valentinrussanov

After getting stomped in 2022, Tech bounced back big time in 2023, gaining over 50%. Tech is also the leading sector so far in 2024, up nearly 8%.

If you’re an income investor, you may have lamented the fact that the Tech sector doesn’t offer attractive dividends. However, you can circumvent that via investing in Tech-related funds.

2 such funds are BlackRock Science And Technology Trust (NYSE:BST) and/or its sister fund, BlackRock Science and Technology Term Trust (BSTZ). These are both closed-end funds, known as CEFs.

Fund Profiles:

BST is a perpetual CEF, with the investment objectives of providing income and total return through a combination of current income, current gains, and long-term capital appreciation. Under normal market conditions, BST will invest at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market cap range. BST’s management sells covered call options on a portion of the common stocks in its portfolio. (BST site)

BSTZ is a limited-term CEF. BSTZ began operations in June 2019, with the investment objectives of providing total return and income through a combination of current income, current gains, and long-term capital appreciation. BSTZ normally invests at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market cap range, selected for their rapid and sustainable growth potential from the development, advancement, and use of science and/or technology. BSTZ’s management also sells covered calls on part of its portfolio. (BSTZ site).

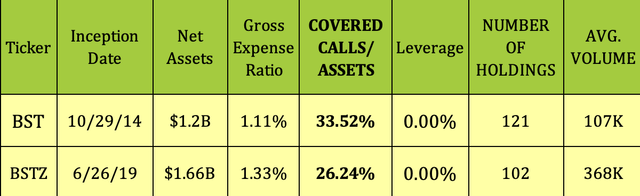

BST started operations in October 2014, while BSTZ began in June 2019.

As mentioned above, both funds sell covered calls on their holdings, in order to generate income for their investors – As of 12/31/23, BST had 33.52% of its portfolio overwritten with call options, while BSTZ had 26/24% overwritten.

BSTZ has a bigger asset base of $1.66B, vs. $1.2B for BST. It also has a much higher average daily volume than BST, at 368K, vs. 107K for BST. Neither fund uses leverage.

Holdings:

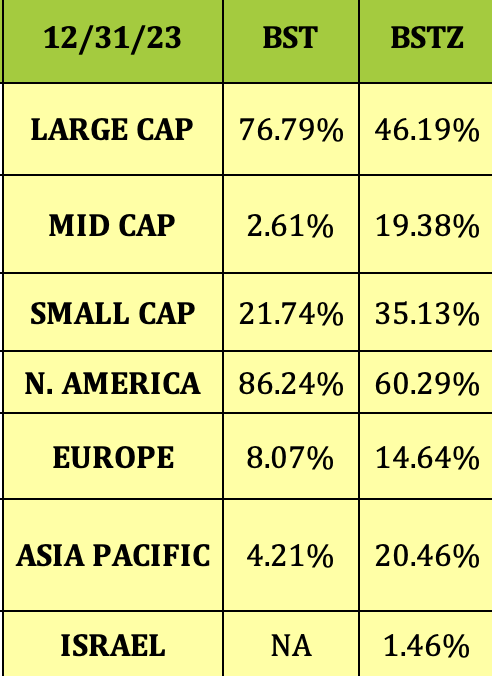

BST favors large caps, with a ~77% exposure, and small caps, with a ~22% exposure, while BSTZ is more evenly split between large caps, at 46%, and small caps, at 35%, in addition to holding 19% in mid-caps.

BST’s portfolio has much more exposure to North America, at 86%, vs. 60% for BSTZ; whereas BSTZ has more exposure to Asia Pacific, at over 20%, vs. just 4% for BST. European tech firms also figure more heavily in BSTZ’s portfolio, at 14.6%, vs. 8% for BST:

