Man trading online svetikd

Thesis

flatexDEGIRO (OTCPK:FNNTF) positions itself as a growth company and a lot of analysts and also one very recent article on Seeking Alpha support this view. I think there is evidence that the growth story is distorted by the significant increase in online trading during the pandemic in 2020 and 2021. flatexDEGIRO revenue is very much dependent on the number of customer transactions on their platform. The current dip in trading activity could just be the normal and 2020 and 2021 the exception.

My hypothesis: While the significant retreat after the quite negative BaFin audit could possibly be used for a short-term “bounce-back trade,” investors who buy the long-term growth story could find that they are actually buying a cyclical and low-growth business.

Business model

The recent Seeking Alpha article “flatexDEGIRO: A Hidden Growth Gem In Europe” gives a good overview of the business, so I do not want to go into it that too much and only add information and a point of view. The gist is that flatexDEGIRO is a retail online broker and active across 18 countries in Europe. (Soon there will be only 16 as the business in Norway and Hungary will be discontinued.)

The company has around 2.4m customer accounts and around EUR 44bn assets under custody. flatexDEGIRO reports in two business segments, Financial Services (FIN) and Technologies (TECH). The Financial Services business sits with a subsidiary flatexDEGIRO Bank AG, with has a full banking licence in Germany and therefore across the EU. The TECH segment covers the operational IT business and IT services. From a growth perspective, only the FIN segment is really relevant. TECH contributed 6.9% to (adj.) EBITDA in 2021 and has been flat this year. The percentage contribution has increased but only because the revenue in Financial Services has come down YoY.

Commission Income is where flatexDEGIRO makes most of the money

Revenue in Financial Services is split between Commission and Interest Income. (It also includes a Business Process Outsourcing part, but this is in run-down mode. The Annual Report for 2021 says it is profitable and continued for existing customers in an expense-optimized manner. We can disregard it in a growth discussion.)

Commission Income is predominantly tied to customer trading. It is the much larger part (more than 80 percent) of Financial Services. This is why you can see that in financial reporting and presentations management talks so much about the number of transactions, revenue per transaction, cost per transaction, average transactions per customer account etc. This is where they make most of the money.

Interest income is smaller and not a long-term growth driver

Interest Income comes to the largest part from margin lending to customers. Around EUR 3bn or 7% of customer assets are cash deposits, a by-product of the online-brokerage. As flatexDEGIRO has a banking license, the investment of some of these customer funds allows for an optimization of interest earnings. This happens through a securities-backed lending business (customers put up their portfolio as collateral for a loan), but also direct investment in assets like overnight money/fixed-term deposits, bank and government bonds etc.

Interest income is much smaller in total numbers than Commission income. The revenue share in 2021 was only 15 percent. The margin is significantly higher though with 242bps versus 96bps according to a recent (November 2022) corporate presentation.

flatexDEGIRO sees additional income potential here because of the increasing interest rate environment, but this is not where long-term growth will come from. On the flip side of a banking license are things like capital requirements and liquidity ratios. This will limit the growth potential. The negative findings from the BaFin audit, which require an additional capital injection into Flatex Bank, are a reminder that there are regulatory and capital constraints.

To summarize: flatexDEGIRO makes money mostly from customers trading on their platform. Revenue growth comes from more trading (currently this is going in the other direction) or more revenue per trade. Therefore, flatexDEGIRO has three growth levers:

- Existing customers can trade more.

- They can squeeze more money out of one trade.

- They can add more customers (who trade).

Potential growth levers

So, let’s have a more detailed look into the different levers of growth on the trading side, to see whether they support a long-term growth story.

Lever 1 – Increase trades per customer

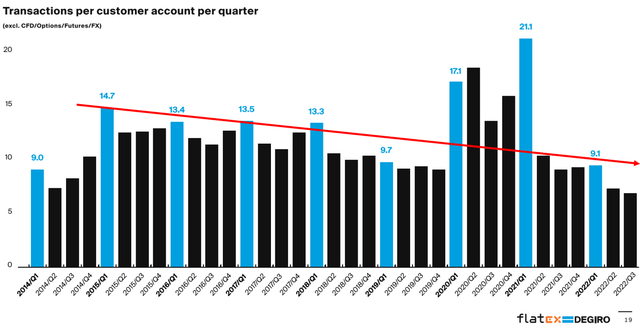

The diagram below is from the November 2022 corporate presentation. The headline says normalised trading levels after the peak years 2020 & Q1/2021. I have added the red line. I think it pretty much speaks for itself. To me this looks like normalised (sic!) trading levels are now lower than they were before the pandemic.

Transactions per customer account per quarter (DataflatexDEGIRO, Corporate Presentation, November 2022)

I admit, there could be a cyclical effect here related to the market downturn. Trading levels could go back to what they were before 2020, but I do not see evidence that continued long-term growth will be enabled by making customers trade more. The pandemic years 2020 and 2021 clearly stand out as the exception to a long-term trend.

Another theoretical option would be to add asset classes that customers cannot trade in yet. A year ago crypto would probably have come up in such a discussion. There were plans and announcements to offer crypto trading, but no product has been introduced. In hindsight and given the regulatory issues flatexDEGIRO is facing now, maybe this is not such a bad thing.

Lever 2 – Increase revenue per trade

Nominally, flatexDEGIRO has a good track record here and has increased the revenue per transaction to EUR 5.15 in Q3 2022 compared to Q3 2021, a 6.1% increase YoY; see Group Interim Management Statement, January – September 2022. There is some additional uplift already on the way. The DEGIRO brand has increased its handling fee by EUR 0.50, effective September 1, 2022. Annualized this should add around 14mn revenue.

The relevant question is – do they have the pricing power to keep charging customers more and more for what is essentially the same thing? flatexDEGIRO calls this optimized monetization. My answer is – probably not, simply due to competitive pressure. There are many other online brokers across Europe and some of them are growing faster. There is a lot of choice for consumers and I do not see that flatexDEGIRO has a significant economic moat. The company is somewhat over-promotional when it calls itself the fastest growing pan-European online broker. In Germany, which is still the largest market for flatexDEGIRO, Trade Republic has outgrown flatex significantly and supposedly has around the same number of customers now, although it only started in 2015 (versus 1999 for flatexDEGIRO).

Additionally, due to how flatexDEGIRO calculates the KPI, the impact of revenue per trade on revenue growth is smaller than it looks. flatexDEGIRO calculates the KPI simply by dividing revenue by the number of transactions in a period. If interest income increases because interest rates go up, which is clearly cyclical, revenue per trade also goes up. But if the number of trades goes up, and everything else stays the same, revenue per trade decreases.

Lever 3 – Increase the number of customers

While I have my doubts that the first two levers will enable significant long-term growth, increasing the number of customers is something that flatexDEGIRO has been consistently doing. The rate of growth has been slowing significantly though this year compared to 2021 and 2020.

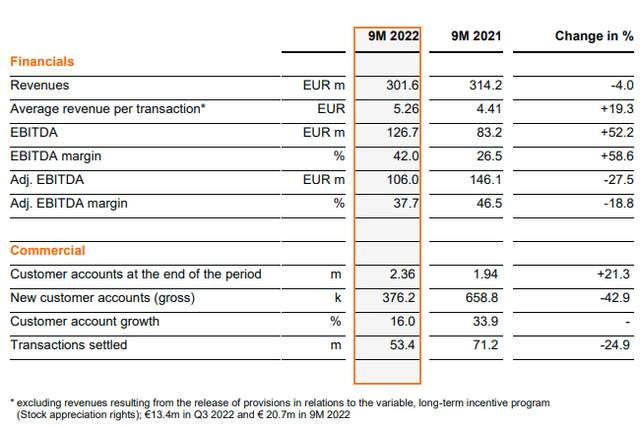

By the end of September 2022, flatexDEGIRO had 2.36mn customer accounts, an increase of 16% (or 376,000 new customer accounts) from 1.94mn customer accounts at the end of September 2021. In the first 9 months of 2021 customer accounts grew by 658,800, so the growth rate more than halved from 33.9% to 16% YoY:

flatexDEGIRO, Q3 interim management statement

(Note: 9M 2022 revenue includes 20.7mn revenue resulting from the release of provisions from a long-term incentive program due to the reduced flatexDEGIRO share price. I am quite surprised to see this under revenue and wondering whether we see less revenue if the share price goes up.)

The decrease in growth rate is not just YoY, but also within the current year from Q1 to Q3. 185,000 customer accounts were added in Q1 2022 and only 94,000 in Q3. With a possible recession in front of us, I think it takes a believer to assume that Q4 2022 and 2023 will be much better.

flatexDEGIRO’s vision for 2026 is to have 7-8mn customer accounts. That requires a CAGR of more than 30%, which they have only achieved during the pandemic years 2020 and 2021. The question is again: Were those years exceptional? I think yes. For those who disagree, I recommend one slide from the November 2022 corporate presentation that talks about the customer demographics. It is a quite focused segment: 70% of customers are between 23 to 49 years old, 81% are male and the majority (no number given here) has an academic background and previous trading experience.

My hypothesis is that if you believe in the long-term growth potential, you need to have reason to assume that they can significantly and consistently break out of that segment to achieve the necessary 30+% CAGR over the next four years. I think it is possible, but I do not see the specific plan how flatexDEGIRO will do it. So, I am a sceptic (and that flatexDEGIRO management has reduced their 2022 outlook two times on short notice over the last few months does not help me).

Are the findings of the BaFin audit an impediment to growth?

Before we come to our conclusion, I want to quickly look at the recent BaFin audit. The findings are certainly an embarrassment for company management, but are they an impediment to their growth agenda?

If the growth agenda included a significant enlargement of their banking business, I would think so. BaFin requires a capital increase in the bank subsidiary and flatexDEGIRO was required to install a dedicated Chief Risk Officer. But that is not the case; growth is mostly supposed to happen in the core trading business.

According to the flatexDEGIRO CFO in an Investor Update a lot of the issues raised by BaFin have to do with a lack of automation and a high level of manual processes. Interestingly, he explains the shortcomings with shortcuts that were taken due to the recent growth and the merger with DEGIRO. This is certainly not a sales pitch for the IT platform. In the Annual Report for 2021 flatexDEGIRO asks “What sets us apart?” and then starts the answer with “Absolutely everything we do is in-house.” So there is some level of embarrassment here, but I do not think that the audit is a significant setback for business growth. Business growth depends on other factors and the levers we talked about.

Conclusion

flatexDEGIRO has set out an ambitious high growth vision, but I am doubtful that it can be implemented. I think the exceptional pandemic years 2020 and 2021 distorted the view on the long-term economic realities: the online broker’s business model, which is geared towards the trading activities of private customers, is very dependent on the economy and the trading preferences of their customers. Due to the significant retreat after a quite negative regulatory BaFin audit, shares seem reasonably valued, if not cheap, and there is the possibility of a short-term bounce-back trade. But investors who buy the long-term growth story could find that they are actually buying a cyclical and low-growth business.

Be the first to comment