Satephoto/iStock via Getty Images

Investment thesis: Not long ago, Peabody’s (NYSE:BTU) outlook seemed bleak, despite the improvement in the coal market we saw last year. The coal price rally was seen as a dead cat bounce at most. It took a long time for the stock to start responding to the robust increase in coal prices because it took a similarly long time for the market to come to terms with the fact that the increase in coal prices is a sustained trend. Since the beginning of this year, as it became clear that the rise in coal prices is sustained, Peabody’s stock price has more than doubled. Such a strong advance in its stock price may be seen as a time to perhaps consider taking some profits. Most of the time that tends to be the prudent course of action. We should keep in mind however that the price at the beginning of the year reflected a market mood towards this stock, which mostly suggested expectations of a near-term default. At best, it was thought that Peabody is a company with a hard struggle ahead, just to keep afloat. The current outlook for the US & global coal demand, for at least the next few years suggests otherwise.

Peabody’s recent financial performance has been improving. Further progress is not yet fully priced in.

For 2021 Peabody managed to produce a net income of $347 million, compared with a loss of $1.87 billion in 2020. Free cash flow achieved came in at $289 million. It does not take much of a deep analysis of these numbers to conclude the obvious, namely that the increased price of coal has a lot to do with it.

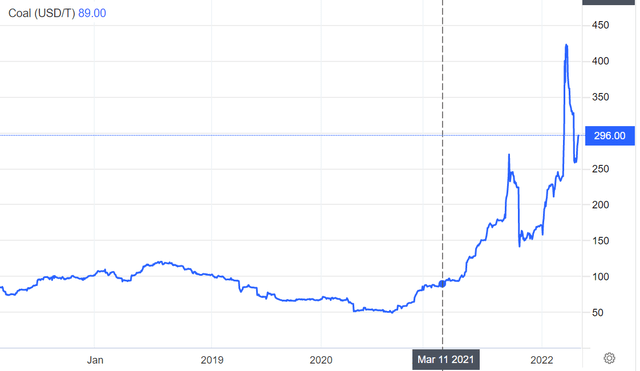

Newcastle coal spot price (Trading Economics)

With coal prices headed much higher, Peabody also saw a significant increase in revenues last year, from $737 million in 2020 to $1.26 billion last year. This year will probably be even better. Based on expectations this year, it has a Forward PE of 2.9, versus its P/E based on last year’s results of around 9.

EU ban on Russian coal is set to push coal prices much higher, while its Russian gas import ambitions will also add to the coal price momentum.

While the market is already reacting to the positive implications of the recently announced EU ban on Russian coal, the wider implications of Europe’s energy policies in response to the Ukraine war are still largely under-appreciated by the market. The EU ban on Russian coal will reduce total net exports of Russian coal to the rest of the world, even if not by the same volume that the EU will replace with other sources.

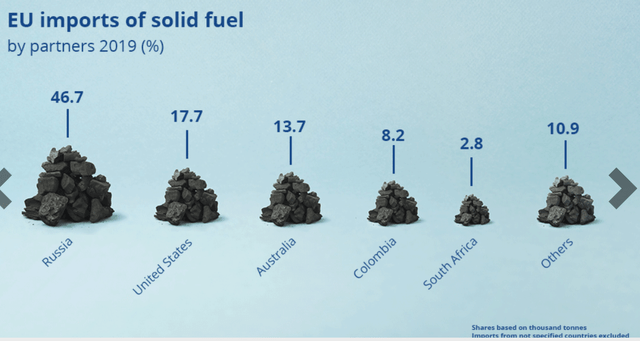

EU coal imports by source country (EC)

Russia has been exporting about 84 million short tons of coal to Europe every year, accounting for one-third of all its coal exports. Some of that export will be re-routed to other parts of the world, even as the EU will increase imports from others. It becomes almost like a game of musical chairs. Logistics will prevent all of that Russian coal from being re-routed to alternative markets, therefore it will result in a net loss in coal availability on the global market, which is already tight.

The part of the equation that I think the market is yet to factor in is the EU plan to cut its dependence on Russian natural gas by the end of this year by as much as two-thirds. That is a proposed cut of as much as 100 Bcm on a yearly basis, equivalent to about 125 million tons of coal. Some of it will be made up through an increase in green energy, some through conservation, some through substitution with gas from elsewhere, but it is increasingly being admitted that an increase in coal demand in the EU should also be expected to happen as a result of these plans. It is yet to be determined how much of an increase in EU coal demand we will see, but what looks increasingly certain is that the EU is about to greatly bid up the price of coal worldwide, as it is set to chase already tight supplies.

Investment implications.

Peabody is heavily dependent on the US market for its coal sales. With US natural gas prices rising, the substitution of natural gas with coal in electricity generation can be expected to occur.

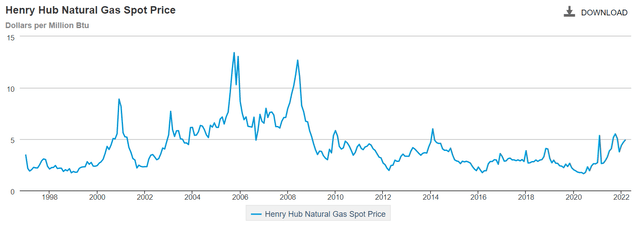

US Henry Hub natural gas spot price (EIA)

While natural gas prices are nowhere near where they were at their highest point, more than a decade ago, we are now at high enough price levels, where some demand destruction via replacement with cheaper coal can start occurring. Based on the growing gap in US natural gas inventories, running below the five-year average, we can expect US natural gas prices to continue firming for the foreseeable future. US coal should therefore see an improvement in domestic demand, as well as a surge in overseas demand for US coal exports.

The prospect of a sustained improvement in coal prices for the foreseeable future has provided Peabody with a second chance after the pain of the last decade, whereas just a few months ago the market wrote it off as a lost cause. In the coming quarters and perhaps years, Peabody will be able to use improved financial results, on the back of more favorable coal prices to shore up its finances. By the end of 2021, Peabody already managed to reduce its long-term debt load by over $400 million, to $1.1 billion, as of the end of last year.

A strong financial performance for this year should be enough to help consolidate its finances to a point where it will once more become a resilient company. After the run that its stock had this year so far, there will be investors ready to take some profit, which should provide for a correction in the stock price in the coming weeks and months. These pullbacks should be seen as a buying opportunity. The longer-term outlook for this company is improving, together with ever-brighter prospects for coal, the dirty fuel that as recently as a few months back, almost everyone was ready to write it off as being on its way out from the global energy mix, sooner rather than later.

Be the first to comment