SolStock/E+ via Getty Images

Investment Thesis

I previously covered American Woodmark (NASDAQ:AMWD) in June where I cited the company’s potential to deliver improved revenue growth and margins in the coming quarters. While the company did post good results last quarter and made meaningful progress in terms of margin improvement, its stock has corrected ~7% since our last coverage in sync with the broader markets. I believe it is even a better buy at the current levels as valuations have become more attractive. AMWD experienced strong sales growth last quarter due to the strength of its new construction, and repair and remodelling businesses. The strong builder backlog is supporting the sales growth in new construction, whereas the growth in repair and remodel business is supported by growth across dealers/distributors and home centre channels. In the near term, the elevated backlog levels in new construction along with incremental pricing actions should support the sales growth. While the incoming order rates are expected to decline in 2H FY23 due to a slowdown in the housing industry, I am not too worried about it as the long-term fundamentals of the housing industry remain strong with favourable demographic trends and the low housing inventory. The long-term trends in the repair and remodelling industry should also benefit from record-high home equity levels. The company is also working towards restoring its margins to pre-Covid levels. With supply chain constraints easing and the company’s pricing actions taking hold, it looks achievable and this margin improvement should be a meaningful driver of earnings growth. The stock offers a good value for long-term investors. Hence, I have a buy rating on the stock.

AMWD’s Q1 FY23 Earnings

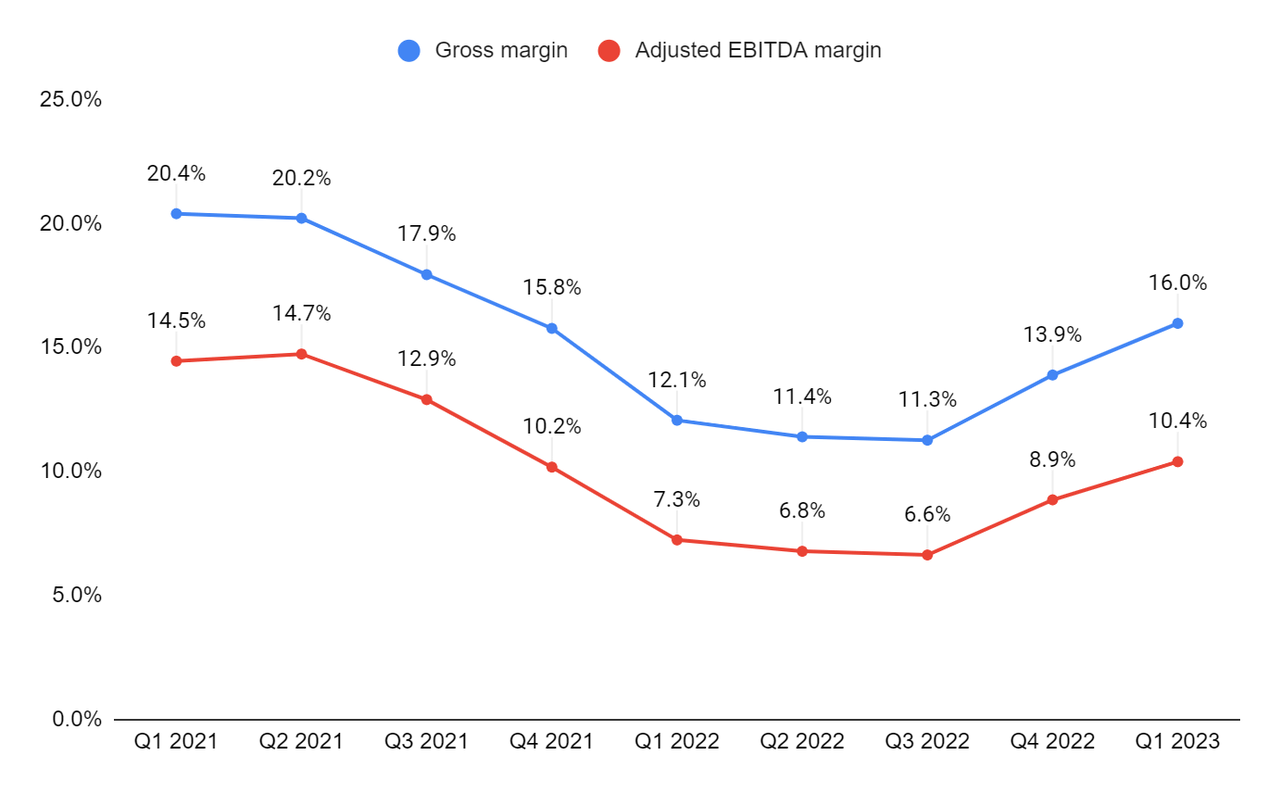

AMWD recently reported better-than-expected first-quarter FY23 financial results. The revenue in the quarter increased 22.7% Y/Y to $542.9 mn (vs. the consensus estimate of $513.07 mn). The adjusted EPS in the quarter grew from $0.70 in Q1 FY22 to $1.71 (vs. the consensus estimate of $1.29). The revenue increase was driven by volume growth in the made-to-order and PCS frameless businesses and price increases across both stock and made-to-order platforms. The adjusted EBITDA margin increased 310 bps Y/Y to 10.4% due to improved mix and efficiency and higher price realization. The improvement in adjusted EBITDA margin and higher sales led to Y/Y growth in adjusted EPS in the quarter.

Revenue Outlook

Within new construction, sales grew ~27.2% Y/Y due to strong order growth across the market as builders are completing their order backlog. The new construction sales channel outpaced the market demand in Q1 FY23. Considering a 60- to 90-day lag between the start and cabinet installation, the overall market starts in single-family homes were up 0.7% in their first fiscal quarter.

The repair and remodelling business, which includes the home centre and independent dealer/distributor businesses, grew 19.6% Y/Y. The home centre business grew 15.3% Y/Y and the dealers/distributors business was up 36% Y/Y in the quarter. The made-to-order backlog, which is represented by days of production, decreased in the quarter as the production levels improved and exceeded the incoming order rate. The stock platform remained under pressure due to the challenges in staffing levels and production capacity.

In the stock platform, the company is taking action to increase the production capacity of stock kitchens and bath products, including footprint adjustments and relocation of certain product manufacturing and sales. This should be executed in the fall of 2022. AMWD is trying to find opportunities to use the existing pool of labour to handle the labour availability issue on its stock platform. The company has stocking opportunities with its retail partners to backfill the inventory in stores. In the made-to-order business, the backlog is more than twice the historical levels and should support sales growth in the next quarter and beyond. The company is working to complete its elevated backlog levels in the new construction business, which rose due to the large separation between starts and completion. The backlog levels are expected to be normalized by the end of the calendar year. The company has started to see some slowdown in the order rates in the repair and remodel business but not in new construction as the builders are aggressively looking to close out the homes sold by the end of their fiscal year.

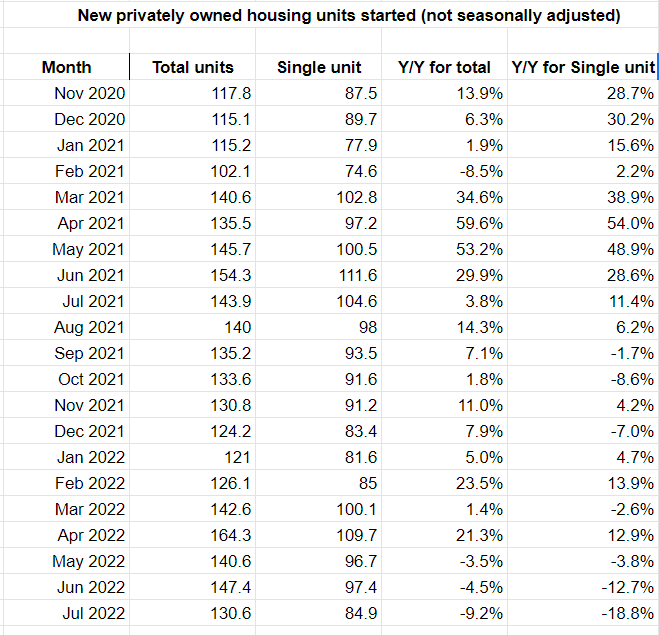

New privately owned housing units started (Census.gov, GS Analytics Research)

Looking forward, I do anticipate a slowdown in new construction orders as well given the recent declines in single-family starts (see table above). However, the existing backlog and price realization should contribute meaningfully to the Y/Y in the fiscal year 2023. Management is expecting mid-teens sales growth this year which looks achievable. While there are some medium-term headwinds, the long-term fundamentals of the housing industry remain strong with lower housing inventory levels and favourable demographic trends. The record-high home-equity levels should also act as a tailwind for the repair and remodelling industry in the long term.

Margins

The gross margin in Q1 FY23 improved 390 bps Y/Y to 16% due to pricing actions and operational improvements, partially offset by continued inflation in input costs. The total operating expenses and selling and marketing expenses as a percentage of sales were lower in the quarter due to the controlled spending and leverage from higher sales.

AMWD’s gross margin and adjusted EBITDA margin (Company data, GS Analytics research)

The price increases in the new construction are already in effect, and for the dealer/distributor and home centre businesses, they are expected to take effect in Q2 FY23. The cost of goods sold inflation is expected to be up 7.5% Y/Y for materials and logistics. The incremental pricing actions should help offset these inflationary pressures and improve the margins.

The company is also committed to restoring its profitability by executing its strategy, which has three main pillars namely growth, digital transformation, and platform design.

The company recently launched four new finishes and several new styles which were positively received by its customers and supported the company’s growth in the last quarter. AMWD’s recent digital transformation efforts include the launch of ERP optimization team and planning efforts for the next implementation area. The company’s platform design work continues with the activation of a warehouse management solution tool in Texas last quarter.

Management is expecting pricing increases and strategic initiatives will help AMWD improve its adjusted EBITDA margin level to low-double-digit in FY23. This looks achievable and I expect the improvement to continue beyond FY23 as well.

Valuation & Conclusion

The stock is trading at 7.28x FY23 consensus EPS estimate of $6.73 which is a significant discount to its five-year average forward P/E of 13.83x. The sales in FY23 should be supported by the elevated backlog levels and incremental pricing actions. While there are medium-term headwinds, the tailwinds from the lower housing inventory and favourable demographic trends should support the company’s sales growth in the long term. The company is working towards improving its margin through pricing actions, digital transformation, growth, and platform design which should drive earnings growth in the near as well as long term. Given the cheap valuations and good earnings growth prospects, I believe AMWD is a good buy.

Be the first to comment