mathieukor

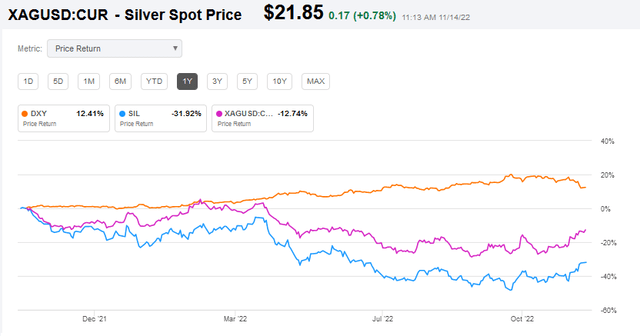

The past year has been tough for the Global X Silver Miners ETF (NYSEARCA:SIL), which is down ~32% even as the spot price of silver itself is down only 12.7%. However, as most of you know, silver is primary traded globally in the U.S. Dollar, which is +12.4% over the past year (see graphic below). That being the case, investing in the SIL ETF (or in silver itself) is primary a bet that the U.S. Dollar will weaken going forward. Note that on the far right of the chart below we see that just in the last week or so the U.S. Dollar has trended lower, and the SIL ETF (and the spot price of silver itself) has jumped higher. That is primarily a function of the recent inflation report, which came in softer than expected.

However, investors should also consider how much diesel is used by silver miners. That being the case, investing in the SIL ETF is also a bet that diesel prices will fall.

Investment Thesis

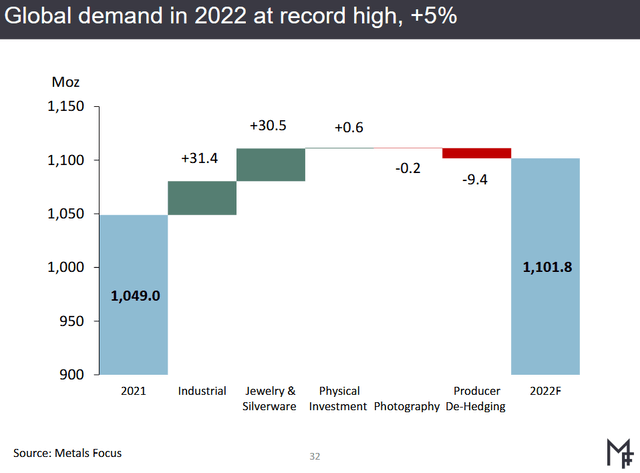

Silver is a globally trade commodity so we have to look at fundamental supply and demand. On that front, the fundamental backdrop appears to be bullish: global demand for silver rose 19% in 2021 to a record 1.049 billion oz. Driven by industrial and jewelry/silverware, demand is expected to climb an additional 5% this year to a new all-time record:

Yet due to the impact of COVID-19 on the miners, global silver production rose only 5.3% last year, far less than demand. This year, global silver mining production – driven by Mexico – is expected to rise only 2.5%. Meantime, the clean energy transition to renewables, specifically solar, is going to be a tailwind for silver demand going forward. The bottom line: the supply/demand fundamentals for silver look to be quite favorable.

So let’s take a closer look at the SIL ETF to see if it might be an opportunity for investors going forward.

Top-10 Holdings

The top-10 holdings in the SIL ETF were taken from the Global X SIL ETF homepage and are shown below. The top-10 equate to what I consider to be a very concentrated 76% of the entire portfolio:

Global X

As you can see from the graphic, the #1 holding is Wheaton Precious (WPM) with a 23.2% weight. That being the case, if you are not comfortable with the prospects for Wheaton going forward, you have no business investing in this ETF.

Wheaton has a high-quality portfolio of long-life, low-cost assets and delivers among the highest cash operating margins in the mining industry. The company has interest 21 operating mines, including 100% of the silver and 50% of the gold from the Constantia mine. WPM’s long-life portfolio also includes a gold stream on Vale’s (VALE) Salobo mine, and silver streams on Glencore’s (OTCPK:GLCNF) (OTCPK:GLNCY) Antamina mine and Newmont’s (NEM) Peñasquito mine.

