Maximusnd

The ProShares Short QQQ ETF (NYSEARCA:PSQ) is a bet against the Nasdaq-tracking Invesco QQQ (QQQ) index. In other words, it’s a bet against US tech stocks on a value-weighted basis, so against big tech. It has the big advantage of limiting liability in a bet-against position, making it a useful speculative tool, safer than shorting. There’s also a strong case for the index to keep improving in its level, and we present the cumulative case here. On the other hand, we always pass on the bet against American propensity to save, so it’s a no-go for us. Still, it’s worth putting on the watch list for any investor.

The Case for the PSQ

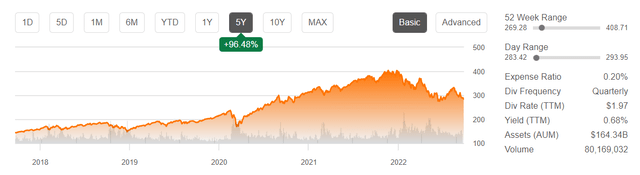

The PSQ is designed to reflect on a daily basis, the -1x factor of any daily movements of the QQQ, which compound on a cumulative basis. It’s no surprise of course that the PSQ has declined much like the value of a car does, and everyone knows that a car isn’t a good investment.

On the other hand, no one invests in the PSQ for the long term. It’s a very useful speculative tool. Does it make sense now? On balance, it might. But we always pass on this sort of thing and will explain why.

Look at the levels of the QQQ. It tracks tech stocks and hasn’t even tracked back to pre-COVID levels, despite the fact that tech stocks have been buoyed by multiple effects more than any part of the market. What do we mean by this? Multiples drive their valuations, and multiples are inextricably linked with expectations. When the outlook is grim, as it is now for reasons including inflation, but even more so to the issue that inflation can possibly only decline if people lose their jobs and get poorer, because the Phillips Curve is back, stocks on the multiple stilts are most at risk. On one hand, COVID-19 has accelerated some of the secular growth in these stocks and brought on their adoption earlier than expected. There’s value in having matured that base faster than expected, and that value has some durability, but with rates being gravity on the markets, and with rates likely increasing up towards 6% in our opinion, as we predicted in April, there could be a paradigm shift from before new normal markets, back when markets’ multiples were on average 33% lower than where they have been in the last decade.

What’s more is that current tech stock fundamentals have been buoyed in large part by durability of corporate spending. At some point, we could get an unemployment-deflation spiral, that the Fed wants to start but hopes to control. If it doesn’t, and honestly even if it is mostly under control, we’ll still see blowback on corporate spending. When that happens, all those cloud stocks and enterprise tech companies could see a cliff. We haven’t seen poor momentum in those fundamentals in a decade, so further tracking of the QQQ, and improvement in the PSQ, could be expected to at least pre-COVID levels if not a fair bit further.

Conclusions

The problem is, Americans are still very employed, and what do Americans do? They put their saved dollars straight into the stock market thanks to all those tax-free stock accounts out there. A bet against the market is a bet against a proportion of the marginal dollar earned hopping into a dropping market, giving it liquidity and creating an eager and still pretty desperate marginal buyer. Bonds are a respectable alternative now, even treasuries, which means that they are taking a larger share of Americans’ marginal propensity to save. The unraveling of TINA conditioning is certainly another point in the case for the PSQ, and the case against the QQQ – a very serious point because it’s reflexive at this point to rely on buy the dip mentality even if we’ve already observed it’s less responsive than before, like an atrophied Galvani frog. But still, stocks are the only place to get that upside that people hunt for, and funds in bonds are shorter-term also because of duration concerns, and could easily roll back into stocks when investors feel that markets have come down enough, whether sensible or not. We aren’t big buyers of the market right now, that’s for sure. No way we’re buying the QQQ. But buying the PSQ is still another big step further, and we’re not going to go that far.

Be the first to comment