Tom Werner/DigitalVision via Getty Images

Express (NYSE:EXPR) is an American apparel retailer with approximately 560 stores in the country. The company became a meme stock in 2021 and has fallen 85% from its June 2021 high.

EXPR has been posting accounting losses but is now at revenue levels similar to those generated in 2019. Additionally, EXPR is generating more cash than its accounting losses suggest, because of higher depreciation than capital expenditures.

EXPR is heavily leveraged, with a term loan and a credit facility for a total of $200 million maturing in May 2024. The company also has operational leverage, generated by its mandatory lease and payroll payments. In my opinion, EXPR could also improve its SG&A expenses, which seem too high.

Coupled with a cyclical industry like apparel retailing, EXPR seems a risky proposition for an uncertain economic context. I show with a financial model that the difference between EXPR failing to pay its fixed charges or generating a $10m free cash flow is as little as 10% revenue.

However, in a more positive economic context, EXPR can become an interesting company to own for the long term if its stock’s price remains depressed.

Note: Unless otherwise stated, all information has been obtained from EXPR’s filings with the SEC.

Industry characteristics

In terms of customers, apparel retailing is an industry where some companies can build a moat while others have to compete on a more commoditized basis. Depending on how much the company builds a brand, its products will seem either special or common to customers.

In my opinion, EXPR seems to position itself closer to the commoditized spectrum. There are several data pieces pointing in that direction. First, the company mentions on its 10-K report that it offers a value proposition to customers. It also mentions that it follows trends rather than creating them and that it uses the services of purchase agents instead of designing its product in-house. Second, its advertising expenditures are low compared to revenue, representing approximately 5% of sales. Third, 200 out of 560 stores are outlet stores. Finally, a quick google search for ‘Is Express clothing expensive’ shows that most forum participants find it either cheap or value priced and that the company is constantly offering discounts on its products.

On the supply side, EXPR is a price taker. The company has no manufacturing facilities. Rather, the company purchases products from 70 vendors, mostly in Asia and Latin America, and outsources its logistics to third parties. In this respect, EXPR may have some bargaining power, but not too much. It may be able to obtain better pricing on volume but nothing that deviates from what the same vendors can obtain from other customers.

In terms of its sales structure, EXPR faces competitive and commoditized markets, also being a price taker. For its stores, all of which are leased, the company has to pay a price that is determined by supply and demand in each particular location. The company’s employees are not particularly qualified, and their bargaining power will vary depending on how constrained labor supply is in general.

This all signifies to me that EXPR will compete on the basis of cost and that a significant portion of costs will not be under its control but will rather be determined at the market level (merchandise, rents and wages).

Finally, the apparel industry is cyclical. If disposable income falls, people will purchase less clothing. It is true however that apparel may be positively influenced by substitution forces as well. In plain terms, this means that when the customer’s income falls, apparel consumption may fall less than other discretionary goods because apparel absorbs the income previously used in more expensive consumptions. As an example, if someone is marginally unable or unwilling to buy a new car or go on vacation this year, that person’s disposable income for apparel actually increases. That consumer might even be more motivated than before to purchase apparel, or to go to restaurants (discretionary but less costly consumptions) in order to compensate for the foregone pleasures.

Express’ operations and cost structure

Express participates in the relatively commoditized end of its industry, and most of its costs are not under its control. This means that in order to be profitable, the company has to squeeze pieces of margin from everywhere it can but particularly from costs under its control.

I cannot say that I am happy with the results of analyzing EXPR’s cost structure. At the merchandise level the company does relatively well, but at the SG&A level its expenses are high.

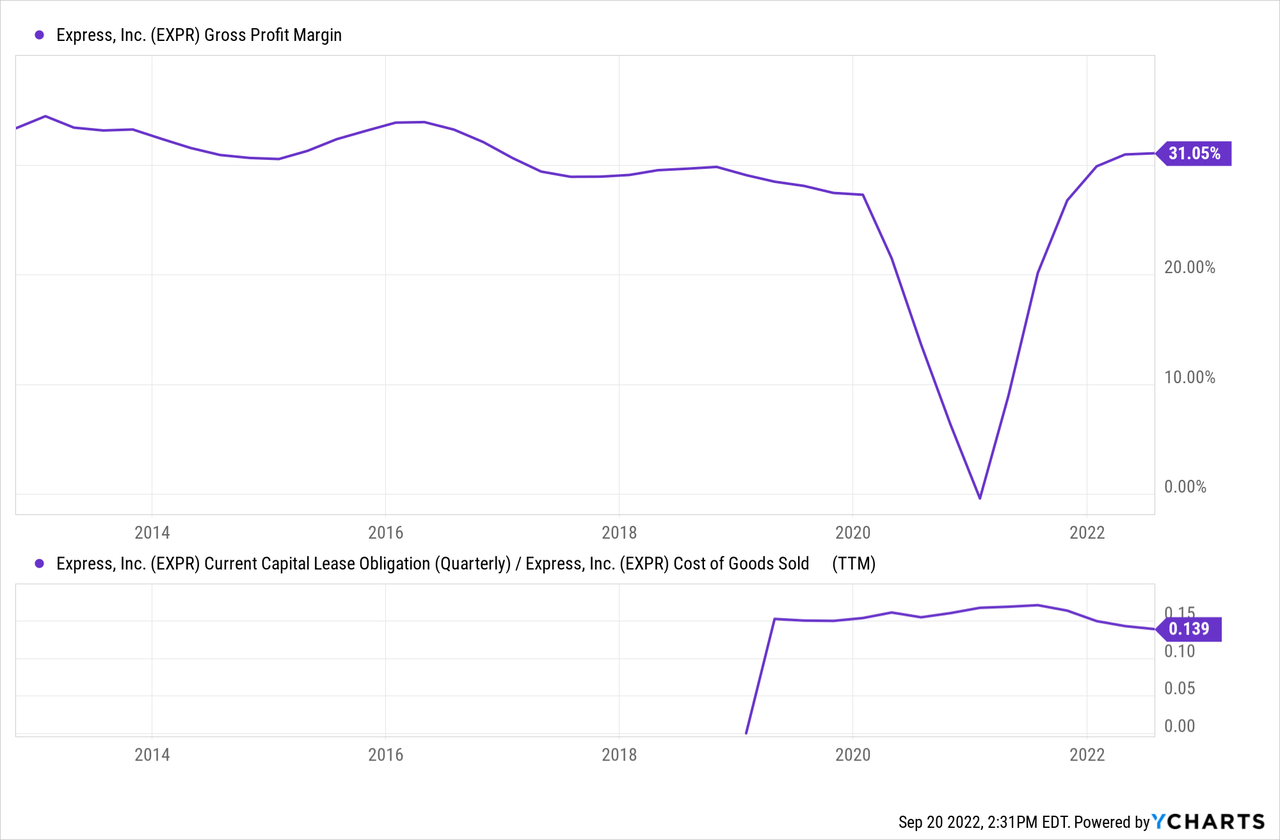

EXPR has had an average gross profit margin of 30%. However, the company recognizes store lease costs on Cost of Goods Sold. I think this is incorrect, because these costs are related to sales and because they are fixed while CoGS should concentrate on the variable portion of costs.

As the second chart below shows, a year of store rent payments (proxied through current capital lease obligations) has generally been around 15% of CoGS. This means that after removing lease costs, EXPR’s gross profit margin is closer to 40%.

This margin is high, also taking into consideration that it includes all inbound and outbound logistic costs, deposit costs and all purchasing, designing and sourcing costs.

EXPR’s problem appears at the SG&A level. The company has averaged $550 million in SG&A expenses for the past 10 years, unable to generate more profits by reducing these expenses, not even in the face of the pandemic.

SG&A expenses are composed mostly of corporate, store personnel payroll and advertising. The company spends about $130 million in advertising, leaving $420 million for payroll and corporate expenses. Considering the company has 3 thousand full-time workers and 7 thousand part-time workers, we arrive at an approximate average salary of $65 thousand a year ($420 million over 6.5 thousand full-time equivalent workers). That comes to an average of $30 an hour. You can do your own numbers with this calculator.

I do not think that EXPR is paying so much to its workers. In fact, a quick search in Indeed shows that the company pays between $8 and $15 an hour to its salespeople. The calculation above had the intention to show that EXPR’s SG&A expenses could improve a lot. The company is probably spending too much at the corporate level.

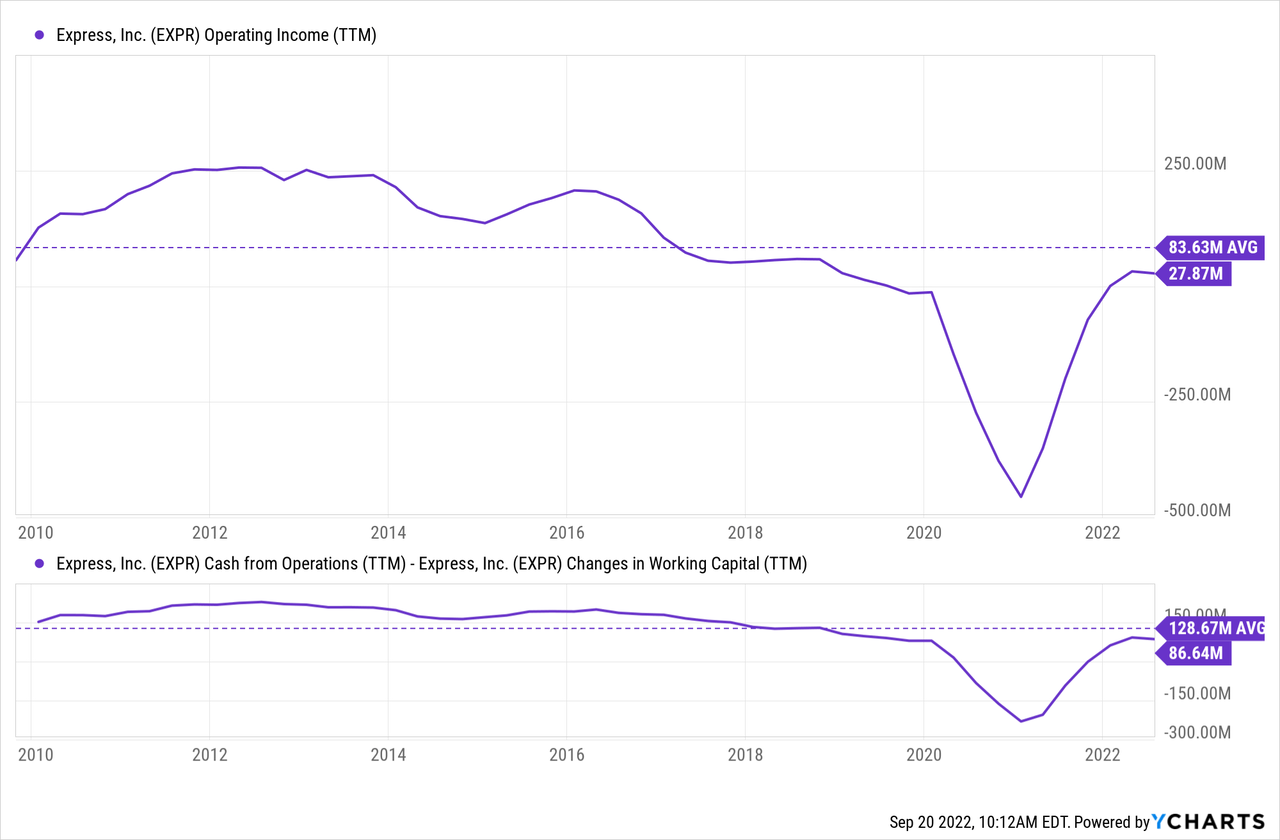

However, even although EXPR could improve at the SG&A level, it has still sustained positive operating income for most of its operating history. This can be seen in the first chart below.

The company did post losses in 2019, 2020 and 2021. However, in 2020 and 2021 it was under the effect of the pandemic. This can be considered a one-time in a century. In 2019, EXPR recognized $197 million in trademark impairments. This impairment was triggered by the fall of its stock’s price according to the company’s 10-K for FY19, but I also believe it is related to the incorporation of a new CEO in 2019, that could then start with a clean sheet.

