StonePhotos/iStock via Getty Images

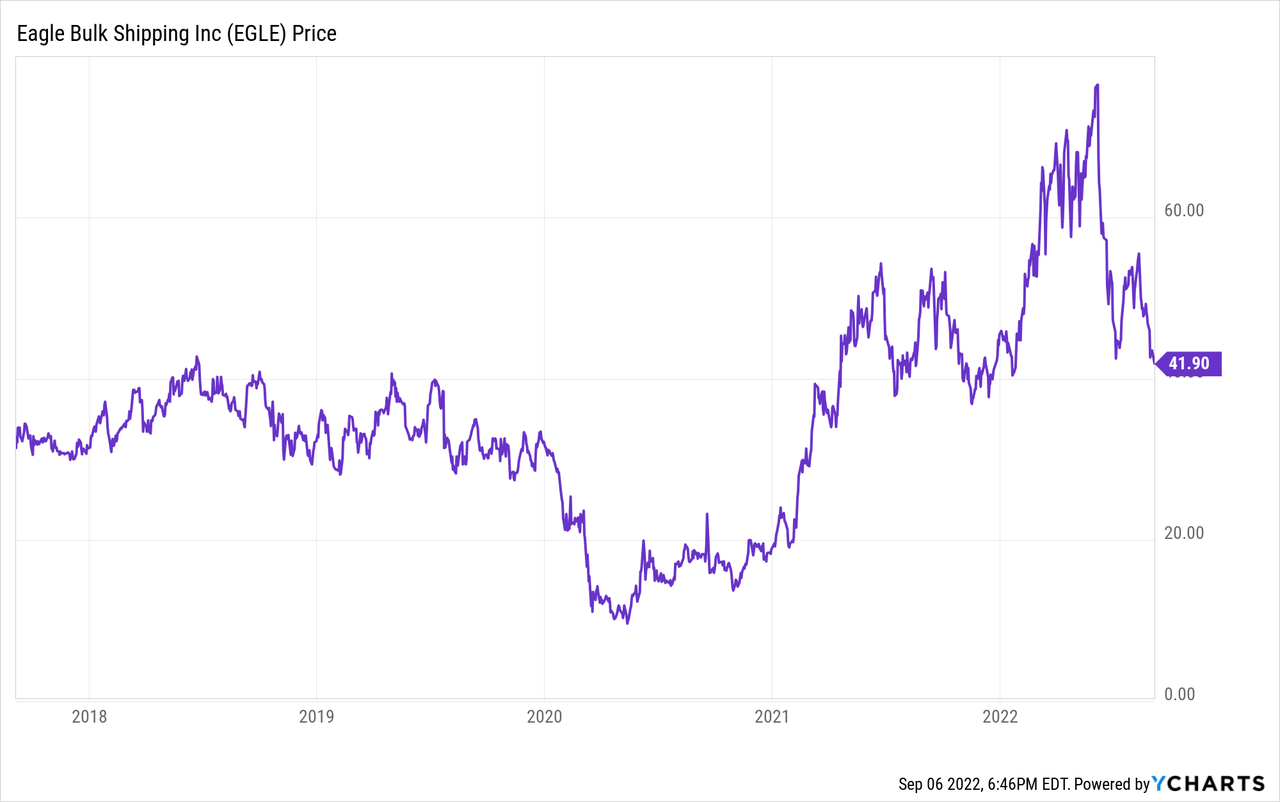

Eagle Bulk Shipping (NASDAQ:EGLE) is currently paying one of the highest yields on the market, almost 19% as I write. This has been enabled by the high bulk shipping rates we saw from about mid-2020 until August 2022. Usually, each year, seasonal demand sends shipping rates up in the late summer and into the early winter. Rates tend to decline to annual lows in the first quarter of the year. Even in that pattern there is usually a great deal of volatility. This article will focus on the surprise rate decline of August 2022, possible future scenarios, and the impact of rates on Eagle Bulk’s profits and dividend payouts going forward.

Much of this article’s analysis is dependent on bulk shipping rates, for which the most general indicator is the Baltic Dry Index.

Q2 2022 Results

Second quarter Eagle Bulk Shipping results set a record for net income. Revenue for the quarter was $199 million, up 53% y/y from $130 million. GAAP net income was $94 million, up a factor of ten from $9.2 million in Q2 2021. On a diluted basis GAAP EPS was $5.77. Non-GAAP net income was lower at $82 million or $4.98 per share. Cash flow from operating activities was $140 million. Cash and equivalents ended at $139 million. Eagle’s bulk ships were valued at $885 million. Debt included $50 million as the current portion of long-term debt and $318 million noncurrent long-term debt. Fleet utilization was 99.8%. At the current stock price on September 6 market capitalization is $596 million.

Eagle Bulk Shipping specific factors

Eagle specializes in two of the mid-sized major classes of bulk carriers, Ultramax and Supramax. For these categories they have one of the larger of the world’s fleets with a total of 53 ships. Notably Eagle does not own Capesize vessels, which are used mainly for iron ore and coal going directly from Brazil, Australia, and other major sources to, mostly, China. But they do carry smaller loads of coal and iron ore to less intense users, plus other ores and grains. If you look at Slide 7 from the Eagle April presentation, you can see that the focus on the Supramax category contrasts with that of Star Bulk (SBLK), Golden Ocean (GOGL) and others in their peer group. Because minor bulks are more varied, Eagle is not as prone to single points of failure, as happens to iron ore and coal carriers when major mines or ports are closed. The Eagle cargo mix is shown on Slide 16 of the presentation just mentioned. Note there is seasonality, as coal is usually more in demand for winter heating and grains get shipped after harvests.

Baltic Dry Index Trends

If you are a short-term speculator, it is important to realize that the BDI (Baltic Drying index) has subcomponents, notably the Capesize, Supramax, and Panamax indexes. It is largely driven by spot rates, while some companies have longer-term contracts with their customers. An individual company’s ability to set rates may vary from industry average reflected in the BDI. Since I am a long-term investor, and this article is mainly for dividend investors and long-term investors, I will only go into the overall BDI here, using it as a proxy for shipping rates.

First, note that short-term events can drive short term variations in rates. In the past decade, for instance, we have seen rates plunge for from a few days to a few months when a major export facility for iron ore or coal was closed by a tropical storm. I do not worry much about that kind of thing because it does not change overall demand. Once the port is reopened it tends to drive up rates as stockpiles are rebuilt at the end consumers. Lack of demand is a larger concern, but these last few years that has tended to be specific to the Chinese government seasonally reducing steel or electricity production in order to reduce air pollution or for some other end. If the current high inflation environment does lead to a significant reduction in overall demand, rates will certainly go lower.

Balancing out the supply-demand situation is the building of new ships and the scrapping of older ships. In the years following a very high spike in shipping rates from about 2003 to 2010, financing and building dry bulk vessels seemed like an easy way to make profits. But it takes about 3 years from concept to launch, and low rates caused by an oversupply of vessels eventually led to a mid-decade slump in which banks were taught a hard lesson. Since 2015 getting bank financing for newbuilds has been more difficult so the number of ships coming onto the market has been a better match for supply, arguably lagging it in 2021. Very few newbuilds are expected to launch in 2022 and 2023. Unless there is a significant increase in orders, we won’t see many until at least 2025. That said, if a macroeconomic downturn is severe enough, even the number of ships currently in the water can turn out to be too many, for a while. So, while I am optimistic, I am prepared to endure some choppy seas until inflation comes back down to normal levels.

At the end of the day on September 6, 2022, the BDI stood at 1,114. The recent peak was at 5650 on October 7, 2021. Looking back over the last 5 years, the BDI spent months below 1000 in both 2019 and 2020, even going below 500 briefly in 2020 during the panic at the beginning of the pandemic, when much of China closed down. The recent Covid related closures in China have not helped with demand, nor has its real-estate building pause. Predicting when strong demand might return is beyond my purview, but I believe the Chinese government wants for demand to return, so it is just a matter of time.

Dividend Sustainability

The dividend for the second quarter was $2.20 per share, payable on August 26 to shareholders of record on August 16, 2022. Trailing 12-month dividends were $8.25. At the close of $41.81 per share on September 6 that results in a yield of nearly 19%. For Q2 it was 30% of GAAP EPS or 44% of non-GAAP EPS. Clearly if Q2 2022 were an indicator of profitability going forward the current dividend level would present no problem. But just a year earlier a $2.20 dividend would have greatly exceeded net income. Looking back, the company first hit a quarter with profits sufficient to pay this level of dividend in Q3 2021. It was not even close before that. Going forward, expect dividends to depend on profits, which will depend on shipping rates.

Given the uncertain outlook for shipping rates (see above), I do not project any certainty for a $2.00 or more per quarter dividend going forward. In Q3 rates look weaker than the rest of the past year, though they could still spring back in September. If Eagle booked most of its shiploads while rates were higher early in the quarter, Q3 profits might be near Q2 levels. I have covered what the future, at least 2023, may look like above. As goes the BDI, so will dividends go, more or less.

Note that dividends could fall substantially and still have great yields. At $1 per share per quarter, and a stock price of $40.00, we would have a 10% dividend. While I do not see a lot of upside from the current $2 per share, all it would take is a revival of the Chinese economy and continued tightness in the number of ships available to keep profits near the levels we saw in 2021 and the first half of 2022. If you want a steady dividend, this is probably not a stock for you. If you can handle some risk, it could continue to be a great dividend, with some volatility.

Conclusion

As of the writing of this article I do not own shares of Eagle Bulk Shipping, but it is at the top of my watch list for the sector. I served as an analyst of bulk shipping stocks, including Star Bulk, back around 2005, and afterwards became an investor in Star Bulk in 2015. For long-term investors, the important move is to accumulate bulk shipping stocks when prices are reasonable. On an annual basis that has tended to be in the late winter or spring. On a cyclical basis there are two cycles that do not typically coincide: the global macroeconomy and the ship building cycle. New ships are not being built in any substantial numbers. I suspect the government of China will revive its real estate sector, and both China and the U.S. are planning large investments in infrastructure. That means demand for bulk shipping should remain strong through 2023 and 2024, with some pauses. It is a risk to buy bulk shipping companies at today’s low prices, but it is a reasonable risk. I will continue my strategy of accumulating bulk shippers when prices seem low. Dividends may fluctuate, but the world cannot exist in its present form without bulk shipping.

Be the first to comment