Mongkol Onnuan

In my previous article about Ares Capital (NASDAQ:ARCC) I discussed how they should benefit from a rising rate environment and how the 8 million share offering would be positive for creating shareholder value. ARCC once again just proved why they are the crème de la creme of Business Development Corporations (BDCs) as they delivered strong Q3 earnings and rewarded shareholders with a 12% dividend increase. I have always indicated that ARCC isn’t flashy and it won’t have the strong tailwinds that the popular tech companies have, but it’s a solid income play that continues to drive value. I felt that the sell-off was unwarranted, and I continued to purchase shares during the sell-off. ARCC delivered a top and bottom line beat in Q3, raised its dividend, and is paying an additional dividend in Q4 as the rising rate environment has been good for business. I think ARCC is still a good investment as it’s still down -8.42% YTD and roughly -16% off its 52-week highs.

ARCC delivered a lot of strong news in Q3

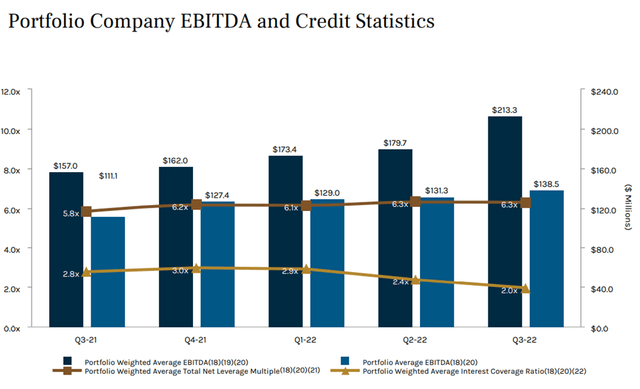

If anyone had questions about ARCC’s ability to drive profitability in a rising rate environment, those questions have been answered. In Q3, ARCC delivered $0.50 of core EPS which was a YoY increase of 6.38% ($0.03) and a QoQ increase of 8.7% ($0.04). ARCC’s net investment income per share jumped 42.5% ($0.17) YoY from $0.40 to $0.57 and 9.62% ($0.05) QoQ. ARCC’s net asset value per share rose 2.16% ($0.04) YoY to $18.56. In Q3, ARCC delivered the largest amount of investment income over the past 5 quarters, as they generated $537 million. ARCC’ ‘s net investment income after expenses and taxes was $288 million, a $104 million (56.52%) increase YoY. This also allowed ARCC to drive its portfolio weighted average EBITDA by 35.86% ($56.3 million) YoY and its average portfolio EBITDA by $27 million (24.66%) YoY.

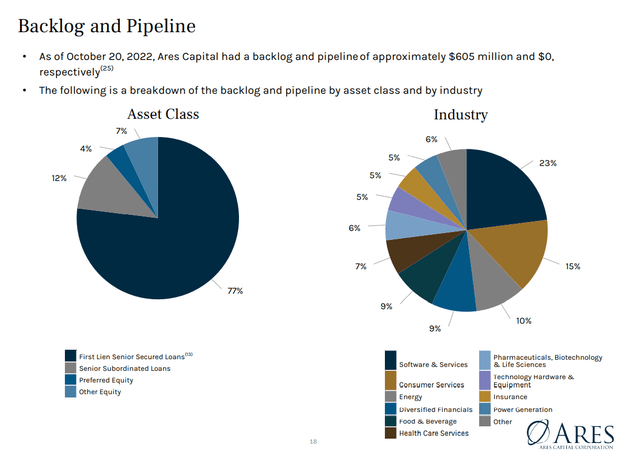

This indicates that ARCC should be in a position to drive larger core earnings in the future as continued rising rates combined with ARCC’s portfolio should provide tailwinds going into Q4 and 2023. ARCC made $2.2 billion of new investment commitments in Q3, which included $242 million of new investment commitments to IHAM. ARCC’s Q3 investment commitments included 13 new portfolio companies, 26 existing portfolio companies, and one additional portfolio company through the Senior Direct Lending Program. Of the $2.2 billion in new commitments made during the third quarter of 2022, 62% were in first-lien senior secured loans, 5% were second-lien senior secured loans, 4% were subordinated certificates of the SDLP, 9% were preferred equity, 15% were for Ares Capital’s investment in IHAM, and 5% were in other equity. Throughout the $2.2 billion of investments, 81% were in floating rate debt securities, of which 91% contained interest rate floors.

ARCC’s activity didn’t stop when Q3 ended, as management has been hard at work looking for opportunities to deliver value for shareholders. Throughout the month of October, which is the first month of Q4, ARCC has allocated $1.1 billion to new investment commitments. ARCC’s commitments consist of first-lien senior secured loans at 68%, second-lien senior secured loans at 31%, and 1% in other equity. 98% of these commitments were at a floating rate, while 1% were non-income producing and 1% were non-accrual status.

The strongest dividend is one that has just been raised

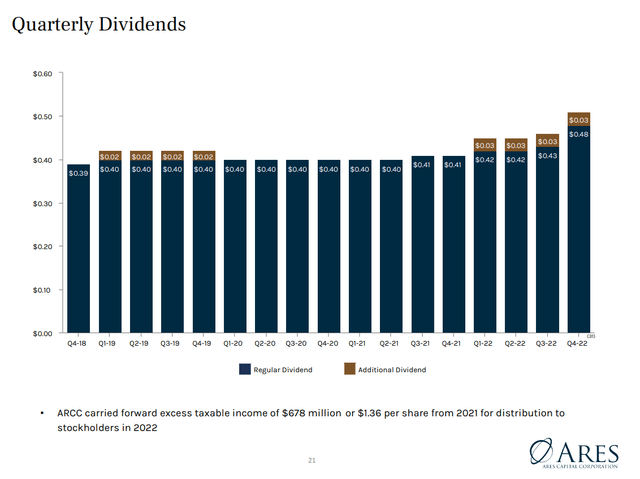

ARCC is an income investment for me, and it does a spectacular job of generating income for shareholders. ARCC just provided a 12% quarterly dividend increase from $0.43 to $0.48. In addition to a double-digit increase, ARCC is paying its 4th consecutive special dividend of $0.03 in Q4. Income investors should be ecstatic as ARCC has delivered 3 dividend increases and 4 special dividends in 2022. ARCC started the year by increasing the quarterly dividend from $0.41 to $0.42, then increased it to $0.43 in Q3 and $0.48 in Q4. ARCC has also delivered an additional $0.12 through special dividends of $0.03 per quarter. The strongest dividend is one that has just been increased, and ARCC has demonstrated the strength of its dividend throughout 2022.

ARCC went public through an IPO at $15 per share in the fall of 2004. When 2022 concludes, ARCC will have paid $27.90 in dividends since it went public, which is 186% of its IPO price. ARCC has a long history of paying dividends and creating value for its shareholders. As rates are set to rise again, 2023 could be another strong year for dividend increases and special dividends being paid to shareholders. ARCC’s dividend track record is hard to replicate, and the special dividends are an added bonus on top of the 54 consecutive quarters of unchanged or growing dividends. ARCC is yielding just below 10% and it’s proven that it can generate large amounts of income throughout different economic cycles.

ARCC’s valuation

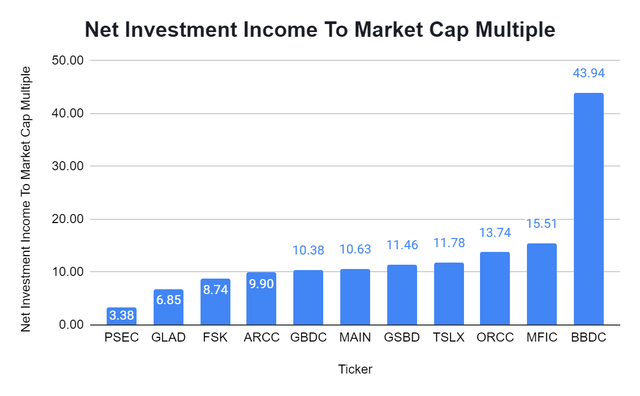

ARCC looks to be trading at an attractive valuation compared to its peers. Currently, ARCC trades at a 9.9x multiple on its NII, which is significantly lower than the 13.30x peer group average. If I was to exclude Barings BDC (BBDC), ARCC would still trade under the group average of 10.24x.

Steven Fiorillo, Seeking Alpha

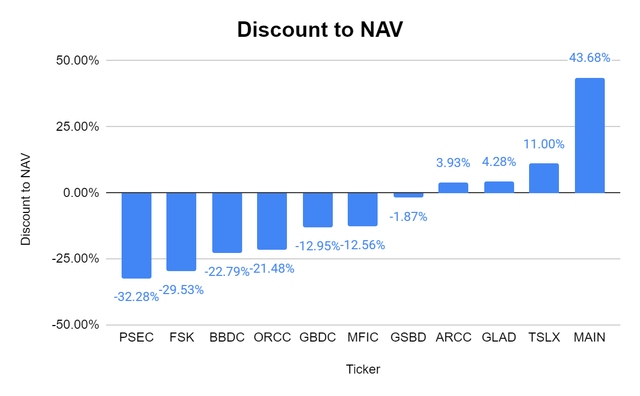

ARCC is trading slightly above its NAV at a 3.93% premium. Since I believe ARCC is the gold standard, I am willing to put a premium on its shares and buy them about the NAV.

Steven Fiorillo, Seeking Alpha

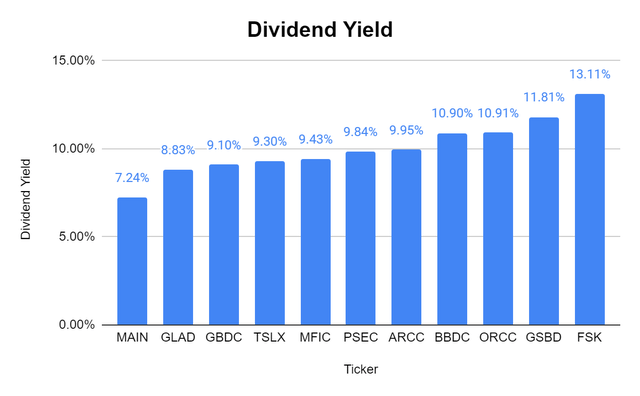

The peer group has an average dividend yield of 10.04%, and ARCC is right under this mark as it pays roughly 9.95%. When you add in the special dividend that ARCC generated, it puts them at around a 10.6% yield. When it comes to ARCC’s dividend, I am not concerned about it being under the peer group average due to ARCC’s track record. When a dividend is this large, I want to know that the dividend is secure and not at risk.

Steven Fiorillo, Seeking Alpha

Conclusion

A beat on the top and bottom line, with a 3rd dividend increase in 2022 and declaring its 4th quarterly special dividend of the year, is nothing to complain about. I believe ARCC just showed the investment community why so many investors look at them as the gold standard of BDCs. I believe ARCC is attractive under $20 as ARCC presents an opportunity for capital appreciation and income generation. I plan on adding more shares as I believe there will be opportunities for dividend increases and additional special dividends in 2023 due to ARCC driving value from rising rates.

Be the first to comment