Jerod Harris

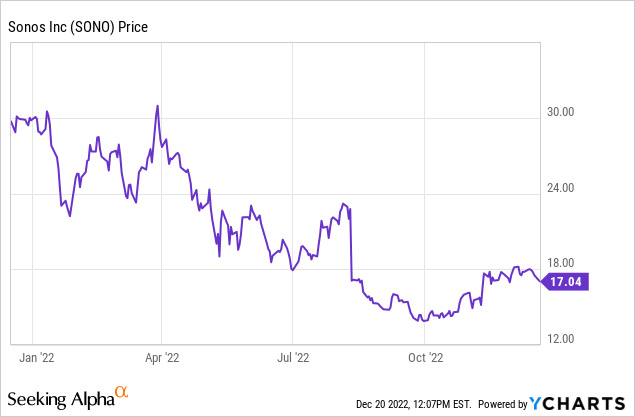

Sonos (NASDAQ:SONO) has had a tough year. The speaker manufacturer has struggled with a number of headwinds in 2022, including inflation in component costs, rising FX rates, sluggish consumer demand, and the very real possibility that its revenue strength last year was more of a pull-in of consumer demand to upgrade their homes rather than a true uplift in the company’s baseline demand.

Back in August, the company shocked the Street by cutting its guidance and making investors aware of the depth of its slowdown, which prompted a ~25% reduction in its share price. Sonos’ recent Q4 earnings print, which largely saw these guidance cuts materialize as reality, did nothing to assure investors that Sonos has a quick turnaround in the works. Year to date, the stock is cumulatively down approximately 45%:

While it’s tempting to try to catch a falling knife here, I remain neutral on Sonos. In my view, until we get incremental “good news” on the company’s trajectory, there will be little incentive to buy and struggle through this stock’s period of sales decline.

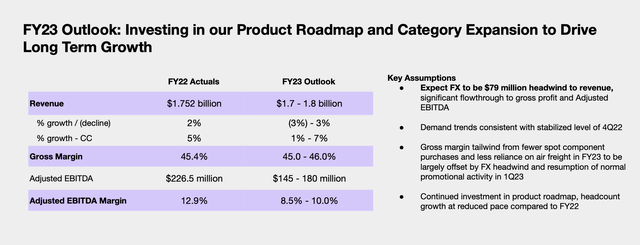

It’s worth noting that while Sonos management has made comments on returning to double-digit revenue growth in its Q4 earnings release, the company’s guidance notes that this won’t be happening in FY23 (which for Sonos is the fiscal year ending in September 2023).

Take a look at the guidance below: which, on top of pointing to a midpoint of zero growth, also factors in a substantial reduction in both adjusted EBITDA and adjusted EBITDA margins:

Sonos FY23 outlook (Sonos Q4 earnings deck)

Considering this lackluster guidance profile, I think Sonos – even after its sharp stock price decline this year – is at best fairly valued for the year ahead. At current share prices near $17, Sonos trades at a market cap of $2.17 billion. After we net off the $274.9 million of cash from the company’s most recent balance sheet, the company’s resulting enterprise value is $1.90 billion.

Against the midpoint of the company’s adjusted EBITDA range for next year ($162.5 million), Sonos trades at 11.7x EV/FY23 adjusted EBITDA – which, to me, doesn’t represent a huge bargain at all.

Right now, investors have plenty of opportunity to buy into beaten-down tech stocks that have seen minimal to no impact from macro factors on their fundamentals. Sonos, on the other hand, is suffering from both top and bottom-line decay, and its share price reduction is a fair representation of its new reality.

The bottom line here: there is little reason to believe that Sonos has a path to near-term recovery. Stay on the sidelines here until either prices come down significantly from current levels, or Sonos shows a path to recovering its growth trajectory earlier than expected.

Q4 highlights

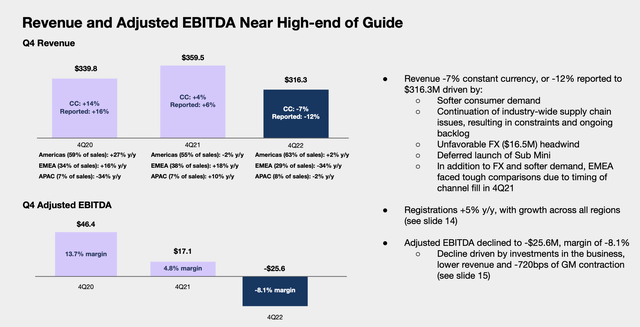

Let’s now go through Sonos’ most recent quarterly results in greater detail. Broadly speaking, Sonos’ fourth quarter demonstrated the weakness that the company alluded to when it slashed its full-year outlook in Q3.

Q4 revenue, as shown in the chart below, declined -12% y/y to $316.3 million – the good news here is that Wall Street had expected even worse revenue of $297.2 million, or a -17% y/y decline. FX headwinds were a major piece of the story here, adding to five points of headwind: in a constant-currency scenario, Sonos’ revenue would have declined “only” -7% y/y.

Sonos Q4 highlights (Sonos Q4 earnings deck)

Still, this growth trend represents significant deceleration from Q3, which grew +2% y/y on an as-reported basis (or -2% y/y on an FX-neutral basis). There is reason to believe here that Sonos’ growth is lagging because Sonos devices are not every-year purchases: and amid the pandemic, when home upgrades and moving homes was far more frequent than it is today, Sonos products got a huge lift alongside other home goods and furnishing companies. This year, after accounting for this pulled-in demand on top of a possible recession and consumers retrenching their spending habits, it makes sense that Sonos’ growth is struggling.

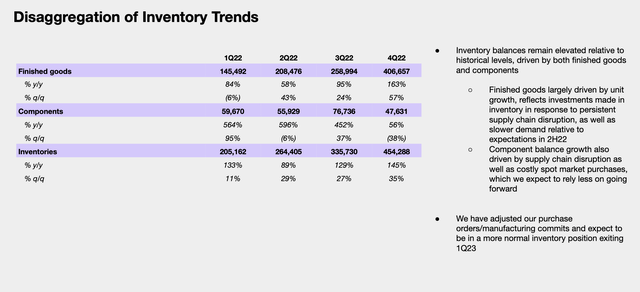

We note that Sonos’ inventory has skyrocketed to $454.3 million, up 145% y/y and up 35% sequentially since Q2, mostly driven by finished goods:

Sonos inventory trends (Sonos Q4 earnings deck)

No longer can Sonos attribute any of its growth lag to supply constraints. We do have to keep an eye on growing inventory especially for a tech manufacturer, as this may mean Sonos has to turn to aggressive discounting to move older models.

The company still continues to put out new products. The Sub Mini launched in Q4, a high-quality $429 home speaker. Per CEO Patrick Spence’s prepared remarks on the Q4 earnings call, the product has exceeded internal expectations so far:

Our newest product, The Sub Mini, is strong out of the gate. Since launching in October, it has garnered outstanding media reviews and is already a hit with customers as we are exceeding our initial sales forecasts. We expect this momentum to continue through the fall and into the holiday season as households build out their home theater system to enjoy sports, movies and music at home. As you know, we have been committed to and executed upon delivering at least two new products every year since 2017.

Fiscal 2023 will be no different. We have already launched Sub Mini and we plan to launch at least two additional products on top of that in the remainder of fiscal 2023. We have built a prudent plan balancing our commitment to profitability with an imperative to invest in the future in light of the exceptional opportunities we set ahead of us in the next few years.”

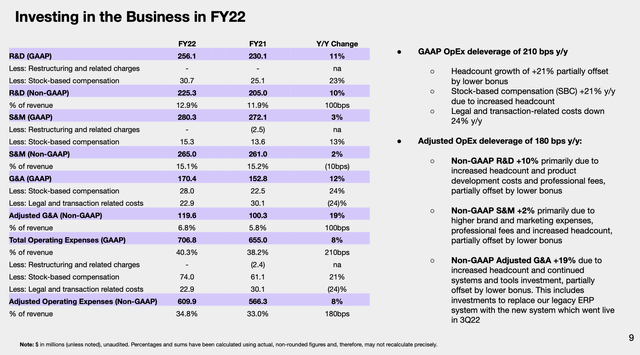

Sonos’ comment to its roadmap and to returning to growth, however, means that the company hasn’t significantly pared back its expenses like other struggling tech peers. As seen in the chart below, adjusted operating expenses as a percentage of revenue grew 180bps y/y, driven by a 100bps increase in each of R&D and general and administrative spend:

Sonos opex trends (Sonos Q4 earnings deck)

Recall that Sonos’ outlook for FY23 calls for between 290bps-440bps of adjusted EBITDA decay despite a single-digit constant currency growth expectation. All in all, Sonos isn’t touting a great fundamental story any longer.

Key takeaways

Sluggish growth, piling inventories, and declining margins – there’s not much reason to invest in Sonos at a ~12x forward adjusted EBITDA multiple at this point in time. Stay cautious here and invest elsewhere.

Be the first to comment