miniseries

Description

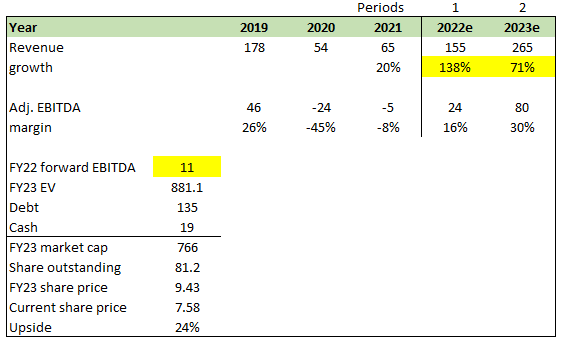

I believe Mondee Holdings, Inc. (NASDAQ:MOND) is worth $9.43, representing ~24% upside from the date of writing (Oct 19, 2022). With a portfolio of leisure and travel brands that are well-known all over the world, MOND is a company that operates in travel technology and the marketplace. The company stands out from the competition thanks to its cutting-edge technological platform, which facilitates faster transactions, is easily accessible on mobile devices, and uses cutting-edge marketing and Fintech tools.

Company overview

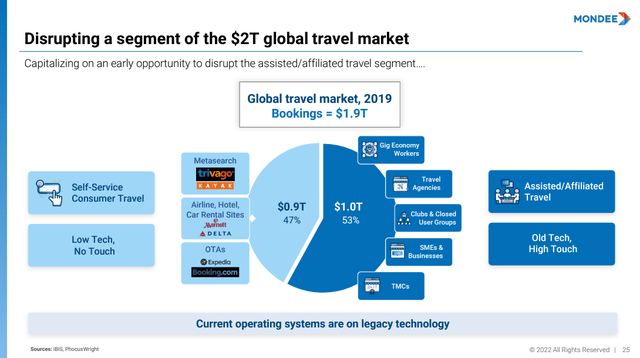

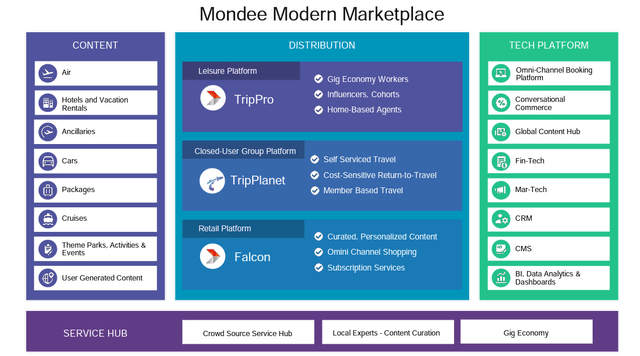

MOND is a travel technology company and marketplace with a portfolio of globally recognized leisure and corporate travel brands. It provides state-of-the-art technologies, operating systems, and services seamlessly enabling travel transactions. These technology-led platforms can access global travel inventory and extensive negotiated travel content. Combined with MOND’s distribution network, these platforms create a modern travel marketplace.

Assisted and affiliated consumer travel is ripe for disruption

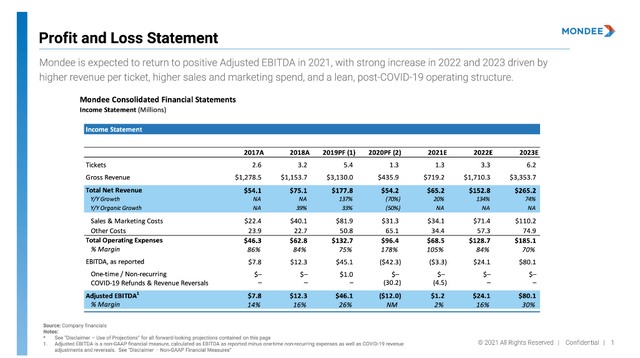

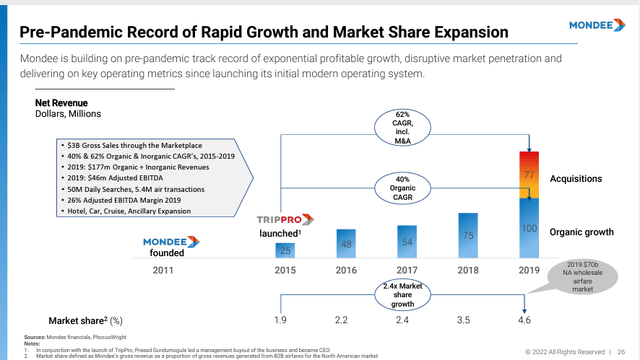

Before the COVID-19 pandemic, travel and tourism were the most significant and fastest-growing global economic sectors. According to MOND’s S-1, in 2019, these sectors represented approximately 10% of the worldwide GDP. Global travel spending equaled $1.9 trillion, and the increment in the annual rate was 6% prior to the coronavirus pandemic.

Assisted and Affiliated Consumer Travel includes inventory sold to travelers through affiliates and curators such as travel agents, TMCs, corporations, call centers, associations, and other membership organizations. With the help of third parties, end consumers gain access to airline and hotel reservations, car reservations, and other accommodations that have been configured for specific trip or experience requirements and best-value prices. MOND reports that the Assisted and Affiliated Consumer Travel vertical accounted for $1 trillion in revenue in 2019. It focuses on this segment of the travel booking market, which is proliferating. According to MOND’s S-1 filing, the global travel market is expected to grow by 9% CAGR from 2021 to 2025, while in the same period, the travel agency market is expected to grow by 11%.

Many of the traditional stakeholders providing Assisted and Affiliated Consumer Travel are still dependent on legacy distribution networks and archaic operating systems and rely on conventional booking methods, failing to align with modern consumers’ booking preferences and lifestyle requirements. They often lack the transaction platforms and operating systems with current consumer engagement technologies and transaction services, thereby underserving the emerging consumer cohorts.

I believe these stakeholders do not satisfy significant segments of the rapidly emerging gig economy travel market, including SMEs, thus creating significant white space market opportunities. In the Assisted and Affiliated Consumer Travel segment, MOND’s platforms offer full solutions and a modern marketplace for both leisure and business travelers.

MOND’s travel ecosystem disrupts incumbent platforms by modernizing an industry still reliant on legacy technology infrastructure. The company’s technology platform increases the efficiency of transactions, provides great mobile accessibility, and incorporates modern marketing and Fintech tools. For example, TripPro is the top solution for the gig economy in the travel services market. It gives gig workers the tools they need to build a successful work-from-anywhere travel business or group.

MOND’s platform provides access to a wide range of content and fares

MOND’s distribution network connects over 50,000 travel affiliates and agents to over 500 airlines and over one million hotel and alternative hospitality accommodations. This distribution network allows it to broadly provide segment-targeted travelers’ access to its Global Content Hub (GUB) inventory. The user-friendly TripPro, Rocketrip, TripPlanet, and UnPub platforms are then used to help travelers in target markets use GCH inventory.

Management intends to expand its extensive flight content to differentiate itself from competitors by working with all airlines that need to fill planes quickly as the COVID-19 pandemic wanes. Most airlines reduced flights and capacity to partially offset the significant reduction in passenger traffic, rapid decrease in load factors, and steep increase in losses. As the travel market recovery progresses and these airlines reopen their routes and re-establish capacity, they will need additional help to fill seats and increase load factors.

Aside from flight content, hotel bookings are a recent addition to the MOND platform and presently account for less than 10% of its bookings. Hotel bookings are an area where MOND plans to focus its efforts, as the company will focus on building relationships with other hotels and other alternative lodging suppliers. MOND believes its UnPub subscription-based product will appeal to hoteliers hoping to fill last-minute hotel inventory. The company plans to use its strength in airfare content to boost hotel bookings by offering hotel bookings as an add-on or as part of a package with mostly air transactions.

MOND will also prioritize adding new categories of travel content, such as cruises, dynamic packages, and entertainment, organically and through acquisitions. Travel affiliates initiate a majority of cruise bookings through offline channels and specialty distributors. It can leverage its strong relationships with travel affiliates and its position with emerging gig workers worldwide to expand its cruise relationships and content.

Strong distribution capabilities

MOND currently maintains a distribution network that includes over 50,000 travel affiliates and agents, corporate enterprise customers, and partners with direct channels to travelers. Management plans to take the following actions to strengthen its worldwide travel distribution network:

- The company plans to expand its presence globally to become a leading operating system for global travel accommodations. As such, international expansion is a priority in 2022 and moving forward.

- MOND is expanding with TripPro’s new “Travel Solutions in a Box” offering, transforming gig workers into 21st-century travel providers. The company expects this new pool of gig workers to exponentially increase the travel provider market. These gig workers will rely on MOND’s platform to conduct this business, strengthening the company’s competitive advantage vis-à-vis legacy providers. I believe the new gig travel economy will also encourage travel suppliers who want to sell their travel content through these new gig travel providers to use MOND’s marketplace, which will strengthen its content and distribution network.

- Expand SME Travel Market Share. Traditionally, only large enterprises have had access to value pricing, better service, and reporting. Still, with TripPlanet, MOND plans to provide this model efficiently to SMEs, nonprofits, and other membership organizations. TripPlanet already brings a deep set of travel benefits, and the company plans to grow this business by targeting more small businesses and non-business organizations. MOND plans to add even more services, such as new benefits for employees and members of these businesses who want to travel for fun.

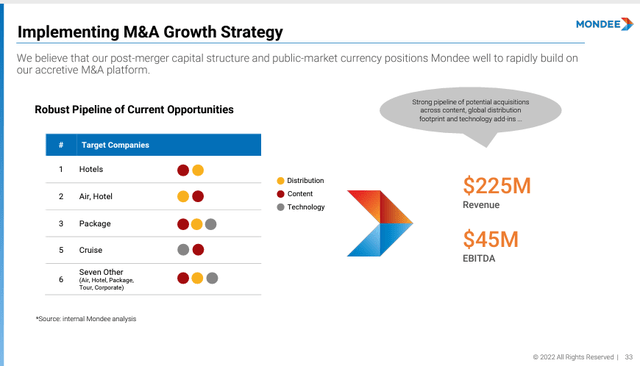

M&A to further boost growth

The company has a strong track record of successfully integrating and enhancing its acquired businesses. MOND plans to keep looking for strategic opportunities that will improve its platforms, broaden and deepen its content, and improve its infrastructure for distributing its content.

MOND plans to expand its dynamic packaging capabilities with even greater content offerings and is assessing acquisition candidates with this expertise to enhance these functions on its platform. The company has identified opportunities to increase its international footprint by acquiring distributors, aggregators, and platforms based in Europe and other global markets. In particular, MOND looked for ways to expand its selection of hotels and other places to stay, cruises, and tours.

Valuation

I believe MOND is worth USD $9.43 in FY23 representing a 24% upside from the date of writing.

This value is derived from my model based on the following assumptions:

- Revenue growth will follow management’s FY22 and FY23 guidance, which is supported by organic growth and M&A.

- I differ from the market and believe that NOTE deserves to trade at a much higher multiple than today when we compare it to other major players in the travel space, such as Booking (BKNG) and Expedia (EXPE). I believe MOND should trade in a similar fashion to EXPE given the higher similarity in the business model. EXPE has historically traded at around 11x forward EBITDA before COVID happened, and I expect MOND to eventually trade at similar levels when the world recovers completely from COVID.

GS Investing estimates MOND 424B3 filing

Key Risks

Competition

The travel services industry is competitive. MOND’s competitors may have access to significant financial resources, greater name recognition, and well-established client bases in their target customer segments. This could make it more difficult for MOND to attract new customers. MOND competes for its own share of the travel services market in multiple market segments, with different business models, technology, and other skills, and in different parts of the world. This may make it harder for MOND to find new customers.

Repeated lockdowns will hurt MOND

These government mandates have had a significant negative impact on the travel industry and many of the travel suppliers on which our business relies, as well as on our workforce, operations, and clients. Travel restrictions imposed by the European and U.S. governments are beginning to be lifted, but there is still a great deal of uncertainty around the impact of the new variants of COVID-19. Concerns have also been raised about how well existing vaccines will work against these new variants and when they will be distributed and given around the world.

Levered balance sheet

If COVID or another major lockdown happens again, MOND could face liquidity issues given its high debt levels. MOND might need to raise additional financing through equity financing, which could dilute investors.

Summary

MOND is currently undervalued at its current share price as of this writing. MOND is a marketplace and technology supplier for the tourism industry, and its client list includes many well-known names. The company distinguishes itself from competitors with its cutting-edge technological platform, which allows for faster transactions, is mobile-friendly, and employs cutting-edge marketing and Fintech technologies. I feel that the current value provides an excellent opportunity for investors to earn moderate returns over the next year.

Be the first to comment