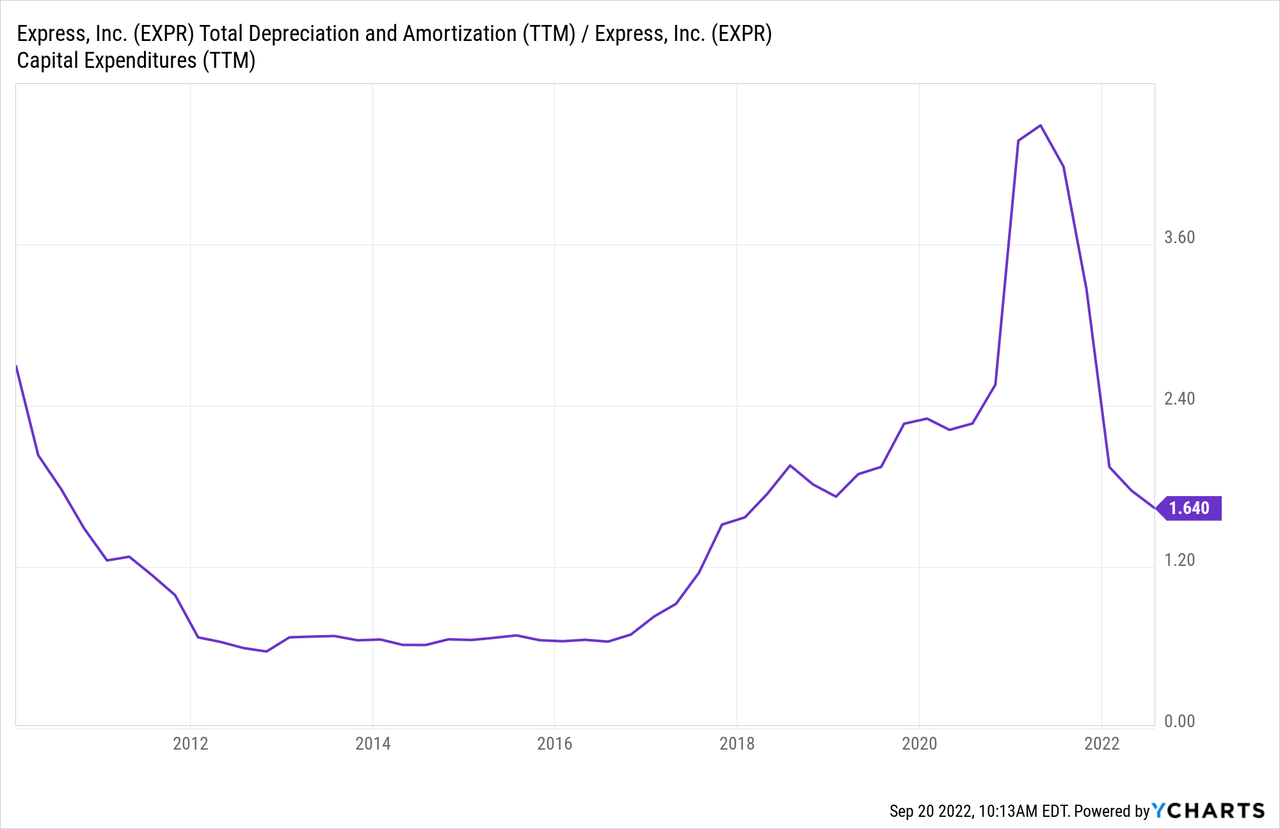

Regarding cash flows, the company has also been positive for the most part. As the second chart above shows, before changes in working capital, the company has been able to post CFO higher than its operating income. This means the company is able to convert operating profits into cash. CFO before working capital is higher than operating profits because the company depreciates PP&E at a rate of around $70 million but has consistently invested less than that. This can be seen in the chart below.

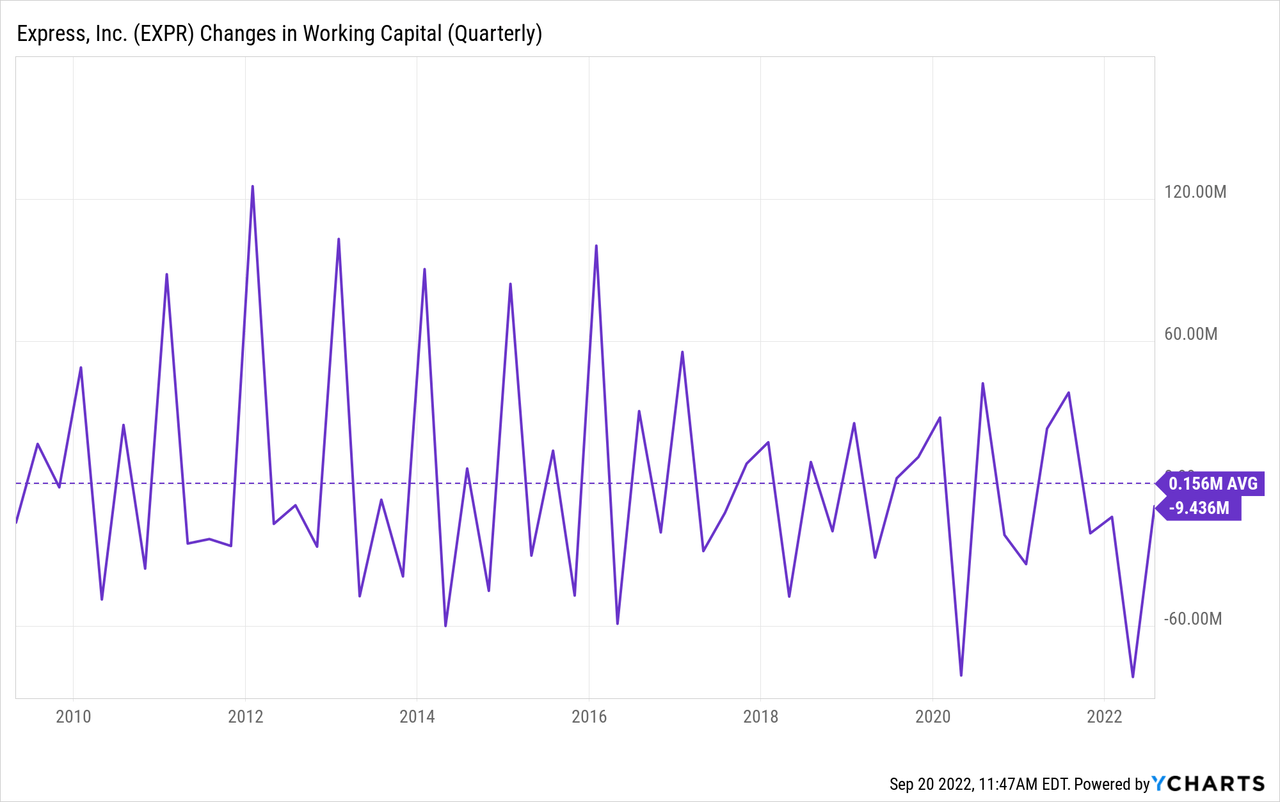

Finally, and before moving to the financing portion, we can comment on EXPR’s seasonality. The company usually has higher operating income in the second half compared to the first half of the year, because of the holiday season. This is also seen at the working capital level below. The company increases working capital (negative below) in Q1 and Q2, and recovers most of that investment in Q4.

Express’ finances

Like most retailers, EXPR got hit hard during the pandemic. The company posted $450 million in operating losses in FY20.

These losses ate most of EXPR’s cash reserves and pushed the company into debt. Before the pandemic, in FY19, the company had $200 million in cash reserves and no debt. After the pandemic, in FY20, the company had $50 million in cash and $200 million in financial debts.

Again, this is understandable, given that the pandemic was a one-time event that no one could forecast. The company had built a cash reserve before the pandemic, but it proved insufficient.

EXPR used two sources of debt. First, a currently open credit facility for $250 million that pays 2% + LIBOR. Second, two-term loans, for $90 and $50 million respectively, paying much higher interest rates, 7% + LIBOR.

The credit facility has to be repaid first and can be drawn again, while the term loans have to be paid after the credit facility and cannot be redrawn. This is inconvenient because both term loans pay a much higher interest rate. Both the credit facility and the term loans mature in May 2024.

In my opinion, after the pandemic, EXPR is in a tight situation. The company has to finance its working capital requirements during the first half of the year. This is aggravated by supply chain bottlenecks that push companies into bullwhip mode, ordering more in advance to stock and hold.

The company cannot issue shares without diluting current shareholders because the share price is too low. To give an example, if EXPR had financed its 1H22 working capital requirements ($70 million) by issuing shares, it would have doubled its share count.

Therefore the company is pushed into drawing from the credit facility in the first half of the year, and to repay in the second half. The term loans’ covenants require the company to repay the credit facility first and only then pay the term loans that yield higher interest.

As of 2Q22, EXPR has $100 million drawn from the term loans and $100 million drawn from the credit facility. With LIBOR at 3%, these debts generate yearly interests of $10 million and $5 million, respectively.

The bearish thesis

Adding EXPR’s delicate financial situation, it needs to borrow for working capital months before it can sell the finished products. With the fears of an imminent recession and the apparel industry’s characteristic cyclicality, it is easy to understand the bearish viewpoint. If EXPR cannot sell its inventory during this fall season, then it may not be able to pay interest due, and it will not be able to borrow for the next season.

Therefore, I think the best is to model EXPR’s cost structure and find out what would be needed for the company to fail on its obligations.

First we start with the assumptions.

As mentioned, if we subtract $200 million of yearly lease payments from CoGS, we find that EXPR’s historic gross margins are close to 40%.

On the expense side, we start with $200 million in lease payments. On top of that, we add $585 million in SG&A expenses (this figure is higher than the historical $550 million average but it was the guidance provided by EXPR’s management on 2Q22). From the financing side, EXPR has to pay $15 million in interest charges. Finally, on a cash basis, we need to subtract $60 million from depreciation.

Those fixed charges add to $740 million. Considering a 40% gross profit margin, EXPR has to generate revenues of $1.85 billion in FY22 to break even (on a cash basis, generating an accounting loss of $60 million).

The revenue guidance provided by the company on its 2Q22 results presentation (filed with the SEC on August 31st) is $1.95 billion. That is, if the company falls 6% short of its revenue guidance it will find trouble repaying its fixed charges. This is a very thin margin of safety.

What would be the balance sheet picture at the end of the year in this situation? The company has paid for all its expenses in our model above, meaning that its balance sheet is the same as the one for year-end FY21.

Because the company used borrowing to pay for part of the working capital, it does not have to pay again to suppliers and it can use the expensed CoGS to rebuild working capital for FY23. In that case, the company will not need to borrow more for working capital but it will keep $200 million in debts. Conversely, it can repay debts and borrow again a few months later to build working capital.

That is, in the $1.85 billion in revenue scenario (6% below guidance) the company breaks even on a cash basis and is back to the same place it was at the beginning of FY22. The only difference would be $50 million in expected capital expenses that need to be paid with additional borrowing.

Using the same model, if the company meets its revenue guidance for this year, it will generate $780 million in gross profits. Subtracting the $740 million of cash-based fixed payments, leaves a CFO of $40 million and pre-tax losses of $20 million. In this scenario, the company would at least pay for most of its capital expenditures without increasing its debts.

Finally, in order to generate $10 million in free cash flow, to justify a market cap of $80 million and the risks associated with the company, EXPR should generate $1.975 billion in revenues, minimally above guidance. This illustrates the effect of substantial operational leverage on the company’s cost structure.

Conclusions

The situation does not provide a significant margin of safety because the difference between a desirable and an undesirable outcome is as little as 10% of revenue.

If the company’s revenues fall 6% behind its 2Q22 provided guidance for FY22, then the company will not generate enough cash to pay for its fixed structure and interest payments. Because the company has substantial operational leverage, if it generates revenues only 2% above guidance, then it will be generating $10 million in FCF, enough to justify its current price.

On a longer-term perspective, EXPR has shown that it can generate profits well above its current market cap. Unfortunately, that is only possible under a positive context. Finally, in order to strengthen the company in preparation for bad times, EXPR should reduce its SG&A expenses as a percentage of revenue.

Be the first to comment