alvarez

The iShares MSCI Germany ETF (NYSEARCA:EWG) is a good way to get exposure to the industry heavy German economy. But do you want that exposure right now? The answer is no. It is a gas dependent nation, and the struggle to wean themselves off Russian gas is going to get real serious when winter comes. Pessimism is already high with households getting pressured by inflation. Winter will make it a lot worse. We think the pain continues for Germany and EWG which has already declined 30% YTD.

EWG Breakdown

The top holdings in the EWG are several very familiar German stalwarts like SAP (SAP), which has its tendrils reaching out to most of the world’s large-cap backends. Other industrial giants make the list, as well as major insurance houses like Allianz (OTCPK:ALIZF). Mercedes (OTCPK:MBGAF) is another industrial element (more consumer discretionary really) that makes the list.

Germany is a relevant global economy and the EWG’s largest holdings are not exposed to just local markets, but all of Europe. Still, the issues of Germany mirror the rest of Europe, although possibly it’s more acute since it was previously more involved with Russia than the typical European nation. In Germany they are already beginning to warn about unrest and the need for rationing. Sounds like wartime to me. Germans are already starting with cold showers and doing what’s necessary to try to make the current gas supplies last.

Economy

From an economic point of view, we are beginning to see a convergence to Germany in terms of economic issues, with it being Europe’s largest economy. France also joins the fray with its economy shrinking, more than Germany’s actually. The reasons are much the same. Business confidence in Europe is falling a lot and it’s coming from consumers, with retail the first line of defense against the economic decline. The culprit is the same which is inflation, again primarily energy costs inflation which is beginning to meaningfully effect household finances.

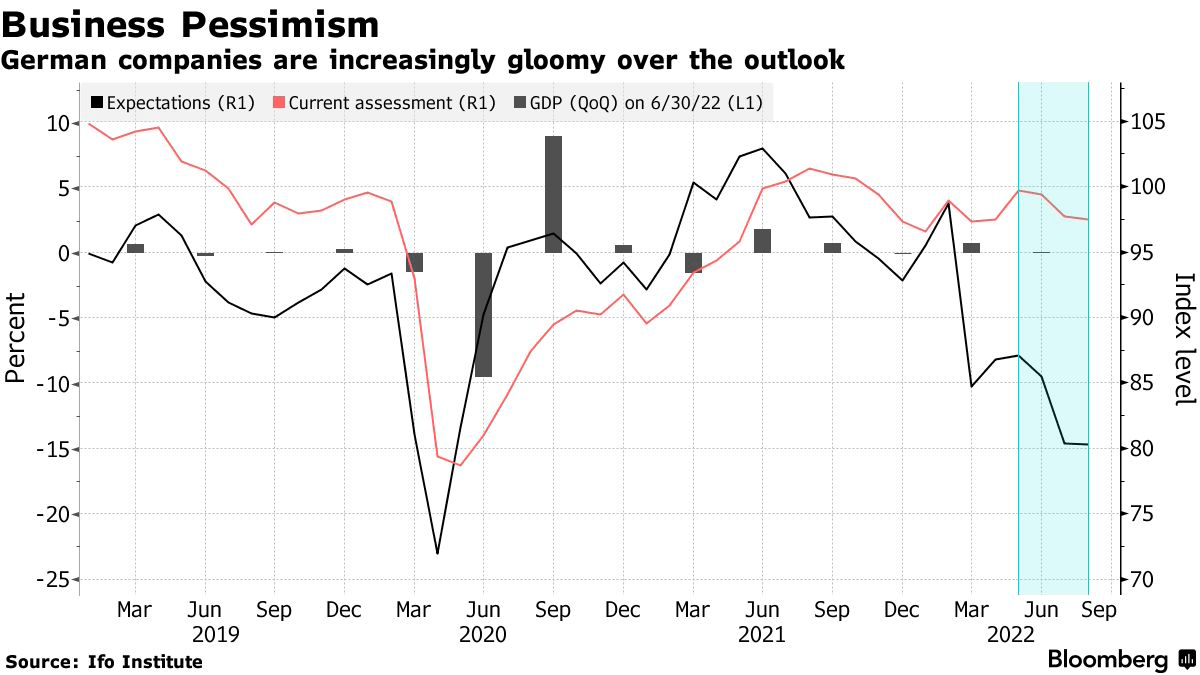

Business Confidence (Ifo Institute through Bloomberg)

They’re about as bad as they were in March 2020, so can’t get much worse, but the problem is that they are likely justified. The intensity of energy consumption in winter is so much more than in the spring and summer months. It varies by geography but in continental climates it can grow by about 50%. The measures that households are going to have to take are going to be a lot more severe.

Nations aren’t doing nothing. Now LNG imports (from the US) are more than gas from Russia for the first time in history, and terminals have admittedly been filling a lot, now taking 70% of European terminaling capacity. This will help ensure that the worst of centralized rationing doesn’t occur. But Europe is paying very dearly for the sanctions imposed on Russia and the direct support of Ukrainian war efforts, while energy companies, and currently the US current account deficit, are getting a major reprieve. Households will continue to be impoverished by this, especially lower income households.

Conclusions

EWG’s companies are mostly corporate facing businesses, and the larger exposures are heavily internationalized. But in all cases the European market will matter, which includes with significant skew the German market. When households in Europe crimp spending in the winter, consumption declines will only get more severe. Currently, despite everything, employment continues to rise in Germany, much like it has in other geographies, but if consumption declines continue and have a reckoning on corporate profits people will lose their jobs and things will just get much worse.

Consumer discretionary is 16% of the portfolio, an industrial about 17%, both of these are levered to household consumption. IT, materials which together account for another 18% of the portfolio, should also suffer once corporates start paying the price of reduced spending. The LTM P/E is 11x signaling these low expectations, and rightly so. YTD declines are currently about 30%. In the longer term, this will surely seem an excessive decline to levy against the German economy. But the issue with energy costs being high is a protracted issue that depends on political action. It is unlikely to come to an end in the near term, and there is no market economy solution to this. Risks are high for the stock. While a 30% decline likely accounts for the value destroyed by having to find a new source of scarce gas, sentiment could get worse. We’re not playing in this market.

Be the first to comment