Hidden Dividend Stocks Plus

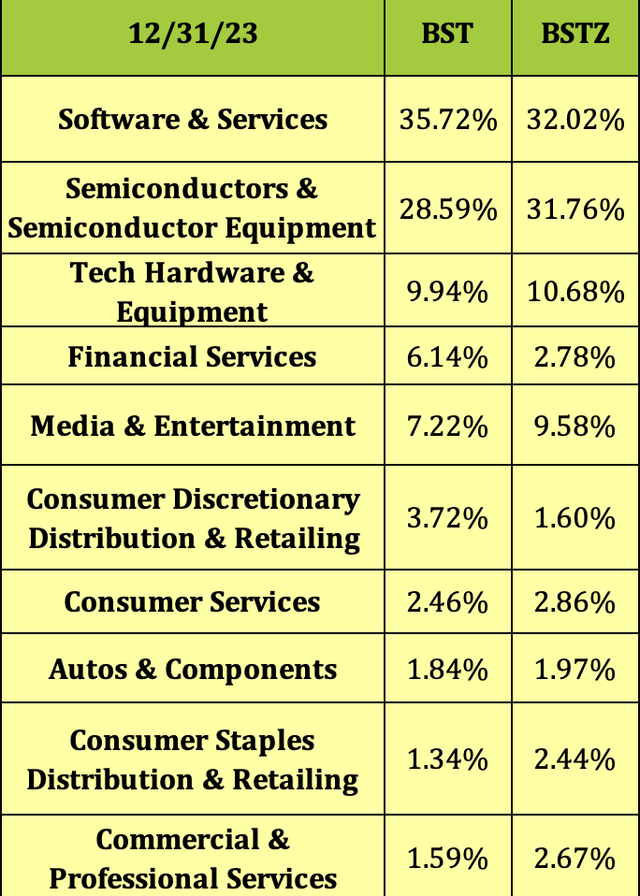

Both funds’ top 3 industry exposures are similar, with Software & Services, Semiconductors & Semiconductor Equipment, and Tech Hardware & Equipment dominating both portfolios, at ~74%.

BST has a heavier weighting in Financial Services, at 6%, vs. 3% for BSTZ, while BSTZ has more exposure to Media & Entertainment, at 9.6%, vs. 7% for BST.

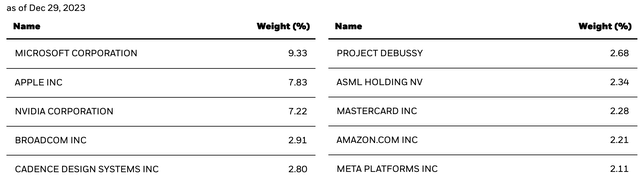

As you might expect, with its heavy large-cap weighting, BST’s top 10 positions include many familiar Tech names, such as Apple, Microsoft, and NVIDIA. These top 10 holdings comprise ~41% of BST’s portfolio:

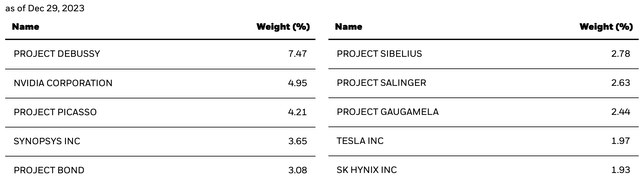

BSTZ’s top 10 features lesser-known tech names, although Tesla and Synopsis are included, and it comprises ~36% of BSTZ’s portfolio:

Dividends:

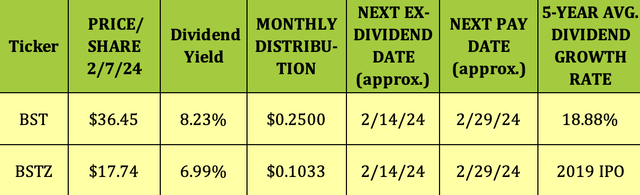

Both BST and BSTZ pay monthly distributions.

At its 2/7/24 closing price of $36.45, BST yielded 8.23%. It goes ex-dividend next on 1/24/24, with a 2/29/24 pay date. BST has an impressive 5-year dividend growth rate of nearly 19%, due to a big 107% rise in 2021. Management raised the monthly payout from $.226 to $.25 in Q4 2021.

BSTZ decreased its dividend in March ’23 from $.1920 to $.1613, and cut it again in October ’23, down to $.1032. In early September, ’23, BlackRock announced that BSTZ would pay monthly distributions to shareholders at an annual rate of 6% of the Fund’s 12-month rolling average daily NAV.

At its 2/7/24 closing price of $17.74, BST yielded 6.99%.

Taxes:

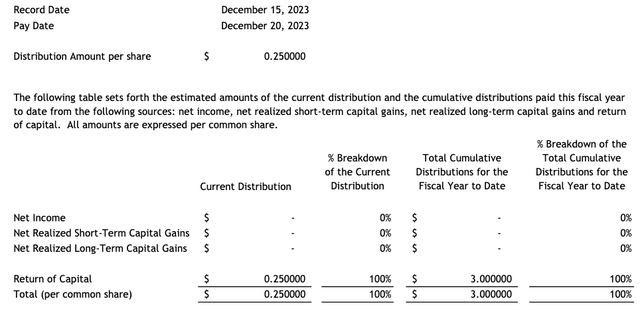

BST’s 2023 distributions were estimated to be 100% Return of Capital – ROC.

ROC offers you a tax deferral advantage, but it lowers your tax basis, so your tax liability is affected when you sell.

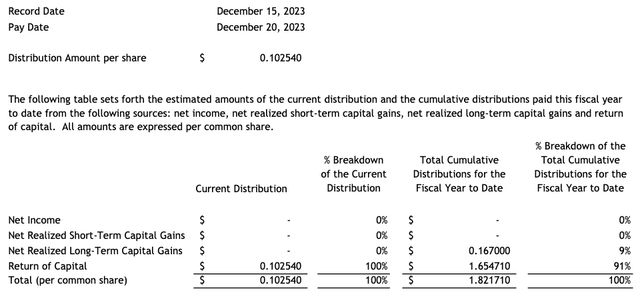

BSTZ’s 2023 distributions were estimated to be comprised of 9% in long-term capital gains, and 91% Return of Capital:

Performance:

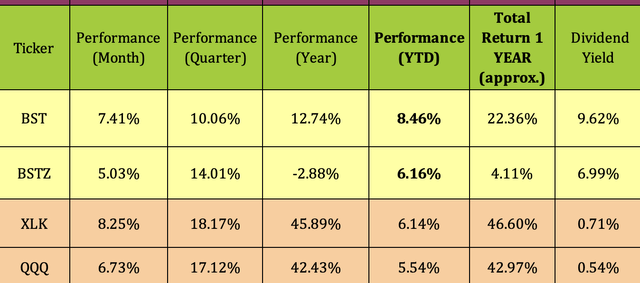

BST has outperformed BSTZ by a wide margin over the past year on a price and total return basis. Both funds have lagged behind the surging Tech sector and the NASDAQ 100 by a great deal over the past year.

So far in 2024, BST is up 8.5%, while BSTZ is up 6.2% – a bit better than the Tech sector’s 6.1% rise and the NASDAQ’s 5.5% price gain, as of the 2/7/24 close.

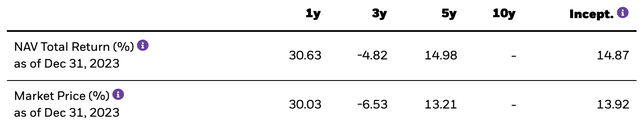

Longer term, as of 12/31/23, BST has a 5-year NAV return of ~15%, but a 3-year NAV return of -4.82%, due to the Tech drubbing of 2022. Its NAV return from inception is ~15%, a bit higher than its price return of 13.92%.

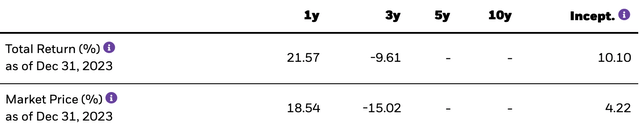

BSTZ’s 3-year NAV return is lower than BST’s, at -9.6%, as is its 1-year NAV return of 31.57%. Its NAV return from inception is ~10%, whereas its price return is just 4.2%:

Valuations:

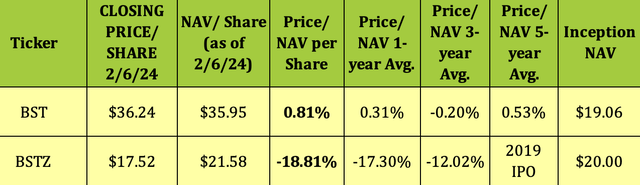

Buying CEFs at a deeper than historical discount can be a useful strategy, due to mean reversion. NAV/share values are calculated after the market closes each day.

As of the 2/6/24 close, BST was selling at a small 0.81% premium to its NAV, which is higher than its 1-, 3-, and 5-year average prices to NAV.

When we last covered BST, in October 2023, it was selling at a 1.25% discount, at a price of $31.65. Since then, it has gained 14.5%.

BSTZ, however, was selling at an 18.8% discount to its NAV/Share, which is a much deeper discount than its 3-year average 12% discount, and is also deeper than its 1-year 17% discount to NAV/share.

BSTZ was selling at a 23% discount back in October ’23, at a price of $15.63. It has gained 12% since then.

Parting Thoughts:

While both funds struggled in the rising interest rate year of 2022, BST offers a better distribution track record. We advise waiting for a discount to NAV before buying BST.

BSTZ is selling at a deep discount and should perform better when interest rates eventually decline. We rate BSTZ a speculative buy for patient investors- it may take a while for its “cutting edge tech stock” investing strategy to pan out.

All tables are furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment