, when the company used to have more cash than debt.

MillerKnoll Investor Presentation

Guidance

For Q1 fiscal year 2023 management guided to revenue between $1.08 and $1.12 billion, gross margin between 34.7% and 35.7%, and Diluted Adjusted Earnings Per Share between $0.32 and $0.38.

We do not think the bar was set too high, and we believe the company should not have much difficulty reaching the revenue number based on previous results, the critical number will be the reported gross margin.

Valuation

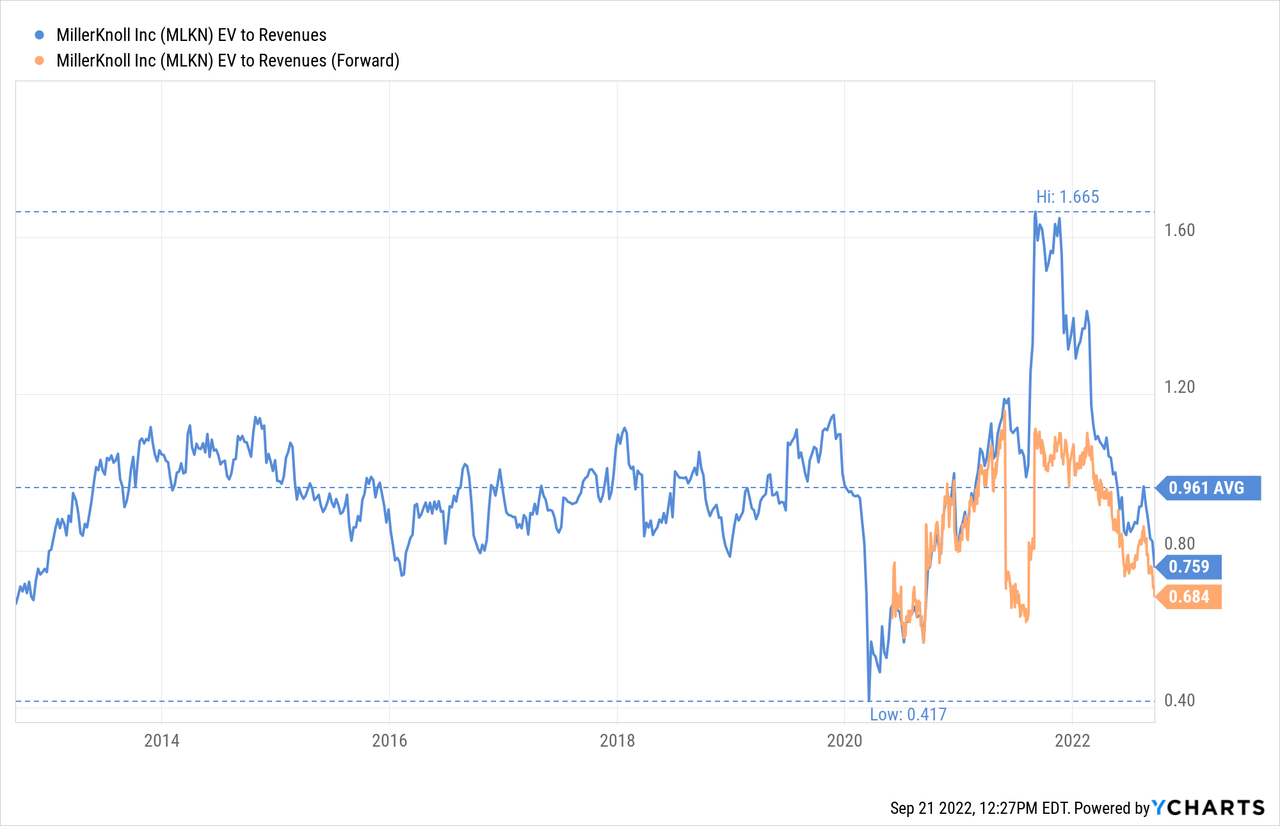

Historically the company has traded with an EV/Revenues multiple of close to 1, but right now there is a nice margin of safety with shares trading with a multiple closer to 0.75, and the forward multiple is even lower.

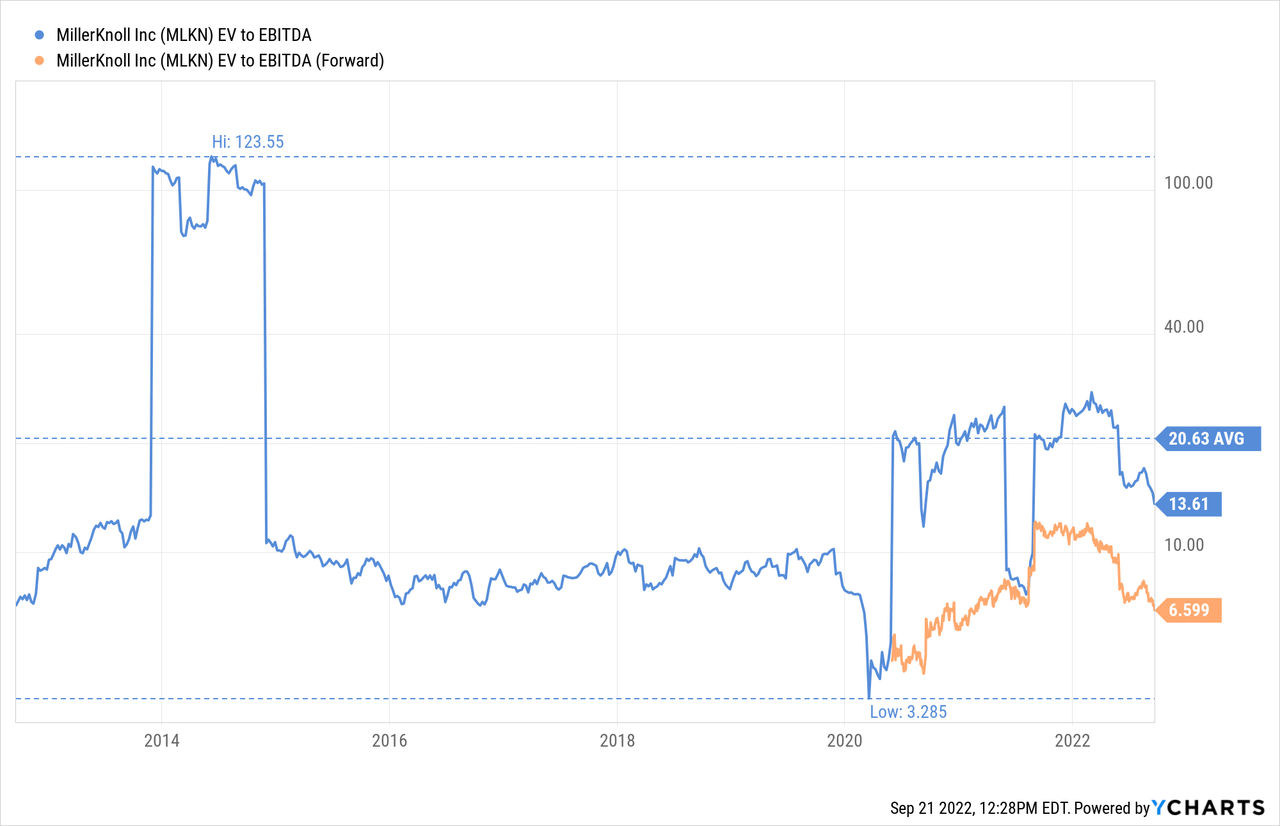

During more normal times MillerKnoll has traded at ~10x EV/EBITDA, but right now due to the profitability issues the multiple is higher. However, it analyst are correct with their estimates, shares are trading at a very cheap forward EV/EBITDA of only ~6.5x.

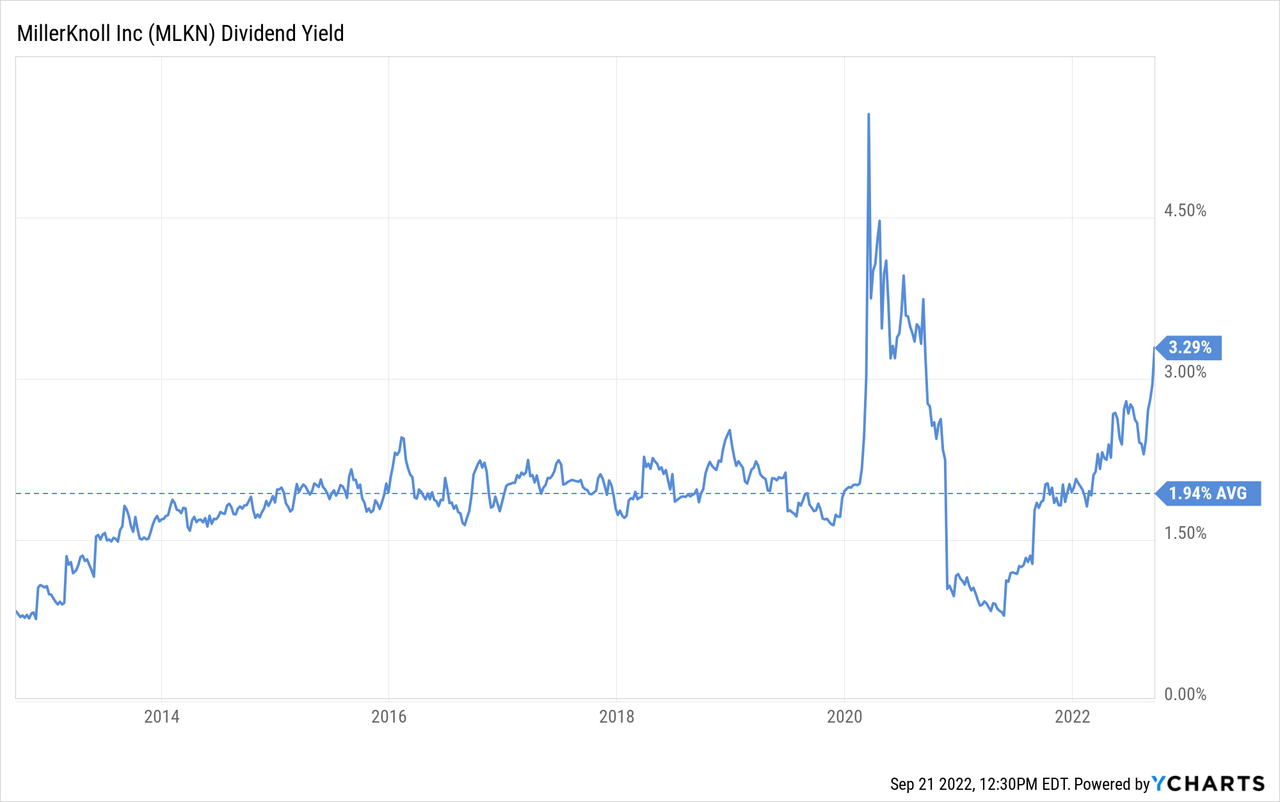

The dividend yield also hints at the undervaluation in the shares, with a dividend yield around 3.3%, which compares quite favorably to the ~2% historical average for the last ten years.

Risks

While we believe than MillerKnoll’s valuation is quite attractive, there are several risks to consider. One is that the inflationary/cost issues could be more permanent than we currently believe, or management has hinted them to be. There is an expectation that with price increases and supply-chain mitigation efforts, margins will recover. However, there is a possibility that inflation will keep running ahead of management for some time.

