Jean-Luc Ichard

Dear readers,

Investors might ask if the positive foundational thesis for Orange SA (NYSE:ORAN), is in fact, intact with everything that’s been going on. It’s not as though the company has been an impressive performer this year – even if it has in fact done better than index, with “only” a 12.19% decline.

Nonetheless, I continue to be positive on Orange. I’ve even, fairly recently, added chunks of the company to my corporate portfolio as well as my private portfolio.

Here we’ll go through the reason why.

Revisiting Orange

After all, it’s not as though telcos are in particular good repute since peers like Verizon (VZ) slashed their growth estimates, and a legitimate case can be made for just how much telecommunication companies expect people to be able to pay for their services.

However, I take all of this will great calm. I own a large stake in Verizon, as well as AT&T (T), Deutsche Telekom (OTCQX:DTEGY), and other local companies. I own the companies for their relative income safety and in spite of their low overall growth.

Much as I’ve said before – the foundational thesis of Orange, it being a fundamentally sound Telco in a very mature geography, has not changed. The company is a telecommunications/FTTH market leader in key nations such as France, and while there have been solid arguments as to why the company should be doubted, or at least worth a little less as it faced expansion problems and high % of CapEx/Revenue, that time is over.

Orange is a market leader in French Fiber, and French fiber investments are finally bearing the fruits they were forecasted to bear years ago. The same sort of investments are being made across its European markets. In fact, 2021 saw some very impressive trends out of Spain, with impressive, multi-million customer growth in Spain.

As I said before – a part of the problem Orange has is the “stuck” state of its dividend. Don’t expect this to improve materially going forward – but the yield at this time is more than fine.

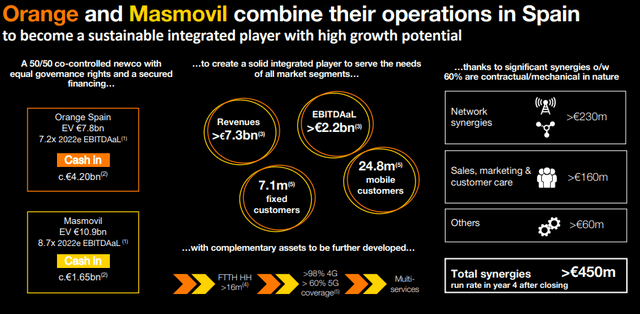

1H22 saw impressive EBITDAaL increases, strong generation of cash (over €1.4B in a single half-year), and impressive moves on the M&A and cooperation perspective, with the company now working with MasMovil in Spain to create a solid player with convincing potential.

The combined player will take some of the stress of Orange’s Spanish operations due to size, with the entity being the second-largest Spanish telco with revenues of €7.5B, compared to over €12B for Telefonica. €450M worth of synergies is expected, as well as a combined EBITDAaL of €2.2B on that €7.5B worth of revenues.

Integration and synergies are the name of the game in the telco sector. This is part of what is driving excellent overall results. It sometimes feels like I am one of the few investors putting a high value on the safety and conservative nature of telecoms – and Orange has been impressively improving its trends for at least a year here.

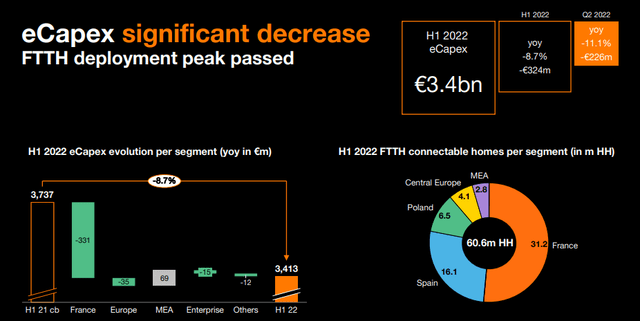

Net debt is now down to 1.91x and stable, and cash flow is up 72% YoY. EBITDA is up as well, and CapEx is down no less than 11.1% YoY. I was clear in one of my former articles that the company will see lower CapEx once these growth projects are done, and this is exactly what we are currently seeing.

I don’t need to draw you a diagram of what happens when earnings increase and capital expenditures decrease. That’s what happened in the last quarter, and that’s what will continue to happen (I believe).

What exactly is the clear reason for the CapEx decrease?

This.

The trend will go up. Significantly. And we add to this it’s still offering, despite recent appreciation and a virtually unchanged dividend, an almost class-leading 6.5% yield.

This yield is also, unlike other telcos – very unlikely to be cut or reduced – especially now. The margins were up – and not by a small amount. Same with net income, due to the recovery of an impairment of the Spanish goodwill from back in 1H21, driving net income to almost €1.5B for the company.

Any business worries? Not really. Europe saw continued solid growth, backed by retail services, convergent services, and roaming customer recovery. Spain is slowly improving – still not great, but really an improvement, with lower churn across the nation.

The company’s emerging growth areas, namely Africa and the Middle East, are seeing sustained higher margins. with a double-digit 25%+ data and FBB YoY revenue growth and similar numbers in customer growth, with EBITDAaL margins of almost 36% here. Great trends overall.

We also have the cyber defense segment, which is growing double digits as well. The segment is on track to reach over €1B worth of revenues, and the company has had success in the labor market, recruiting significant talent.

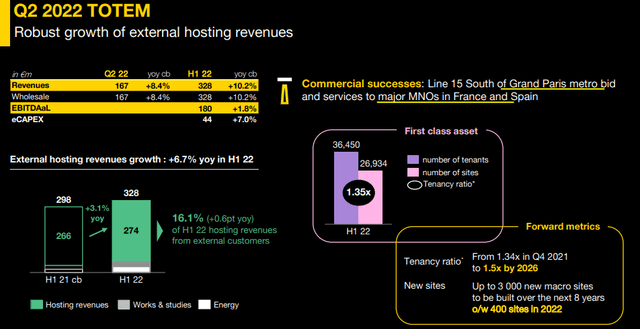

Let’s also not forget Totem – the burgeoning towerCo. Revenues are up 10.2% YoY, and the company has seen significant improvements in fundamentals in the segment.

All in all, the company has confirmed the 2022E Guidance, seeing a 2-3% in EBITDAaL growth, below €7.5B in eCapEx, and over €2.9B in organic free cash flow – but from the telco segment alone.

The dividend remains fixed – €0.7/share.

That means we have a close to 6.9% dividend yield, which is among the best in the entire business.

I hope this explains why I remain positive about Orange as an investment.

Orange & Valuation

I’ve talked extensively about Orange’s valuation before – so let me do it again and really, once again, hammer this stuff home about this company.

This view is on the current appeal of Orange as a business as an investment – and from the context of the telecommunications sector as a whole.

The telecom sector offers probably one of the best visibilities in dividends for the next ten years, a point that is worth considering even in this market environment. By investing in qualitative telcos, you’re “parking” money in electronic communications infrastructure – plays that typically have some sort of inflation protection or indexing, either directly or indirectly, much like we’ve seen companies like Verizon doing by upping their prices across the board.

On the back of significant EBITDAaL increases, I’m forecasting a significant earnings growth that influences the DCF, but the undervaluation is present across every single other perspective as well.

When European telcos have finally completed the deployment of their fixed ultra-fast broadband networks (fiber or upgraded cable), they will control the primary access to all of the services that people now rely on. That is really what you’re investing in here – and that is what Orange has done.

I’m currently forecasting an along-guidance EBITDAaL and EPS growth of between 3-7% (synergies included), up to 9% at most if things go along as expected. Based on such expectations, we see a massive upside available for Orange here.

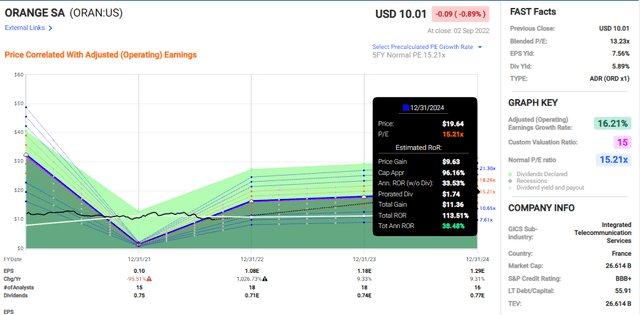

Based on the current valuation, we can forecast Orange at overall very low levels and still generate impressive RoR. With a 15.2x forward P/E, based on a 5-year average, we can see an upside of no less than 113% until 2024E, or 38.4% per year. This is obviously somewhat optimistic – but in like with the company’s expected EPS growth. Will we see the company trade up to €15-€17/share for the native?

Perhaps.

Orange Upside (F.A.S.T graphs)

I believe it could happen if the market shifts perhaps a bit and starts viewing Orange more favorably. However, even if this isn’t the case, there are still plenty of things to like about Orange. The company would have to trade below 5-6x P/E until you see negative RoR here.

I find this to be unrealistic, as the company is on an improvement, not on a declining path.

S&P Global analysts call for an average valuation of €12.63/share. You’ll note that this is an improvement on the sub-€12/share average that we saw in March and April of this year. The range has expanded from €8.6 low and €15 high to a €9 low and €16 high. The current share price of €10.13 suggests an upside of 25% here at the very least, and 13 out of 20 analysts – also an improvement – currently have the company at a “BUY” or equivalent “outperform” rating.

The company isn’t entirely without its risks. France still has four legacy players in Telco. Even if Orange has by far the best position, the others also want to play. The company also won’t push its dividend – forget anything above €0.7 until CapEx spending is completely wound down to normalized levels and until the pandemic is over.

Thesis

My thesis on Orange is as follows:

- Orange is one of the more appealing Telcos in terms of valuation, in all of Europe. I split my investments between Deutsche and Orange at this time.

- The company has an upside on a conservative basis, of almost 25-35%.

- Orange is a “BUY” here. A price target that I would consider attractive for investment based on my goals would be around €14/share – though every investor of course needs to look at their own targets, goals, and strategies. I would also always consult with a finance professional before making investment decisions such as this.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment