eyewave/iStock Editorial via Getty Images

In the world of fashion and luxury LVMH (OTCPK:LVMHF) is undoubtedly the most important company in the world, not only as a matter of income but also because of its reputation built up over decades. In second place we have Kering, also a French company albeit relatively younger. The latter, in my opinion, is often overshadowed by LVMH, however, objectively, its achievements in recent years deserve to be discussed in depth. Kering (OTCPK:PPRUF) is still inferior to LVMH, but in this article I will highlight my reasons why I believe the gap may narrow in the coming years. In addition, I will also address the short-to-medium-term trend.

Luxury fashion market and competitive advantage

The luxury fashion market is an industry that has been in vogue for decades, which is why future growth prospects are not so rosy. The most renowned brands are almost always the same, highly valued and with a rather predictable demand. Since the products sold are extremely expensive, it is likely that growth in this sector will be low and steady over time.

While we have a market that is now saturated and limited in its ability to expand, however, we must emphasize how difficult it is for a new competitor to enter. There are many barriers to entry, which is why both Kering and LVMH brands have, in my opinion, one of the best competitive advantages in the world.

- The manufacturing process is extremely complex for brands such as Gucci and Louis Vuitton, for example. These products are handmade using the best possible materials through a meticulous procedure adopted by skilled workers. The final products sold exhibit such quality that they can be used for decades.

- Since the average consumer associates these brands with quality and long-lasting products, they are willing to pay even very high amounts of money. Succeeding in shaping consumer perceptions toward these brands has been possible over decades, however, and is not something that can be achieved overnight. Assuming a company entered the luxury fashion market that could generate products of the same quality at the same price, I doubt that consumers would spend so much on such an unfamiliar brand. The choice in my opinion would always fall to Gucci or Louis Vuitton.

- Buying a Gucci or Louis Vuitton product is not only a matter of quality and durability, but also, and more importantly, a matter of visibility. Dressing these brands is a way to feel part of an upper class, although often the reality is quite different. The most well-known personalities in the public eye wear these expensive brands, and as a result the average consumer tries to “emulate” their status symbol by buying them. For some people, wearing these brands is a way to feel comfortable and look as good as possible. Thus, it is interesting to note that this psychological factor ensures that even those who technically cannot spend €1000 on a sweatshirt will eventually do so. Believing that the target customers of Kering and LVMH are only wealthy people is a mistake.

So, everyone wants the brands of Kering and LVMH, and any new competitors start with a strong disadvantage related mainly to the reputational factor. Personally, I highly value both companies because of their competitive advantage, but it is worth noting that there are important differences between them despite the fact that they operate in the same market. This is what the next section will deal with.

Main differences

Kering and LVMH differ mainly in two aspects: style and diversification.

Style

Taking as reference points once again the main brands of the respective companies, Gucci for Kering and Louis Vuitton for LVMH, the differences in style are obvious.

Gucci’s style is more modern, bold and youthful. Beyond the famous monogram, its products often feature themes related to insects such as bees or reptiles such as snakes. It is overall a flashy, innovative brand for those with a creative style. For all these reasons, the Gucci brand has achieved considerable success in recent years, especially among millennials, thanks in part to the visibility given to it by highly-followed social media personalities such as Kylie Jenner, Lil Pump, and Harry Styles.

If Gucci has represented an innovative reality in recent years, on the other hand we have Louis Vuitton, which represents the epitome of formality and versatility. Its retro and elegant style suits almost any situation, and the quality of its bags is among the best. Unlike a Gucci bag, those made by Louis Vuitton, especially the most sought-after ones, even tend to appreciate over time. Because of this, especially for handbags, Louis Vuitton has higher prices. Finally, the target consumers are generally older than Gucci.

Diversification

LVMH operates in multiple luxury sectors, while Kering only that related to high fashion and eyewear. Specifically, here are the main brands of the two companies:

- Kering: Gucci, Saint Laurent, Bottega Veneta, Alexander McQueen, Balenciaga e prodotti a marchio Kering Eyewear.

- LVMH: Celine, Christian Dior, FENDI, Givenchy, Louis Vuitton, Marc Jacobs, Bulgari, Tiffany & Co, Château d’Yquem, Dom Pérignon, Ruinart, Moët & Chandon, Hennessy, Belvedere.

From this list, one can appreciate how LVMH has a remarkable variety of successful brands, moreover in multiple sectors; from fashion to wine, from jewelry to cosmetics. Keep in mind that I have omitted some major brands so as not to make the list too long.

In light of this difference between LVMH and Kering, in my opinion, it is evident how the former has a more solid and reliable business model than the latter since it does not depend entirely on a single sector. In any case, this does not mean, however, that Kering is not worthy of attention, as although focused mainly on a few brands, its profitability results since 2017 have been remarkable, even better than LVMH’s.

Revenues and profitability

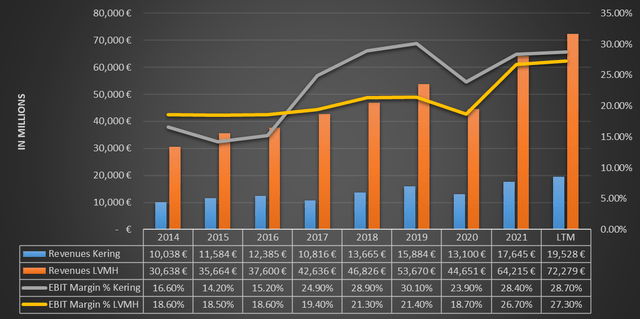

In this section there will be an income comparison between the two companies to understand which of the two is potentially more attractive. I would like to point out that the key aspect of this comparison will not be about the quantity of revenues, but about their quality. It is obvious that LVMH manages to generate more revenues than Kering since it has a market capitalization almost 6 times higher and a 100-year history behind it.

The most interesting aspect is the operating margin, which Kering from 2017 onward has maintained stably above that of LVMH. So, for the same revenue, Kering gets a higher operating income, which is a sign of strong competitive advantage of its brands. In any case, it can be seen that before 2017 this was not the case at all, so what justifies such a “sudden” improvement? In my opinion, there are two main factors that have favored Kering’s rise:

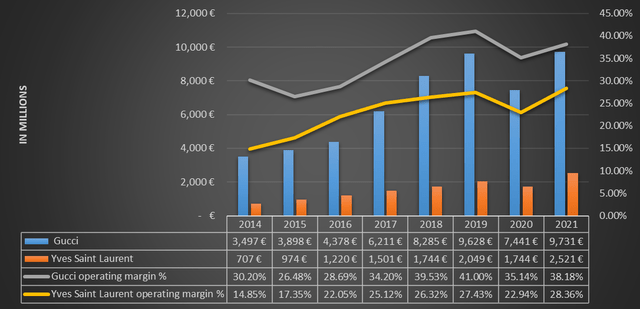

The first is due to the management’s decision to focus the entire business model on core high-fashion brands. The goal was to focus on the growth of the latter since they exhibit a rather high operating margin. So, in 2018 the company made a historic turnaround by spinning off the Puma brand from its business and revitalizing historic brands such as Gucci and Yves Saint Laurent.

With the benefit of hindsight, we can say that management by abandoning the sportswear segment made an apt choice to breathe life back into Kering’s growth. Yves Saint Laurent has now become a globally appreciated brand thanks to its unique, elegant and timeless style, while Gucci is back in vogue again thanks to the creativity of Alessandro Michele. The operating margins of these two brands are significantly higher than what Puma could have achieved; therefore, the company’s choice proved to be correct. In any case, Gucci recently announced that Alessandro Michele will no longer be at the helm, so this is rather negative news.

The second reason why Kering’s margins have become higher than LVMH’s concerns the diversification aspect. Kering mainly operates in the luxury fashion market, which is known for its high margins, while LVMH as explained earlier operates in multiple luxury segments. This means that LVMH’s operating margin is influenced by multiple market segments, sometimes with lower margins. Kering has been fully successful in taking advantage of the strong demand for luxury garments in recent years, while LVMH has had to focus on other areas as well.

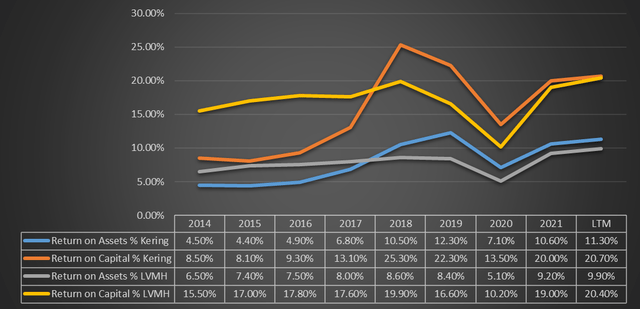

Finally, in addition to operating margin, profitability ratios are also on Kering’s side.

From 2018 onward, both ROA and Return on Capital have been higher for Kering, showing how its management is better allocating the capital at its disposal. Beyond the comparison with LVMH, over the past 5 years, Return on Capital has almost always been above 20%, a remarkable achievement.

Risks for LVMH and Kering

The main risks for LVMH and Kering are very similar but not the same. In fact, I recall that LVMH is highly diversified in the luxury sector, so it greatly reduces risk exposure on a single market segment. This is not the case with Kering, so I consider the latter to be more volatile and riskier. Also, staying with the diversification theme, most of Kering’s revenues come from only two brands (Gucci, YSL), so you have to pay close attention to that.

As for the main risk in common, it is obviously related to the economic slowdown we are experiencing. Obviously in a recession no one needs a €1000 shirt to survive; therefore, it is obvious that luxury goods will be the first to be less in demand. However, this aspect affects less wealthy households, because those who are very wealthy will still be able to lead their lifestyles even in a recessionary period.

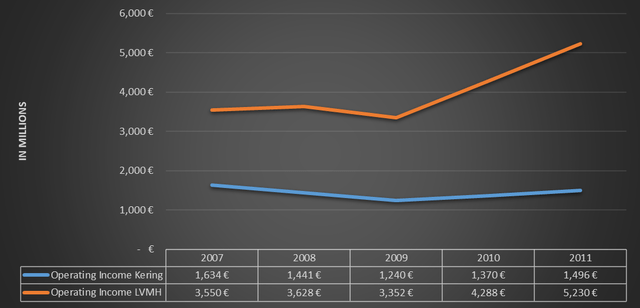

In the last major recession, we can see how what has just been said actually happened. LVMH experienced a slight drop in operating income in the year most affected by the crisis and then recovered quickly; Kering being less diversified suffered a more pronounced drop in operating income and took longer to recover.

Certainly after 15 years there have been significant changes and Kering has become much stronger; however, I think it likely that this scenario could repeat itself albeit with a smaller magnitude.

Latest considerations

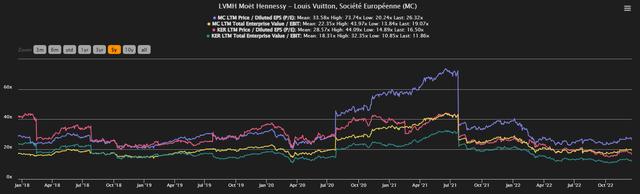

Both Kering and LVMH are the leading companies in high fashion, and their competitive advantage is almost insurmountable. Brands such as Gucci and Louis Vuitton have taken decades to be globally recognized today as synonymous with quality and reliability, so their dominance cannot cease at any moment. Over the past 5 years, Kering’s change of strategy has paid off, managing to surpass LVMH in terms of profitability, but there is still a long way to go. LVMH is a perfectly branched group in multiple segments, making it a less risky investment than Kering, which focuses mainly on only two brands. In any case, in light of these considerations, my view is that over the next few years the gap between LVMH and Kering may narrow since the latter is managing to make better use of the capital at its disposal. However, the market does not seem to have discounted this scenario since LVMH’s market capitalization is currently almost 6 times that of Kering. In addition, Kering’s price multiples seem more attractive than LVMH’s.

The values of Kering’s current multiples deviate from the historical average more than those of LVMH; a signal that the former is potentially at a discount, the latter is at full price.

Kering is currently 38% far from its all-time high, with peaks of 46%; LVMH is virtually at near all-time high being only 8% far. The latter has experienced a strong recovery in recent months since it had plummeted 28%. As a result of this data, in my opinion LVMH has rallied too much while Kering has slowed down too much, so I expect that the performance of these two companies may converge as early as the next few months.

LVMH is among the best companies in the world but is currently overpriced; Kering is inferior but is more attractive at the current price.

Be the first to comment