Caiaimage/Tom Merton/iStock via Getty Images

Investment Thesis

Snap (NYSE:NYSE:SNAP) has had a poor track record in the past few years, despite the boom of social media giants during the heights of pandemic, such as Meta (META) and Alphabet (GOOG) (GOOGL). Both companies had reported massive growth with ad revenues of $114.93B and $209.49B in FY2021, respectively, compared to SNAP’s -$487.96M net losses at the same time. It had also a poorer 5Y return of -32.9%, compared to Meta’s -20.2% (post-Apple (AAPL) correction ) and GOOG’s 100.8%.

Nonetheless, the winds of change seem to be here for SNAP, given its strategic cost cuts thus far and ambitious targets of $6B revenue and 450M Daily Active Users (DAU) by FY2023. Its improved profitability may also trigger a slow but sure stock recovery ahead, depending on its upcoming FQ3’22 call. The critical key will be its Snapchat+ performance in FQ3’22, given the management’s early announcement of over 1M paying subscribers within six weeks of launch since June 2022. With a monthly fee of $3.99, we may be looking at a really nice boost in SNAP’s top and bottom line growth indeed.

Though the macroeconomics seemed to be at peak pessimism levels, with the S&P 500 Index plunging by -25.25% YTD, we expect these to be temporary headwinds. Assuming a moderated September CPI by early October, we may see a meaningful stock market recovery ahead. Combined with the Fed’s projected terminal rate of 4.6% by 2023, indicating a 75 basis point hike in November, with January 2023 moderating to 50, we may speculatively assume that most of the pessimism is already baked in, pointing to the stock’s near bottom levels.

SNAP’s Performance Remains Lacking, Though Things May Improve By FY2023

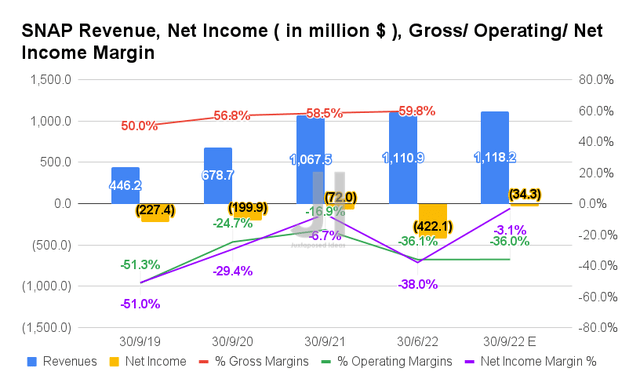

For its upcoming FQ3’22 earnings call, SNAP is expected to report revenues of $1.11B and an operating margin of -36%, representing inline QoQ. Otherwise, a minimal increase of 4.74% though a decline of -19.1 percentage points YoY, respectively. In the meantime, the company continues its lack of profitability, with net incomes of -$34.3M and net income margins of -3.1% for the next quarter. It indicates a notable improvement of 91.87% and 34.9 percentage points QoQ, respectively, potentially attributed to its aggressive cost-cutting strategies thus far. We shall see, since Q4 will bring better results due to its noteworthy 20% workforce layoff.

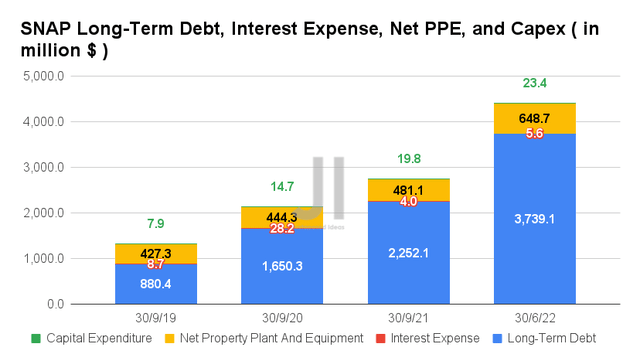

SNAP also continued its reliance on long-term debts, with $3.73B and $5.6M of interest expenses reported in FQ2’22, representing a massive increase of 46.27% and 21.71% YoY, respectively. While certain projects are shut down as part of its refocused restructuring, we expect to still see elevated debts in FQ3’22 due to its lack of profitability.

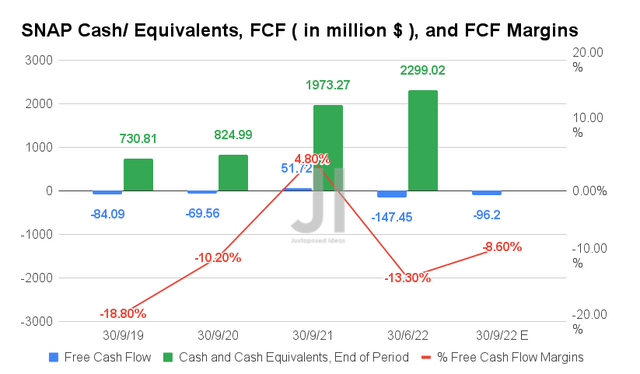

Given the company’s elevated capital expenditure of $88.96M in the last twelve months (LTM), indicating a massive increase of 57.03% sequentially, it is no wonder that SNAP is expected to report negative Free Cash Flow (FCF) generation of -$96.2M and an FCF margin of -8.6% in FQ3’22. Nonetheless, investors probably will be encouraged by the 34.75% and 4.7 percentage points QoQ improvement, respectively. Its massive liquidity of $2.29B in the last quarter would also be more than sufficient to weather the upcoming economic downturn.

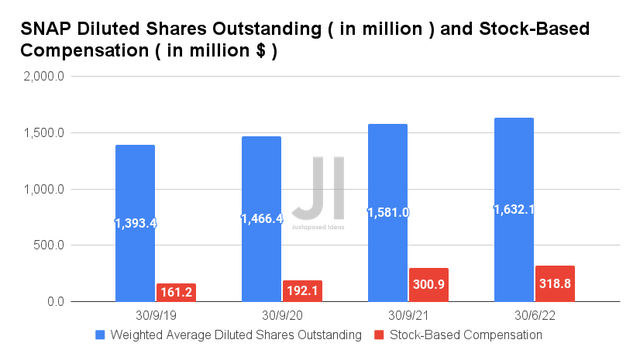

On the other hand, SNAP’s Stock-Based Compensation (SBC) expenses remain elevated thus far, at an eye-watering sum of $1.19B in the LTM. No wonder, the company isn’t GAAP profitable yet. This has also directly contributed to the growth of its diluted shares outstanding by 5.49% YoY or by 33.6% since its IPO in March 2017. Nonetheless, these numbers still seem moderate for now, given the company’s ambitious target of $1.5B in adj. EBITDA and $1B in FCF by the end of 2023.

In the meantime, SNAP is likely to report up to $1.47B in SBC expenses through the next twelve months, assuming a similar rate of growth. An alarming number, in our humble opinion, given the economic downturn ahead.

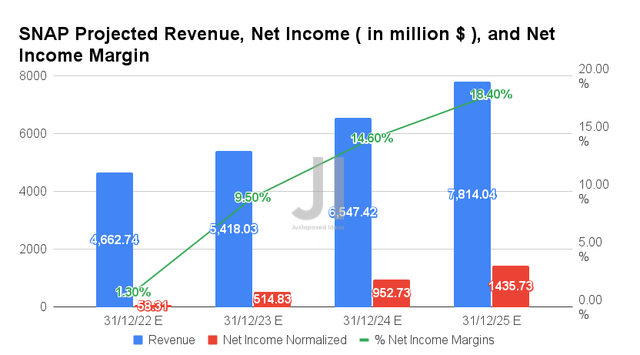

Over the next four years, SNAP is expected to report revenue and net income growth at a CAGR of 17.41% and 70.43%, respectively. The latter being attributed to its paid subscription service, Snapchat+, and its AR-based advertising, contributing up to $350M and $600M in revenue by FY2023, respectively. Assuming that the company is able to achieve its aggressive estimates, SNAP will report exponential growth in profitability, from net income margins of -60.3% in FY2019, improving to -11.9% in 2021, and finally settling at a stellar 18.4% by FY2025. Impressive indeed.

In the meantime, SNAP is expected to report revenues of $4.66B, net incomes of $58.31M, and net income margins of 1.3% for FY2022, representing tremendous YoY growth of 13.38%, 936.83%, and 13.2 percentage points, respectively. Analysts will also be closely watching its FQ3’22 performance, with EPS -$0.02, inline QoQ though a decline of -111.6% YoY. Assuming another miss, we may see SNAP plunge as it did post FQ2’22 earnings call at -39.08% then. However, we are a little more hopeful, given the speculative success of its Snapchat+ in Q3, though the rising inflation may potentially put a slight damper on consumer discretionary spending as well.

So, Is SNAP Stock A Buy, Sell, or Hold?

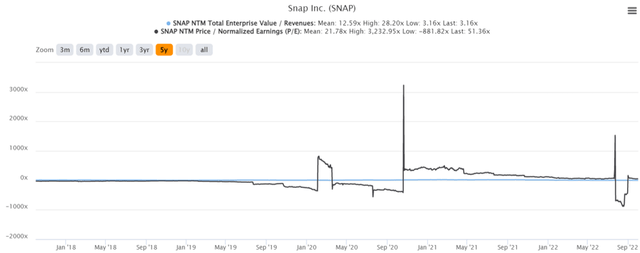

SNAP 5Y EV/Revenue and P/E Valuations

SNAP is currently trading at an EV/NTM Revenue of 3.16x and NTM P/E of 51.36x, lower than its 5Y EV/Revenue mean of 12.59x though massively elevated from its 5Y P/E mean of 21.78x. The stock is also trading at $9.82, down -87.61% from its 52 weeks high of $79.30, nearing its 52 weeks low of $9.34. Nonetheless, consensus estimates remain cautiously confident about SNAP’s prospects, given their price target of $14.00 and a 42.57% upside from current prices.

SNAP 5Y Stock Price

The bulls may, therefore, continue to nibble at current levels, though we prefer the margin of safety that $7 or $8 will offer, if the stock breaches its previous May 2020 lows of $9.18 over the next week. However, we must also highlight the speculative nature of this stock, given its minimal profitability, if the S&P 500 Index continues to free fall from this level. Investors, take note.

Be the first to comment