tumsasedgars

The stock market is punishing retail investors. But those who have been through bear markets know it eventually turns and a bull market starts, although the timing is uncertain. For instance, the dot-com crash and the subprime mortgage crises took several years to work through excess speculation before turning into a bull market.

Today, stock prices and valuations are down, and dividend yields are up. Granted, high inflation, rising interest rates, and geopolitical issues make for uncertain times. As a result, many investors ask themselves, are we in a recession? However, brave investors may want to add to existing positions. In many cases, the yields are the highest in a decade. As a result, it is possible to create a 5%+ passive income portfolio. Below, we discuss several dividend growth stocks with high yields to buy.

Western Union

The Western Union Company (WU) is the market leader in cross-border money transfers. The firm operates through its 550,000+ global retail agents, digital app, and websites. The company receives most revenue and profits through the consumer-to-consumer [C2C] segment. Also, it is exiting the business-to-business [B2B] segment. Total revenue was $4,865 million in the past twelve months.

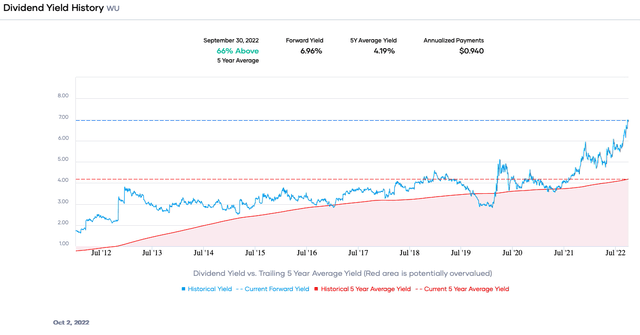

Western Union is yielding nearly 7%, the highest in a decade and almost three percentage points above the 5-year average. Furthermore, the firm is a Dividend Challenger (raised the dividend for 5-9 years in a row), although the streak may end this year unless the dividend increases in the fourth quarter. Despite the high yield, the payout ratio is modest at only ~43%. Moreover, the money transfer business is not capital intensive, and free cash flow [FCF] of ~$968 million covers the dividend of ~$373 million.

Western Union is now offering digital banking in Europe and expanding to Brazil. The stock is a bargain, trading at a forward price-to-earnings ratio of about 7.5X, well below the 5-year and 10-year ranges. Although the stock price may remain under pressure because of recession fears, the combination of dividend yield, dividend safety, and undervaluation make Western Union a buy.

International Business Machines

International Business Machines Corporation (IBM) is a company many investors love to hate. But the over 100-year-old firm has reinvented itself after acquiring Red Hat and divesting the Managed Infrastructure Services business, now Kyndryl Holdings (KD). IBM is focusing on hybrid cloud and consulting. Revenue is rising organically and through bolt-on acquisitions. Total revenue was $59,680 million in the last twelve months.

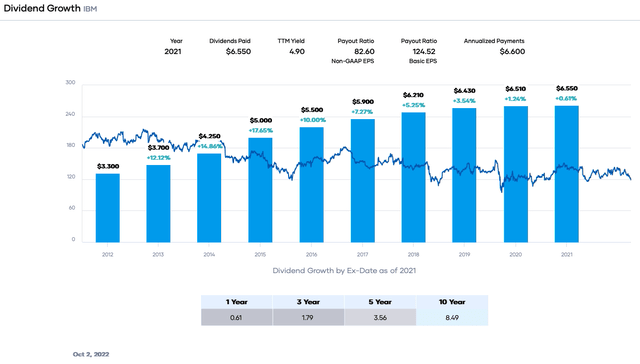

The market downturn has pushed IBM’s dividend yield up to 5.5%, more than the 5-year average and triple the S&P 500 Index’s average dividend yield. Additionally, the company is a Dividend Aristocrat and Dividend Champion, although the dividend growth rate has slowed. Furthermore, IBM has paid a dividend for over 100 years, making it one of the companies with the longest dividend streaks. That said, IBM’s dividend safety is of concern because of a high payout ratio of ~82.6%. However, the FCF of $6,957 million covers the dividend requirement of $5,908 million, and leverage is declining.

IBM has a valuation of ~12.7X consensus earnings, making it reasonably priced to buy now, especially considering the dividend yield.

Franklin Resources

Franklin Resources, Inc. (BEN) is a family-controlled and publicly traded asset manager. The firm owns the Franklin Templeton, Brandywine, Western Asset Management, Clarion, Martin Currie, Royce, and Legg Mason funds. Besides acquisition, the firm grows its assets under management [AUM] through net inflows and market action. However, the reverse is also true: a bear market depresses the AUM, and thus, a risk exists. Total revenue was $8,517 million in the trailing twelve months.

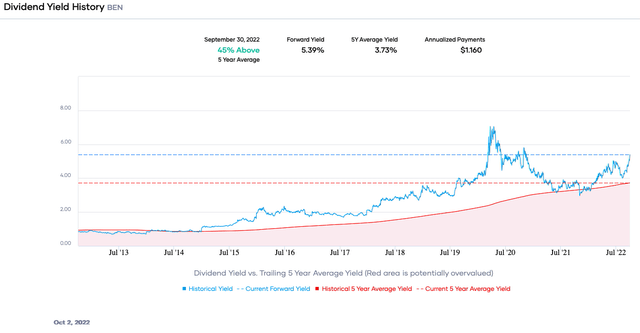

A declining stock price has caused the dividend yield to rise to the highest level since the pandemic bear market. The 5.39% dividend yield is above the 5-year average too. Moreover, Franklin Resources is a Dividend Aristocrat and Dividend Champion. The conservative payout ratio of ~30% combined with a dividend-to-FCF ratio of ~39% provide confidence about dividend safety and future growth.

Franklins Resources is undervalued, now trading at a ~7.4X earnings multiple. This value is below the 5-year and 10-year ranges. Despite fears of a recession, the rock bottom valuation, dividend yield, and solid dividend safety make the stock a buy now.

Verizon Communications

Verizon Communications Inc. (VZ) passes many screens today because of its high dividend yield and low valuation. Moreover, the company is one of the three market leaders in cellular service in the U.S. The company is also a leader in fiber broadband and still has some fixed-line telecom operations. Specifically, Verizon has about 120 million wireless connections, 25 million data devices, 13.1 million FiOS connections, and 25 million fixed-line telecom connections. Total revenue was approximately $134,325 million in the past twelve months.

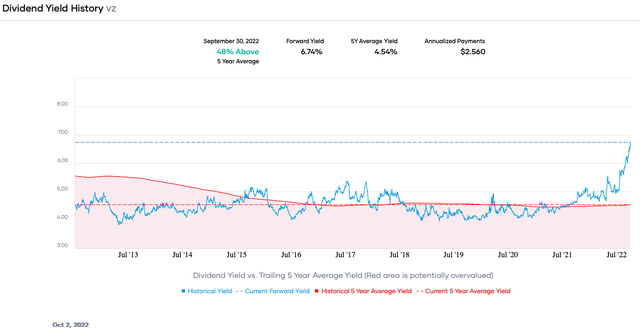

Verizon’s stock price has plummeted because of cellular customer losses combined with tough 5G competition from T-Mobile US (TMUS). This drop has pushed the dividend yield to ~6.75%, the highest in a decade and much higher than the 5-year average. In addition, Verizon is a Dividend Contender (10-24 consecutive years of dividend growth). Although the dividend yield is high, the payout ratio is modest at ~47%, and the FCF of $14,705 million covers the dividend requirement of $10,625 million. Moreover, the FCF is depressed because of high capital expenditures.

Verizon is undervalued now. The P/E ratio is ~7.4X, significantly below the 5-yer and 10-year ranges. Of course, some risk exists that Verizon cannot turn around its subscriber losses, but the nearly 7% dividend yield, decent dividend safety, and undervaluation make the stock a buy.

Whirlpool

Whirlpool Corporation (WHR) is one of the largest makers of home appliances. It owns the Whirlpool, Maytag, Amana, JennAir, KitchenAid, Roper, etc. brands. Whirlpool grows organically and by acquisitions. For example, the firm recently inked a deal to buy the InSinkErator business adding to its collection of appliance brands. Total revenue was roughly $21,320 million in the trailing twelve months.

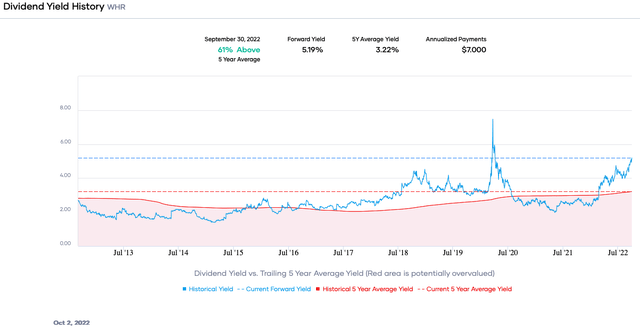

Whirlpool’s stock price has plunged because of falling home sales, which will probably cause lower appliance sales. This has caused the dividend yield to increase to ~5.2% for this Dividend Contender. This value is the highest since the worst months of the pandemic bear market and almost two percentage points above the 5-year average. However, the dividend safety is excellent, with a modest payout ratio of ~21% and a dividend-to-FCF of ~47%.

Whirlpool’s falling stock price has caused the valuation to decline to ~6.1X forward earnings estimates. The stock is the cheapest since the pandemic bear market. The low valuation, excellent dividend yield, and good dividend safety make Whirlpool a buy now.

Final Thoughts

Investing during a bear market is difficult because most investors dislike unrealized losses. Furthermore, fear of more losses sometimes leads to inaction. However, to quote Warren Buffett, “The true investor welcomes volatility…a wildly fluctuating market means that irrationally low prices will periodically be attached to solid businesses.” The above companies are solid businesses trading at low valuations with 5%+ dividend yields.

Be the first to comment