Funtap/iStock via Getty Images

Physicians Realty Trust (NYSE:DOC) is an excellent choice for dividend investors who place a premium on dividend stability. The REIT has a growing real estate portfolio and recently announced a large business transaction that will result in increased funds from operations. Physicians Realty Trust’s funds from operations are fairly valued, and the dividend is sufficiently covered by FFO.

Real Estate Portfolio And Growth

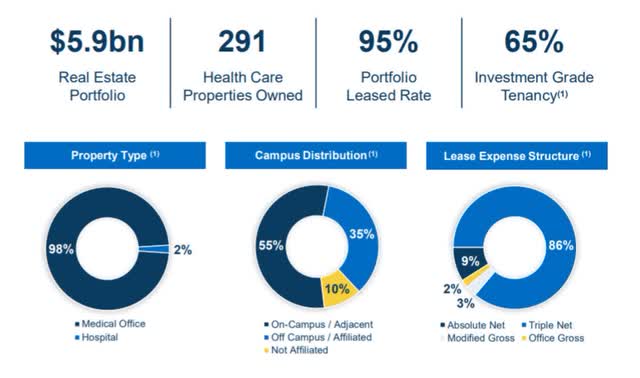

Past growth is the best predictor of future growth, and Physicians Realty Trust clearly excels in this area. The REIT has developed a core focus on medical offices, but it also owns a few hospitals to round out its portfolio. The trust’s real estate portfolio includes 291 properties in the healthcare sector, the majority of which are medical offices (98%), and the total real estate value of the REIT is $5.9 billion.

The properties of Physicians Realty Trust are 95% occupied, and the majority of the trust’s leases are structured as triple net leases, which require the tenant to pay for building expenses such as maintenance and taxes.

Portfolio And Growth (Physicians Realty Trust)

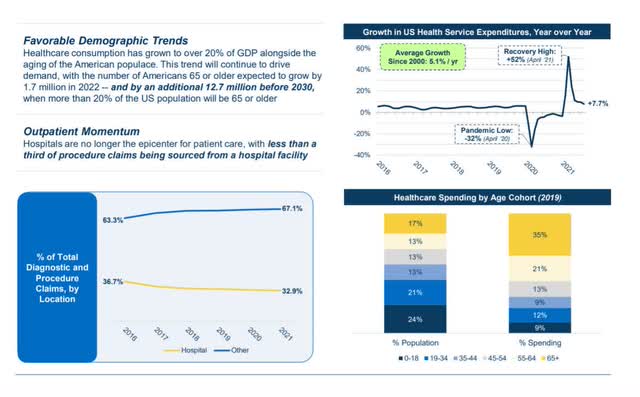

A Physicians Realty Trust investment is primarily a long-term investment that capitalizes on two societal trends: favorable demographic trends that will result in a larger share of the 65+ age group as a percentage of the population, and rising per-capita healthcare spending as people get older. The 65+ age group spends the most money on healthcare, implying that landlords of medical offices face long-term growth trends that will be difficult to disrupt.

Demographics And Spending Trends (Physicians Realty Trust)

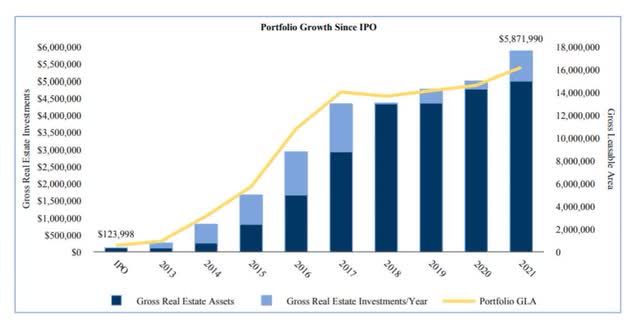

Physicians Realty Trust is already capitalizing on these trends, with the portfolio growing at a rapid pace over the last nine years. The REIT only had 528K square feet of rental space in its portfolio at the time of its IPO (2013).

The trust now owns 16.2 million square feet, representing a 3,000% increase. Similarly, the trust’s real asset investments have skyrocketed, rising from $124 million in 2013 to $5.9 billion in 2021.

Portfolio Growth Since IPO (Physicians Realty Trust)

Physicians Realty Trust’s portfolio expansion has been driven by consistent net acquisitions aimed at diversifying the REIT’s portfolio and increasing funds from operations. The trust increased its acquisitions aggressively last year in order to capitalize on new investment opportunities presented by the Covid-19 pandemic.

Since the trust’s IPO in 2013, investment yields have ranged between 5.0% and 8.6%, indicating that Physicians Realty Trust has been able to acquire real estate profitably on a consistent basis.

Investments Since IPO (Physicians Realty Trust)

$750 Million Landmark Portfolio Acquisition

Physicians Realty Trust announced its largest acquisition to date, a $750 million Landmark portfolio acquisition, at the end of 2021. The trust’s portfolio was expanded by 14 medical offices totaling 1.4 million square feet as a result of the acquisition. Physicians Realty Trust anticipates that the transaction, which was completed at a 4.9% cap rate, will contribute to the trust’s future funds from operations growth.

Landmark Acquisition (Physicians Realty Trust)

Funds From Operations, Yield And FFO Multiple

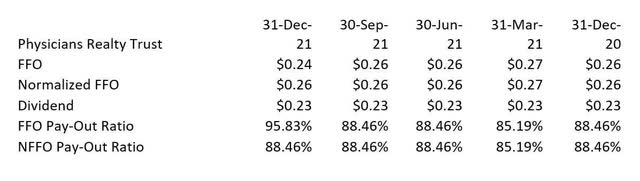

If we look at the last five quarters, Physicians Realty Trust’s portfolio generates quarterly funds from operations ranging from $0.24 to $0.27 per share.

The trust outperforms its dividend with funds from operations and had a pay-out ratio of around 89% based on FFO in 2021. The trust’s funds from operations are expected to grow as the Landmark portfolio is expected to be earnings accretive.

FFO, Yield And FFO Multiple (Author Created Table Using Trust Information)

An investment in the trust yields 5.2% based on a quarterly dividend payment of $0.23 per share and a current stock price of $17.68. The trust’s dividend has been stable in recent years, but it may increase as it captures funds from operations growth from the Landmark portfolio acquisition.

To be conservative, I assume no increase in funds from operations in 2022, implying that Physicians Realty Trust could report FFO ranging from $1.02 to $1.05 per share. The FFO range implies a funds from operations multiple of around 17x, which is quite appealing given the trust’s strong portfolio growth.

The market has valued Physicians Realty Trust at a higher multiple this year, and I believe the stock looks very appealing here due to the trust’s covered dividend and significant portfolio growth potential.

Counterarguments To The Long Thesis

Physicians Realty Trusts profits from long-term societal trends such as population aging and rising health-care costs. However, there are risks that must be considered as well. An increase in the vacancy rate, as well as the inability to complete accretive transactions at accretive cap rates, represent a risk to the trust’s FFO growth.

Taking into account both FFO growth opportunities and investment risks, I continue to favor Physician Realty Trust as a long-term investment.

My Conclusion

Physicians Realty Trust stock is a buy because the aging population and rising healthcare spending are two extremely powerful long-term growth drivers. The stock is also reasonably priced, and the FFO pay-out ratio suggests that the dividend at its current level is not only sustainable, but may even grow.

Be the first to comment