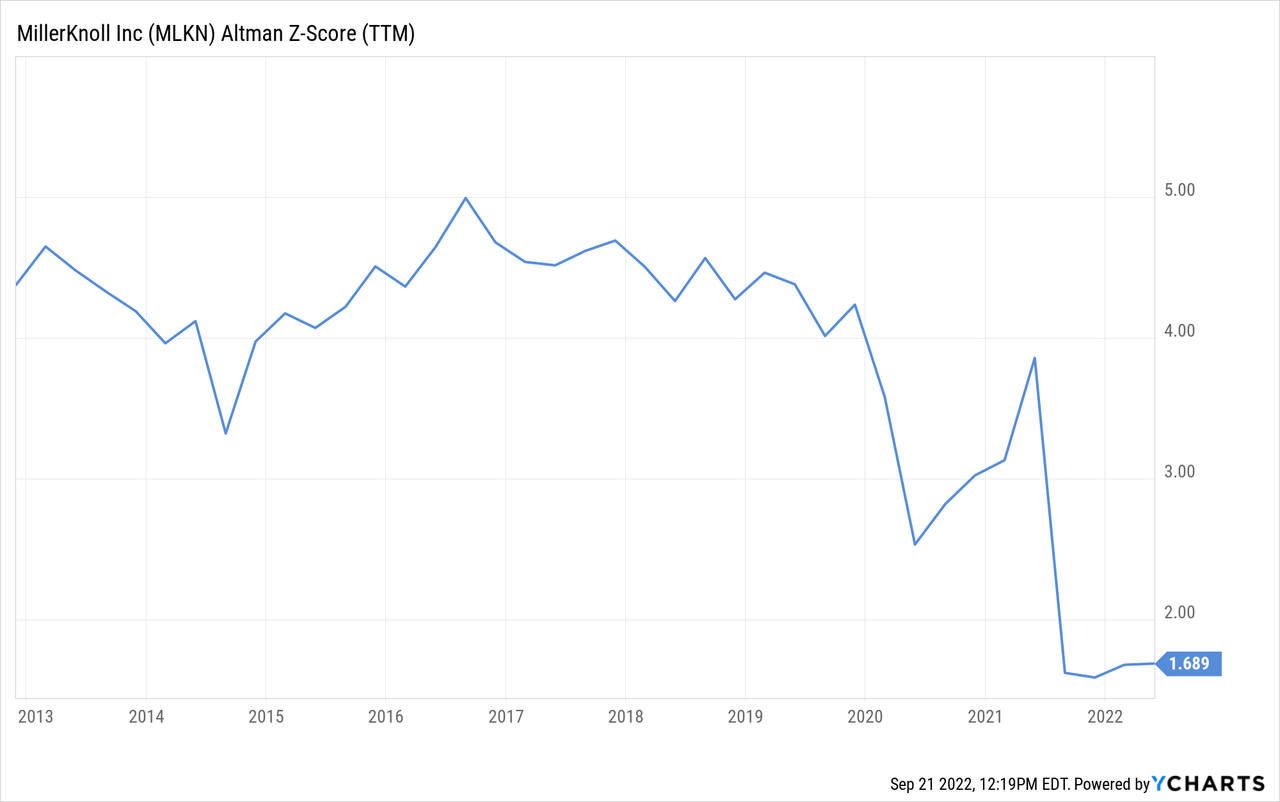

Equally important, the Knoll acquisition weakened the balance sheet considerably, as can be seen with the Altman Z-score. The company used to have a score comfortably above the 3.0 threshold, and it is now below this critical value. That puts the company in a difficult position if a severe recession were to arrive.

Conclusion

MillerKnoll is expected to report Q1 FY 23 earnings on September 28th (Post-Market), and the margins the company reports will be critical to determine how the share price reacts. We expect a significant move in either direction, depending to a large extent on the reported margins. We’ll also pay attention to management’s commentary to determine if commodity costs and supply chain issues are moderating, or getting worse. If you are a MillerKnoll shareholder, this is a quarterly report you don’t want to miss.

Be the first to comment