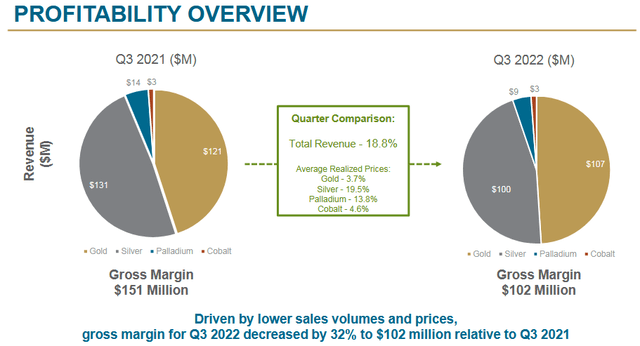

From the Q3 presentation, Wheaton’s profitability is roughly a 50/50 split between gold and silver:

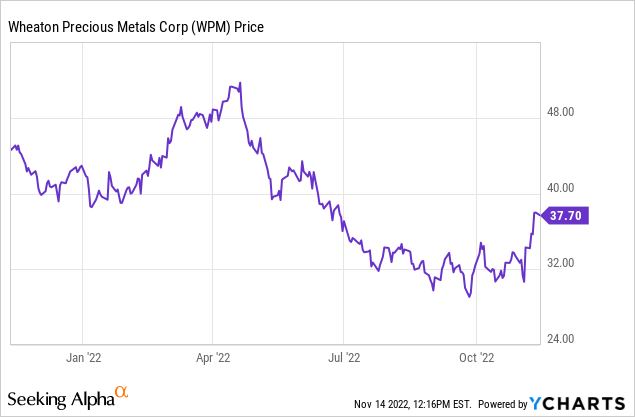

As you can see from the graphic above, WPM’s returns have followed the price of silver and gold, and were down 18.8% yoy. WPM stock yields 1.58%, has a forward P/E of 32x, and a market cap of $17 billion. The stock has had a tough year, but as you can see on the right-hand side of the graph below, it has perked up recently as the US$ has fallen and the “risk-on” trade gained new life:

The #3 holding with an 8% weight is Pan American Silver Corp. (PAAS). Pan American stock is down ~46% over the past year as profitability has suffered given the decline in metals prices and the strong U.S. dollar. The company had a Q3 non-GAAP loss of a penny as revenue declined 26.4% yoy. Management guided full-year silver production lower: to be between 18.0-18.5 million ounces from the previous 19.0-20.5 million ounces.

First Majestic Silver Corp (AG) is the #7 holding with a 3.9% weight. AG is a Canadian based miner that focuses on silver and gold production in North America. The company holds 100% interests in the San Dimas Silver/Gold Mine covering 71,868 hectares in the Mexican states of Durango and Sinaloa; the Santa Elena Silver/Gold Mine covering an area of 102,244 hectares, also located in Sonora; the Jerritt Canyon gold mine located in Elko County, Nevada; as well as the La Encantada Silver Mine covering 4,076 hectares in Coahuila, Mexico. First Majestic also lost money in Q3, even though revenue jumped 28%+ yoy and silver production hit a record 8.8 million ounces (+21% yoy). In Q3, AISC costs for silver were $13.34/oz while realized prices averaged $19.74/oz. The loss was due to “share-based payments, unrealized losses on marketable securities and non-recurring write-downs on mineral inventory.”

The #9 holding is Hecla Mining (HL) with a 4.6% weight. Hecla also posted a Q3 loss as revenue declined to $146.33 million (-24.4% yoy). Helca yields on 0.30% and has a forward P/E = 129x.

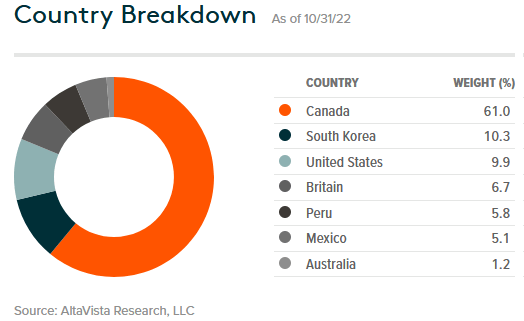

Overall, Global X shows the SIL ETF has no exposure to China and is primarily exposed to Canada (61%):

Global X

That said, as shown earlier, many of the “Canadian” miners have significant resources in Mexico. That being the case, the percentage of silver mined – and revenue generation from Mexico – is likely significantly higher than the chart above implies.

Performance

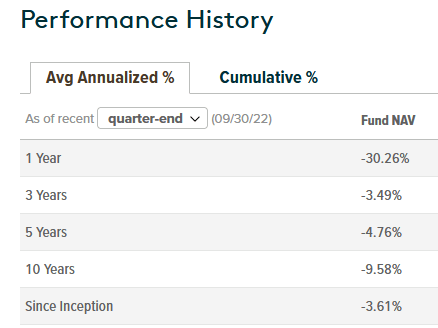

The long-term performance of the SIL ETF is just awful, which makes me wonder how the fund still has $960 million in assets and has not be liquidated:

Global X

Meantime, as shown in the analysis of the top-10 holding above, the ETF holds some companies that aren’t even profitable with silver above $20/oz. These are obviously not the kind of companies that the current market is supportive of. I see no reason to hold this fund – even if you are a silver bull. Much better off on investing in some of the bigger silver producing companies (which may also produce gold …) that are not only currently profitable but also pay decent dividends. Say a Glencore or a Newmont, for instance, which yield 4.3% and 4.7%, respectively.

Risks

At pixel time, the gold/silver ratio is currently at $1771/$22 = ~80.5x, which is considerably higher than its long-term average of ~68x. That being the case, one could argue that silver needs to rise to ~$26/oz to get back to a “normal” valuation as compared to gold. If so, that would certainly be a bullish catalyst for the SIL ETF.

On the downside, falling grades are pushing the GHG intensity of silver output higher because diesel accounts for an estimated 58% of energy consumed by silver miners to extract, transport, and process the metal. Diesel is currently in high-demand relative to supply and diesel prices are far higher than that of gasoline (one reason I believe refiner Phillips 66 (PSX) will continue to outperform). In my opinion, high diesel costs will continue to have a direct and negative impact on miners for the foreseeable future and be a significant headwind.

The SIL ETF has a expense ratio of 0.65%, which is on the high-side and is a tad higher than its 30-day SEC yield (0.62%).

While silver demand may continue to rise, the U.S. dollar could also continue to demonstrate strength. Combined with the high cost of diesel, the stocks in the SIL ETF could continue to perform badly even if the price of silver rises by a couple dollars per ounce.

Summary & Conclusion

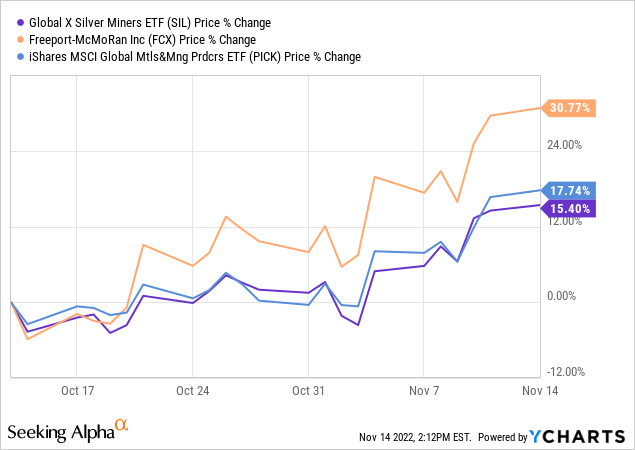

The SIL ETF is an awful investment. If you own it, sell-it. If you don’t own it, and want exposure to metals, I suggest you take a look a copper (and gold and moly) producer Freeport McMoRan (FCX) or, for more diversified exposure, the iShares Global Metals & Miners ETF (PICK). I have recently covered Freeport McMoRan here on Seeking Alpha (see FCX: Why Conoco Phillips’ CEO Sold Oil And Bought Copper). Note that both FCX and PICK have outperformed the SIL ETF over the recent “risk-on” trade due to softening in the strength of the U.S. Dollar Index. I suspect that outperformance over the SIL ETF will continue into 2023 and beyond.

Be the first to comment