pjohnson1/iStock Unreleased via Getty Images

Initiating Coverage

We are initiating coverage on Yum! Brands (NYSE:YUM) and are recommending investors to buy the shares for capital preservation. Yum! Brands operates global fast food franchises that can provide stable financial growth and continue to increase shareholder value through dividend hikes and stock buyback programs. We believe that the current valuation is attractive at a historical level, and we like the dividend yield growth moving forward.

Company Overview

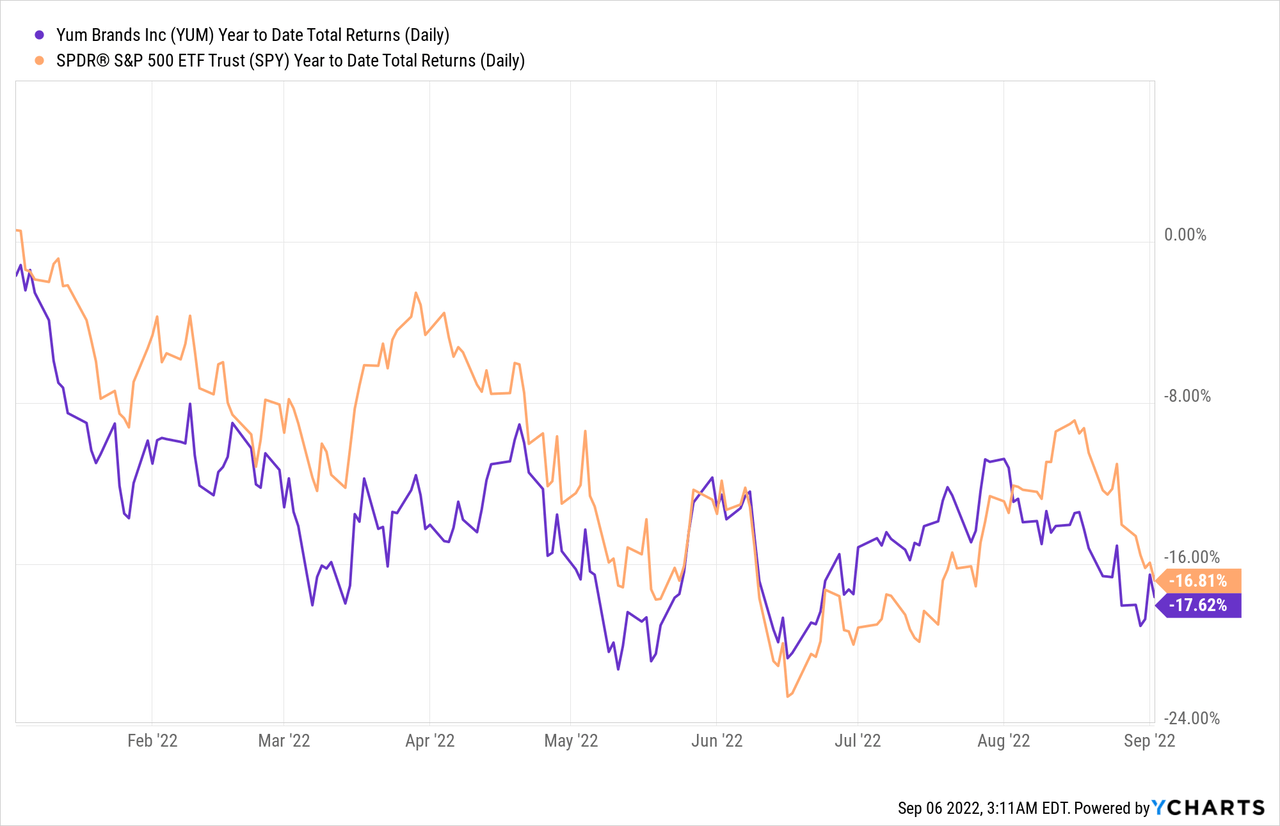

Yum! Brands is an American fast food corporation based in Louisville, Kentucky. The fast food corporation operates famous fast food brands, such as KFC, Taco Bell, Habit Burger Grill, and Taco Bell globally with the exception of China. The company operates more than 53,350 restaurants and has a market capitalization of $32.08 billion. The company’s stock price performance year-to-date has closely tracked the S&P 500. Yum! Brands returned -17.62% compared to S&P 500’s return of -16.81%.

Recession Proof

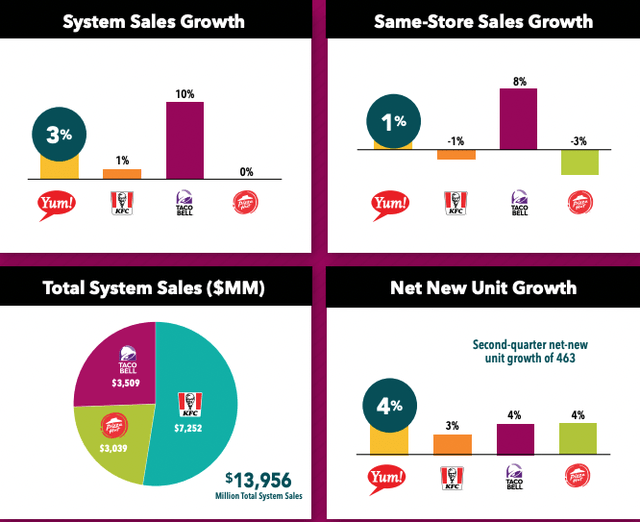

Fast food chains are well-known to be recession proof, and Yum! Brands subsidiaries are no different. Fast food brands like Yum! Brands are considered to be recession proof due to the fact that their products are priced lower than other restaurants, and also because they utilize franchise models which has more predictable cash flow generation. Though we cannot yet see the immediate impact of economic slowdown on Yum! Brands’ financial performance, the most recent quarterly performance has been solid, with 2% revenue growth YoY for Q2 2022. Taco Bell has been an especially bright spot for the company, as management saw a 10% YoY growth in System Sales growth and 8% YoY growth in Same-Store Sales Growth. We believe that the mix of low priced products and franchise model will make this company fairly resilient against a steep recession.

Shareholder Friendly Policies

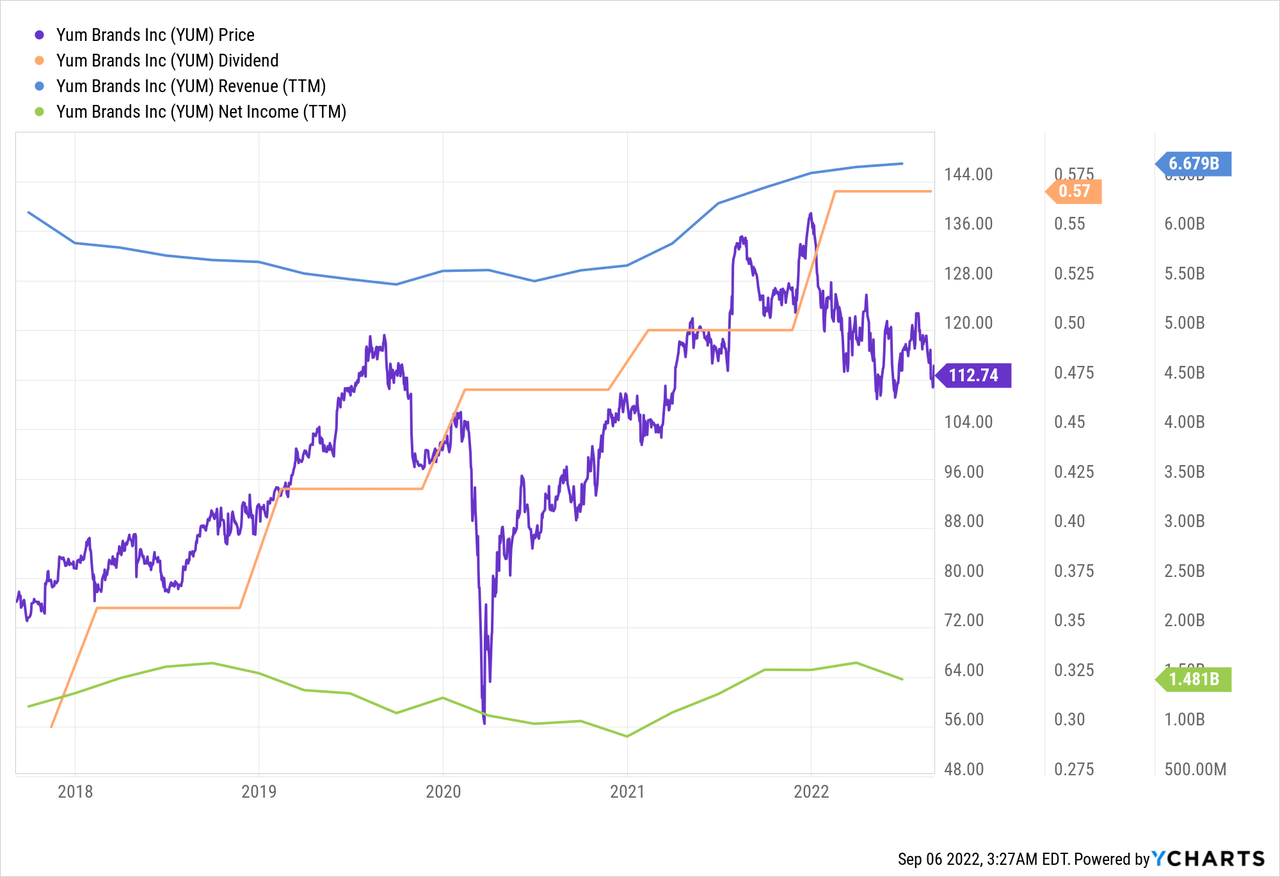

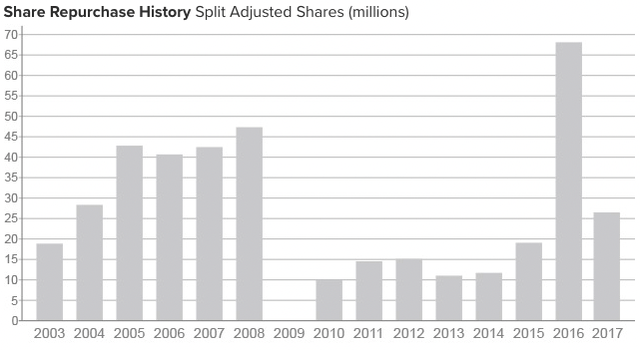

Yum! Brands recently announced a quarterly dividend per share of $0.57, which annualized equates to $2.28 per share. Based on the current price, this translates to an annual dividend yield of ~2.03% which is a bit higher than the S&P 500 dividend yield of 1.69%. In the past 5 years, dividend yield growth has been strong, as the quarterly dividend has risen with a CAGR of 13.7%. Based on the chart below, we see that dividends have risen consistently every year despite the stagnating revenue and net income. Though we would like to see revenue and net income also grow, we are pleased to see the company’s commitment to increasing dividend for shareholders. We believe that this dividend payout is fairly sustainable given that the current payout ratio is ~42.9%. On top of this, the company also authorized a $2 billion buyback program in 2021 that will last until the end of this year. The company has a long history of share buyback programs, and we believe that management will continue to be proactive in increasing shareholder value through such programs.

Yum! Brands

Valuation

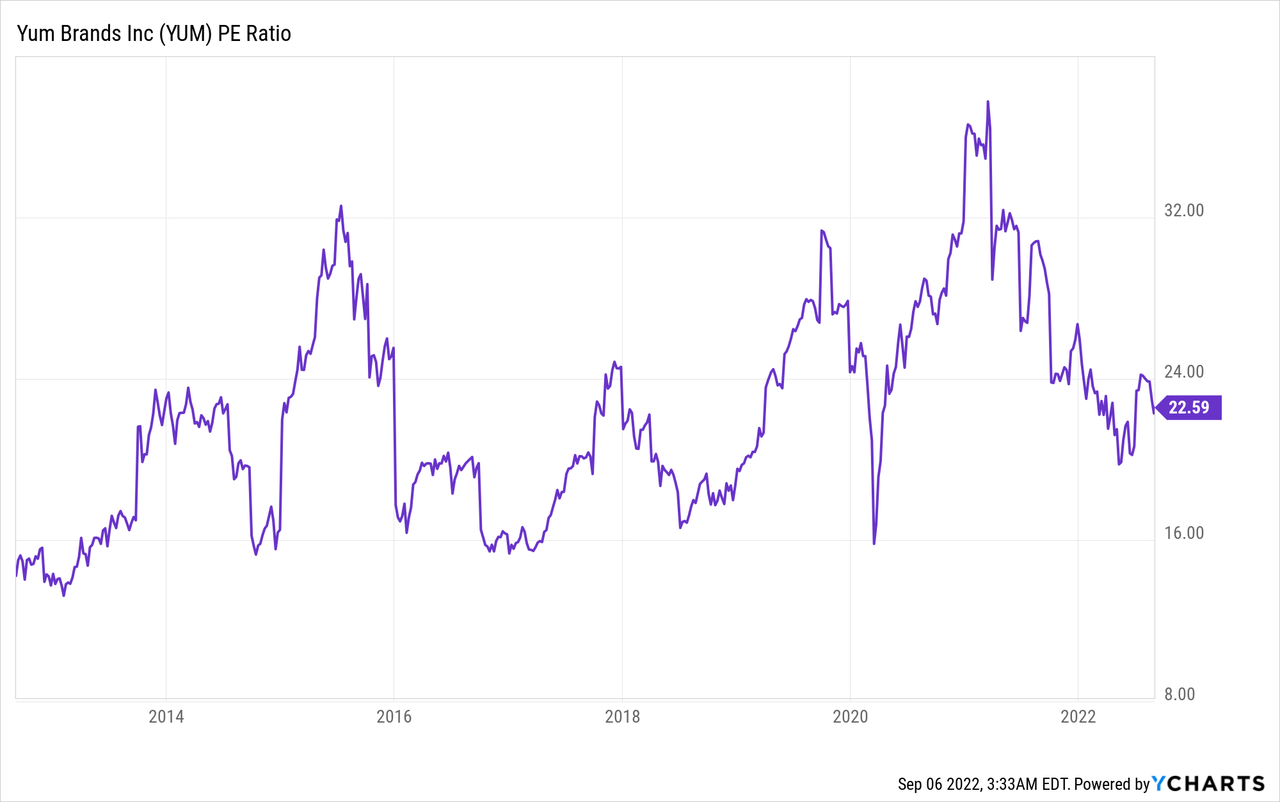

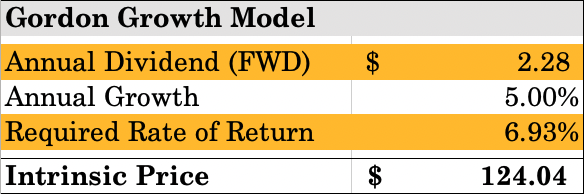

The historical valuation range for Yum! Brands has been fairly consistent, with a P/E Ratio floor of ~16x and a ceiling of ~32x. Currently, the P/E ratio is 22.59x, and is hovering in the middle of the valuation range. We believe that the stock is attractively valued at the moment even based on a historical range and can provide good capital preservation in the event of an economic downturn. Using a Gordon Growth Model, we also see that the stock is slightly undervalued based on an annual dividend of $2.28 and perpetual growth of 5%. The Required Rate of Return of 6.93% is from the Restaurant/Dining industry average cost of capital from NYU Stern’s database. Based on our assumptions, our model represents a ~10% upside.

Sweet Minute Capital Valuation

Conclusion

We are initiating coverage on Yum! Brands and are recommending a BUY rating. We like the recession proof fast food chain business and the strong dividend growth that the company has provided in the past 5 years. With a low dividend payout ratio and a history of solid buyback programs, we believe the company can provide good shareholder value appreciation even during economic downturns. We recommend investors to buy the stock given the reasonable valuation based on historical levels and based on our valuation model.

Be the first to comment