Hispanolistic

A Quick Take On Alarm.com

Alarm.com Holdings (NASDAQ:ALRM) recently reported its Q2 2022 financial results on August 9, 2022, beating expected revenue and EPS estimates.

The company provides cloud-based security systems and intelligent automation functions to residential and commercial customers.

Given a likely negative economic environment for the next few quarters, I have a hard time seeing a meaningful upward catalyst appearing for Alarm.com.

As such, I’m on Hold for ALRM for the near term.

Alarm.com Overview And Market

Tysons, Virginia-based Alarm.com was founded in 2000 to offer a range of security and other intelligent building services in the U.S. and internationally.

The firm is headed by Chief Executive Officer Stephen Trundle, who was previously Chief Technical Officer at MicroStrategy (MSTR) and MDI at Bath Iron Works.

The company’s primary offerings include:

-

Security & Safety

-

Video Monitoring

-

Home Management

-

Wellness

-

Access Control

-

Energy Management & Temperature Monitoring

-

Multi-location Management

The firm acquires customers via direct sales for large accounts, through partners and resellers and via its website.

According to a 2021 market research report by Verified Market Research, the global market for alarm monitoring was an estimated $48.9 billion in 2019 and is forecast to reach $68.6 billion by 2027.

This represents a forecast CAGR of 5.0% from 2020 to 2027.

The main drivers for this expected growth are an increase in adoption of security systems in residential and commercial facilities due to insurance rate reductions and more capable system offerings at lower prices.

Also, the market for monitoring is increasingly fragmented, with new service providers such as Google and Amazon entering the market for various types of consumer-oriented monitoring solutions.

Alarm.com’s Recent Financial Performance

-

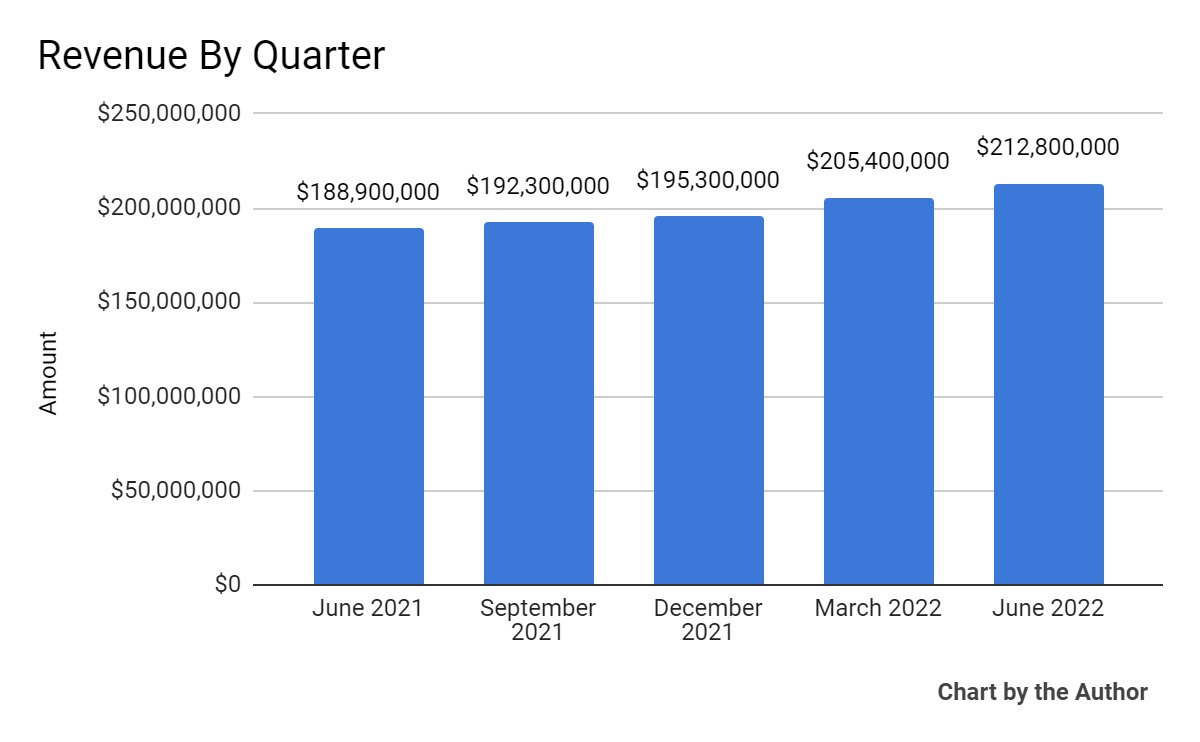

Total revenue by quarter has trended higher in recent quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

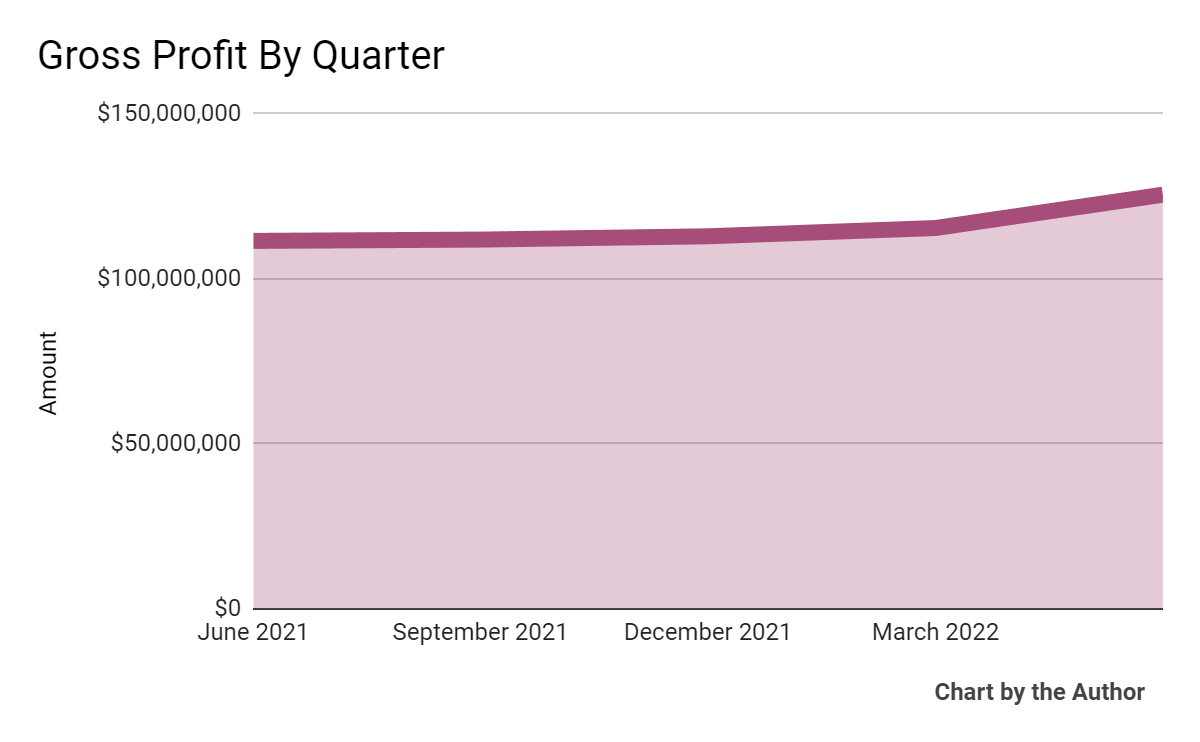

Gross profit by quarter has trended upward in a similar trajectory to that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

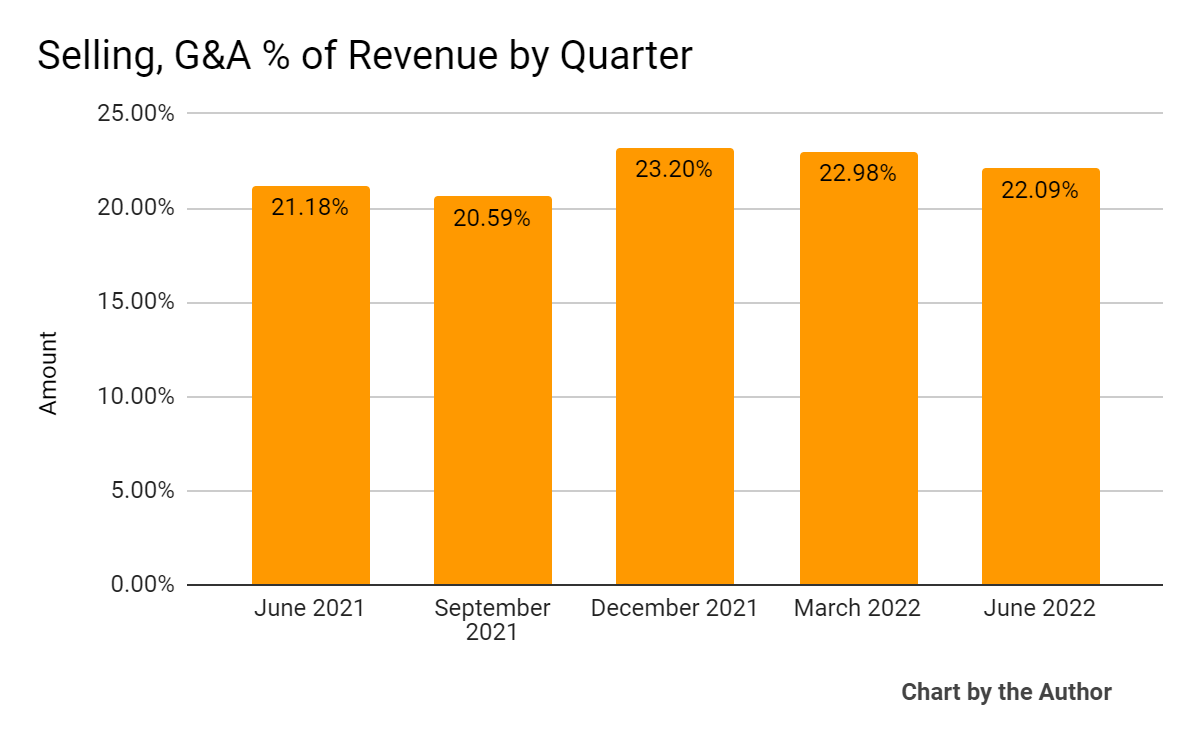

Selling, G&A expenses as a percentage of total revenue by quarter have remained within a fairly limited range:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

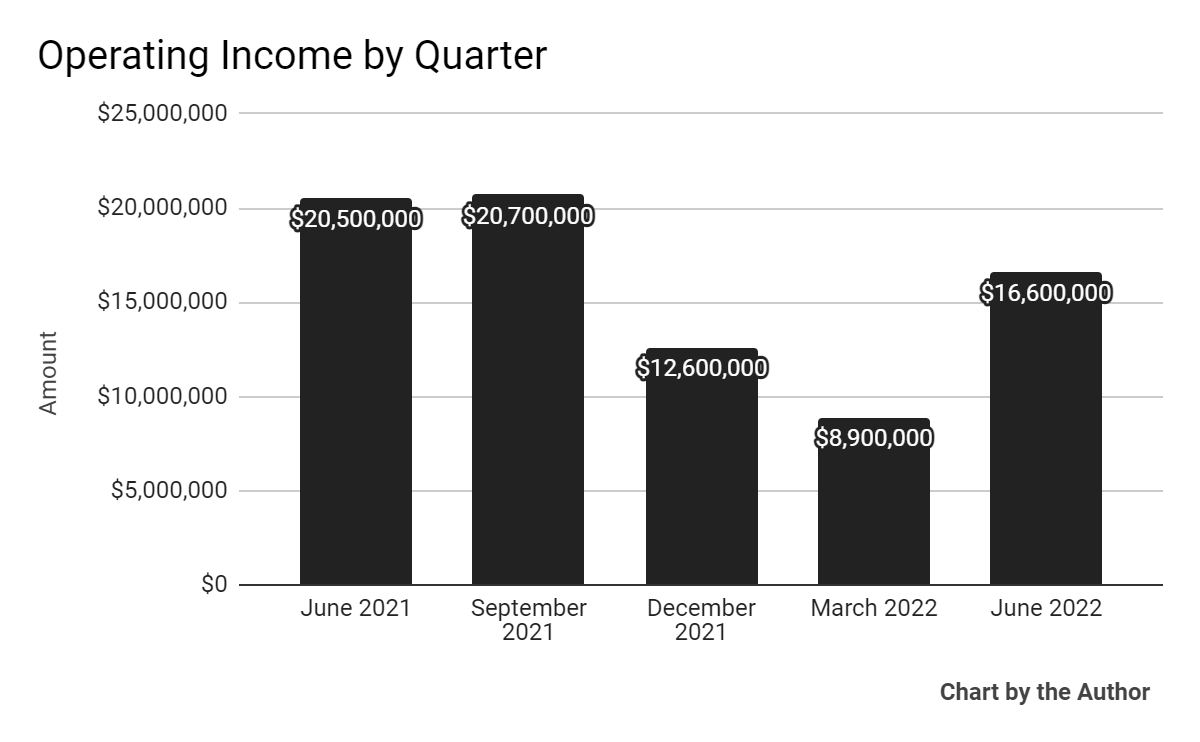

Operating income by quarter has fluctuated as follows:

5 Quarter Operating Income (Seeking Alpha)

-

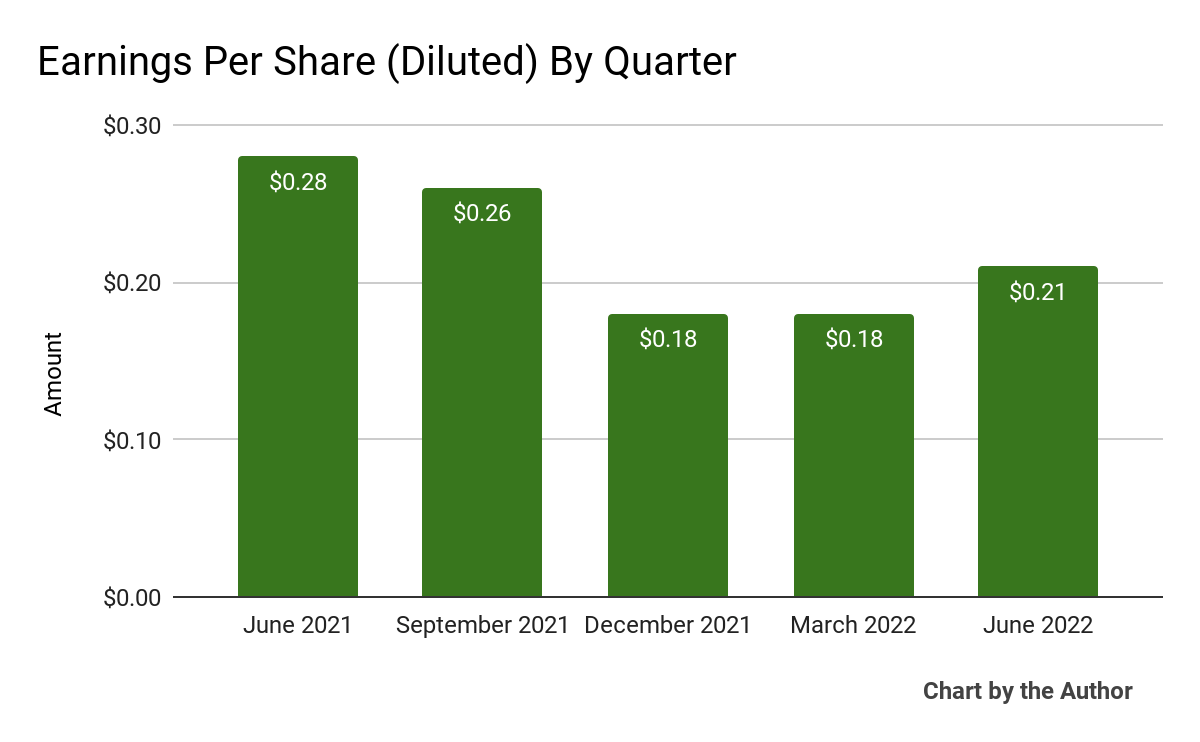

Earnings per share (Diluted) have remained positive in recent quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

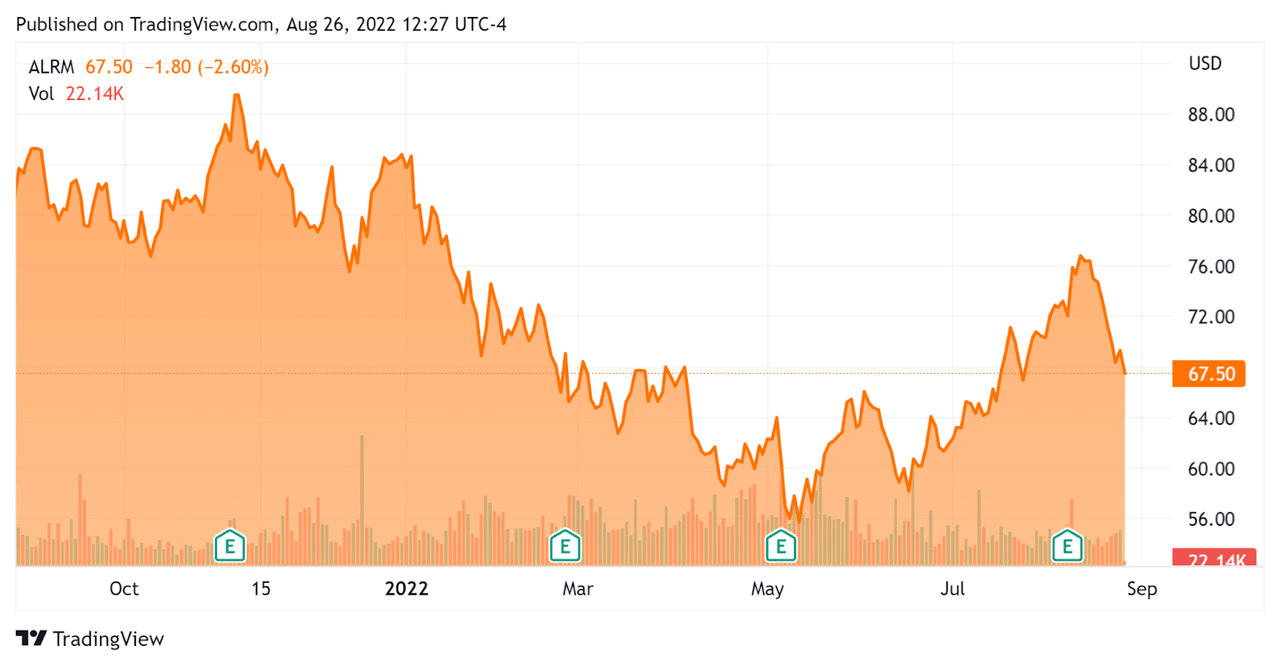

In the past 12 months, ALRM’s stock price has dropped 16.9% vs. the U.S. S&P 500 index’s fall of around 8.7%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Alarm.com

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

4.16 |

|

Revenue Growth Rate |

17.5% |

|

Net Income Margin |

5.3% |

|

GAAP EBITDA % |

10.4% |

|

Market Capitalization |

$3,450,000,000 |

|

Enterprise Value |

$3,350,000,000 |

|

Operating Cash Flow |

$70,110,000 |

|

Earnings Per Share (Fully Diluted) |

$0.83 |

(Source – Seeking Alpha)

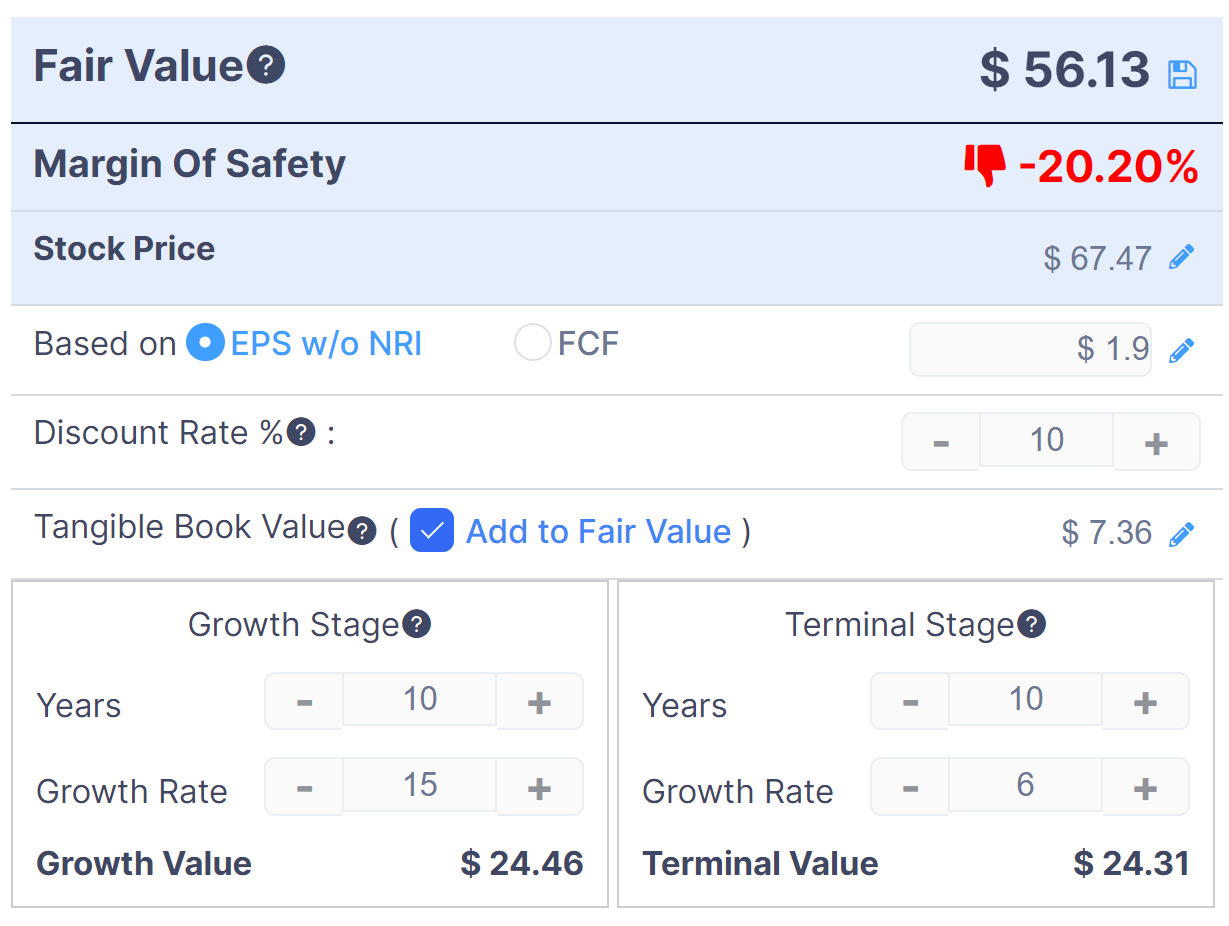

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

ALRM Discounted Cash Flow (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $56.13 versus the current price of $67.47, indicating they are potentially currently overvalued, with the given earnings, growth and discount rate assumptions of the DCF.

As a reference, a relevant partial public comparable would be ADT (ADT); shown below is a comparison of their primary valuation metrics:

|

Metric |

ADT |

Alarm.com |

Variance |

|

Net Income Margin |

-0.41% |

5.29% |

–% |

|

Revenue Growth Rate |

11.9% |

10.4% |

-13.0% |

|

Operating Cash Flow |

$16,900,000 |

$70,110,000 |

314.9% |

|

Enterprise Value / Sales |

2.9 |

4.2 |

42.5% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

Although the company isn’t a pure software firm, ALRM’s most recent GAAP Rule of 40 calculation was 27.9% as of Q2 2022, so the firm needs some improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

17.5% |

|

GAAP EBITDA % |

10.4% |

|

Total |

27.9% |

(Source – Seeking Alpha)

Commentary On Alarm.com

In its last earnings call covering Q2 2022’s results, management highlighted its ‘growing momentum in commercial markets’ in North America.

For its residential smart home customers, the company also introduced ‘Smart Arming’, to automatically arm and disarm the security system based on home activity, utilizing both user input and system sensing to adjust system parameters.

In its commercial segment, the company launched smartphone access to locked doors instead of key cards or fobs. System administrators can more easily provision and manage access credentials without providing a physical item to the user.

Management believes the SMB opportunity for its services is up to 5.5 million business properties in the U.S. and Canada alone, and that these prospects have the potential to offer a significantly higher ARPU (Average Revenue Per User) than the residential market.

As to its financial results, total revenue rose 12.7% year-over-year, and the SaaS and license revenue component grew at a faster rate of 14.4% and accounted for nearly 61% of total revenue.

Management did not disclose its net dollar retention rate, an important metric to determine its customer churn and sales & marketing efficiency.

R&D expenses rose due to increased employee-related expenses but sales and marketing costs were slightly lower as a percentage of revenue, year-over-year. G&A expenses grew as the firm expanded its facilities for growth reasons.

For the balance sheet, the firm finished the quarter with $643.4 million in cash and equivalents and long-term debt of $489 million. For the four quarters just ended, ALRM generated free cash flow of $40.1 million.

Looking ahead, for full year 2022 management increased revenue guidance slightly to $838 million at the midpoint, representing an increase of 11.8% over 2021 if achieved.

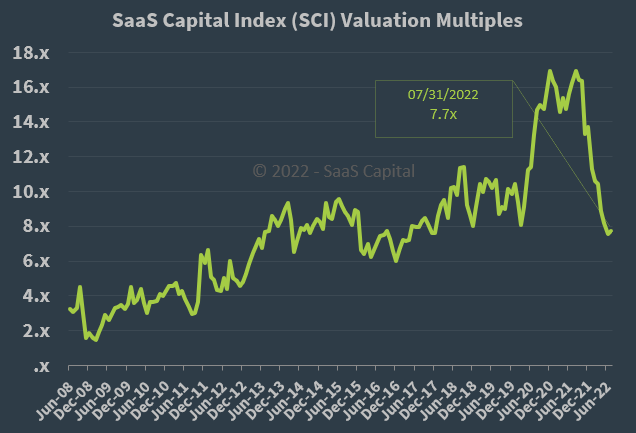

Regarding valuation, the market is valuing ALRM at an EV/Sales multiple of around 4.2x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.7x at July 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, ALRM is currently valued by the market at a discount to the SaaS Capital Index, at least as of July 31, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

An upside catalyst would be better than expected growth in the commercial segment, with its higher ARPU potential.

With a higher cost of capital environment due to rising interest rates, the firm’s valuation multiple may be reduced as the U.S. Federal Reserve maintains downward pressure on economic conditions.

Recently, ALRM has rallied as investors have assumed a higher potential for Fed easing, but those hopes appear to be dashed for now.

Given a likely negative economic environment for the next few quarters, I have a hard time seeing a meaningful upward catalyst appearing for Alarm.com.

As such, I’m on Hold for ALRM for the near term.

Be the first to comment