Eric Bascol/iStock Editorial via Getty Images

Introduction

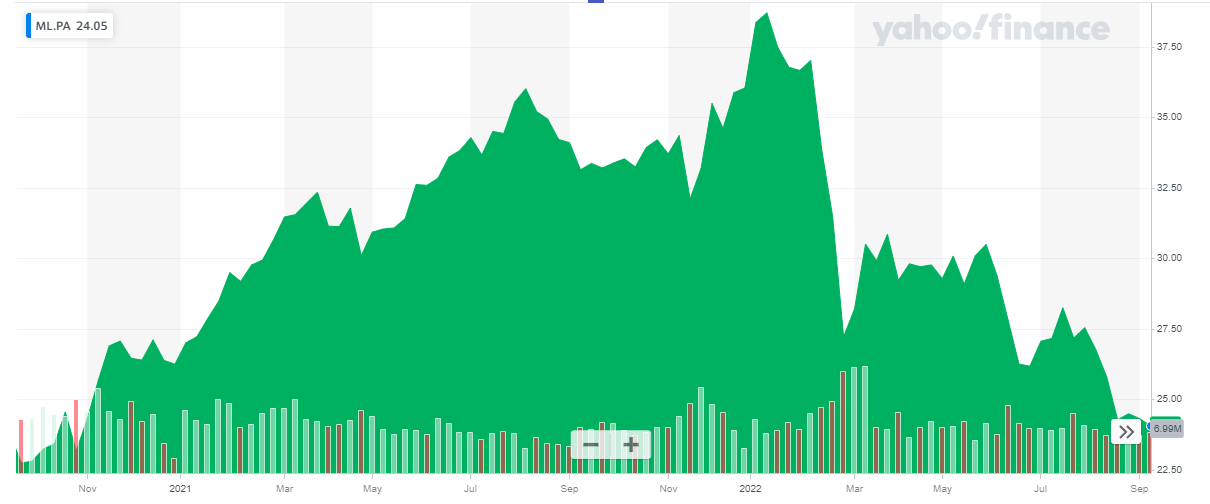

The last time I looked at Michelin (OTCPK:MGDDF) (OTCPK:MGDDY) was before COVID struck. Back in January 2020 I liked what I saw as the company was trading at a 7.5% free cash flow yield and a 3.6% dividend yield, but then it dropped a little bit off my radar during COVID as the company had to deal with a lower amount of newbuild cars and a dip in the replacement market as cars and semis completed fewer kilometers. The share price bounced back nicely as economies reopened, but the share price is now down about 40% from its January peak. Time to have another look and perhaps consider starting to bottom-fish.

Yahoo Finance

Michelin is part of the CAC 40 index on Euronext Paris and that obviously is the most liquid trading venue for investors interested in Michelin. The ticker symbol in Paris is ML and with an average daily volume of approximately 1.6 million shares, the Paris listing is clearly superior to any of the secondary listings. Michelin currently has a market capitalization of approximately 17B EUR based on the current share price of approximately 24 EUR per share.

MGDDF represents one underlying share, MGDDY represents ½ of a share. I will refer to the Paris listing and use the EUR as base currency throughout this article. All relevant information I am referring to in this article can be found here.

The first half of the year wasn’t so bad, despite a continuous decrease in tires for new vehicles

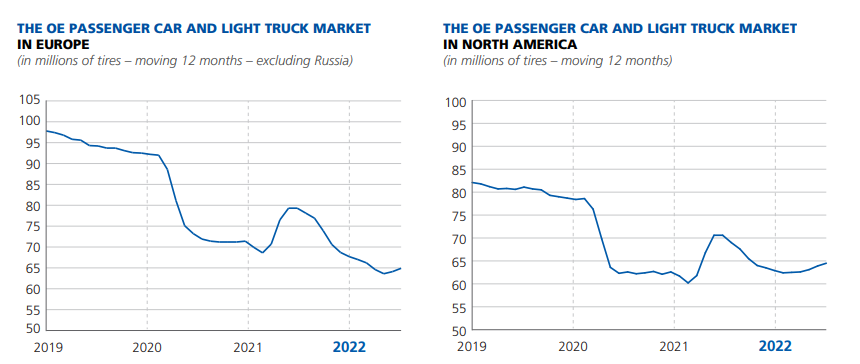

The issues in the car manufacturing industry have been going on for a few years now and tire providers like Michelin are definitely not immune. The image below shows the estimated tire volume in the ‘original equipment’ division (read: new cars), and Michelin is seeing a very clear decline in its European and North American markets.

Michelin Investor Relations

And although fewer cars were built which resulted in a demand decrease for Michelin tires to be fitted under the newbuilts, the car usage numbers continued to increase over the past 2-2.5 years since COVID initially broke out. In fact, the replacement tire volumes for cars and light trucks is now higher than in 2019.

Michelin Investor Relations

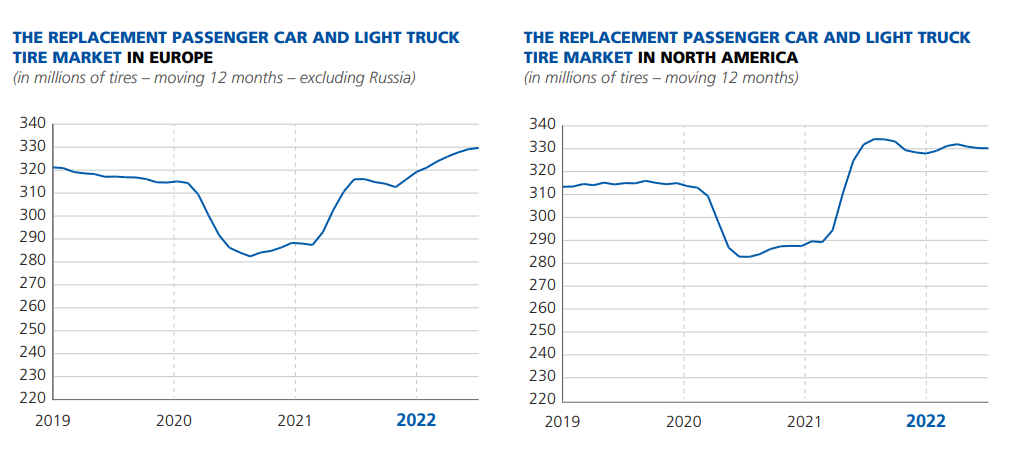

Michelin reported a total revenue of just under 13.3B EUR in the first half of this year but due to the increasing COGS, the gross income increased by less than 10% to 3.64B EUR. A decent enough result but unfortunately most other expenses also increased at a pace of approximately 10% which caused the operating income to increase from 1.42B EUR to ‘just’ 1.53B EUR. A good result, but perhaps a little bit underwhelming.

Michelin Investor Relations

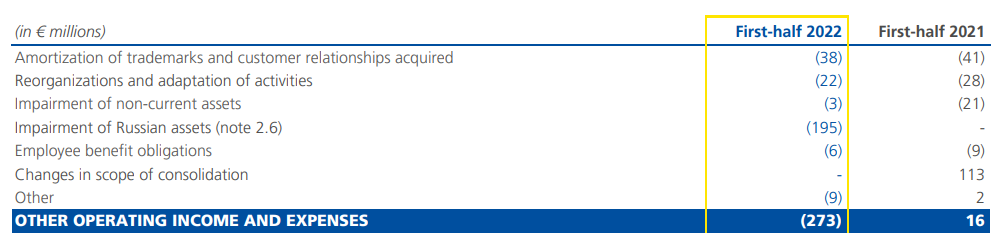

After deducting the 273M EUR in ‘other’ operating expenses (according to the footnotes this is mainly related to the impairment charge on Russian assets with a few other non-recurring items contributing to the total, as you can see below), the reported operating income was just under 1.26B EUR.

Michelin Investor Relations

As the net interest expenses are increasing and as Michelin was able to record a positive attributable income from equity-accounted investments, it was able to keep the ‘damage’ limited and the net income came in at 843M EUR, of which 841M EUR or 1.18 EUR per share was attributable to the common shareholders of Michelin. The average tax rate should decrease in the future as the tax bill was higher than it should be due to some non-deductible expenses.

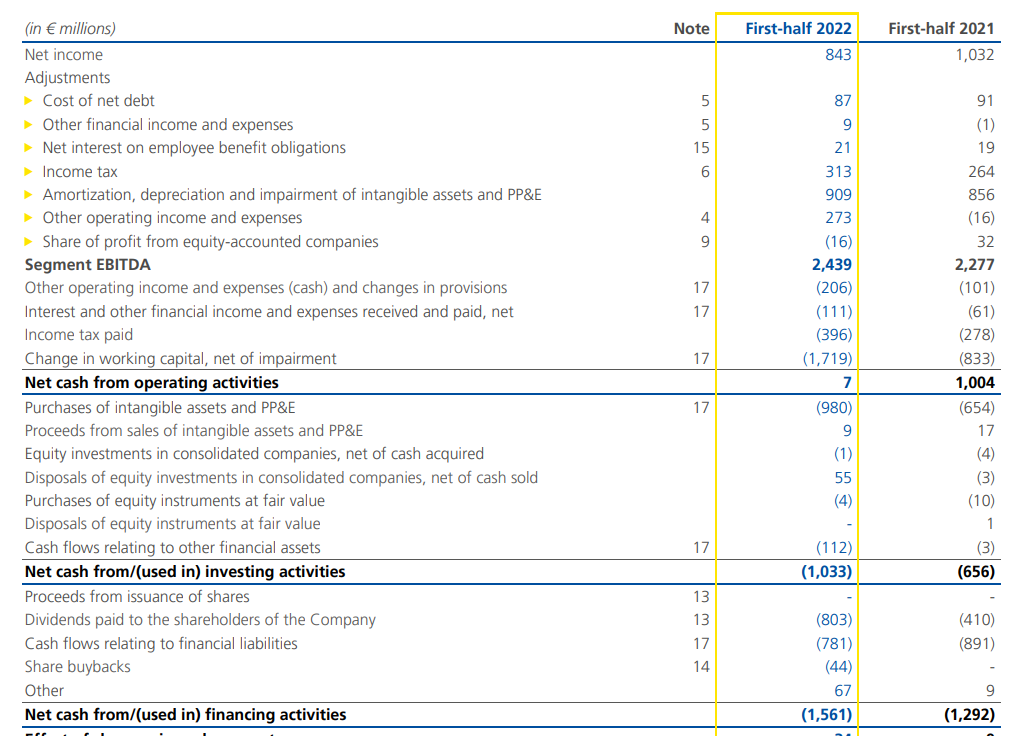

As my focus is generally on the cash flows generated by a company, I wanted to make sure Michelin is still generating a healthy amount of free cash flow. As you can see below, the reported operating cash flow was just 7M EUR but this was obviously the direct result of the 1.72B EUR investment in the working capital position. Additionally, the company paid 396M EUR in taxes although only 313M EUR was due. Adjusting the result for these two elements, the operating cash flow was just over $1.8B.

Michelin Investor Relations

We also need to deduct about 130M EUR in lease payments (which is included in the 781M EUR in ‘cash flows related to financial liabilities) to end up with an adjusted operating cash flow of 1.67B EUR. Slightly lower than in H1 2021 but still a very decent result.

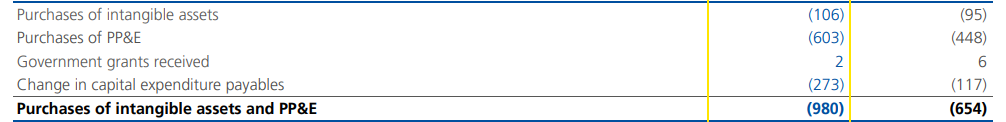

The total capex of 980M EUR is pretty high, especially when you also take the lease payments into consideration, the total comes in at about 1.1B EUR, which is about 20% higher than the 909M EUR in depreciation and amortization expenses. That being said, looking at the capex breakdown, we see the company allocated 273M EUR to ‘changes in payables’. The ‘pure’ capex was just 709M EUR.

Michelin Investor Relations

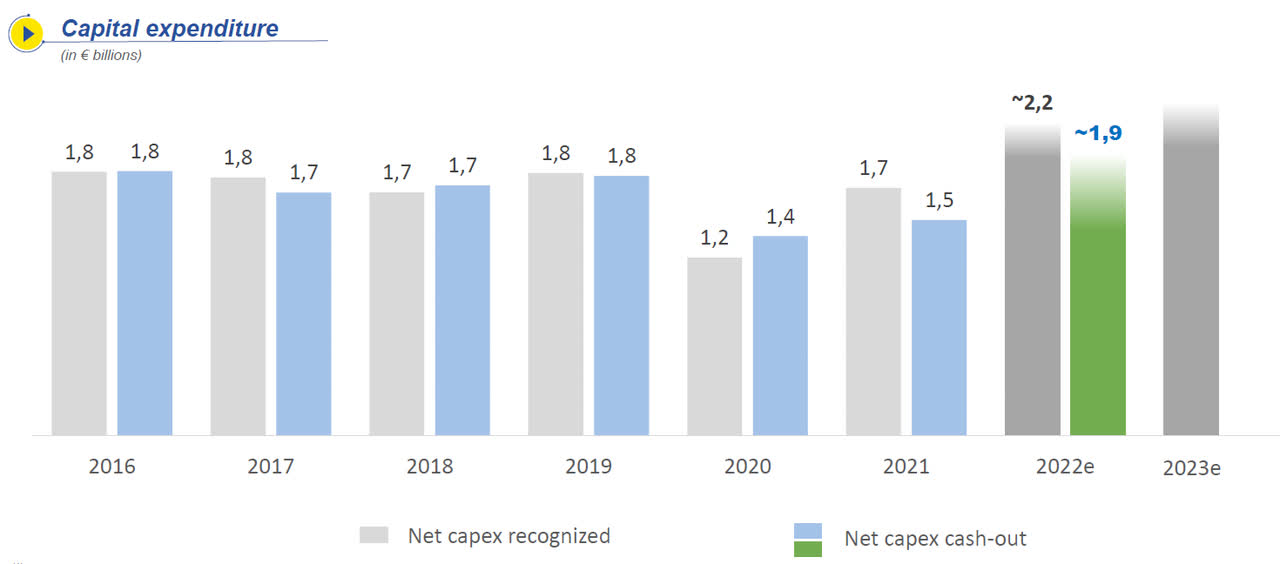

The full-year capex will be 1.9B EUR this year, but that is also because Michelin is catching up on the lower capex spent in 2020 and 2021 when it was reducing its cash outflow during the COVID crisis.

Michelin Investor Relations

I think it is fair to assume the normalized capex will be around 1.7-1.8B EUR (similar to the amounts incurred during the pre-COVID years). The sustaining capex should be even lower than that but Michelin is hesitant to give a breakdown in sustaining capex versus growth capex. I think the normalized sustaining capex (even after taking the impact from the current inflation numbers into account) is just around 1.5B EUR per year.

Applying that to an anticipated full-year operating cash flow of approximately 3.3B EUR, I anticipate the full-year sustaining free cash flow to be approximately 1.8B EUR. This translates into approximately 2.5 EUR per share.

Investment thesis

And that makes Michelin quite attractive at the current levels. Sure, an economic slowdown will also impact the demand for new tires and a volatile rubber price will also have to be dealt with by Michelin. But from a fundamental perspective with a net debt of less than 4.5B EUR (including the cash management assets) and about 4.9B EUR in EBITDA, the debt ratio (1.1) and EV/EBITDA ratio (less than 5) are appealing. Additionally, Michelin continues to generate healthy amounts of free cash flow and with an anticipated payout ratio of 50% of the recurring income, shareholders may expect a dividend of 1.2-1.4 EUR per share which would represent a yield of 5-6% (subject to the 12.8% French dividend withholding tax).

I currently don’t have a position in Michelin, but would be interested in going long. I will likely write some put options with a strike price that is just out of the money.

Be the first to comment