onfilm/iStock Unreleased via Getty Images

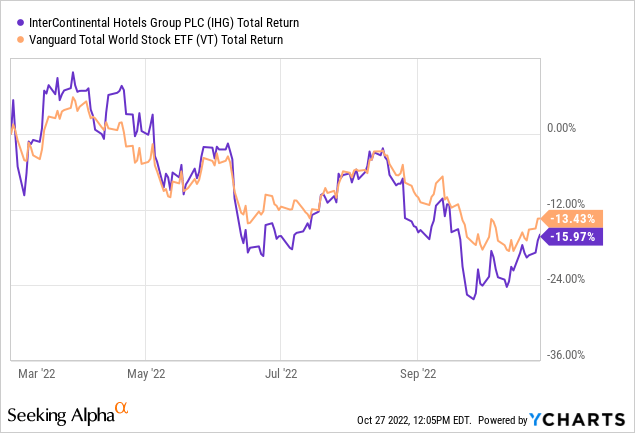

I had somewhat mixed views on InterContinental Hotels Group (NYSE:IHG) when I first covered the stock back in March. There was nothing wrong with the long-term outlook, but with the then stock price already baking in a full post-COVID recovery and the near-term outlook set to sour due to events in Ukraine, it didn’t strike me as an obvious buy. These shares have since fallen around 15%, albeit that reflects the more general decline in global stocks rather than anything company-specific.

This puts IHG in a much more interesting position than it was back in early March. The company has notched up a couple more quarters of recovery-driven growth since then, and while the macro environment is obviously getting gloomier for consumer discretionary firms, the continuing return to pre-pandemic travel trends should more than absorb that over the coming year or two. With the sell-off putting these shares on a healthier-looking forward valuation, I’m upgrading IHG to long-term ‘buy’.

Recovery Continuing Nicely

2022 was always going to be a year of recovery-driven growth for the global lodging industry, and at IHG that recovery looks to be chugging along quite nicely based on its recently released third quarter trading update.

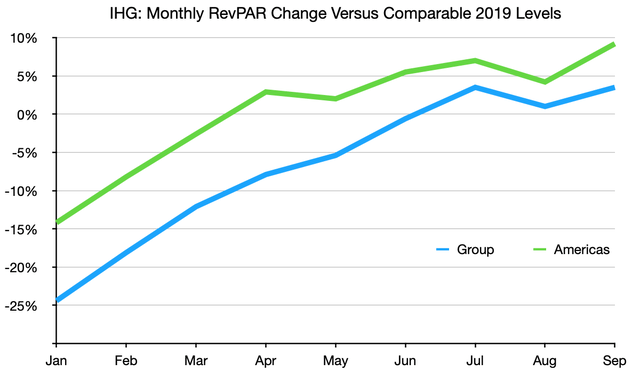

Q3 2022 marked a big milestone for the company, with global revenue per available room (“RevPAR”) finally inching past pre-COVID levels for the first time. Group RevPAR came in at $87.37, up nearly 28% on the year-ago period and nearly 3% on the comparable period in 2019 (both figures presented at constant exchange rates). That was driven by strong growth in the average daily rate, which at $129.29 was up almost 13% year-on-year and just over 11% versus 2019 levels, and helped offset still-softish occupancy, which at 67.6% remained 5.8 points below pre-COVID levels albeit on an improving trend.

Data Source: IHG Q3 2022 Trading Update

Digging a little deeper, there were bright spots in areas that were still weak back in the first quarter. That includes Europe, with the group’s wider EMEAA (Europe, the Middle East, Asia & Africa) segment virtually back to pre-COVID RevPAR levels (EMEAA RevPAR was just 0.1% below 2019 levels in Q3). Greater China also booked another quarter of sequential improvement. RevPAR for the region remained 20% below 2019 levels – a marked improvement on both Q2 (49% below 2019 levels) and Q1 (42% below 2019 levels).

The Americas remains the engine of the recovery, helped by its largely domestic travel mix and high share of total group rooms. Americas RevPAR was up 6.8% on 2019 levels in Q3, and the occupancy rate was just 3.4 points below pre-pandemic levels.

Long-Term Outlook Solid; Short Term Slightly Less So

Low levels of unemployment have aided the post-COVID recovery here:

Employment levels globally remain high, which supports occupancy levels that are 8 percentage points up on last year and now just 6 percentage points below 2019.

With that in mind, mounting fears of a global recession will undoubtedly weigh on sentiment, given IHG and the broader lodging industry’s sensitivity to economic conditions.

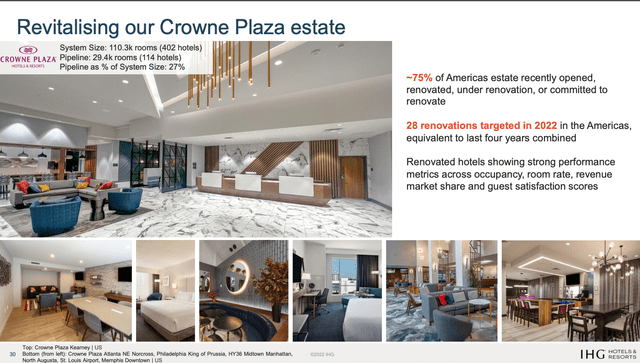

While that makes for a more uncertain near-term outlook here, there are some offsetting features that can work in IHG’s favor. Firstly, IHG’s hotel estate skews to the Americas, with over 50% of group-wide rooms situated in the United States. The US obviously isn’t immune to the worsening macro environment, but it is in a much better place than Europe, which only represents around 13% of total group rooms here. The recent revamp of the company’s Crowne Plaza and Holiday Inn brands in the region should help in that respect too, with renovated hotels typically sporting higher occupancy levels and room rates.

Source: IHG 2022 Half Year Results Presentation

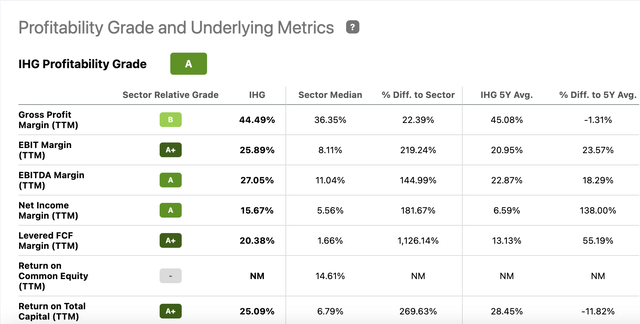

Secondly, and in line with other industry leaders, IHG’s high return on capital fee-based business model will allow it to absorb a downturn while remaining highly profitable. Note that the company scores an ‘A’ on Seeking Alpha’s Profitability Grade and an ‘A+’ for return on total capital specifically. Finally, there is still a significant degree of recovery-fueled growth left in H1 2023 given the relatively soft 1H 2022 (versus pre-COVID levels).

Source: Seeking Alpha IHG Profitability Tab

I remain bullish in the long run. IHG benefits from a number of advantages, including structurally higher growth prospects for branded hotels, which typically yield higher occupancy rates than independents. Third party hotel managers can tap into company loyalty programs, for example, with IHG’s own loyalty program topping 100 million members. As per the company, loyalty program members typically spend more and represent a more profitable source of guests for hotel owners:

Our members drive around half of all room nights globally each year and spend 20% more in our hotels than non-members. They are also nine times more likely to book direct, which is more profitable to our owners.

Many existing independent hotels are likewise opting to convert over to branded names for the same reason, as evidenced by the relatively fast rollout of IHG’s newer brands like voco and Vignette.

Shares Now Comfortably Undervalued

IHG ADRs currently trade for a little over $55 apiece in New York trading, putting them at around 20x estimated 2022 EPS and 16.5x estimated 2023 EPS. I’m modeling high single digit RevPAR growth here in the medium term, with that based on circa 3-4% annualized room growth plus similar growth in average daily rate and a gradual return to pre-COVID occupancy rates. Operating margins expanding into the 20%-plus area can drive double-digit annualized free cash flow growth.

Discounting that back to the present gets me to a fair value in the low $70s per ADR range, or ~33% above the prevailing price. Knocking medium-term free cash flow growth down a couple of points still lands a fair value of around $65, or ~20% above the current ADR price. Buy.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment