Andrzej Rostek/iStock via Getty Images

Australia-based Whitehaven Coal (OTCPK:WHITF), engaged in the development and operation of coal mines, has seen its stock rally in recent months on rising coal prices and supply tightening in the aftermath of the Russia-Ukraine conflict. The record FY22 result validated the bull case, as EBITDA gains from the blending up of lower quality coal more than offset any headwinds from the Narrabri underground mine. Beyond this fiscal year, the thermal coal outlook remains favorable, as supply-side issues across Indonesia, Australia, and Russia, as well as the European Union’s August ban on Russian coal, look set to further tighten supply.

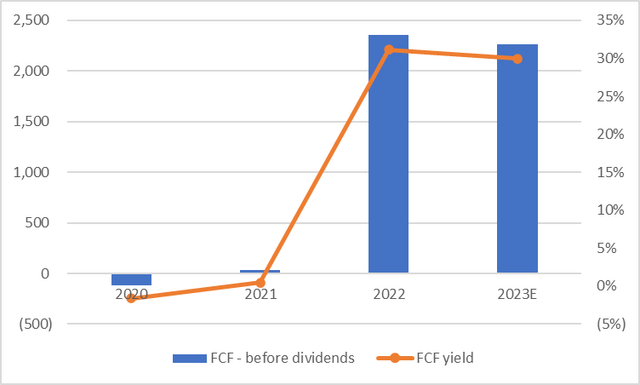

Thus far, Whitehaven has taken full advantage of the higher coal prices to get the balance sheet to a net cash position. Expect cash balances to continue rising amid the supportive backdrop, paving the way for capital allocation upside. With a strong FY23/24 FCF yield and a near-term buyback expansion catalyst adding to the re-rating potential, Whitehaven stock is a worthy addition to any portfolio, in my view.

Coal Price Tailwinds Drive Record FY22 Results

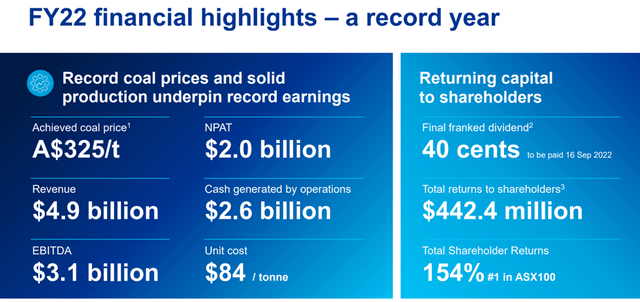

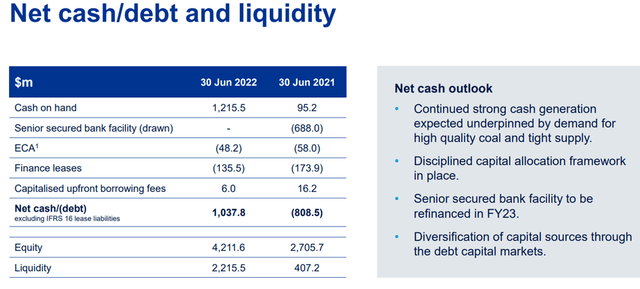

Underlying FY22 EBITDA reached a record A$3.1bn, along with net profit at A$1.95bn, as a higher than expected benefit from the blending up of lower quality (own and purchased) coal outweighed any shortfalls from the Narrabri underground mine. While the widespread cost inflation did flow through the P&L as well, with FY22 unit costs now at ~A$84/t (i.e., at the upper end of guidance), this was largely offset by strong pricing. As a result, Whitehaven exits the fiscal year with a massive ~A$1bn net cash pile (vs. a ~A$800m net debt position last fiscal year). For context, the fourth quarter alone saw the company generate ~A$1.4bn of cash, highlighting its ability to capitalize on the ongoing spot price tailwind to generate strong free cash flow.

Breaking the headline numbers down, Narrabri’s full-year EBITDA stood at A$617m on lower A$954m revenue due to lower quality coal sales in the first three quarters. Given things turned around in the fourth quarter (after discounts were closed), however, this was a decent result, in my view. The three open cuts (Maules Creek, Tarrawonga, and Werris Creek) also contributed strongly with EBITDA of A$2.2bn on slightly higher revenue of A$3.4bn, while coal purchases and unallocated revenue also saw upside at A$492m of EBITDA (helped by ~A$184m gains from blending up lower quality coal).

FY23 Guidance Signals More Upside Ahead

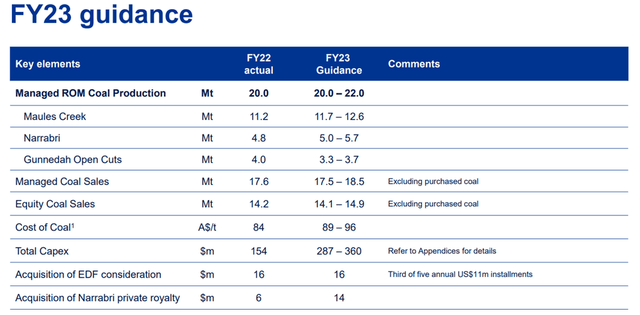

Recent heavy rainfall events aside, domestic operating conditions have improved – of note, coal sales at the port of Newcastle have resumed after a ten-day outage, with no impact on volumes. As things stand, FY23 guidance calls for managed coal sales of 17.5-18.5Mt (equity of 14.1-14.9mt) and coal production of 20-22Mt (an implied ~5% increase). In line with the higher production guidance, Whitehaven also expects a ~10% increase in unit costs for the higher-margin Maules Creek (11.7-12.6Mt) and Narrabri (5.0-5.7Mt) mines.

As expected, the overall unit cost guidance will rise to A$89-96/t in FY23, while capex will double to A$290-360m on increased maintenance capex at the Narrabri mine. Of note, Whitehaven has also budgeted ~$200m on development work around the Narrabri 200 precinct, covering an upgrade of the coal handling and preparation plant as well as mains development, although most of this will be incurred in FY24. As we move into Narrabri Stage 3 (assuming approvals are granted) in FY26/27, capex should then moderate, implying a total ~$400m spend. In the meantime, the Maules Creek and Tarrawonga mines hold the most upside potential, in my view – given they continue to command a premium, new longer-dated contracts could see upward revisions in the coming months.

Market Outlook Points to a Supply Crunch Ahead

In the near term, all signs point to thermal coal prices remaining elevated as sanctions on Russian coal intensify and supply side disruptions extend into the coming months. The Russia aspect is key, as the EU ban has just come into force in August, and several customers outside of the region are already looking into self-sanctioning their Russian coal volumes. Even if some adopt a more measured phase-out, potentially taking contracted volumes through 2023, the tapering process bodes well for Whitehaven. Not only are these customers (likely from Asian countries like Japan and Korea) more likely to lock in longer-duration contracts, but they may also be open to accepting premiums given the ongoing supply/demand imbalance. Plus, addressing the under-investment in thermal coal supply will take time, and with energy security becoming top of mind globally, I see healthy spot price tailwinds over the mid-term as well.

Net Cash Position Supports Capital Return Upside

With WHC on track to complete its upsized A$550m buyback (recall, the Board previously approved an increase from a A$400m cap to A$550m) in H1 2023, I see a clear path to more capital return heading into the October AGM. As of its most recent fiscal year, ~20% of earnings has been allocated for dividends (fully franked), with the balance to be returned via buybacks. Coming out of earnings, management has already executed ~A$363m of stock buybacks, while recent commentary citing returns from buybacks outpacing even new greenfield project returns at 15-20% indicates intent. Plus, the balance sheet is firmly net cash, and assuming the strong FY22 cash generation extends into FY23 as well, Whitehaven should quite easily support another >A$1bn program (in addition to the remaining ~A$190m of buybacks).

A Compelling Play on the Coal Upcycle

On the back of record FY22 financials, the Whitehaven outlook appears as bright as ever. For one, thermal coal supply-side tightness remains across key production regions (e.g., Indonesia, Australia, and Russia). Adding to the supply tightness is the EU’s ban on Russian coal in August, which could further exacerbate market conditions heading into winter in the Northern Hemisphere (when thermal demand is particularly high). Thus, expect spot price to continue outpacing consensus estimates, supporting more upward revisions for Whitehaven in the coming year.

In the meantime, management has capitalized on the cash generation throughout this upcycle, building out a strong balance sheet and allocating capital toward value-accretive buybacks. With the buyback set for another extension/expansion soon (subject to Board approval), capital allocation will be a key near-term catalyst. Over the mid to long term, the stock could also further re-rate on an increased emphasis on energy security globally (vs. the current ESG headwind).

Be the first to comment