Justin Sullivan

Thesis

We presented a post-earnings update in August, suggesting investors wait for a deeper pullback in SoFi Technologies, Inc. (NASDAQ:SOFI) stock before adding more positions. Despite the initial retracement following SoftBank’s (OTCPK:SFTBY) share sale, we posited that its post-earnings surge had not been digested. Therefore, SOFI’s price action was still ominously configured for a deeper fall before it could find more robust buying support. Consequently, SOFI has underperformed the market significantly, posting a return of -15% against the SPDR S&P 500 ETF’s (SPY) -3.3% gain since our previous article.

We are pleased to inform investors that we observed SOFI might have likely staged a near-term bottom, buoyed by the significant developments over the student loan forgiveness announced by President Joe Biden.

With the likely near-term bottom in SOFI, we are confident that downside should be limited from here, as buyers return to support its recovery momentum.

We revise our rating on SOFI from Hold to Speculative Buy and urge investors to use the current sell-off to add more positions. Our medium-term price target of $8 implies a potential upside of 26%.

SOFI’s Post-Q2 Earnings Spike Completely Digested

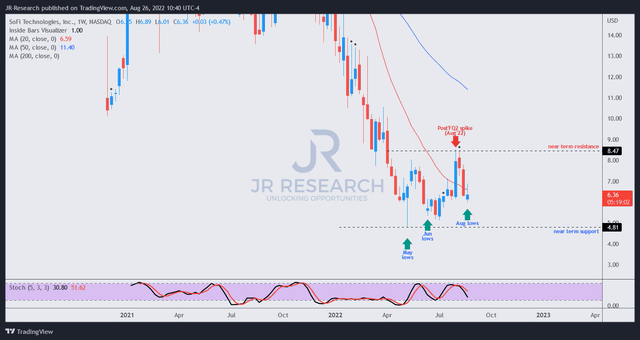

SOFI price chart (weekly) (TradingView)

As seen above, SOFI’s post-earnings momentum spike has been completely digested, as SOFI fell back to its late July lows. Therefore, we urge investors to be wary of chasing such momentum spikes, allowing astute investors to take profit and rotate their exposure. Furthermore, we cautioned that SOFI’s valuation was well-balanced at its August highs and, therefore, not attractive enough for a reasonable margin of safety.

However, despite the recent deep pullback, we are confident that SOFI’s May and June lows should be underpinned robustly. In addition, we are confident that the likely resumption of student loan payments in FY23 should help lift a significant overhang on SoFi’s highly profitable student loan segment.

Student Loan Refinancing Should Drive Demand

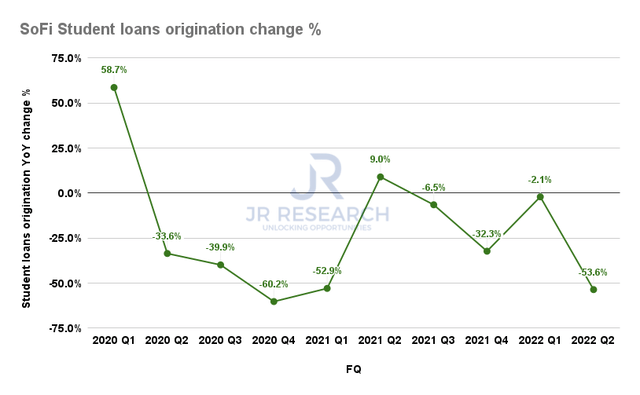

SoFi student loans origination change % (Company filings)

As seen above, SoFi’s student loan originations have suffered tremendously due to the ongoing moratorium. As a result, the company posted a 53.6% YoY decline in origination in FQ2. However, given the strong income base (average $170K weighted average income) of SoFi’s student loan segment, most of SoFi members should not be eligible to qualify for debt forgiveness.

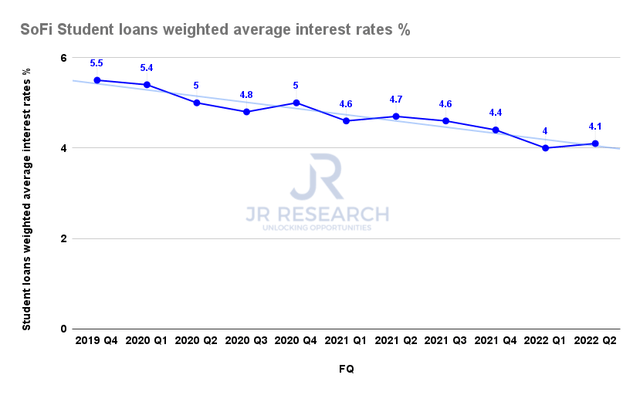

SoFi student loans weighted average interest rates % (Company filings)

As a result, the end of the moratorium by the end of 2022 should spur refinancing demand, helping SoFi benefit from a profitable segment, which could lift its adjusted EBITDA profitability trajectory.

As seen above, SoFi’s student loans’ weighted average interest rates have fallen markedly from their pre-COVID days. However, with the expected surge in refinancing demand, it should help improve its weighted average interest rates and SoFi’s EBITDA profitability into FY23, potentially lifting management’s guidance moving forward. Morgan Stanley also highlighted in a recent commentary, as it articulated:

Student loan repayments [are] now set to resume in January 2023 after two years of pause. This announcement is an important step towards removing a key overhang for SOFI, as an end to the moratorium should drive a surge in private student loan refi volumes in 2023. – Seeking Alpha

Is SOFI Stock A Buy, Sell, Or Hold?

As a reminder, management guided that the resumption of student loan payments would drive demand significantly moving forward. Therefore, we expect SoFi to lift its guidance for FY23 in its subsequent earnings call, as management accentuated:

As it relates to student loans, we, in our guidance and our outlook, still assume the moratorium will end until 2023. If it ends sooner, we’d expect the demand for that product to really go through the roof and be back to normalized levels that we saw in 2019 and Q1 of 2020 which, was over $2 billion of origination, and that would be a huge tailwind that allows us to step on the gas even more because it’s a really profitable business and high incremental profit margins. (SoFi FQ2’22 earnings call)

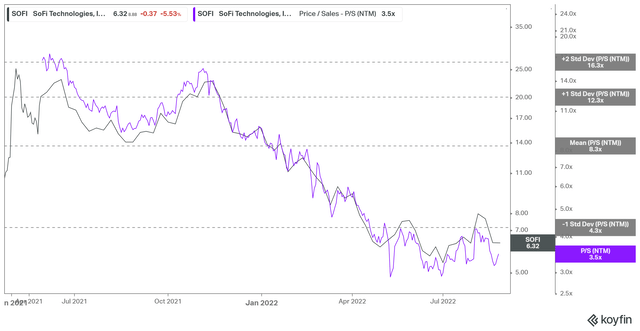

SOFI P/NTM Sales valuation trend (Koyfin)

As such, we are confident that SOFI’s valuation has been sufficiently de-risked, as it traded well below the one standard deviation zone below its mean at its May lows.

Coupled with an expected improvement in profitability guidance moving ahead, we postulate that buying sentiments should return to help re-rate SOFI robustly.

We revise our rating on SOFI from Hold to Speculative Buy, with a medium-term PT of $8.

Be the first to comment