grapestock/iStock via Getty Images

Thesis

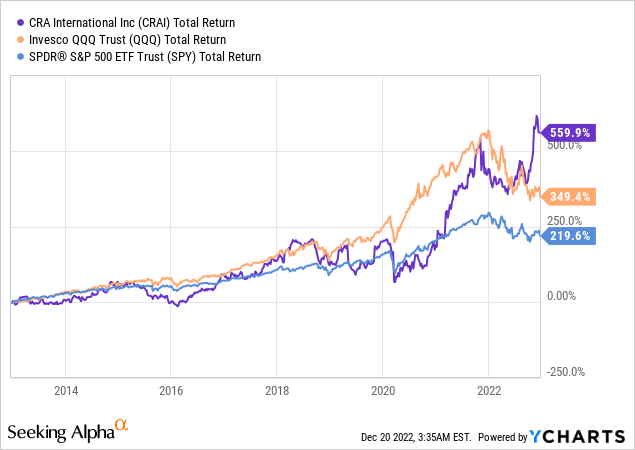

CRA International, Inc. (NASDAQ:CRAI) is an $813 million market cap consulting services company that has been outperforming the general market – both (SPY) and (QQQ) – by a wide margin over the past 5-10 years (CAGRs of 20.6% and 19.8%, respectively):

I believe the company’s current stock price reflects its fair value, considering its year-to-date rally of 21.21%. However, based on my calculations, it’s still likely that the company will exceed earnings expectations in Q4 2022. That’s why I am rating the stock a Buy today and recommending that you put it on your watchlist.

Why do I think so?

From the most recent 10-Q filing, CRA International, Inc. is a consulting services firm that applies advanced analytic techniques and in-depth industry knowledge to complex engagements for a broad range of clients including 78 companies from the Fortune 100 in the last 2 years [from the IR material Q3 2022]:

CRAI’s IR presentation [Q3 2022]![CRAI's IR presentation [Q3 2022]](https://static.seekingalpha.com/uploads/2022/12/19/49513514-16715106008388195.png)

CRAI offers services in 2 broad areas: 1) litigation, regulatory, and financial consulting and 2) management consulting. Although these areas of operation may be distinct, the company reports within a single business segment. It appears to me that the company has a form of diversification within its single operating segment – what I mean is that CRAI can offer both legal and business consulting services, allowing for stable long-term growth without the need to divide the business into separate segments.

The backbone of any consulting firm is quality talent acquisition. CRA International understands this very well, as in recent years the company has put the lion’s share of its investments into finding and developing talent, seeing this as a long-term addition like CAPEX:

CRAI’s IR presentation [Q3 2022]![CRAI's IR presentation [Q3 2022]](https://static.seekingalpha.com/uploads/2022/12/19/49513514-16715117508928525.png)

This approach has allowed the company to bring quite a bit of value to shareholders over the indicated period [since the beginning of 2017]:

- Annual total return (CAGR, 6 years) of the stock of around 22.78%;

- Annual EPS growth of 36.65% (TTM value used as the latest number);

- Annual revenue growth of 10.17% (TTM value used as the latest number);

- EBIT margin improved from 4.3% (FY2017) to 9.9% (TTM);

- ROIC improved from 3.3% (FY2017) to 13.8% (TTM);

- The number of diluted weighted average shares outstanding decreased by roughly 13% since FY2017, i.e. annually by 2.3%;

- The payout ratio decreased from 64.81% (FY2017) to 21.2% (TTM).

- The dividend per share increased by about 218% (from $0.6 per share in FY2017 to $1.91 per share TTM).

Thus, the company was able to properly allocate capital and expand margins to multiply EPS even though sales grew three times slower. I particularly like the fact that CRA continues to work diligently to optimize its business processes/costs, paying particular attention to metrics that at first glance appear to be quite specific.

Unfortunately, CRA does not provide a clear definition of utilization rate – although the company regularly reports on this metric.

CRAI’s IR presentation [Q3 2022], author’s notes![CRAI's IR presentation [Q3 2022], author's notes](https://static.seekingalpha.com/uploads/2022/12/20/49513514-1671513512227361.png)

The utilization rate shows the amount of time CRAI’s employees spend working on client projects compared to internal tasks. By increasing employee utilization, you can improve your profits and take on more projects, hire the best talent, and attract high-quality clients.

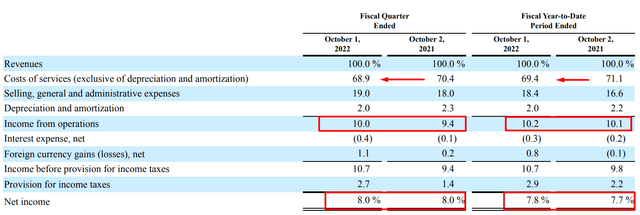

Based on what we see on the slide above, CRAI has improved this metric year over year, albeit marginally, but it has definitely made the company’s operations more efficient and essentially allowed it to pay less for work that was completed faster. Therefore, the vertical analysis of the company’s income statement shows an improvement in 2022:

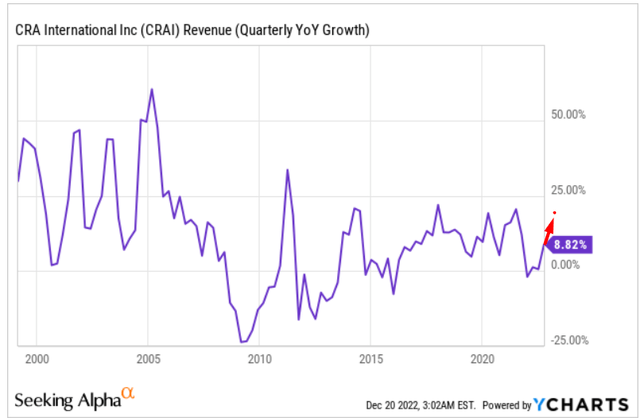

In Q3 2022, the company’s revenue grew only 8.8% year-over-year, while EBIT grew 16.35% – existing operating leverage allows the company to scale operations intensively [by optimization and offering improvement] rather than extensively [by increasing just volumes].

However, as we can see, currency gains also played into the company’s hands in 2022 – if the net income had been adjusted for this item, the company would have posted a 5.7% lower net profit in the 9 months of 2022, YoY. All else being equal, EPS would have been $4.47 instead of the actual $4.72, which is 3.15% less than last year for the same period [last year’s figure is also adjusted].

It is worth noting that CRA has adequately managed the headwinds in some of the areas in which it operates. For example, as the CEO said at the last earnings call, merger activity slowed significantly in the 3rd quarter as global mergers and acquisitions fell 59% year-over-year. This is where the company benefited from the hidden diversification I wrote about above: CRAI’s legal and regulatory revenues were up 14% year-over-year in 3Q 2022. So, if we “zoom out” on the actual performance of the company in recent years and match it with the business cycles of one of its largest end markets, we cannot find a strong negative effect on CRAI’s operations even when the cycle is turning down like in 2022:

Author’s calculations, based on CRAI’s IR materials [Q3 2022]![Author's calculations, based on CRAI's IR materials [Q3 2022]](https://static.seekingalpha.com/uploads/2022/12/20/49513514-1671515982782512.png)

The stability of the business momentum, particularly in the last reported quarter, allowed management to increase its guidance for the full fiscal year 2022.

Reflecting the continued strength and quality of our business, we are raising our revenue and profit guidance. For full year fiscal 2022 on a constant currency basis relative to fiscal 2021, we expect revenue in the range of $600 million to $608 million and non-GAAP EBITDA margin in the range of 12.5% to 13%. This new guidance compares with a prior revenue range of $585 million to $605 million and a prior non-GAAP EBITDA margin range of 11.3% to 12.0%.

Source: CEO on the last earnings call transcript, 3Q 2022

Let us now try to assess how relatively fairly the company is trading and what is priced in.

Valuation and Expectation

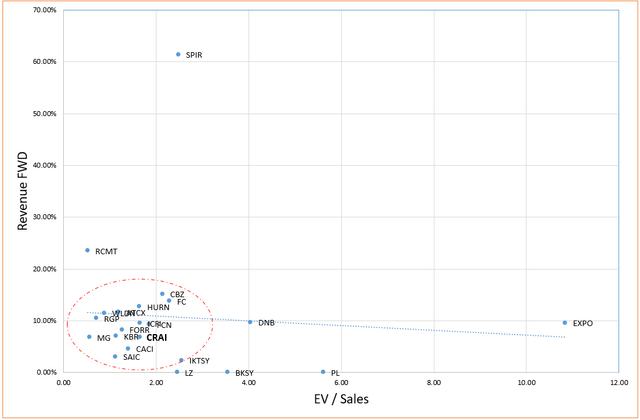

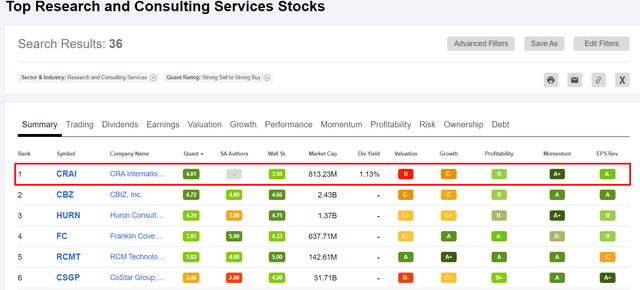

In its industry – Research and Consulting Services Stocks – CRA International stock is ranked number 1, although the company is far from receiving the best grades based on the Seeking Alpha Quant System:

The first grade that catches the eye is the “D” in the Valuation criteria – is CRAI stock really that expensive compared to peers?

To answer this question, I downloaded key data from Seeking Alpha and removed all companies with an EV greater than $10 billion from the sample, leaving a total of 22 companies (out of 36).

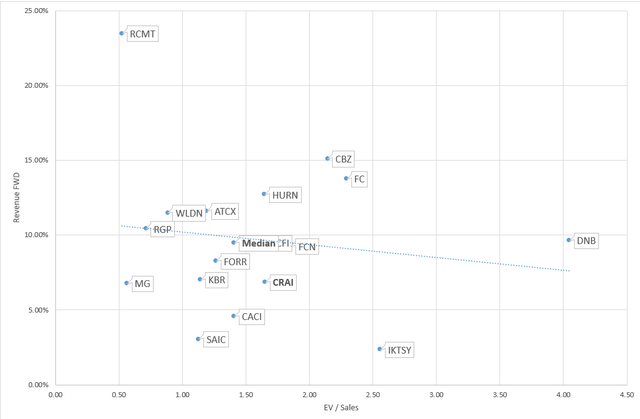

Let compare EV/sales multiples to sales growth rates (FWD) to see if there are cheaper analogs in the market for the growth the company is showing.

Author’s calculations, SA data

Without considering Exponent, Inc. (EXPO) and Spire Global, Inc. (SPIR) as exceptional cases, it becomes apparent that CRAI will likely have a valuation that is quite average compared to other peers.

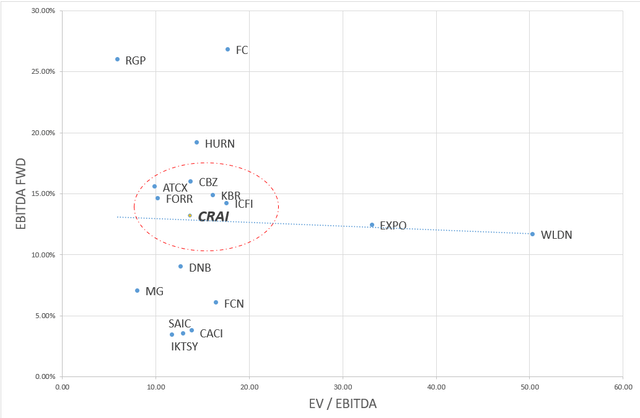

The same goes for matching EV/EBITDA (TTM) with forward EBITDA growth rates:

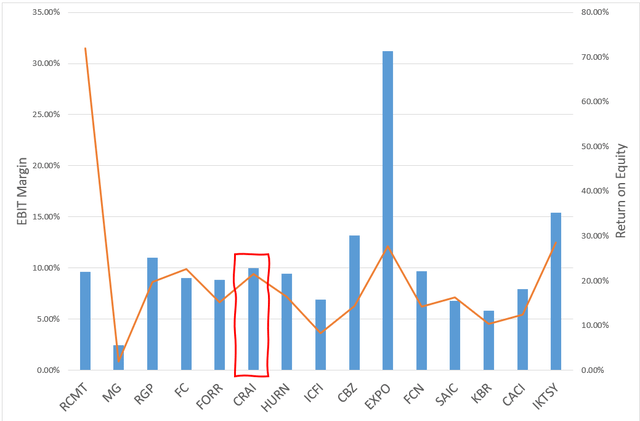

In terms of the relationship between profitability and margin, it can be observed that CRAI is a profitable company, but not exceptionally so. Its indicators are around the median levels:

From all this, I conclude that CRAI stock is not a very expensive company – at least compared to its closest peers. There is of course no question of a margin of safety in my view – the company is fairly valued rather than undervalued, and that is its main problem.

Now a few words about priced-in expectations.

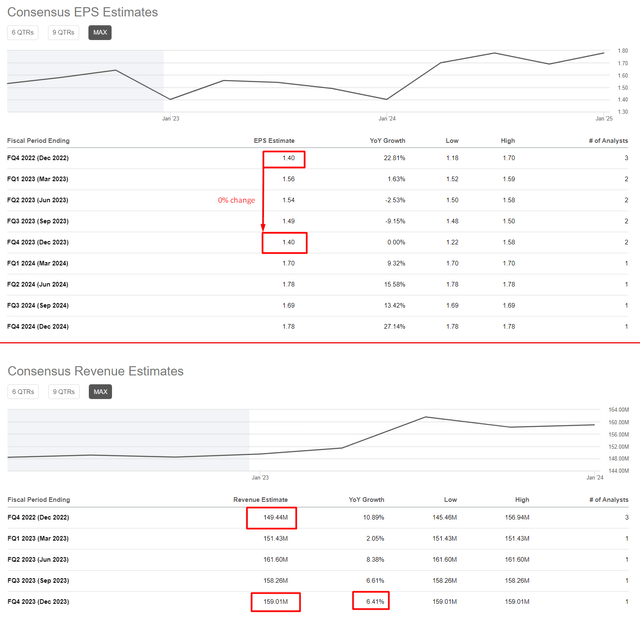

In Q4 2021 – the last quarter of last year – the company reported a 1.93% decline in revenue, mainly because the year before (FY2020) was 1 week longer, so there was a high base effect. Over the last 3 quarters, the company repurchased 5.3% of outstanding shares, and moreover, the number of weeks will not change this time. I expect there will be even fewer shares in Q4 2022 – accordingly, EPS will be quite high. But the Street also understands this and is seasonally expecting the largest EPS growth in recent years for Q4 (+22.81% YoY):

Analysts expect revenue of approximately $149.44 million for the 4th quarter of fiscal 2022, an increase of approximately 11% year-over-year.

However, for some unknown reason, 3 analysts are predicting revenue figures lower than what management has guided. Just follow my simple math: CRAI has 9 months 2022 revenue of $445.925M; management has given full year 2022 revenue guidance of $600M to $608M (=$604M in the middle); so the implied 4Q 2022 figure should be $158.075M if we target the mid-range, which is 5.77% above what is currently priced in.

I also noticed something else that is worth mentioning. According to analysts’ forecasts, the company’s earnings per share will not change in the 4th quarter of 2023, while at the same time, sales are expected to increase by 6.4% YoY during this period.

Now it’s not surprising that the company has consistently exceeded analysts’ forecasts 92% of the time over the past 3 years, and it is likely that we will see the same in early March of next year when CRAI releases its results for the 4th quarter of 2022. This will likely be the case unless analysts revise their forecasts upwards. Regardless, the strong momentum of the stock will likely benefit in either scenario.

Bottom Line

My thesis is not risk-proof.

One of the main obstacles the company faces is the challenge of expanding beyond its current valuation, which remains high. For example, in 2016, the company had an average annual price-to-earnings ratio of around 16.6x, and in that year, earnings per share increased by 78.8% YoY and return on capital invested (ROIC) almost doubled. While 2022 has also been a good year for CRAI, it has not seen the same level of growth as in 2016, with an average annual P/E of 19.4x.

In addition, even if the company offers a diverse range of services, CRAI may still face difficulties in the short term if a recession occurs, whether mild or severe. However, I believe it’s possible to avoid a significant business decline – yes, the stock price may decrease significantly, but the business itself may not be severely impacted. This was seen in FY2009, when EPS only fell 9.75% year-over-year.

It is worth noting the changes in the M&A market, which the CEO mentioned during the last earnings call. If the decline in this market does not abate, a decrease in deal volumes will be inevitable.

Despite all the risks, the revenue forecasts we see in analysts’ forecasts today seem unfair to me. They are well below what management has guided – which perfectly explains the regularity with which the company exceeds these forecasts from quarter to quarter.

I expect a repeat of the current trend in March 2023, when CRAI reports for Q4 2022 – then once again the stock could make another significant gain. So I rate CRAI as a Buy despite its relatively fair valuation [lack of safety margin].

Thanks for reading!

Be the first to comment