dem10

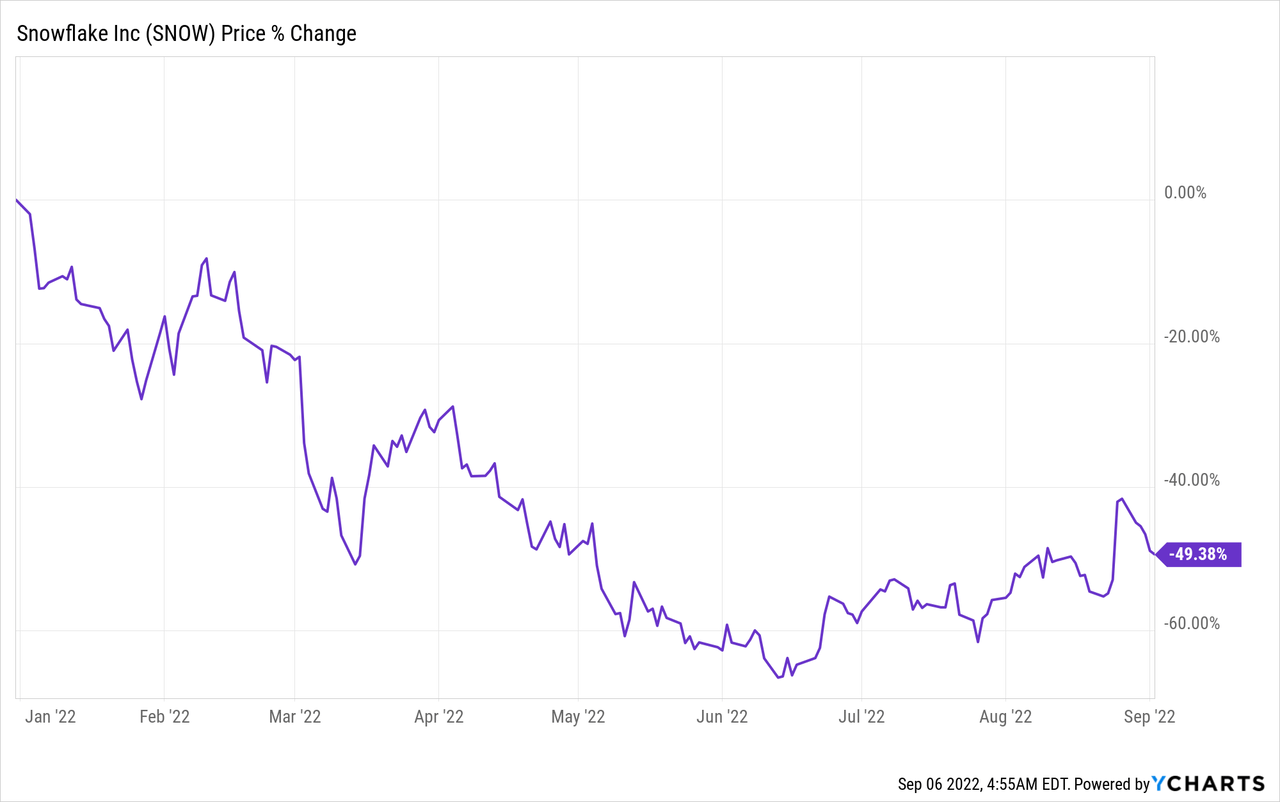

Shares of Snowflake (NYSE:SNOW) soared 23% after the cloud data platform provider reported better than expected revenue for the second-quarter in August. However, share price weakness has developed in recent days which may create a new buying opportunity. While recognizing that Snowflake trades at a high valuation based off of revenue, the software company is growing extremely fast and has issued a strong revenue forecast for FY 2023. The firm is executing well regarding customer monetization and is adding a significant number of new clients to its platform, especially in the $1M+ revenue category. Since Snowflake is also generating profitable growth, the stock is interesting for the long term!

Snowflake’s Q2’23 results

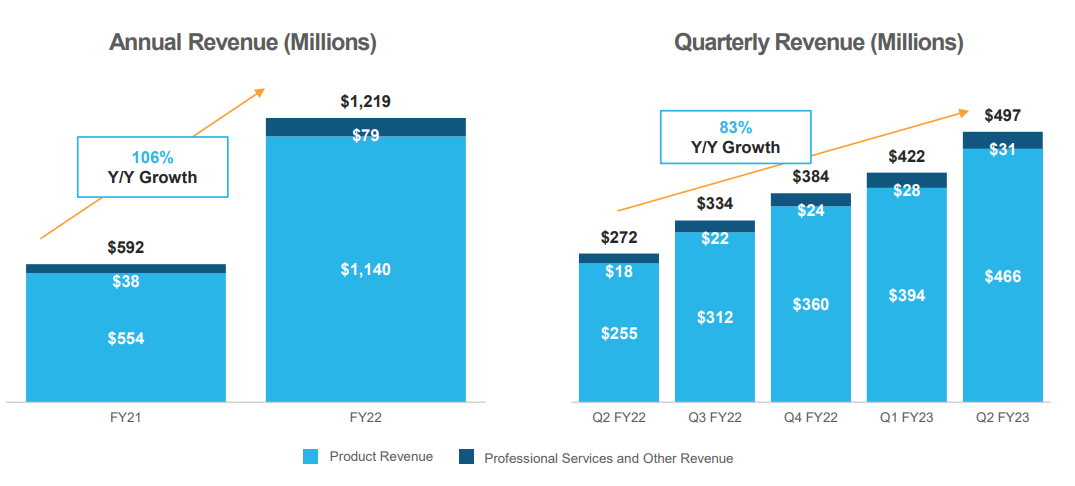

Snowflake is putting up impressive growth numbers quarter after quarter. In the earnings sheet for Snowflake’s second-quarter, the company revealed revenues of $497M, showing 83% year over year growth. Estimates for Snowflake’s Q2’23 called for just $467M in revenue.

Product revenue, which represents 94% of Snowflake’s top line, grew at the same rate of 83% year over year. As impressive as Snowflake’s revenue growth in core product revenue is, top line growth has been decelerating… which is what most companies in the cloud market are experiencing in a post-pandemic world. While the pandemic boosted Snowflake’s client acquisition and top line growth, the business is in a post-pandemic adjustment period that is seeing moderating growth. In Q1’23, for example, Snowflake generated 85% revenue growth while in FY 2022 the firm’s revenue base more than doubled.

Snowflake: Q2’22 (Product) Revenue

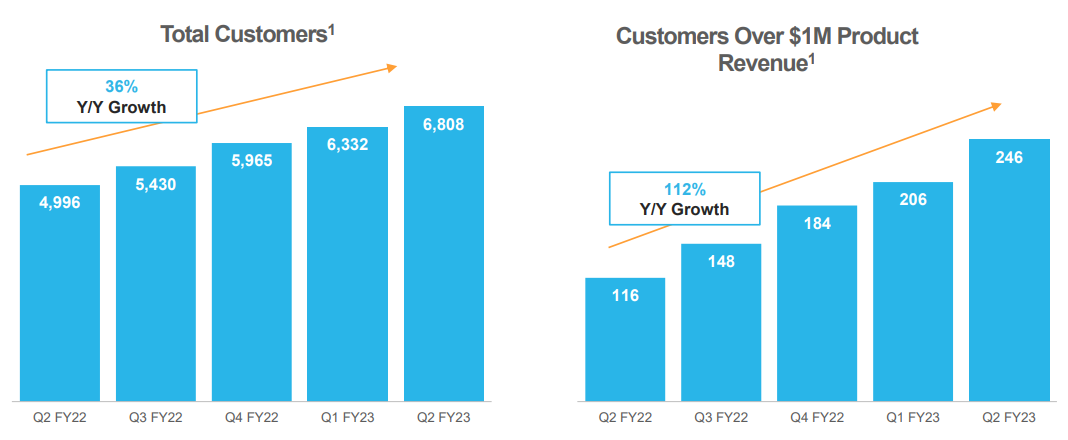

What also remained impressive in the first six months of FY 2023 is that Snowflake continued to show strong customer acquisition skills, especially in the group of customers that are the most lucrative for the Snowflake platform: customers that have at least a $1M annual product-spend. Snowflake’s total customer count surged 36% year over to 6,808 in Q2’22 which in itself is not bad at all. But Snowflake really has success with large enterprise customers that can afford to spend big bucks on Snowflake’s various products and services. The number of customers with a product-spend of $1M or more soared 112% year over year to 246 in Q2’23 — three times the rate of its total customers.

Snowflake: Q2’22 Customer Account Growth

Customer monetization

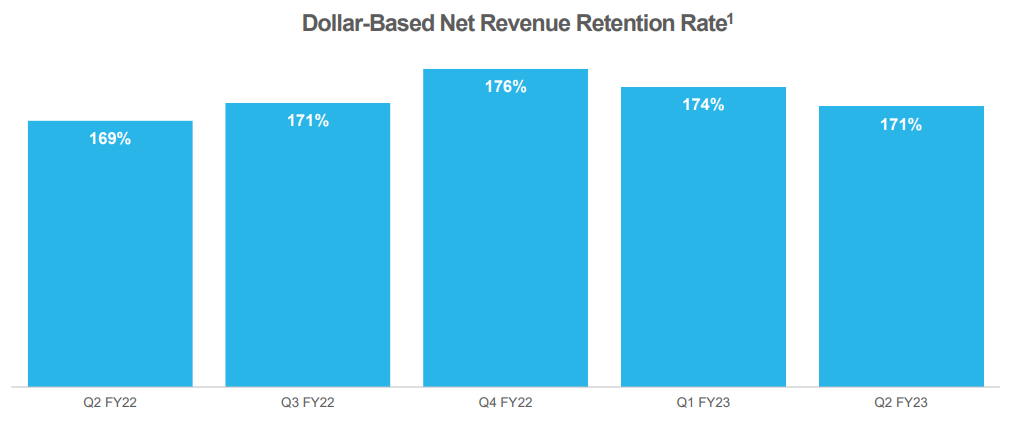

What I also really like about Snowflake is the firm’s strong customer monetization. Cloud-based software companies measure customer monetization through a figure called dollar-based net revenue retention rate. Other cloud companies give this figure different names — such as net dollar retention — but they all measure the same thing: the increase of platform spending from one reporting period to the next by the same pool of customers. It is expressed as a percentage and effectively measures internal revenue growth. Snowflake’s dollar-based net revenue retention rate was 171% in Q2’23, meaning the average customer increased its spending on the Snowflake platform by 71% year over year which is extremely impressive. However, Snowflake’s retention rate also dropped two quarters consecutively from a peak of 176% in Q4’22.

Snowflake: Dollar-Based Net Retention Rate

Snowflake’s outlook for FY 2023

The company’s guidance for FY 2023 calls for product revenue of $1,905-1,915M, implying 67-68 year over year growth, and a free cash flow margin of 17%. In FY 2022, Snowflake’s product revenue was $1,141M and the top line grew 106% that year. Although Snowflake’s growth is decelerating, I believe the forecast for FY 2023 is very strong.

Snowflake is expensive, but worth the price

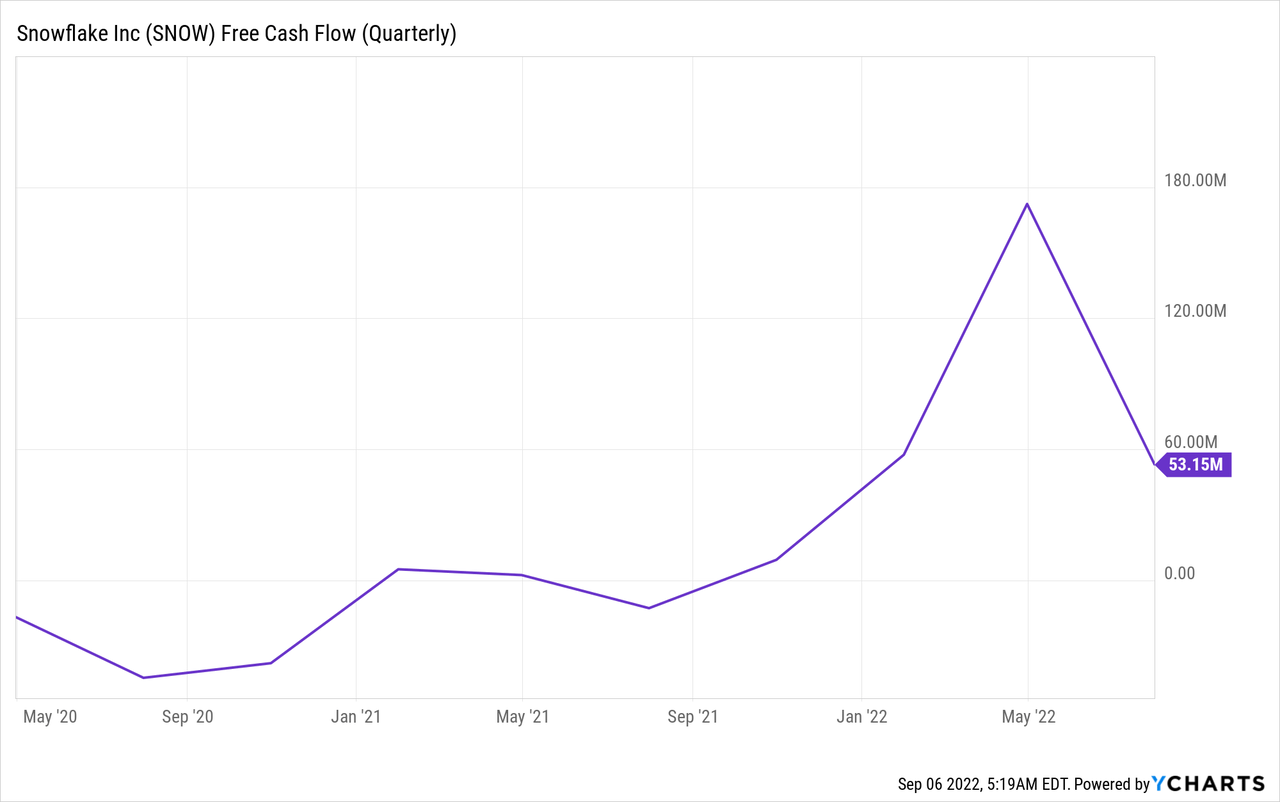

Snowflake’s shares are trading at a premium valuation factor and this is due to the firm’s exceptional execution regarding top line growth and customer monetization. Snowflake is also wildly profitable which distinguishes the company from most other start-ups that are still generating losses. Snowflake generated free cash flow (“FCF”) of $53.8M in Q2’23 and the firm’s FCF has ramped up nicely in the last year: Snowflake has been consistently FCF profitable in the last four quarters…

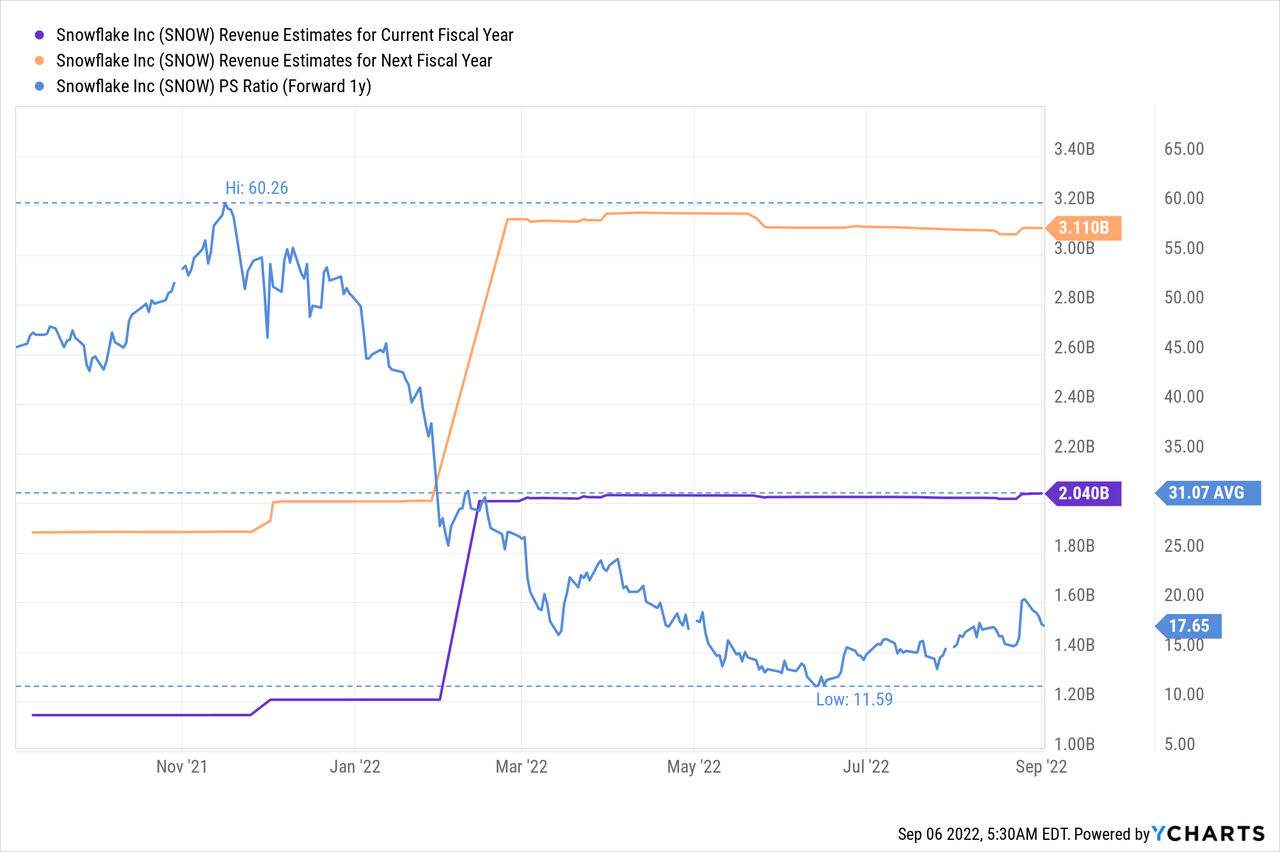

Based off of $3.11B in revenues estimated for FY 2024, Snowflake is trading at a price-to-revenue of 17.7 X. The average P-S ratio in the last year was 31.1 X, so Snowflake trades at a significantly lower valuation factor after a near-50% drop in pricing…

Risks with Snowflake

By far the biggest risk for Snowflake is the valuation. Cloud data providers have never been really cheap and this is largely because of the enormous growth prospects the sector offers companies and their shareholders. Slowing top line growth is therefore the biggest commercial challenge for Snowflake and its stock. Customer monetization is going strong, so I don’t see any issues here. However, should top line growth decelerate markedly in the near future, shares of Snowflake may be up for a fundamental re-pricing.

Final thoughts

Snowflake is doing an exceptionally good job regarding customer acquisition and monetization, and revenue growth in Q2’23 wildly exceeded expectations. The cloud data provider continues to see strong momentum in the most lucrative group of customers which generate $1M or more in annual product-spend. While shares aren’t cheap, the risk profile is skewed to the upside here!

Be the first to comment